public active trading

public active trading

Options trading.

Upgraded.Advanced tools, zero commissions,1 and rebates on your trades.

Maximize your moves.

Minimize your costs.

Earn rebates on stock and ETF contracts

On Public, you can earn $0.06–$0.18 for each stock or ETF options contract you trade, with higher earnings as you trade more contracts each month.

-

Tier 1

up to 999 stock and ETF contracts -

Tier 2

1,000-4,999 stock and most ETF contracts -

Tier 3

5,000-9,999 stock and most ETF contracts -

Tier 4

10,000+ stock and most ETF contracts

Standard Rebate

- Tier 1 up to 999 stock and ETF contracts

- Tier 2 1,000-4,999 stock and most ETF contracts

- Tier 3 5,000-9,999 stock and most ETF contracts

- Tier 4 10,000+ stock and most ETF contracts

API Rebate

- Tier 1,2,3 up to 9,999 stock and ETFs contracts

- Tier 4 10,000+ stock and most ETFs contracts

*We provide an adjusted rebate on QQQ, SPY, IWM, and all contracts traded via the API. Members in Tiers 1-3 earn $0.06 per contract, while Tier 4 earns $0.10 per contract.

Trade index options.

With industry-low fees.

At just $0.35–$0.50 per contract, you can expand your options trading strategies with some of the largest indices, including NDX, SPX, VIX, and CBTX.

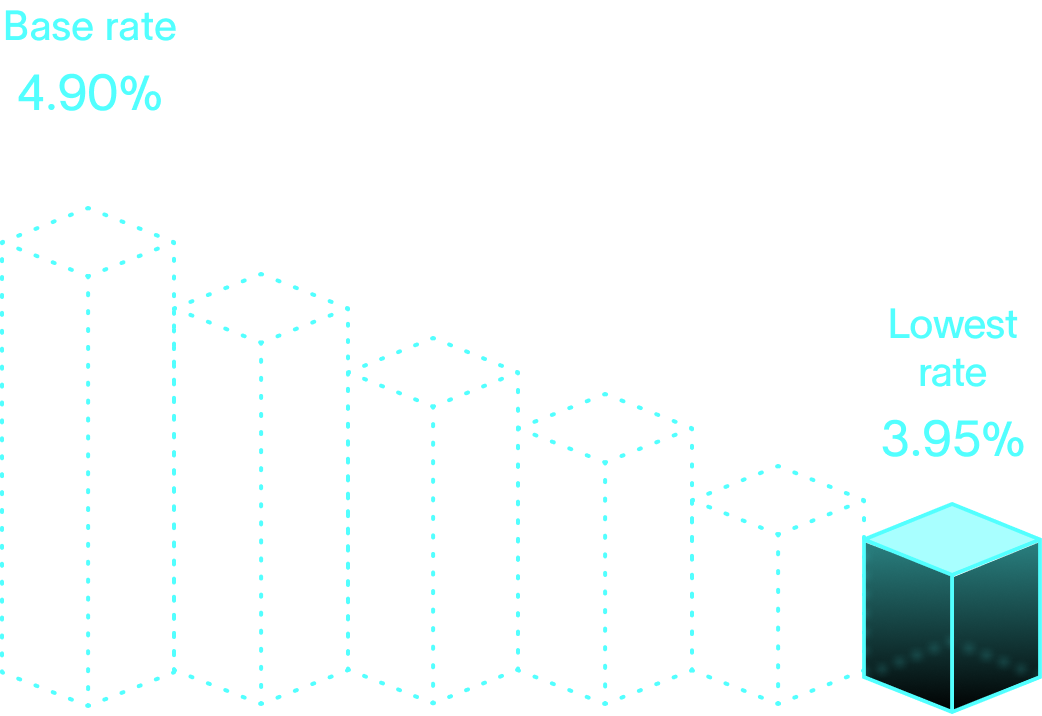

Trade on margin with

rates as low as 3.95%*

Level 3+ options traders enrolled in margin investing can unlock advanced options trading strategies at some of the industry's lowest margin rates.

Don’t leave money on the table.

Earn rebates on options trades.

Public is the only brokerage with an options trading rebate program, helping you minimize your options trading costs compared with other brokerages.

| Broker | Rebate | Fees |

|---|---|---|

| Earn up to $0.18per stock & ETF contract traded | $0.05 | |

| Robinhood | None | $0.05 |

| TD Ameritrade | None | $0.66 |

| Fidelity | None | $0.67 |

Trading fees for competitors were taken from their website on 5/20/2025, and are exclusive of promo rates. The trading fees above are an approximation, are subject to change, and may vary based on factors such as the total number of contracts and price per contract. See terms & conditions for enrolling in Public’s options rebates at public.com/disclosures/rebate-terms

Access our API for

programmatic trading

With the Public API, you can tap into real-time market data and automate your trading—all while earning rebates on your stock and ETF options contracts.

Be ready when

opportunity strikes

The options market moves fast. Public allows you to make moves without waiting for funds to settle on a platform with near-perfect uptime.

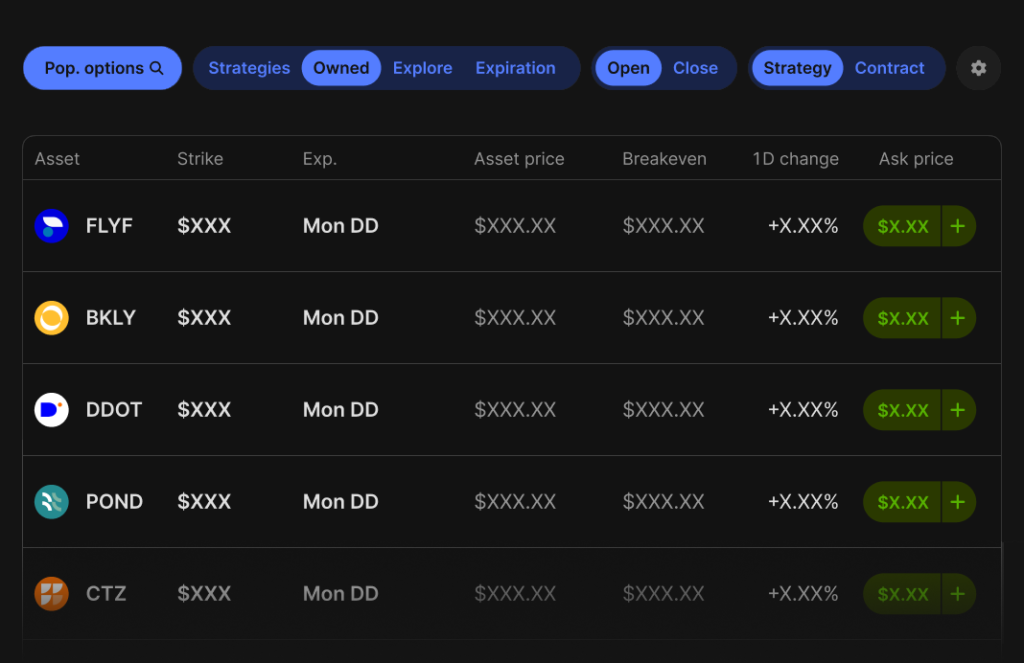

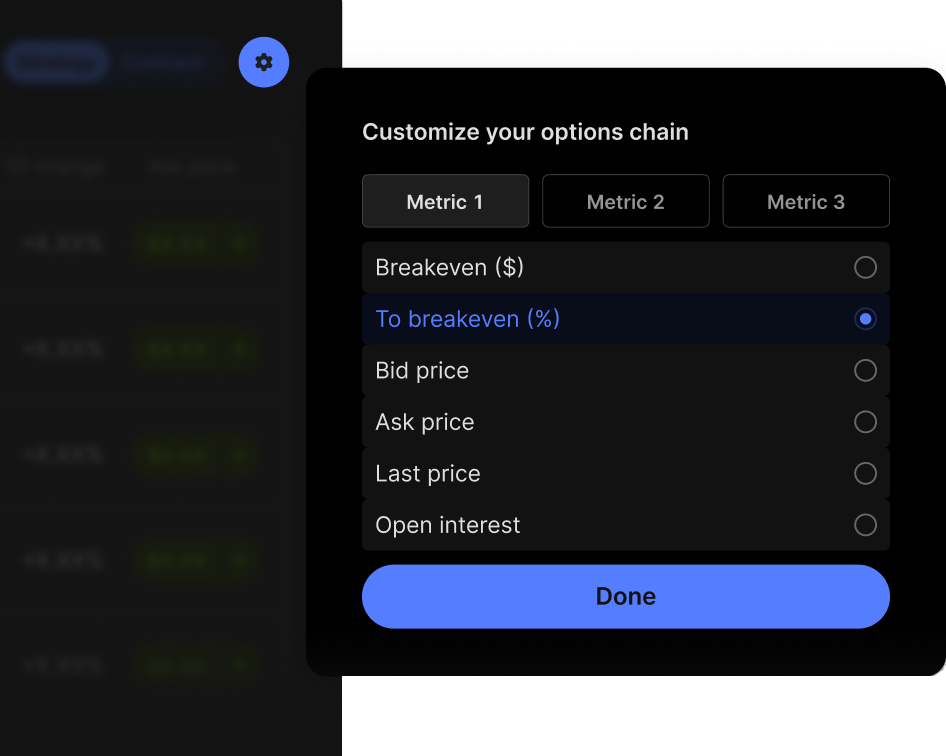

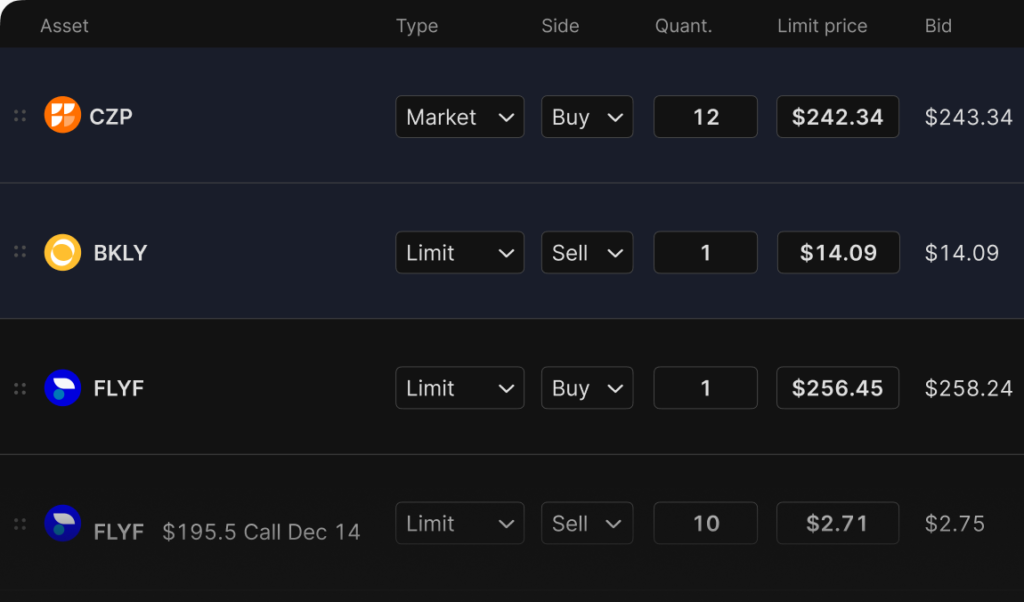

Five features you’ll love

on Public

Trade options tied to Bitcoin. No wallet required.

Want to access Bitcoin’s price action? Now, you can trade options on Bitcoin-linked assets like the iShares Bitcoin Trust ETF and more—without directly owning crypto.

Have questions? Find answers.

How much does it cost to trade options on Public?

Public charges no commissions or per-contract fees for stock and ETF options trades. In fact, you can earn a rebate on every eligible contract you trade. Your options rebate tier is based on how many contracts you trade each month. If you trade enough contracts to reach a higher tier, you’ll keep that better rate for the rest of the current month and all of the next one. After that, your rebate tier resets to your original level.

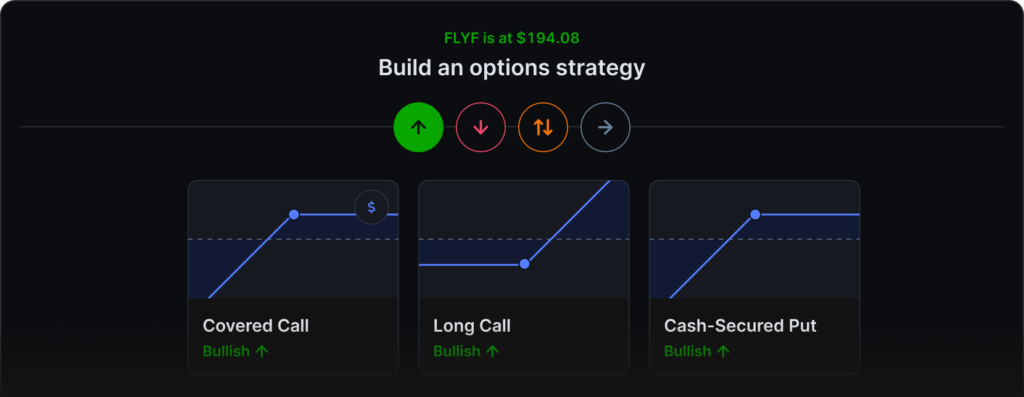

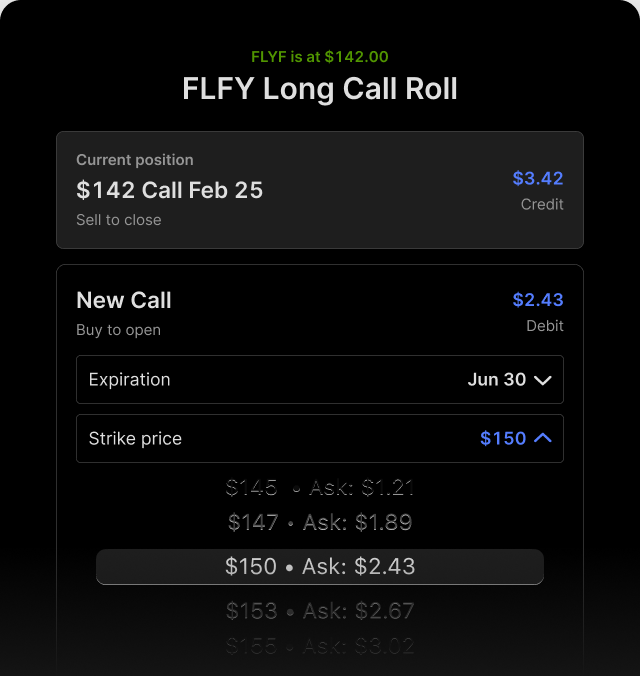

What options strategies are available on Public?

Public offers foundational strategies like long calls, long puts, covered calls, and cash-secured puts—as well as more advanced multi-leg strategies including straddles, strangles, collars, debit and credit spreads, butterflies, and condors (for members approved for these strategies).

What is the options rebate and how does it work?

Public offers a rebate on every stock and ETF options contract you trade. Your rebate tier is based on the number of contracts you trade each month. The more contracts you trade, the higher your rebate per contract. Once you qualify for a higher tier, you’ll keep that rate for the rest of the month and the entire next month. After that, your tier resets.

In the options world, every order gets executed on exchange, and payment for order flow is an essential part of the market structure. But now, you can share in the revenue it generates. Every time you place an options trade on Public, you’ll receive 50% of our payment for order flow revenue, minimizing your transaction costs.

Why are options considered riskier than other investments?

Options are considered riskier than many other investments because they are leveraged instruments, meaning that a small investment can lead to large gains or losses. Option prices can fluctuate significantly, and the potential for the total loss of your investment is higher than stocks or bonds.

Have additional questions about Options on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Ready to upgrade your

options trading strategy?

1 See Fee Schedule for all options trading fees. Index options have special features and fees that should be carefully considered, including settlement, exercise, expiration, tax, and cost characteristics.

* 4.50% rate on margin balances of $250,000 or more. See all margin rates here.

2 Refers to having zero complete outages in the previous, rolling 12 months