Bond prices could rise and yields may fall. Investors may opt to lock in higher yields by buying bonds before an anticipated rate cut.

Locked in.

Discover a new way to invest in bonds and earn a 5.4%* yield with regular interest payments.

*This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. Because the YTW of each bond is a function of that bond’s market price, which can fluctuate, your yield at time of purchase may be different from the yield shown here and YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.

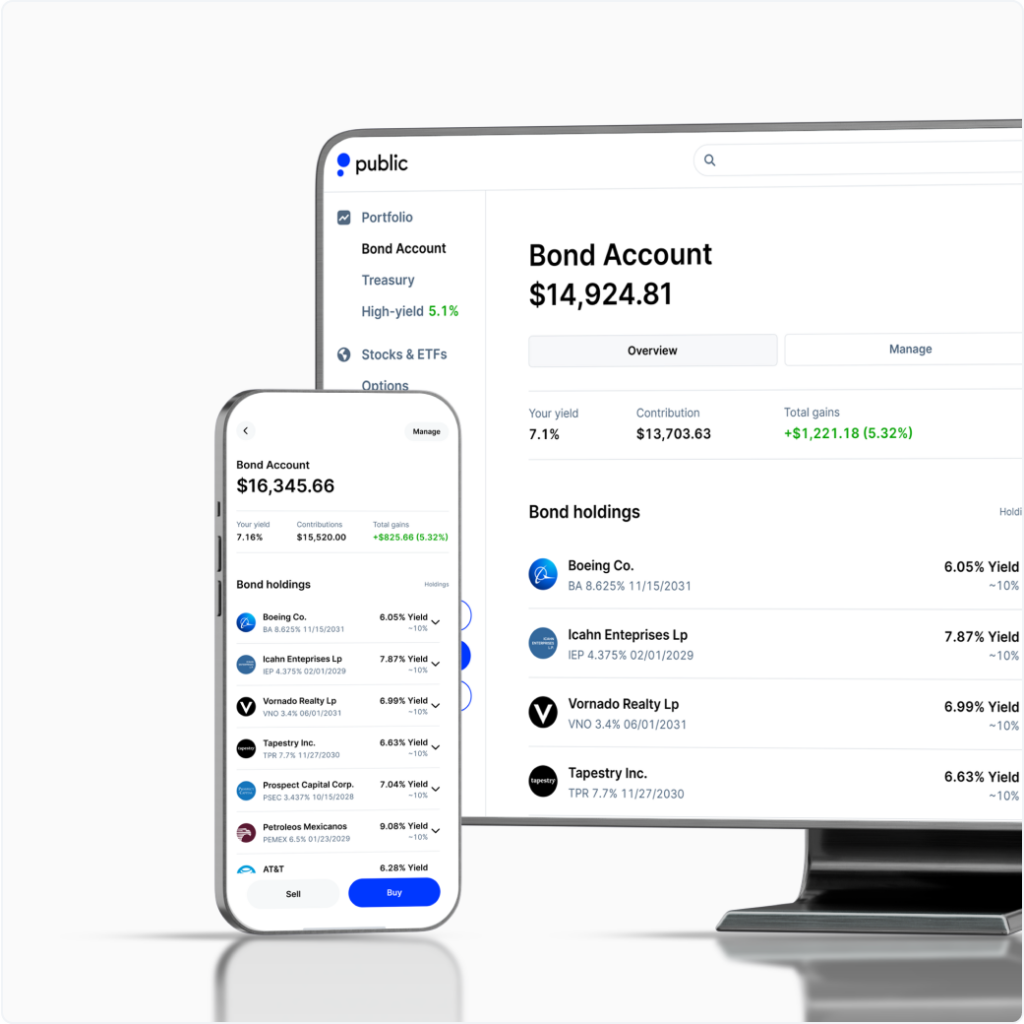

What is a Bond Account?

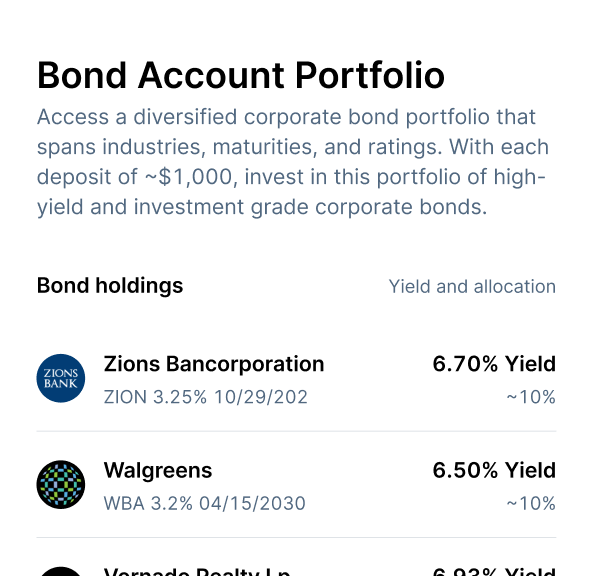

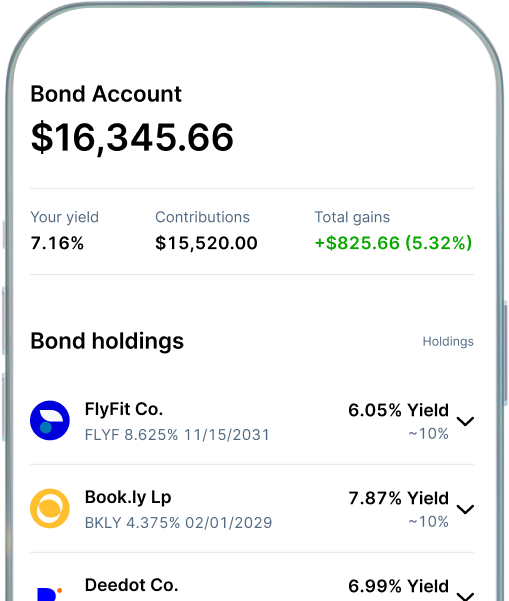

Now, you can invest in a diversified portfolio of investment-grade and high-yield corporate bonds that earn yield over an extended period of time.

Lock in your yield

Unlike a High-Yield Cash Account, the yield of a Bond Account is locked in at the time of purchase. That means you’ll receive that yield until the first of the ten bonds matures or is called. 1

Skip the sky-high minimums

With a minimum initial $1,000 deposit, you can invest in a portfolio of ten bonds. Many bonds on other platforms are only available in investment sizes of $10k or more.

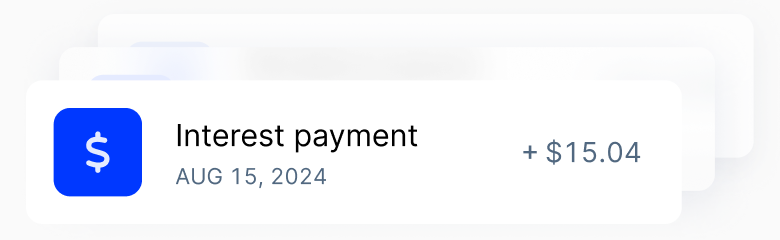

Receive regular interest payments

While you are invested in a Bond Account, you’ll receive 20 interest payments throughout the year from your diversified portfolio of ten corporate bonds.2

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 fractional investment-grade and high-yield bonds in equal par value allocations. All bond investments are subject to risk, including risk of default. High-yield bonds carry greater risk of default than higher rated bonds. Learn more

- Your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. When a bond in the bond account matures, is called, or defaults, the YTW of the remaining bonds in your Bond Account will adjust accordingly. Please refer to your portfolio for specific details.

- As of today, the ten bonds in the Bond Account each pay interest semi-annually, and each bond has a different payment schedule. Assuming the issuers do not miss payments or otherwise default, if you hold all ten bonds, you will receive 20 interest payments a year. Interest payments will not be evenly distributed.

Lock in your 5.4%* yield in two steps

Deposit cash

Your deposits are allocated to a portfolio of ten investment-grade and high-yield corporate bonds.

Get regular payments

You'll receive 20 regular payments throughout the year.1 Once your income reaches ~$100, it is reinvested at the then-current yield.

*This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.

- As of today, the ten bonds in the Bond Account each pay interest semi-annually, and each bond has a different payment schedule. Assuming the issuers do not miss payments or otherwise default, if you hold all ten bonds, you will receive 20 interest payments a year. Interest payments will not be evenly distributed.

Earn 5.4%* even if the Fed cuts rates.

The Fed has signaled potential rate cuts this year, and market expectations are for cuts of 1% or more by year-end. Plus, the market has priced in additional cuts in 2025. That means bond yields could go down. Soon.

If the Fed cuts rates...

If the Fed raises rates...

Bond prices could fall and yields may rise. Investors may choose to wait until rates increase before purchasing bonds.

The good news? With a Bond Account on Public, you can lock in the yield from 10 bonds until they mature. The first maturity in the account is in 2028—giving you four years of 5.4%* yield from your initial investment.

Protect your earnings from rate cuts

Locking in your 5.4%* yield before the Fed's potential rate cuts can have a significant impact on the earnings you generate over the next 4–5 years.

*This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. Because the YTW of each bond is a function of that bond’s market price, which can fluctuate, your yield at time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.

While corporate bond yields should fall in reaction to a Federal Reserve rate cut, we cannot know whether that will be true of the bonds in the Bond Account, how quickly bond yields will respond, or how much they will decline.

Explore the key stats

Investing in a portfolio of corporate bonds from various industries and with different credit ratings can help balance risk and return.

Bond Account

5.4% Yield*The yields shown below correspond to each individual bond’s current yield. The Bond Account’s overall yield equals the current average, annualized yield to worst (YTW) across all ten individual bonds in the Bond Account, before fees. Your set of 10 bonds will be established at the time you submit your Bond Account purchase and may be different from what is shown here. The Bond Account is not a recommendation of its overall set of bonds, or its individual holdings or default allocations. You are solely responsible for determining whether to purchase or sell the bonds in the Account. Learn more.

Explore the Bond Account portfolio

Apollo Debt Solutions BDCALLSO 6.7% 07/29/2031

Apollo Debt Solutions BDCALLSO 6.7% 07/29/2031

CenteneCNC 3.0% 10/15/2030

CenteneCNC 3.0% 10/15/2030

EdisonEIX 6.95% 11/15/2029

EdisonEIX 6.95% 11/15/2029

Ford Motor CompanyF 7.45% 07/16/2031

Ford Motor CompanyF 7.45% 07/16/2031

Helmerich & PayneHP 2.9% 09/29/2031

Helmerich & PayneHP 2.9% 09/29/2031

Main Street CapitalMAIN 6.95% 03/01/2029

Main Street CapitalMAIN 6.95% 03/01/2029

Piedmont Office Realty TrustPDM 3.15% 08/15/2030

Piedmont Office Realty TrustPDM 3.15% 08/15/2030

Prospect CapitalPSEC 3.437% 10/15/2028

Prospect CapitalPSEC 3.437% 10/15/2028

V.F.VFC 2.95% 04/23/2030

V.F.VFC 2.95% 04/23/2030

Vornado Realty TrustVNO 3.4% 06/01/2031

Vornado Realty TrustVNO 3.4% 06/01/2031

Learn more about the Bond Account

Gain a deeper understanding of the current interest rate environment and why we created the Bond Account.

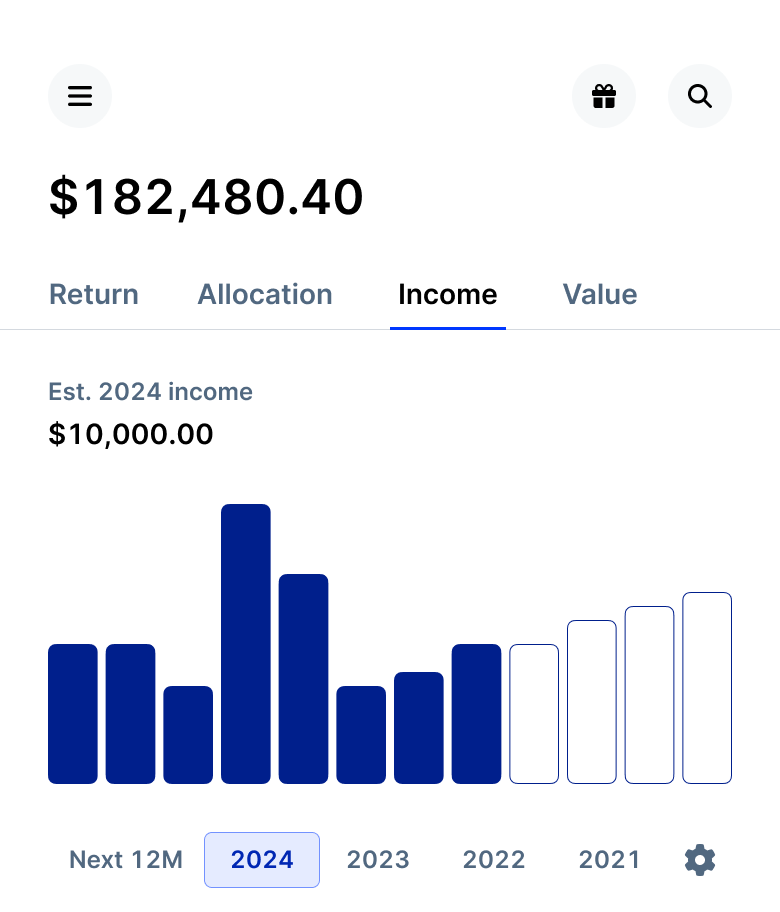

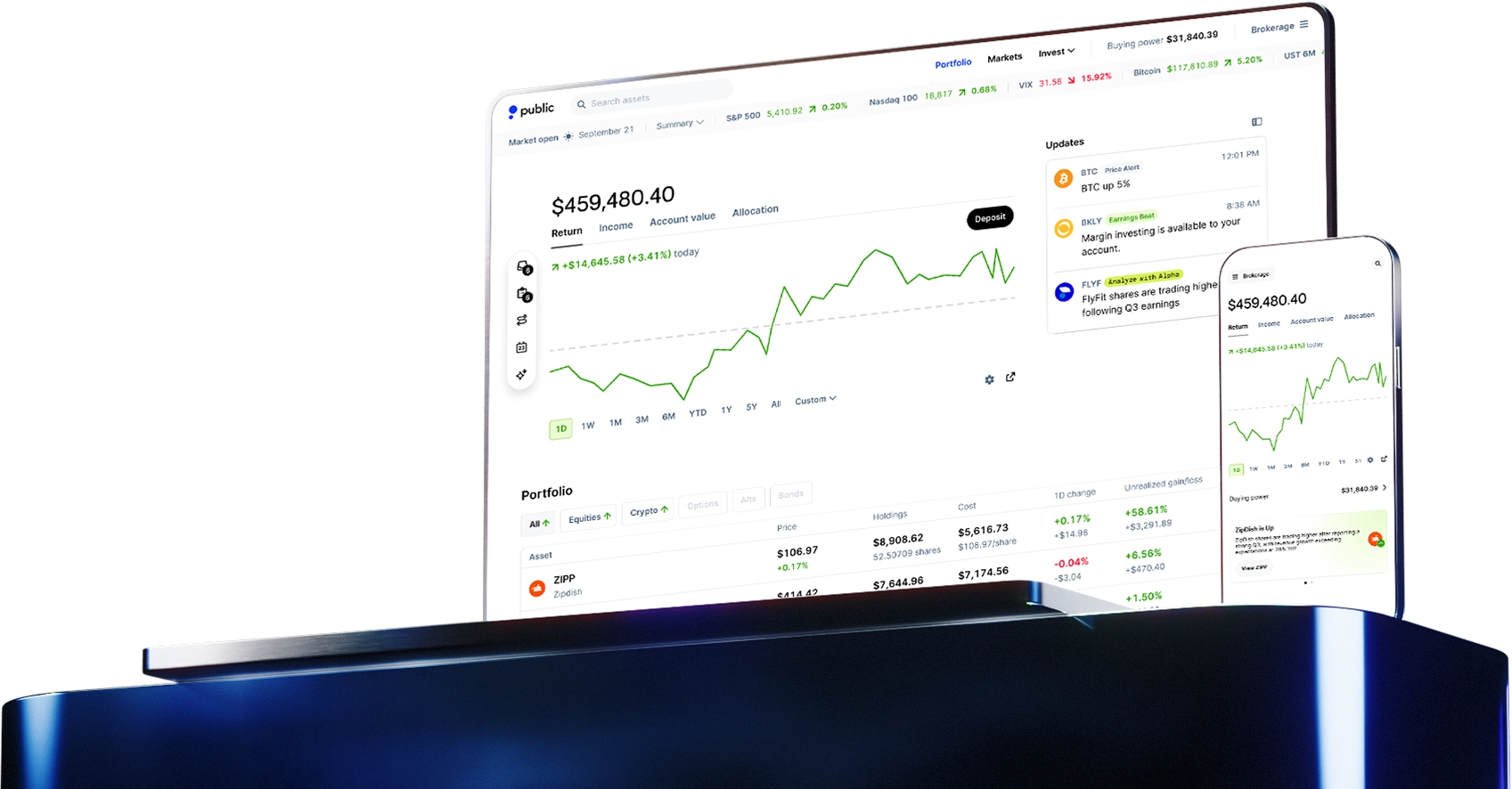

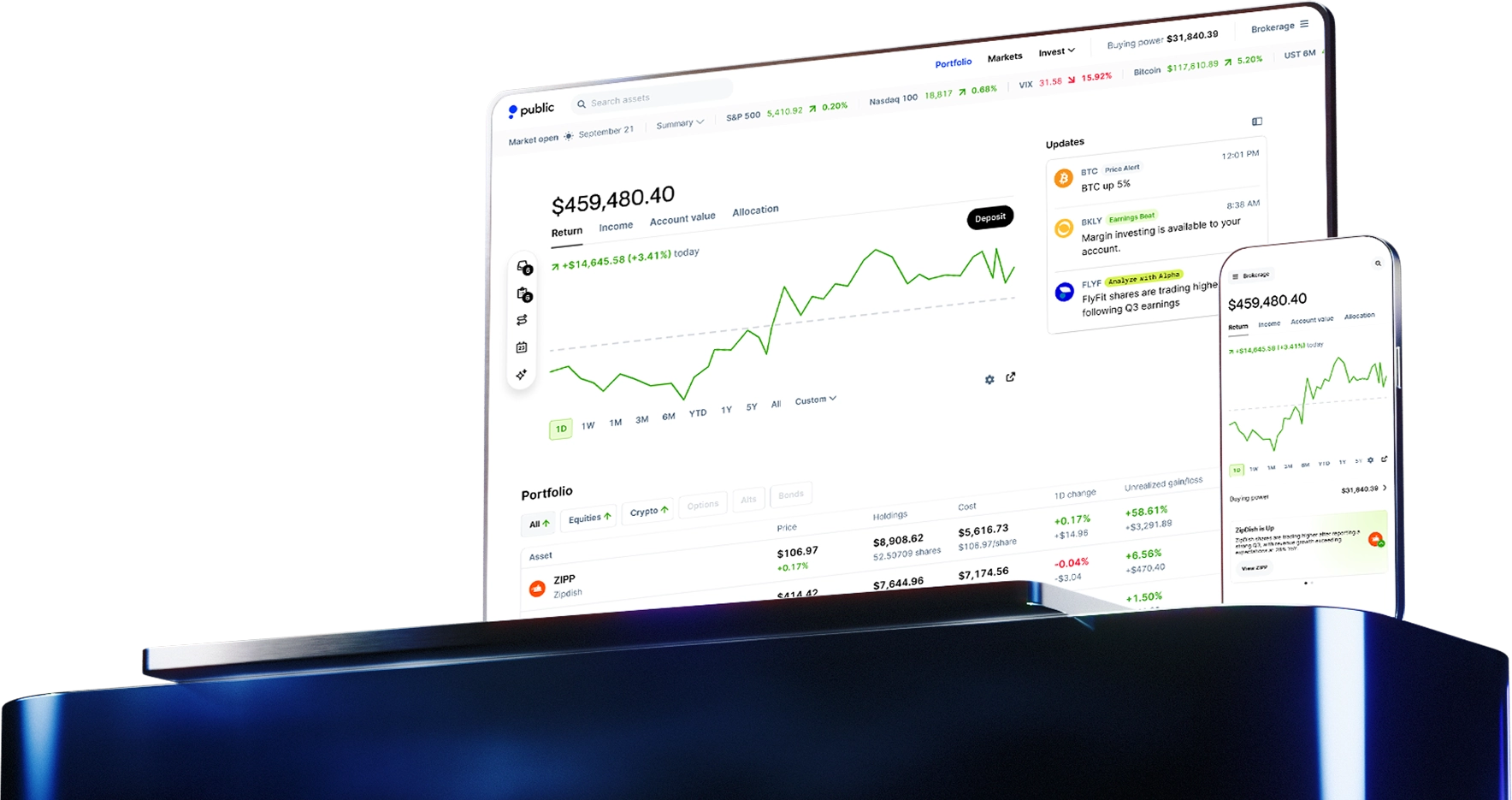

Download PDFChart your income journey

It's easy to monitor your income sources on Public with our monthly breakdown of your earnings from each asset class, including your Bond Account.

View a monthly breakdown of all your income sources.

Refine your view by filtering by asset class.

See your estimated earnings for the next 12 months.

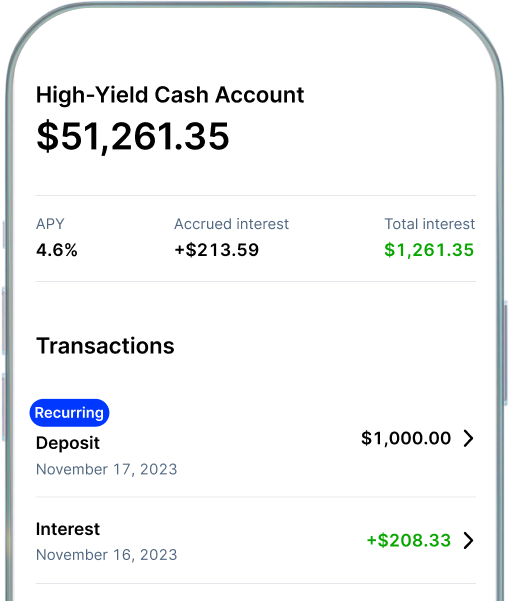

Discover our suite of yield accounts

High-Yield Cash Account 3.3%

Earn an industry-leading 3.3% APY* on your cash with no fees. Plus, get up to $5M FDIC insurance.

Learn more

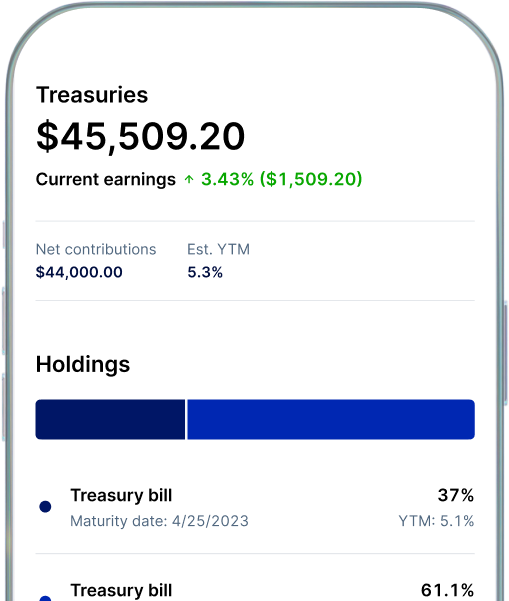

Treasury Account 3.64%

Invest in US Treasury bills with a 3.64%** yield, and pay no state or local taxes on your earnings.

Learn more

Bond Account 5.4%

Balance risk and return with a diversified portfolio of corporate bonds that generate a 5.4%*** yield.

Sign up*Rate as of 9/19/2024. APY is variable and subject to change

**Yield is an annualized 26-week T-bill rate (as of 8/12/2024) when held to maturity. Rate is gross of fees and is subject to change

***This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. Because the YTW of each bond is a function of that bond’s market price, which can fluctuate, your yield at time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.

What else do I need to know?

How do I invest in a Bond Account on Public?

You can find the Bond Account alongside other yield accounts (Treasury and High Yield Cash) on the Public app or on the web. You can fund the account from your existing buying power or from an external account with an investment of $1,000 or more. Each investment of $1,000 will be used to purchase a portfolio of ten fractional investment-grade and high-yield bonds in equal par value allocations. You may make a one-time investment into the Bond Account or schedule recurring investments on a weekly or monthly basis.

What are the benefits and risks of investing in a Bond Account?

One key benefit of a Bond Account is locking in your yield at time of purchase. Unlike a savings account or other variable rate account, your yield for each bond is fixed at the time of purchase, though the return may be affected if you do not hold a bond to maturity, or if the issuer defaults or calls the bond. Other benefits include the ability to invest in ten bonds for $1,000, where typically individual bonds have minimums of $1,000+. However, fractional bonds carry some risks, which can be found here. Other risks include the risk of default, liquidity risk, and inflation risk (if inflation outpaces the fixed income from a bond, this may reduce the real return on investment.)

How does the Bond Account compare to other yield accounts?

Compared to Public’s High Yield Cash Account and Treasury Account, a Bond Account generates a higher yield, but comes with higher risk of default and illiquidity. Like a Treasury Account on Public, the Bond Account reinvests interest at the current rate automatically once it hits a minimum threshold (in this case ~$100). Similar to other yield accounts on Public, cash in a Bond Account may be withdrawn at any time, but there is a small fee if bonds need to be sold to do so ($0.50 per $100).

What happens to my investment if interest rates change?

Once you are invested in a Bond Account, your yield on that investment is locked in unless a bond in the account defaults, is called, or is sold. That means that even if interest rates fall (i.e. the Federal Reserve cuts rates), your Bond Account yield for deposits already made will not change. Note that the Bond Account yield will fluctuate daily and subsequent deposits into the account may be at different yields than your original deposit.

Are there any fees for the Bond Account?

Purchases and Sales in the Bond Account are subject to a markup of 50 basis points (i.e. $5 per $1,000 invested). In addition, there is a $3.99 monthly fee for the account which is waived until 2025. The monthly account fee will also be waived for all Public Premium members. See fee schedule.

How is my Bond Account protected?

A Bond Account at Public is a separate account from your brokerage account but cash and securities are combined for SIPC coverage limits. SIPC coverage protects assets up to a total of $500,000, of which $250,000 applies for cash. There are additional terms and limits on SIPC coverage that aren’t discussed here. For full details, please refer to www.SIPC.org and read more on our SIPC FAQ.

Need help? Reach out.

Have additional questions about Bond Account on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Build your portfolio with Public

*This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. Because the YTW of each bond is a function of that bond’s market price, which can fluctuate, your yield at time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.