Earn an industry-leading

3.3%APY*

Make your savings work harder with a high-yield cash account on Public. Right now, you can earn 3.3% APY*—one of the highest rates in the market.

*Rate subject to change. HYCA Disclosures

All of the interest.

None of the fees.

- No fees

- No subscription

- No minimum balance requirements

- No maximum balance limits

- Unlimited transfers and withdrawals

Access your cash. Whenever.

Withdrawing from your high-yield cash account is as easy as making a deposit. There are no fees or limits to how often you can access your cash.

Get 20x the standard FDIC coverage3

A standard bank offers up to $250,000 of FDIC insurance coverage. We partner with 20 of them so you can get a combined coverage of up to $5M.

3Source: FDIC.gov

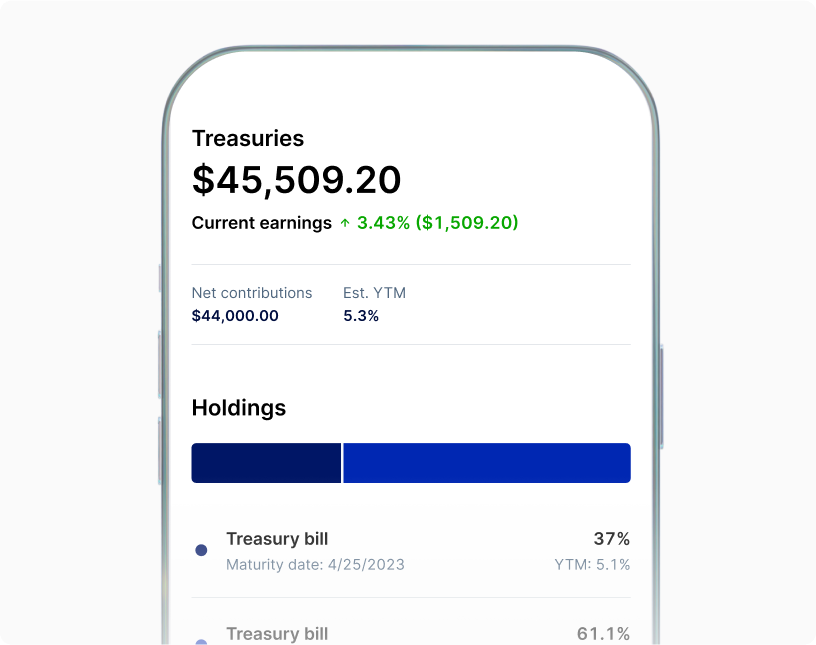

Looking for more ways to generate yield?

Treasury Accounts

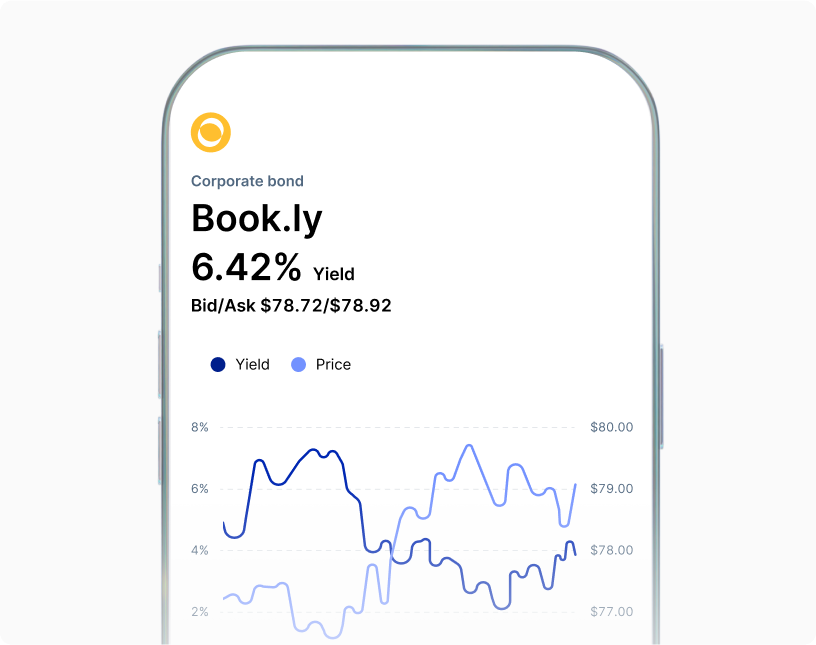

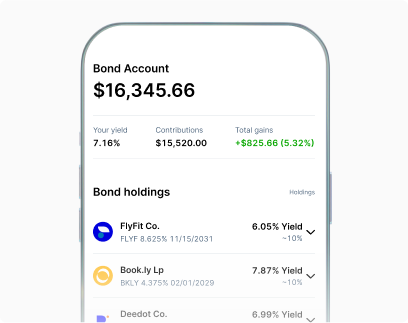

Bonds

Bond Account

Have questions? Find answers.

What is better than a high-yield savings account?

A High-Yield Cash Account on Public can outpace most high-yield savings accounts with its industry-leading 3.3% APY.* Plus you get 20x the standard FDIC insurance.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.

Is it worth putting money into a high-yield savings account?

When you move your money into a High-Yield Cash Account on Public, you can secure an industry-leading 3.3% APY* with no subscription required.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.

Do you pay taxes on a high-yield savings account?

The income you generate from a High-Yield Cash Account is taxed at a federal and state level—just like a traditional savings account.

Neither Public Investing nor any of its affiliates is a bank. Learn more.

Is there a downside to a high-yield savings account?

Beyond its industry-leading 3.3% APY*, a High-Yield Cash Account on Public also has zero fees and 20x the standard FDIC insurance.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.

How much will $10,000 make in a high-yield savings account?

A high-yield cash account on Public generates an industry-leading 3.3% APY*. With a $10,000 investment, you could earn $386.69** over 12 months.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.

**This calculation assumes that balance and rate do not change for 12 months. APY is variable and subject to change.

Have additional questions about Stocks on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.