Bonds are a go-to option for investors looking to balance their portfolios with stability and steady income. When you buy a bond, you’re essentially lending money to an entity—whether it’s the government, a corporation, or a municipality—in exchange for regular interest payments and the return of your principal at maturity.

With so many types of bonds available, each with its own risks and rewards, it’s important to understand how they work. This guide will walk you through the different types of bonds to help you make informed investment choices.

What are bonds?

Bonds are essentially IOUs issued by corporations, municipalities, or governments to raise capital. When you purchase a bond, you’re lending money to the issuer. In return, the issuer agrees to repay the principal amount on a specific maturity date and typically provides periodic interest payments, known as the “coupon rate.”

Why invest in bonds?

Bonds may offer several benefits, including providing a stable income stream through interest payments, preserving capital, and diversifying an investment portfolio.

- Consistent income: Regular interest payments can provide a stable income stream.

- Lower risk: Bonds, particularly government and investment-grade bonds, are often considered less risky than stocks.

- Portfolio diversification: Including bonds in your investment portfolio can help balance risk, especially during volatile market periods.

Different Types of Bonds

Bonds come in different types, providing stable income while helping governments, corporations, and municipalities raise funds. Your choice of bond can affect risk, returns, and your financial strategy.

1. Treasury bonds (T-Bonds)

Treasury Bonds (T-Bonds) are long-term U.S. government bonds with maturities ranging from 10 to 30 years. They offer fixed interest payments every six months and are considered one of the safest investments due to being backed by the “full faith and credit” of the U.S. government. T-Bonds are ideal for investors seeking stability and a reliable income stream.

- Issuer: U.S. Government

- Feature: Fixed interest payments, low risk

- Interest payments: Semi-annual

- Use case: Suitable for conservative investors looking for stability

2. Corporate bonds

Corporate Bonds are issued by companies to raise capital for operations, expansion, or other business activities. They generally offer higher yields than government bonds but carry varying levels of risk depending on the issuing company’s creditworthiness.

- Issuer: Corporations

- Feature: Higher yield potential, varying risk levels

- Interest payments: Typically semi-annual

- Use case: Good for income-seeking investors with moderate to high-risk tolerance

Investment-grade corporate bonds typically provide a balance of yield and safety, while non-investment-grade (junk) bonds offer higher yields with increased risk.

3. Municipal bonds (Munis)

Municipal Bonds (Munis) are issued by state, municipal, or local governments to fund public projects like schools, roads, and infrastructure. They often provide tax-exempt interest income, making them attractive to investors in higher tax brackets.

- Issuer: State and local governments

- Feature: Tax-exempt interest income

- Interest payments: Semi-annual

- Use case: Ideal for high-net-worth investors seeking tax advantages

4. Zero-coupon bonds

Zero-Coupon Bonds are sold at a discount and do not provide periodic interest payments. Instead, investors receive the bond’s face value at maturity. The difference between the purchase price and the face value represents the interest earned.

- Issuer: Corporations, municipalities, and governments

- Feature: No periodic interest payments, issued at a discount

- Interest payments: Paid at maturity

- Use case: Suitable for long-term goals like education or retirement savings

These bonds can be more sensitive to interest rate changes than traditional bonds, leading to significant market value fluctuations.

5. Convertible bonds

Convertible Bonds offer the option to convert the bond into a predetermined number of the issuing company’s shares. They provide fixed income along with potential equity upside if the company’s stock performs well.

- Issuer: Corporations

- Feature: Convertible into company stock

- Interest Payments: Typically semi-annual

- Use Case: Good for investors looking for income with growth potential

6. Callable bonds

Callable Bonds allow the issuer to repay the bond before its maturity date, typically when interest rates fall. While they may offer higher yields to compensate for this risk, investors could lose out on future interest payments if the bond is called early.

- Issuer: Corporations and governments

- Feature: Can be redeemed before maturity

- Interest Payments: Semi-annual until called

- Use Case: Suitable for investors comfortable with call risk in exchange for higher yields

7. Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are U.S. government bonds designed to protect against inflation. The principal value of TIPS adjusts with the Consumer Price Index (CPI), ensuring your investment maintains its purchasing power.

Interest payments are made semi-annually based on the adjusted principal, making TIPS a solid choice for hedging against inflation risks.

- Issuer: U.S. Government

- Feature: Principal value adjusts with inflation, maintaining purchasing power

- Interest Payments: Based on the adjusted principal

- Use Case: Ideal for hedging against inflation risks

How to choose the right type of bond for your portfolio?

Selecting an appropriate bond type aligns with several considerations:

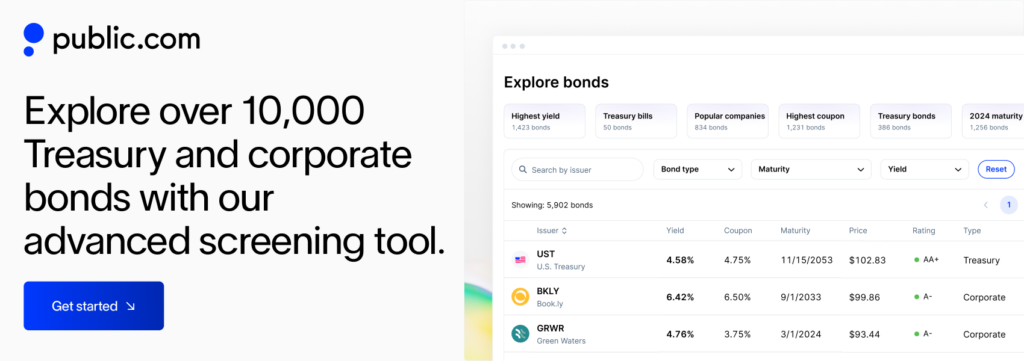

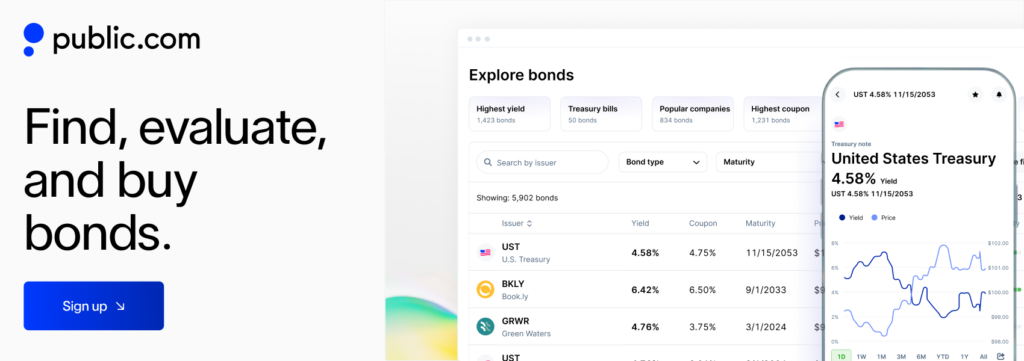

While bonds can be purchased directly from issuers like the U.S. government, they are also readily accessible through brokers, including our user-friendly platform at Public.com. Additionally, secondary markets offer an avenue to both purchase and offload bonds, providing flexibility for those who might wish to exit their position before maturity.

It’s essential to gather comprehensive information and possibly consult with financial professionals to understand the nuances of each bond type and its alignment with individual investment objectives.

Conclusion

Bonds offer a reliable way to add stability and income to your investment portfolio. With a wide range of bond types available, you can find options that align with your financial goals—whether you prioritize safety, higher returns, or tax benefits. By matching your bond choice with your risk tolerance and investment strategy, you can ensure it supports your broader financial objectives.

Join Public.com to explore opportunities in both bond and stock markets and build a portfolio that meets your investment needs.