Multi-leg Strategies

Calendar Spread

A long calendar spread, also known as a time spread or horizontal spread, involves buying and selling two options of the same type (call or put) with the same strike price but different expiration dates. It's designed to profit from the difference in time decay between the two options, assuming minimal changes in the underlying asset's price.

- Outlook: Neutral

- Use: Primarily used when investors expect little price movement. The goal of a long calendar spread is to take advantage of time decay, also known as theta decay. This strategy may be especially useful in low-volatility markets

- Profit: You’ll profit if the stock is trading between the two breakeven prices at the expiration of the short call or put

- Loss: You’ll incur losses if the underlying asset's price experiences significant movement away from the strike price, rendering both options less valuable. Similar to other debit spreads, your max loss is limited to the net premium paid to establish the spread

Risks

Calendar spreads provide a defined risk-reward profile and controlled exposure to underlying price movements. While your maximum loss is capped at the net premium paid to establish the position, you still have risk that your short option position may be assigned. The trade may not be profitable if the stock moves too far from the strike price.

Basic example

Let’s say that you believe there will be little movement in the price of FlyFit over the coming months. FlyFit is trading at $100 so you buy a long-term call option with a $100 strike price for $5 premium and sell a short-term call option with a $100 strike price for $3 premium. This strategy is often called a long calendar call spread.

- Strike price: $100 Long-term, $100 Short-termStrike price represents the price you’d pay if you were to exercise your long call or the amount you’d receive if your short call were to be assigned

- Contract price: $5 Long-term, $3 Short-termPer-share price of the option contracts

- Total cost: ($5 - $3) x 100 = $200Options have a contract multiplier, or the number of shares presented. Total cost is the cost to purchase the long-term call option ($5), less the premium collected for selling the short-term call ($3), multiplied by the contract multiplier. There may be add’l fees charged by your Brokerage

If you get assigned on the short-term call option, you’d deliver 100 shares and receive $10,000. If you exercise the long-term call option, you’d purchase 100 shares for $10,000.

Maximum profit and loss

The P/L calculations take into consideration both the short call position and the long call position.

- Max loss: $200Your maximum loss is capped at the net premium paid to establish the position

- Breakeven: MultipleThe exact breakevens are unknown until the expiration of the short position. Breakeven is when you are selling the short term for as much as the long term is worth. Any losses from the short-term sale is made up by the long-term premium

- Max profit: UnlimitedThe max profit is unlimited. Once the short-call option expires, the investor is left with just a long call position, which has unlimited profit potential

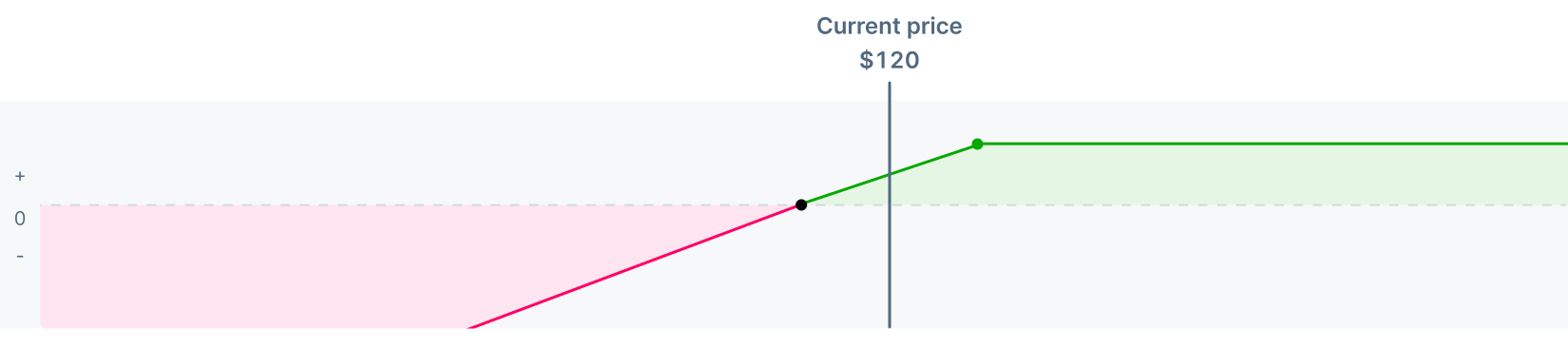

Profit if...

FlyFit’s stock price remains close to the strike price when the short-term call/put option expires and there remains value in the long-term call/put option.

- Total profit: ($100 - $100 - $1) x 100 = $100Difference between the current price and strike price, less the net premium paid, plus the premium remaining ($3) in the long-term call option

If FlyFit's stock price remains near the strike prices, the short-term call/put option will expire worthless and you will be left holding the longer-term call/put option, which still has value given there is time remaining. You could then sell this option or hold it if you think it will become more valuable.

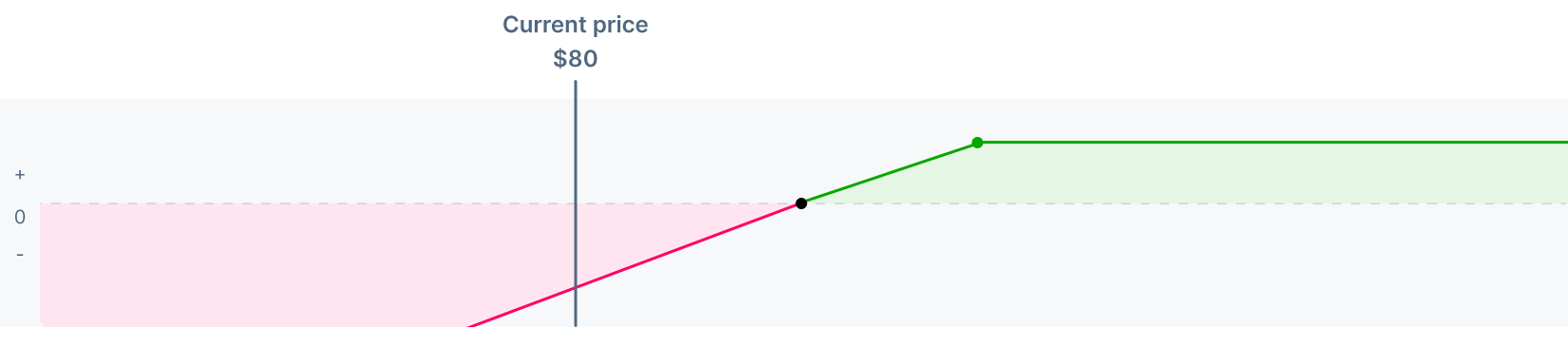

Loss if...

FlyFit’s stock price moves far away from the strike price in either direction.

- Total loss: $2 x 100 = $200The cost of the spread is the maximum loss. This occurs if both calls/puts expire out-of-the-money on their respective expiration dates.

The price is well below the strike prices and both call options are far out-of-the-money with their values close to $0. The loss is equal to the net premium originally paid to enter the strategy.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Fundamentals

Multi-leg Strategies

Chapter 14Long straddle

Chapter 14Long straddle Chapter 15Long strangle

Chapter 15Long strangle Chapter 16Debit spread

Chapter 16Debit spread Chapter 17Credit spread

Chapter 17Credit spread Chapter 18Calendar spread

Chapter 18Calendar spread