Multi-leg Strategies

Long Straddle

A long straddle involves buying both a call and a put option with the same strike price and expiration date. Investors may use a long straddle when they expect significant price movement in the underlying asset but are uncertain about the direction of the movement. Long straddles allow investors to potentially profit from a substantial price swing, whether up or down.

- Outlook: Volatile

- Use: Primarily used when attempting to profit from big changes in the underlying stock price, whether up or down. It’s often used when there is an event on the horizon that could either be very good or bad for the stock, like an earnings call or product launch

- Profit: You’ll profit if the stock price rises above (strike price + premiums paid) or falls below (strike price - premiums paid) the breakeven prices

- Loss: You’ll incur losses if the stock price does not move much, remaining between the breakeven prices

Risks

Keep in mind that long straddles can be expensive to implement due to purchasing both a call and put option where the strike price is close to the current price of the stock. They also require significant price movement to be profitable.

Basic example

Let’s say that you believe there will be significant price movement for FlyFit when they release their quarterly earnings. FlyFit is trading at $100 so you purchase a call option with a $100 strike price for a $5 premium, and you also purchase a put option with a $100 strike price for a $5 premium.

- Strike price: $100 Call, $100 PutStrike price represents the price you’d pay if you were to exercise your call or the price you’d receive if you were to exercise your put

- Contract price: $5 Call, $5 PutPer-share price of the option contracts

- Total cost: $1,000Options have a contract multiplier, or the number of shares presented. Total cost is the contract premium x the contract multiplier for all options, or $5 x 100 for both the call and put. There may be additional fees charged by your Brokerage.

If you exercise the call option, you’d purchase 100 shares for a total of $10,000. If you exercise the put option, you’d deliver 100 shares and receive $10,000.

Maximum profit and loss

The P/L calculations take into consideration both the long call and long put positions.

- Max loss: $1,000The maximum loss of a long straddle is the premium you paid for the call and put options if both options expire worthless

- Breakeven: $110 and $90There are two breakeven prices, calculated as the strike price +/- the total premium paid

- Max profit: UnlimitedDifference between FlyFit’s current price and the breakeven x the contract multiplier (usually 100)

The max profit can be unlimited — the call option value increases along with the stock price and the put option value increases as the stock declines. Max profit occurs when the stock price is either $0 or infinite.

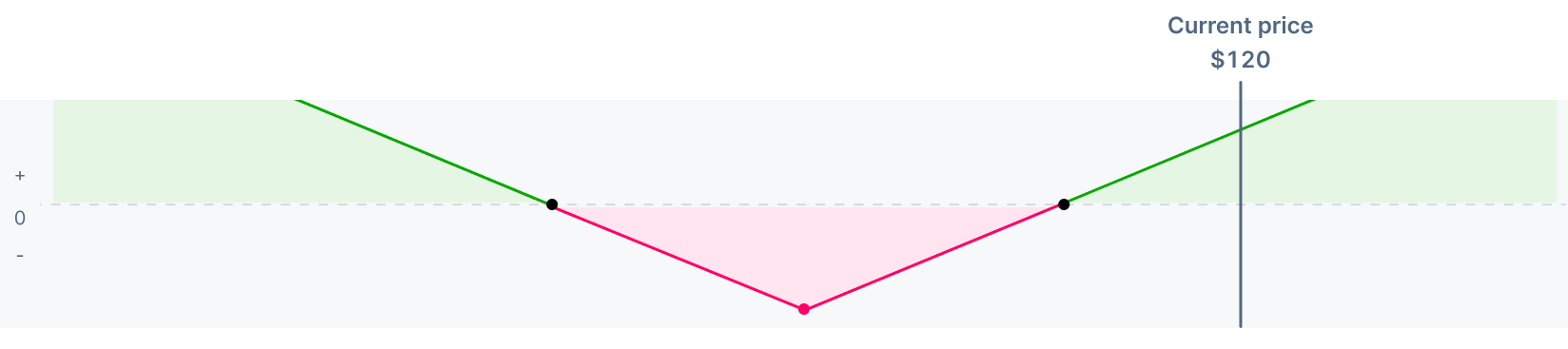

Profit if...

FlyFit’s stock price is above the the higher breakeven price (call) or below the lower breakeven price (put).

- Total profit: ($120 - $100 - $10) x 100 = $1,000Difference between the current price and strike price, less the cost of the put and call options

In the scenario above, you’d purchase 100 shares of FlyFit for $100, or $10,000. You would immediately sell your shares for the market price of $120, or $12,000 total. This results in a gain of $2,000, but since the options originally cost $1,000, the overall trade results in a net proft of $1,000.

When FlyFit's stock price rises well above the strike price, exercising the call option and selling the underlying shares at the prevailing price more than compensates for the cost of both options. Similarly, if the price falls well below the strike price, the put option will be in-the-money and could lead to a profitable trade.

In either scenario, one of the options expires worthless, but the other option’s profits exceeds the cost of entering into the long straddle.

When FlyFit's stock price rises well above the strike price, exercising the call option and selling the underlying shares at the prevailing price more than compensates for the cost of both options. Similarly, if the price falls well below the strike price, the put option will be in-the-money and could lead to a profitable trade.

In either scenario, one of the options expires worthless, but the other option’s profits exceeds the cost of entering into the long straddle.

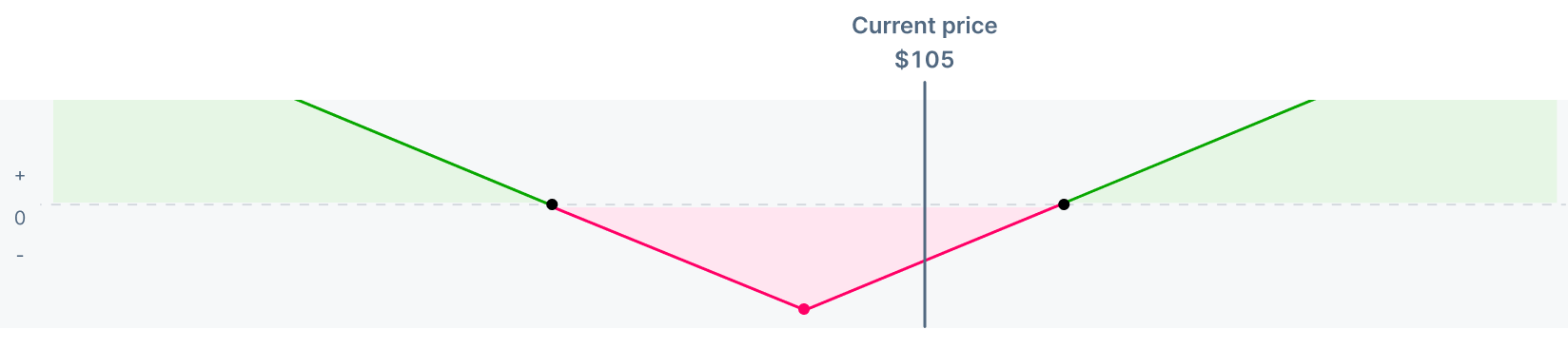

Loss if...

FlyFit’s stock price remains relatively stable and does not go above or below a certain price.

- Total loss: ($105 - $100 - $10) x 100 = $500Difference between the current price and strike price, less the cost of the put and call options

In the scenario above, you’d purchase 100 shares of FlyFit for $100, or $10,000. You would immediately sell your shares for the market price of $105, or $10,500 total. This results in a gain of $500, but since the put option and call option originally cost $1,000, the overall trade results in a net loss of $500.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Fundamentals

Multi-leg Strategies

Chapter 14Long straddle

Chapter 14Long straddle Chapter 15Long strangle

Chapter 15Long strangle Chapter 16Debit spread

Chapter 16Debit spread Chapter 17Credit spread

Chapter 17Credit spread Chapter 18Calendar spread

Chapter 18Calendar spread