Fundamentals

Long Put

A long put, or owning a put option contract, grants the investor the right to sell equity shares at a predetermined price at or before expiration, offering a safeguard against losses or a strategy for capitalizing on a downward market.

- Outlook: Bearish

- Use: If you think that the price of a stock will fall within the contracted time frame

- Profit: You’ll profit if the stock price falls below the strike price, after deducting the premium paid for the contract

- Loss: You’ll incur losses equal to the premium you paid if the stock price doesn’t fall to or below the strike price

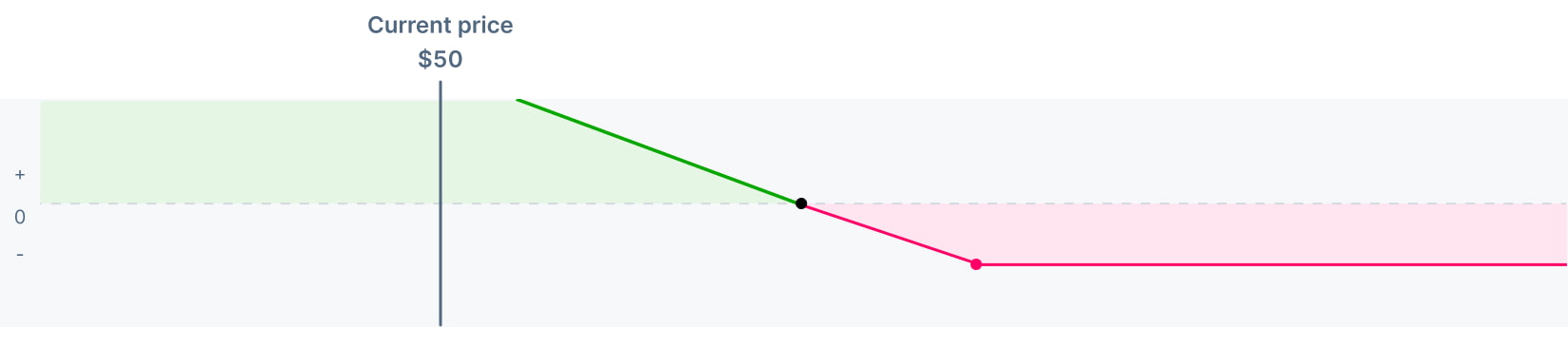

Basic example

Let’s say you think that FlyFit’s stock price might decline in the coming months. Currently, FlyFit is trading at $70 per share, but you anticipate it could drop to $50, so you decide to purchase a put option with a strike price of $65.

- Strike price: $65Price you think the stock will drop below. Strike price represents the price you’d pay if you were to exercise the put

- Contract price: $3Per-share price of the option contract

- Total cost: $300Options have a contract multiplier, or the number of shares presented. Total cost is the contract price x the contract multiplier, or $3 x 100 for this FlyFit option. There may be additional fees charged by your Brokerage.

If you exercise your put option, you’d sell 100 shares of FlyFit for a total cost of $6,500.

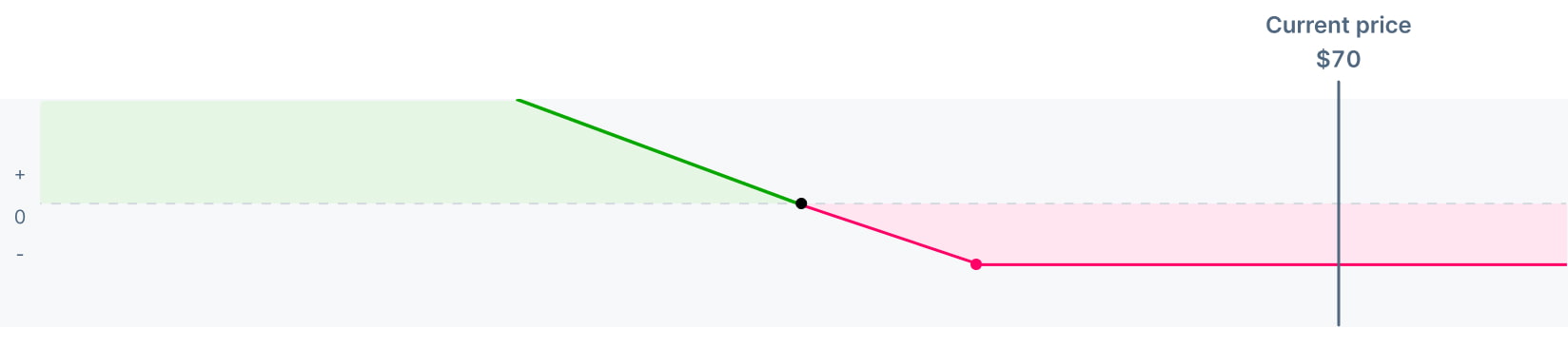

Maximum profit and loss

- Max loss: $300The maximum loss of a long put is the total premium you paid, or the total cost you paid to purchase the FlyFit put

- Breakeven: $62Strike price - contract price

- Max profit: SubstantialDifference between the breakeven and FlyFit’s current price x the contract multiplier (usually 100)

Since a stock price can decline in value significantly, the max profit of a long put is substantial. However, it is not unlimited, like the long call, as there is a floor when the price falls to $0.

Profit if...

FlyFit’s stock price falls below your breakeven. That means that your long put strategy has made a profit that exceeds what you paid for the put option.

- Total profit: ($62 - $50) x 100 = $1,200Difference between breakeven and current price x the number of shares represented (usually 100)

Breaking down the math further, you’d make $5,000 selling 100 shares in the market. However, you have a put option with a strike price of $65, so you can sell 100 shares for $65 each, or $6,500 total. You stand to make a profit of $1,500. But remember that you initially paid $300 for the put option, so we need to subtract that premium, making your net profit $1,200.

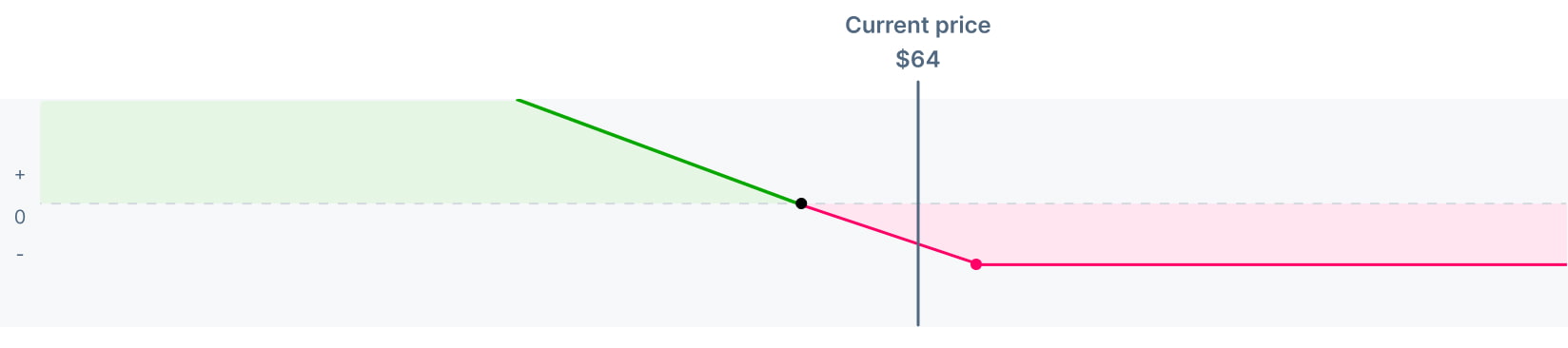

Loss if...

FlyFit’s stock price doesn’t fall below your breakeven. That means that your long put strategy has not made enough of a profit to cover what you paid for the put.

- Total loss: ($64 - $62) x 100 = $200Difference between current and breakeven price x the number of shares represented (usually 100), with a max loss equal to the price of the long put strategy

In the scenario above, you’d make $6,400 selling 100 shares in the market. However, you have a put option with a strike price of $65, so you can sell 100 shares for $65 each, or $6,500 total. You stand to make a profit of $100. But remember that you initially paid $300 for the call option, so we need to subtract that premium, making your net loss $200.

In-the-money and out-of-the-money

Your put is in-the-money (ITM) if the stock price drops below the strike price, and out-of-money (OTM) if the stock price is more than the strike price. While ITM and OTM does not take into consideration the cost of buying the put, it is critical in understanding if your contract would exercise at expiration.

Options that are in-the-money at the time of expiration, even if only be $0.01, will be automatically exercised, posing a potential risk if you don’t have the required shares to sell. If you do not have the necessary shares, Public may have to try liquidating the option on your behalf to prevent you from being short shares.

Options that are in-the-money at the time of expiration, even if only be $0.01, will be automatically exercised, posing a potential risk if you don’t have the required shares to sell. If you do not have the necessary shares, Public may have to try liquidating the option on your behalf to prevent you from being short shares.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Fundamentals

Chapter 9Long call

Chapter 9Long call Chapter 10Long put

Chapter 10Long put Chapter 11Protective put

Chapter 11Protective put Chapter 12Covered call

Chapter 12Covered call Chapter 13Cash-secured put

Chapter 13Cash-secured putMulti-leg Strategies