Fundamentals

Cash-secured Put

A cash-secured put is when an investor sells a put, and sets aside some money for the stock in case the buyer decides to exercise their option. In exchange for giving someone else the right to sell you a stock at a predetermined price, you receive a premium. Cash-secured puts are typically used when an investor anticipates the stock’s price will increase, and wants to generate income.

- Outlook: Bullish

- Use: Primarily used to generate income if you expect the stock price to increase moderately. Some investors also use it to acquire the equity

- Profit: You’ll profit if the stock price rises above your breakeven (strike price - premium received)

- Loss: You’ll incur losses if the stock price falls below your breakeven (strike price - premium received)

Risks

Short puts, even when backed by collateral in the case of cash-secured puts, have a high risk profile. If the stock price drops significantly below the strike price, you'll still be obliged to purchase the shares, and your potential loss can be substantial. While the premium you collected will provide some cushion, you should remember that the stock price could drop to zero, and you'll still be on the hook to buy the shares at the strike price.

Basic example

Let’s say FlyFit is currently trading at $100. You're interested in buying FlyFit but think that $90 is a more attractive price point. You could sell a cash-secured put with a strike price of $90 that expires in a month, for which you collect a $5 premium.

- Strike price: $90Strike price represents the price you’d pay if your put were to be assigned

- Contract price: $5Per-share price of the option contract

- Total sale proceeds: $500Options have a contract multiplier, or the number of shares presented. Total sale proceeds is the contract premium x the contract multiplier, or $5 x 100 for this FlyFit option

- Collateral: $9,000The required buying power set aside if you must purchase 1 contract x 100 shares of the underlying stock for $90/share

Since you are selling the put option, you will immediately generate $500 from the proceeds received when your order is executed, netting out any add’l fees charged by your Broker.

Maximum profit and loss

The P/L calculations take into consideration both the long stock position and the short call position.

- Max loss: SubstantialDifference between the breakeven and FlyFit’s current price x the contract multiplier (usually 100)

- Breakeven: $85Strike price - premium received

- Max profit: $500The maximum profit is the total premium received for selling the FlyFit put

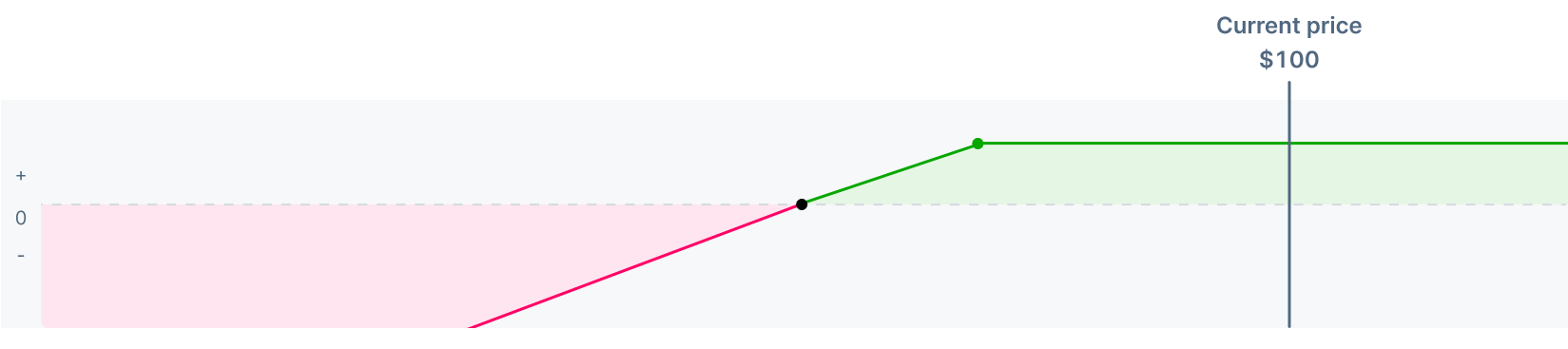

The max profit occurs if the stock price rises above your breakeven, and your short put expires worthless.

Profit if...

FlyFit’s stock price is above your breakeven.

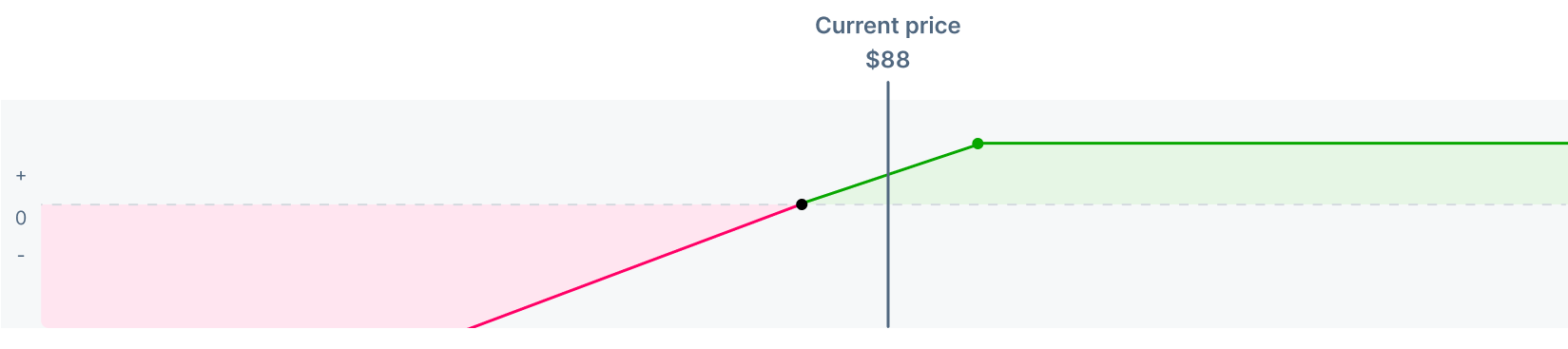

- Total profit: ($88 - $90 + $5) x 100 = $300Difference between strike price and FlyFit’s current price paid plus the premium collected x the number of shares represented (usually 100)

If FlyFit's stock price drops below the strike price of $90, then the buyer of your put option might exercise their right to sell you shares at $90. Since FlyFit is currently trading at $88, you stand to generate losses of $2 per share or $200 total. But remember, you still get to keep your $500 premium collected. Thus, your net profit is $300.

If FlyFit’s price were to remain above $90, the put option would expire worthless. You‘d retain the $500 premium, and would not have to purchase any FlyFit shares.

If FlyFit’s price were to remain above $90, the put option would expire worthless. You‘d retain the $500 premium, and would not have to purchase any FlyFit shares.

Loss if...

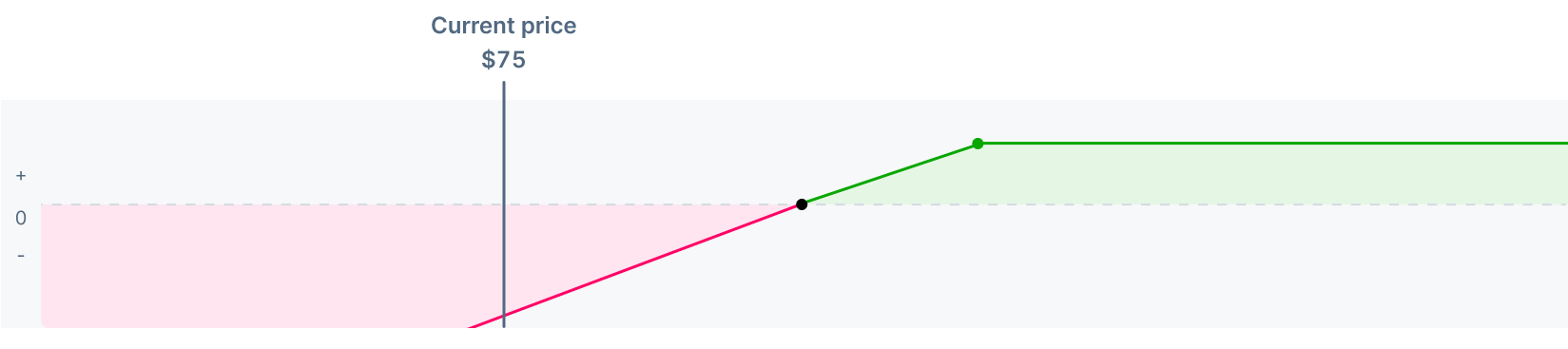

FlyFit’s stock price falls below your breakeven. That means you did not receive enough sale proceeds to offset the current decline in market price.

- Total loss: ($75 - $90 + $5) x 100 = $1,000Difference between strike price and FlyFit’s current price paid plus the premium collected x the number of shares represented (usually 100)

In the scenario above, you’d acquire 100 shares of FlyFit for $90 per share, or $9,000 total. FlyFit has declined to $75 per share. Your unrealized losses are $1,500. However, since you initially made a premium of $500 for selling the put option, your net loss is only $1,000 instead of $1,500.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Fundamentals

Chapter 9Long call

Chapter 9Long call Chapter 10Long put

Chapter 10Long put Chapter 11Protective put

Chapter 11Protective put Chapter 12Covered call

Chapter 12Covered call Chapter 13Cash-secured put

Chapter 13Cash-secured putMulti-leg Strategies