Invest in ETFs

Broaden your market exposure with collections of securities that align with a specific industry, trend, or investment style.

Sign UpExplore ETFs

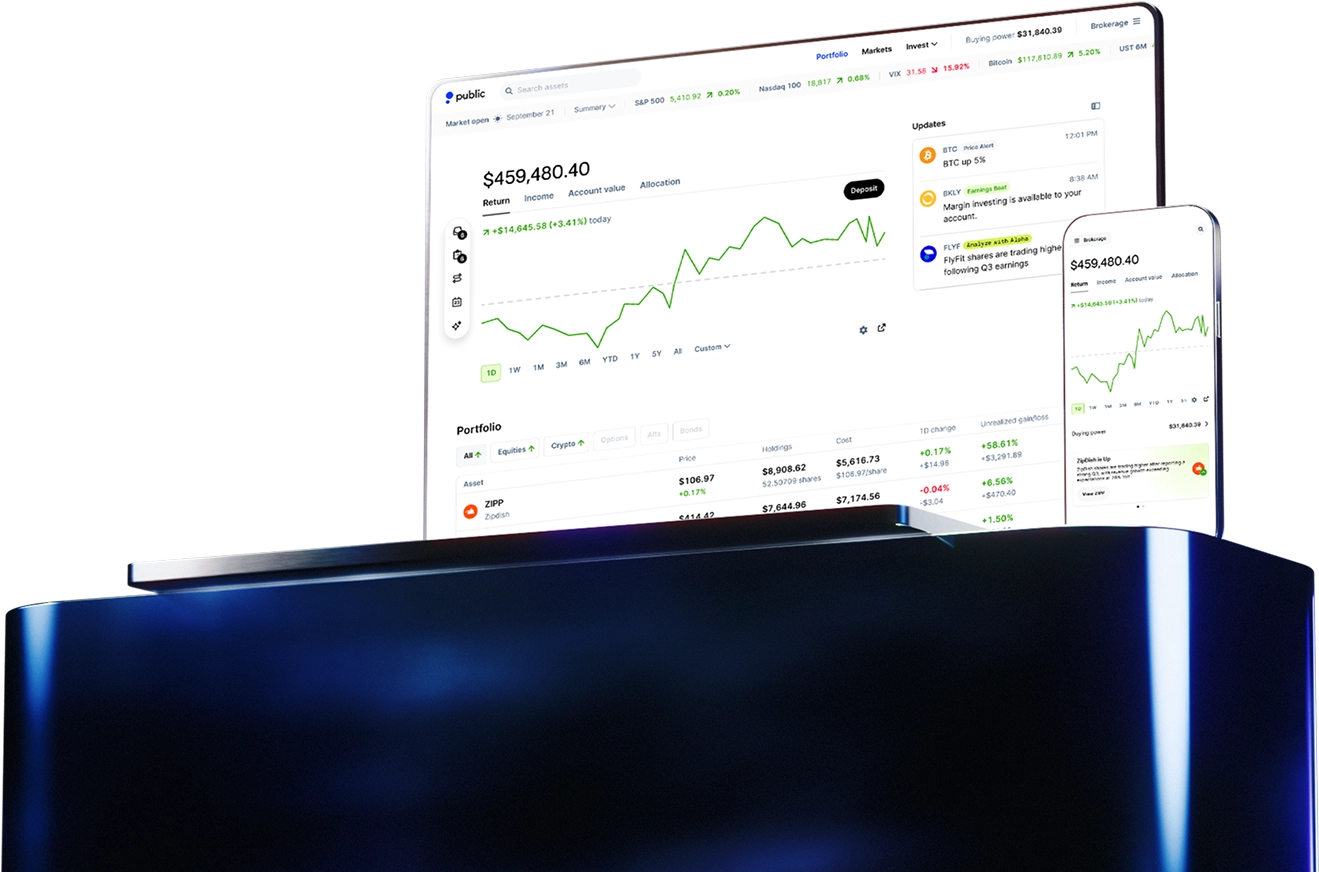

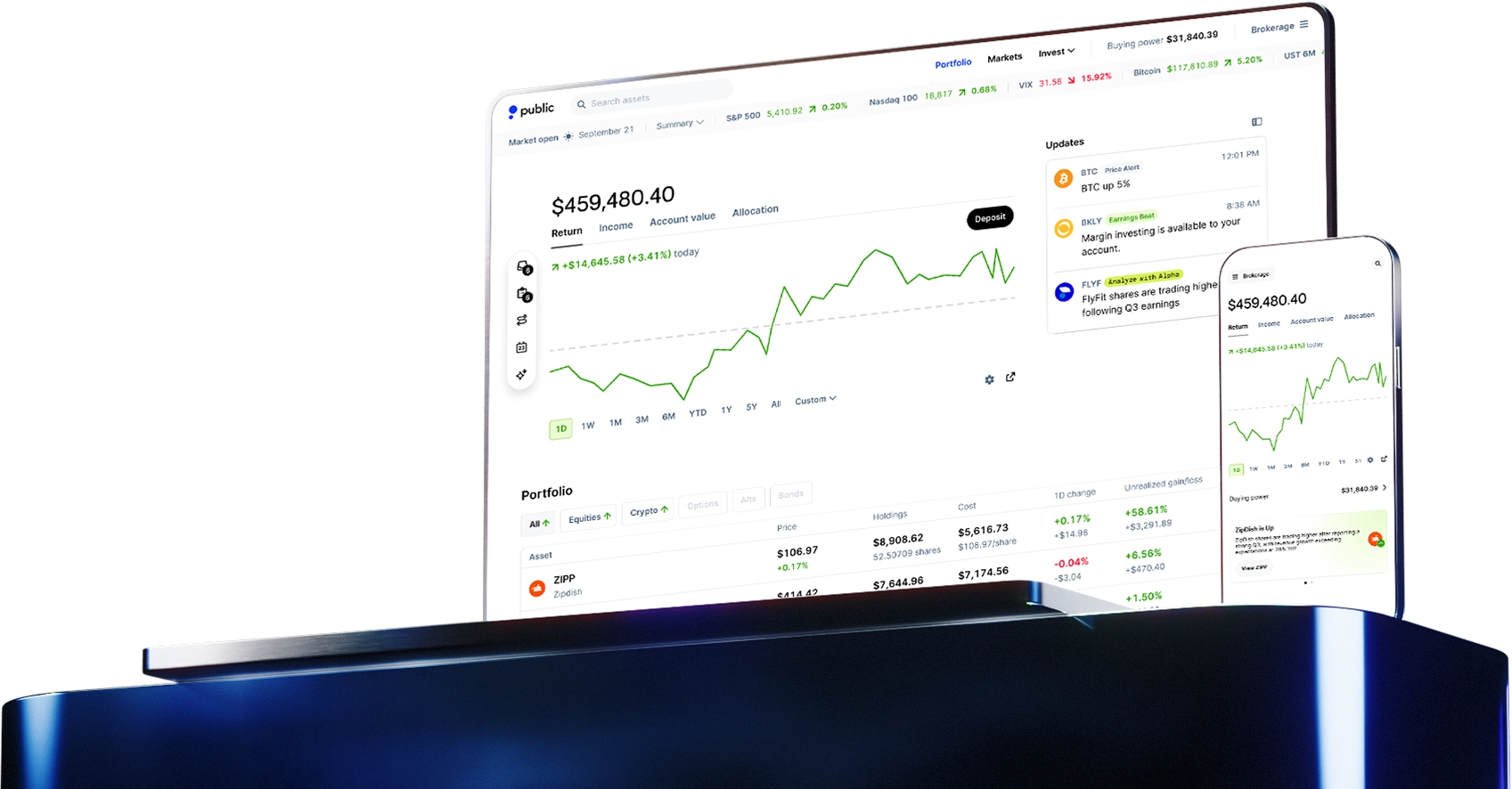

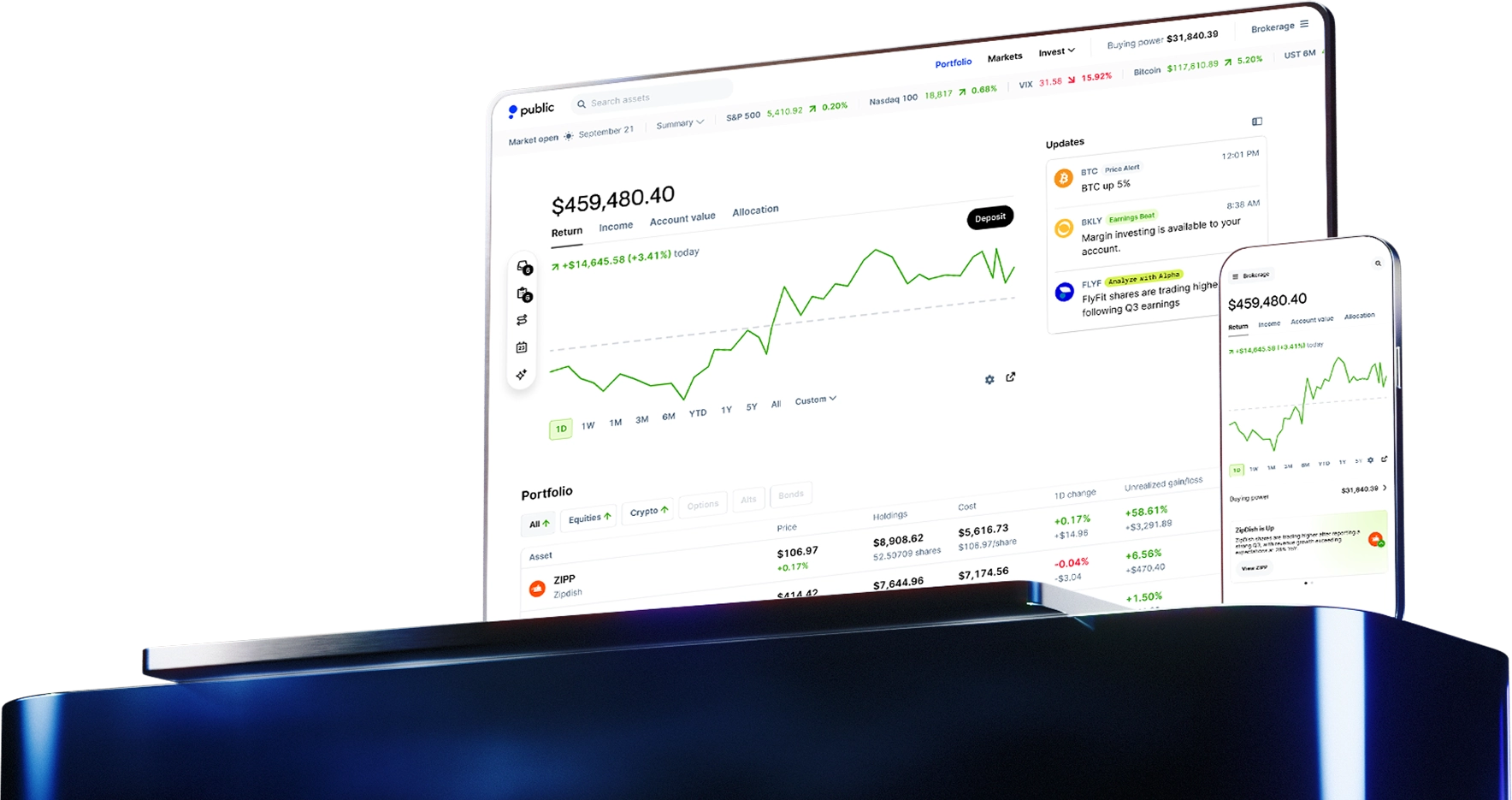

Investing tools

Access powerful investing tools

Set price alerts for ETFs

Make timely investment decisions with price alerts for ETFs. Get notified when an asset falls above or below your set threshold.

Get more time to react to market events

With extended-hours trading, you get over 5 additional hours to buy and sell ETFs. Access pre-market trading from 8 AM to 9:30 AM ET and after-hours trading from 4 PM to 8 PM ET.

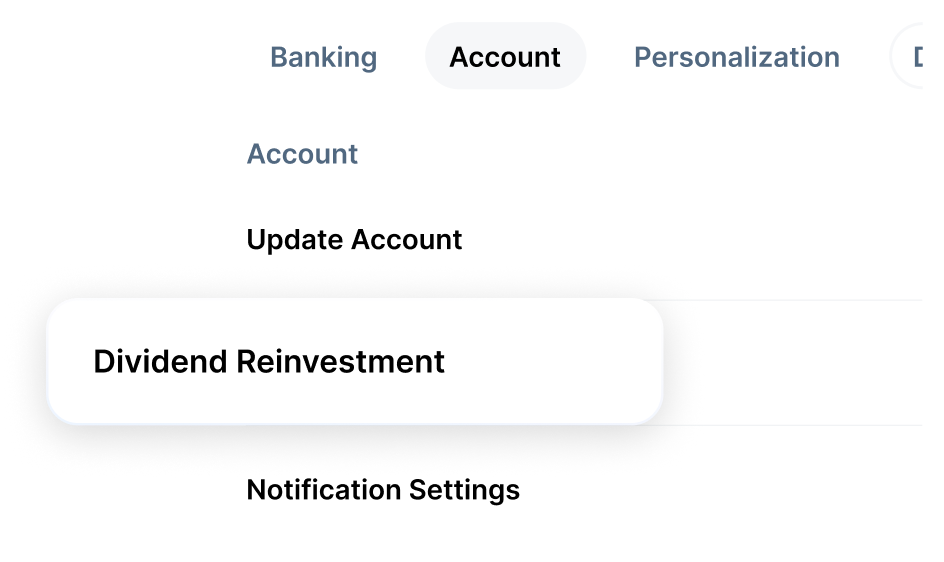

Automatically reinvest your dividends

If your ETFs pay dividends, you can automatically reinvest your dividends right back into the fund that paid them out.

Market insights

Make informed investment decisions

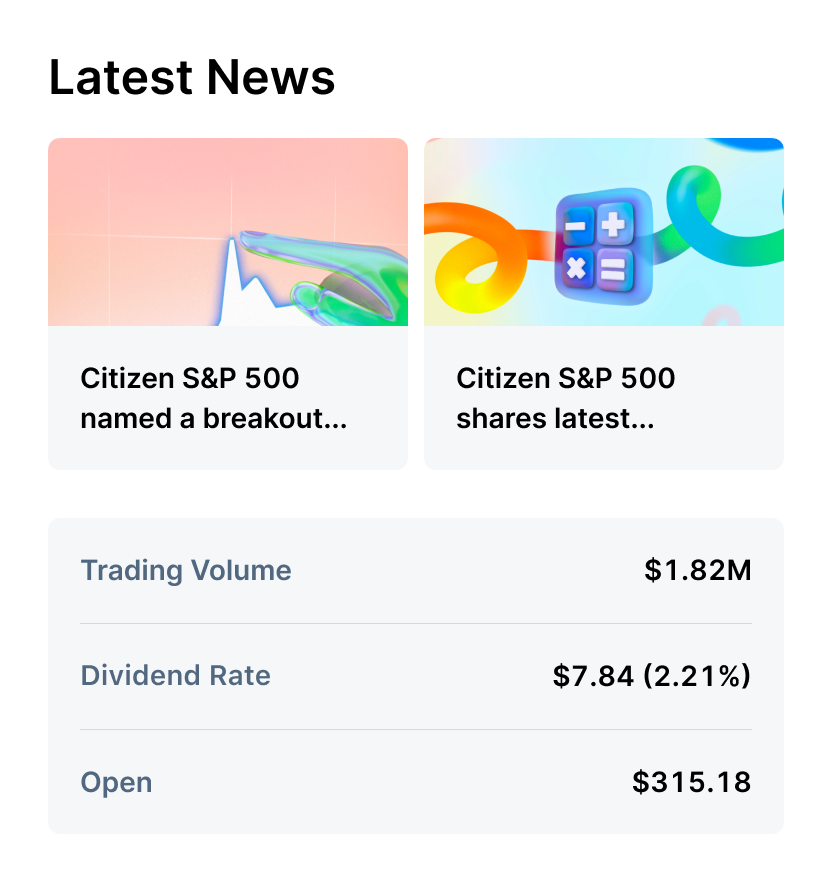

Take a closer look at any ETF

Every ETF page on Public has helpful information about the fund and its performance, including key metrics, news, and recent activity from other investors.

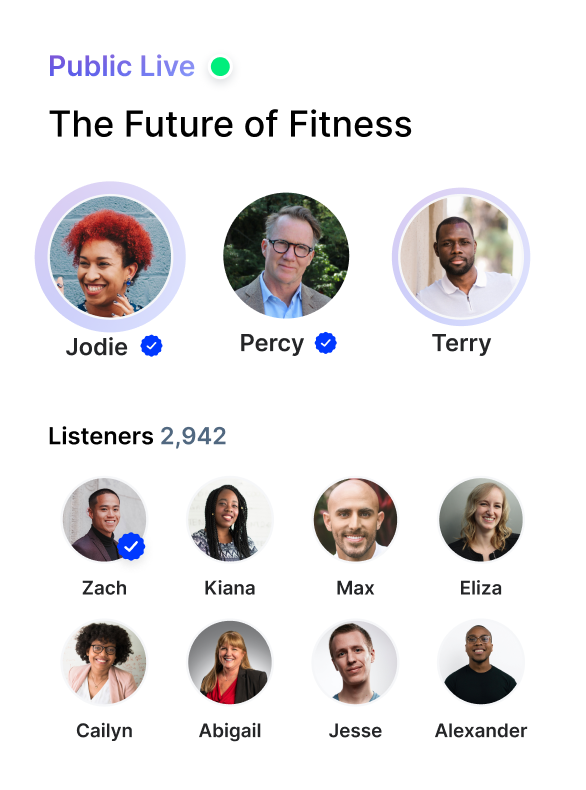

Get daily live analysis on the markets

Each day, you can hear experts, analysts, and journalists discuss the day’s biggest market headlines—and what they mean for your portfolio—on Public Live.

Upgrade your portfolio

With Public Premium, you can unlock advanced data and analysis to help inform your ETF trading strategies even further.

Have questions? Find answers.

What is an ETF and how does it work?

Also known as an ETF, an exchange-traded fund is multiple stocks or assets offered together as a bundle or package. To learn more about ETFs, click here.

What is the difference between an ETF and a mutual fund?

Mutual funds are priced once per day after market closes and ETF prices change during market hours as they are traded on an exchange throughout the day. Click here to learn more.

How do you choose an ETF to invest in?

When choosing what ETF to invest in, you should determine if the fund’s investment objectives align with your investing goals. It is important to do your research, taking things like past performance and fund manager into consideration. Public offers a suite of diversified ETFs that helps your investment align with your goals.

How can I invest in ETFs on Public?

There are numerous ETFs that you can invest in on the Public platform. With one transaction, you can buy a diversified set of investments that align to your goals. Download the app & sign up to get started.

Have additional questions about investing in ETFs with Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Build your portfolio with Public