If you’re exploring ways to make your cash work harder while keeping it accessible and safe, you may have come across the term “high-yield savings account”. But what exactly is a high-yield savings account, how does it work, how to open it, and what should you consider before opening one?

This comprehensive guide will walk you through the essentials, tailored for investors who may be seeking clarity and information.

What is a high-yield savings account?

A high-yield savings account is a type of deposit account offered by banks and credit unions that pays a significantly higher interest rate, often several times the national average, compared to traditional savings accounts. These accounts are designed in a way that may help your savings grow more efficiently, while maintaining the safety and liquidity that you may expect from a bank account.

Key features:

- Higher interest rates: With a high-yield savings account, you may earn a significantly higher annual percentage yield (APY) compared to a regular savings account. Some of the best high-yield savings accounts offer APYs around 3.3%, while the national average for traditional savings accounts is about 0.01 to 0.06%.

- Federal insurance: If your high-yield savings account is with an FDIC-insured bank, your deposits are insured up to $250,000 per depositor, per bank, and per ownership category. If you choose a credit union, similar protection is provided through the NCUA.

- Accessibility: These accounts are generally easy to open and manage online, and your funds remain readily accessible for withdrawals and transfers.

- Variable rates: The interest rates on high-yield savings accounts are variable, meaning they may change over time based on economic conditions and decisions by the Federal Reserve.

How do high-yield savings accounts work?

When you deposit money into a high-yield savings account, the bank pays you interest, typically calculated daily and credited monthly. This interest is compounded, meaning you earn interest not only on your initial deposit but also on the accumulated interest over time.

Let’s take an example as below:

Suppose you deposit $10,000 into a high-yield savings account with a 3.3% APY. Over one year, if the rate remains constant, your balance would grow to approximately $10,330. In contrast, a traditional savings account with a 0.06% APY would yield about $6 in interest over the same period.

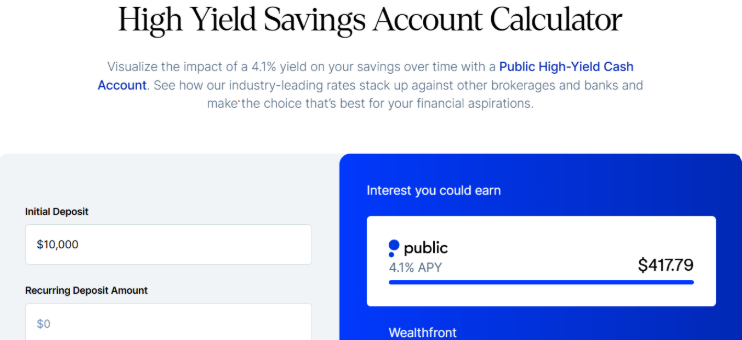

You can also estimate potential interest earnings with a high-yield cash account using Public’s High-Yield Savings Calculator. Just enter your deposit amount, contribution frequency, and timeframe to see how your cash may grow over time.

Public’s High-Yield Cash Account

If you are holding cash and looking for a place to keep it accessible while potentially earning interest, Public’s High-Yield Cash Account may be an option to explore. The high-yield cash account is built to help you earn more on your uninvested cash while maintaining flexibility and security.

As of Oct 2025, the account offers:

- 3.3% APY*, *Rate subject to change

- FDIC insurance up to $5 million through partner banks

- No subscription required

- Zero account fees and interest start accruing daily

- No maximum balance limits

- No balance requirements

- Unlimited transfers and withdrawals

- Straightforward and simple

- Seamless access to cash within your Public.com portfolio

You can manage your high-yield cash account directly from the same app you use for stocks, ETFs, crypto, options, bonds, Treasuries, and IRAs. Interest accrues daily, and withdrawals are typically processed on the same day, giving you a balance between earning power and liquidity.

To learn more or get started, sign up on Public app.

Potential benefits of a high-yield savings account

1. Liquidity

You can typically access your money at any time without penalties, making high-yield savings accounts suitable for emergency funds or savings you may need on short notice. Many accounts allow easy online transfers and, in some cases, come with ATM access.

2. Higher-than-average interest yield

The primary advantage is the ability to earn more interest on your savings compared to a standard account. This can be especially beneficial for building emergency funds, saving for short-term goals, or simply letting your money grow in a low-risk environment.

3. Safety:

Federal Deposit Insurance Corporation (FDIC) insurance protects your deposits up to the legal limit, so you don’t face the risk of losing your money due to bank failure.

4. Low risk

Unlike investments in stocks or mutual funds, high-yield savings accounts are not subject to market volatility. Your principal is secure, and you continue to earn interest regardless of market conditions.

5. Digital convenience

Most high-yield savings accounts can be managed entirely online, offering features such as mobile check deposits, instant transfers, and easy account monitoring.

Potential drawbacks and considerations

1. Variable interest rates

The interest rate on a high-yield savings accounts is typically variable, meaning it can change at any time based on market conditions and decisions by the Federal Reserve. If rates go down, your earnings may decrease.

2. Fees and minimum balances

Some high-yield savings accounts require a minimum deposit to open or maintain the account. Others may charge monthly fees if your balance falls below a certain threshold. It’s important to review the terms and conditions before opening an account

3. Online-only access:

If you prefer in-person banking, some high-yield savings accounts may not be ideal, as many are offered by online-only banks.

Conclusion

If you’re considering where to hold your cash while earning interest, a high-yield savings account remains a straightforward option that combines liquidity with a higher rate than typical savings accounts. As of Oct 2025, Public.com offers a high-yield cash account with an APY* of 3.3%, one of the most competitive rates currently available in the market.

You benefit from FDIC insurance coverage up to $5 million through a network of partner banks, and no fees or minimum balance are required. Start earning interest – Get started here