Looking for a safe and tax-efficient investment option? Municipal bonds might be the answer. These bonds not only help you maintain steady interest income but also provide potential tax benefits.

Whether you’re a conservative investor seeking stability or someone aiming to reduce your taxable income, understanding municipal bonds can help you make informed investment decisions.

This article will explore everything you need to know about municipal bonds, from their types and tax benefits to risks and investment strategies.

What are municipal bonds?

A municipal bond is a type of debt security issued by state, city, or local governments to finance public projects such as building roads, schools, hospitals, and infrastructure improvements. When you purchase a municipal bond, you lend money to the issuing municipality.

In return, you receive periodic interest payments and the full return of your principal when the bond matures. Municipal bonds are considered relatively low-risk investments because the issuing government entity backs them.

Types of municipal bonds

Municipal bonds come in various types, each serving specific purposes and offering different levels of security:

1. General obligation bonds (GO)

General Obligation bonds are backed by the full faith and credit of the issuing government entity. These bonds are typically repaid through taxes, which means the issuer can raise taxes if necessary to meet its obligations.

2. Revenue bonds

Revenue bonds are tied to specific revenue-generating projects, such as toll roads, utilities, or public infrastructure. The bondholders are paid from the income generated by these projects. While revenue bonds may offer higher yields, they also carry more risk since payments depend on the project’s success.

3. Taxable municipal bonds

Unlike traditional municipal bonds, which often offer tax-exempt interest, taxable municipal bonds are subject to federal income tax. These bonds are usually issued for projects that do not meet the requirements for tax-exempt status. However, they may offer higher interest rates to compensate for the tax implications.

4. Municipal notes

Municipal notes are short-term securities that provide municipalities with interim financing until longer-term funding is secured. These notes typically have maturities of less than one year and are often used to cover cash flow shortages or finance specific projects.

5. Variable Rate Demand Obligations (VRDOs)

VRDOs are long-term municipal bonds with interest rates that reset periodically—typically daily, weekly, or monthly—based on current market conditions. They offer a “demand” option, allowing investors to sell the bond back to the issuer at par value with minimal notice, offering liquidity despite the bond’s long-term maturity.

How do municipal bonds work?

When a government entity needs funds for a public project, it may issue municipal bonds to raise capital. Investors who buy these bonds provide the required funds, and in return, the government agrees to pay interest (typically semiannually) until the bond matures.

Upon maturity, the investor receives the original investment amount, known as the principal. Municipal bonds are often issued with fixed interest rates, providing predictable income over the bond’s life.

For example, if you invest $10,000 in a municipal bond with a 5% annual interest rate, you could expect $500 in interest income each year. Depending on the bond type, this interest may be exempt from federal, state, and local taxes, adding to the investment’s appeal.

Advantages of investing in municipal bonds

While not without risks, investing in municipal bonds may provide a way to preserve capital while earning interest. Key benefits include:

- Diversification for portfolios: Historically, municipal bonds have shown a low correlation with stocks. Adding them to a stock-heavy portfolio may help introduce stability to a portion of your investments. However, diversification does not guarantee profits or protect against losses.

- Interest: Municipal bonds have traditionally been associated with consistent interest payments. While interest is a benefit of municipal bonds, investors should conduct thorough research and consider the issuer’s creditworthiness.

Potential tax advantages of municipal bonds

One of the most attractive features of municipal bonds is their potential tax advantages. These benefits can vary based on the type of bond and the investor’s location.

1. Federal income tax exemption

Municipal bonds may offer federal income tax exemption on interest income. However, capital gains taxes can apply if bonds are sold at a profit, especially if purchased at a discount and redeemed on the secondary market.

2. State and local tax benefits

Investing in municipal bonds from your home state may also provide exemptions from state and local taxes. However, bonds from other states might still incur taxes depending on your residence.

3. Alternative minimum tax (AMT)

While municipal bond interest is generally tax-exempt, some bonds, such as those funding stadiums or airports, may be subject to AMT. It’s important to verify your AMT status before investing.

4. Tax swaps

A tax swap involves selling a bond with a capital loss while buying a similar bond. This strategy may help manage capital gains and losses effectively. This strategy is often used to offset gains with losses, potentially reducing tax liabilities.

5. Taxable equivalent yield

The taxable equivalent yield helps compare the after-tax return of a tax-free municipal bond to a taxable bond. This calculation can be handy for investors in higher tax brackets, helping them assess the true value of tax-exempt income.

Potential risks of investing in municipal bonds

Like any investment, municipal bonds carry risks, including:

1. Credit risk of the issuer: Financial struggles or economic downturns could affect an issuer’s ability to meet debt obligations. For example, a financially challenged city might struggle with interest payments.

2. Interest rate risk: Interest rate changes may impact bond values, especially for long-term bonds. For example, a bond with a 3% fixed rate may lose value if market rates rise to 4%.

3. Liquidity risk: Some municipal bonds may not be quickly sold in the secondary market, limiting access to cash.

4. Call risk: Callable bonds allow the issuer to repay the bond before maturity, potentially affecting expected interest income.

How to invest in municipal bonds?

There are several ways to invest in municipal bonds:

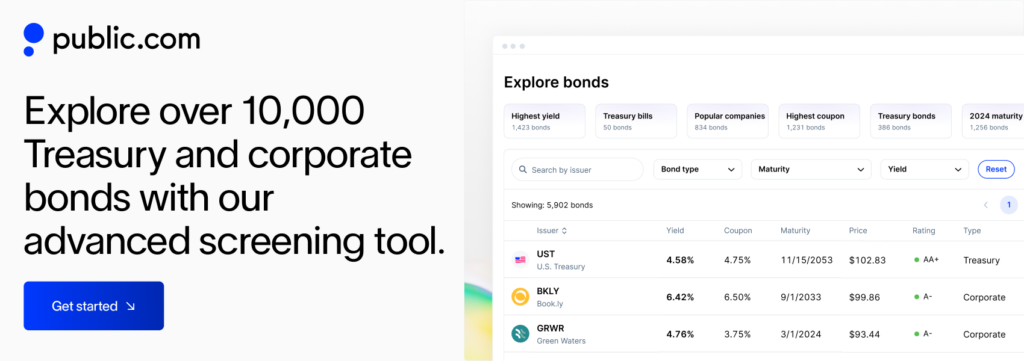

- Bond market platforms: You can buy municipal bonds through brokers or online trading platforms that offer a marketplace for buyers and sellers.

- Municipal bond funds: Managed by professional portfolio managers, these funds pool investors’ money to buy a diversified portfolio of municipal bonds.

- Over-the-counter (OTC) market: The OTC market allows for direct bond trading with dealers, offering flexibility but requiring more research and market knowledge.

- Unit Investment Trusts (UITs): Offer a fixed portfolio of municipal bonds typically held until maturity.

- Key Considerations: Evaluate bond ratings from agencies like Moody’s, S&P, and Fitch, as well as maturity dates and yields before investing.

- Financial institutions: You can also purchase municipal bonds from banks and credit unions, which may offer options tailored to individual investors.

Conclusion

Municipal bonds play a key role in funding public projects and may offer tax advantages to investors. Like all investments, they carry risks, so understanding their features and potential impact on your portfolio is essential.

Public.com provides a platform where you can explore a range of investment options, including stocks, crypto, options, bonds, and IRAs—all in one place. With tools like the Income Hub for tracking earnings and Alpha, an AI-powered assistant for market insights, Public helps you stay informed as you build and manage your portfolio.