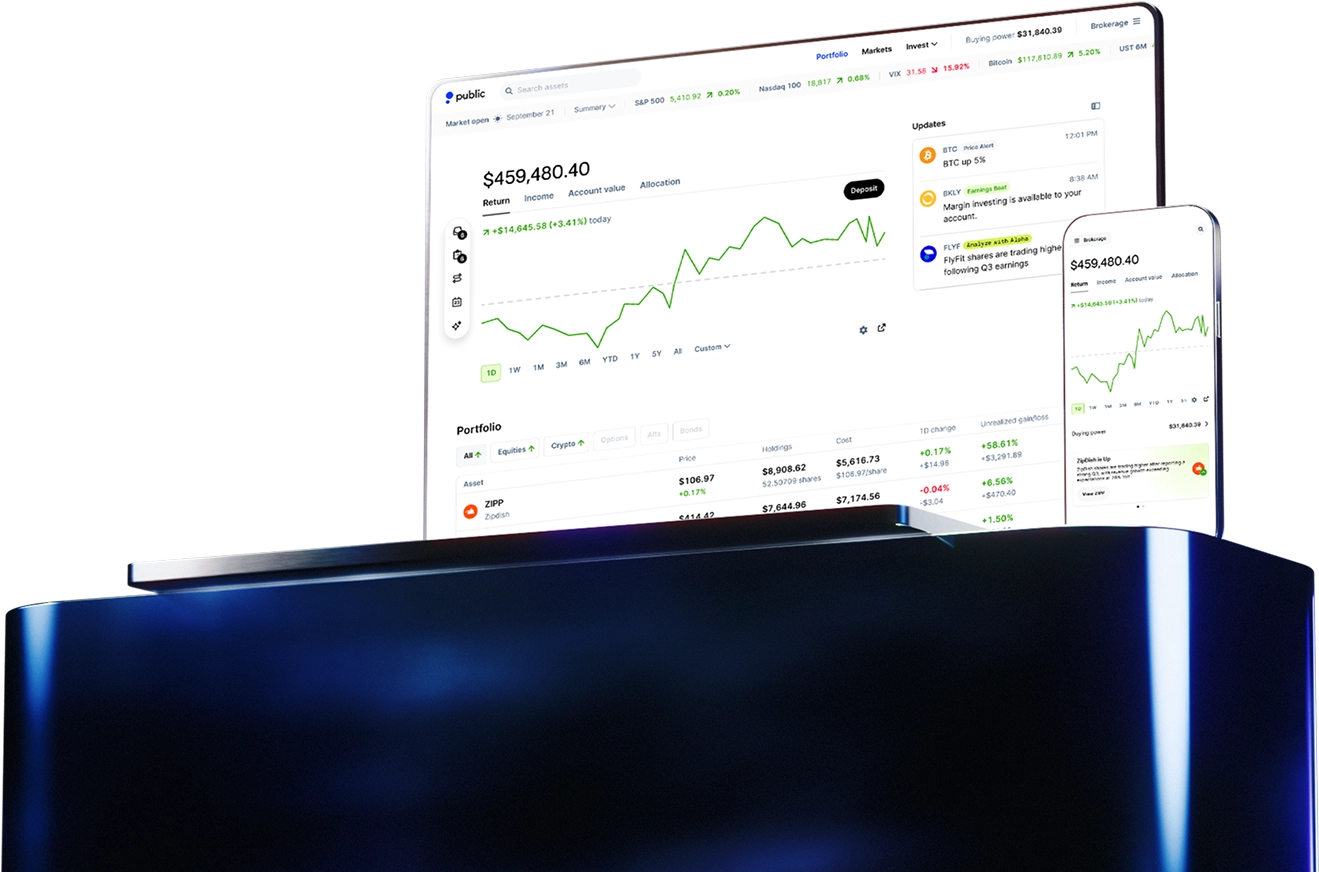

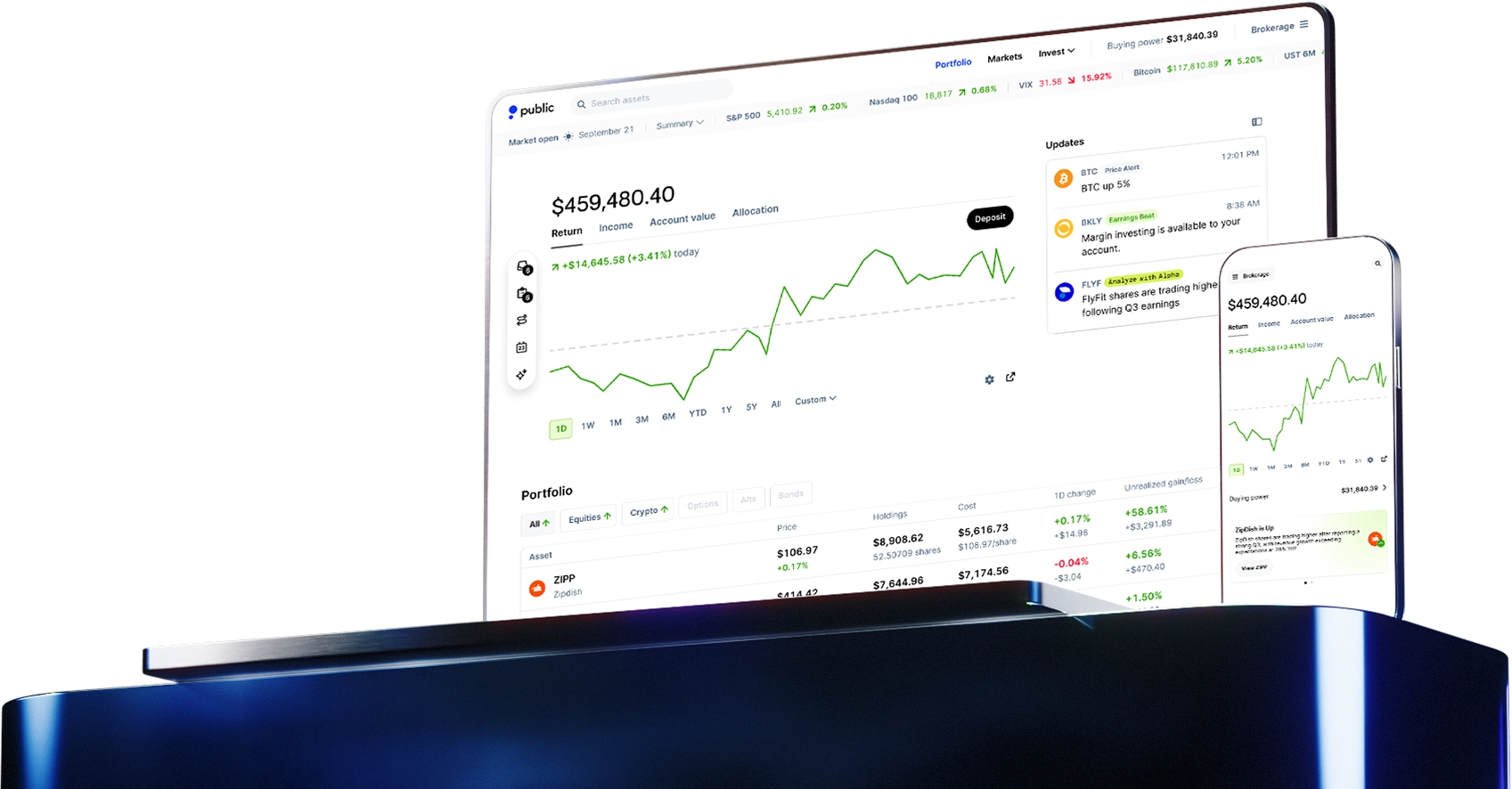

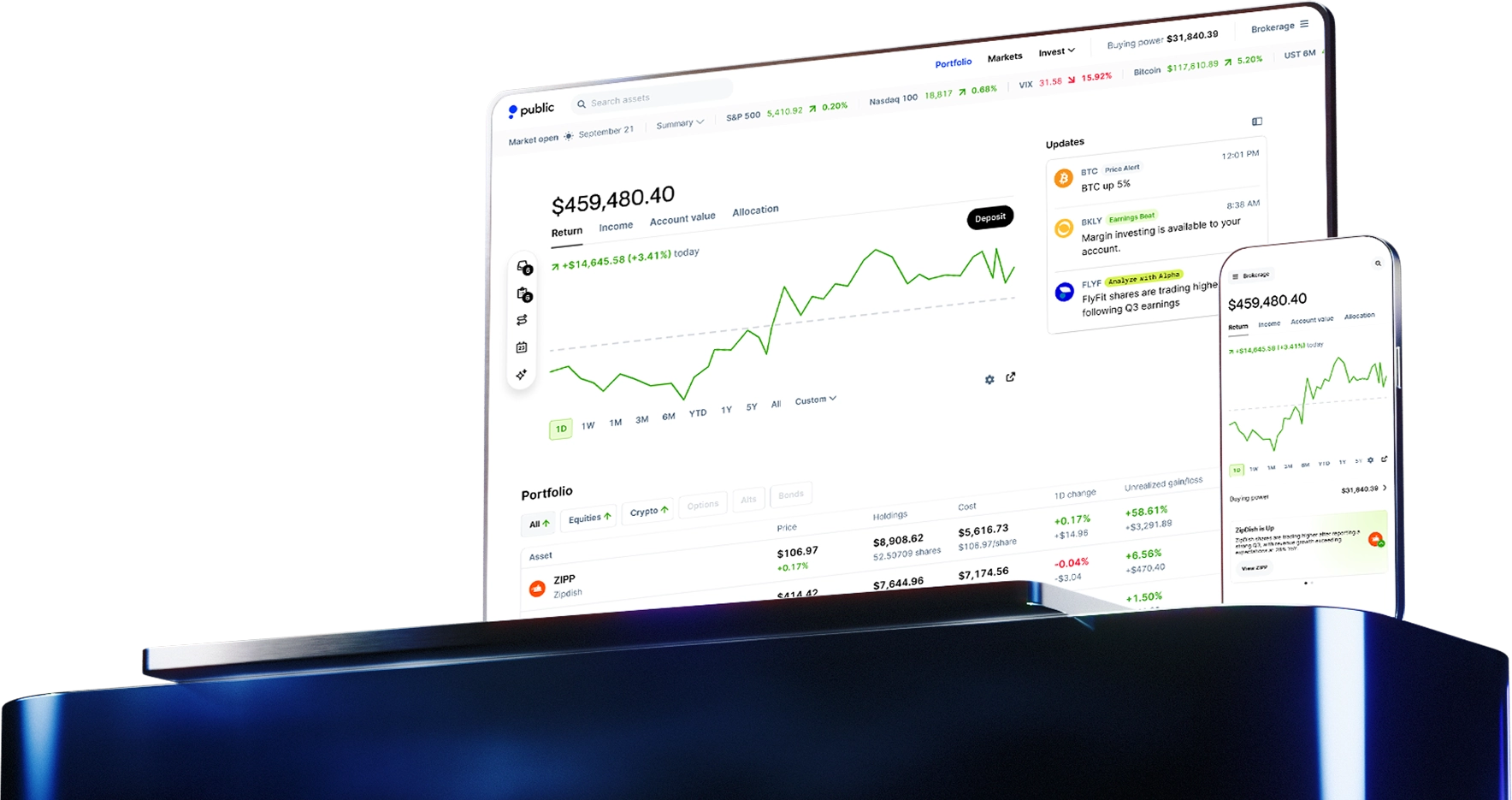

Automate your

investing strategy

Sign Up Dollar-cost averaging

Take the emotion out of investing

An Investment Plan on Public may help mitigate your risk of buying at a peak by spreading your investments over time. This strategy is known as dollar-cost averaging. Although it doesn't eliminate risk completely, dollar-cost averaging can help lessen the overall impact of market volatility.

Get started in 3 steps

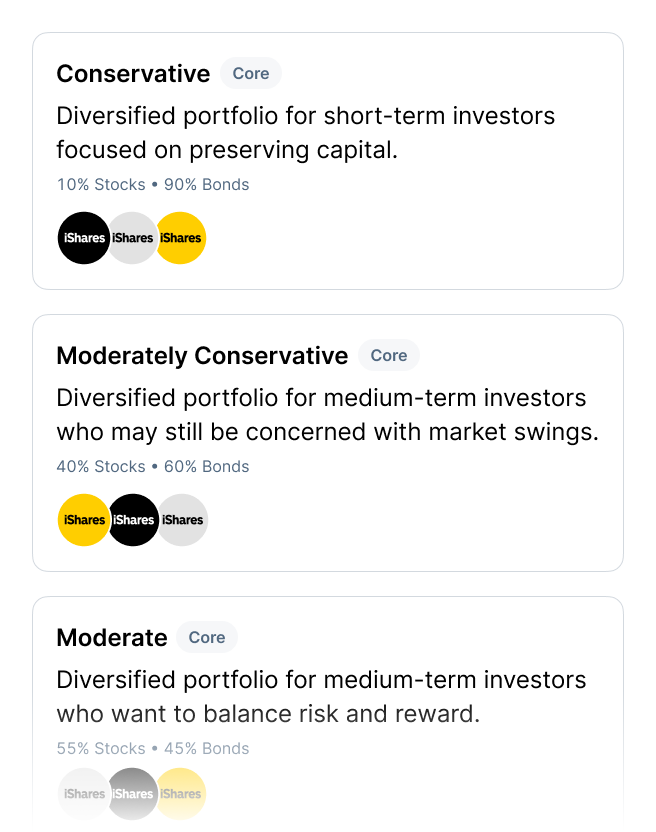

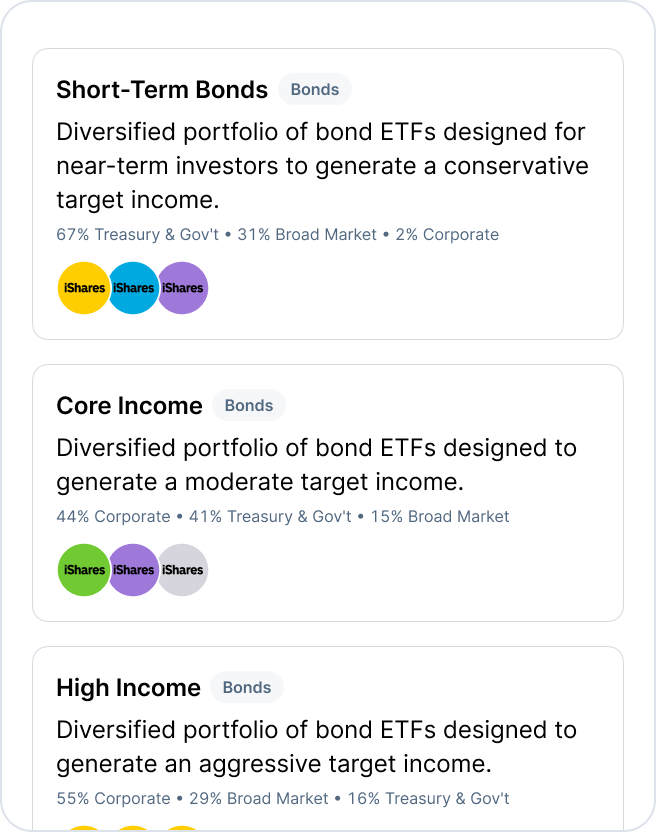

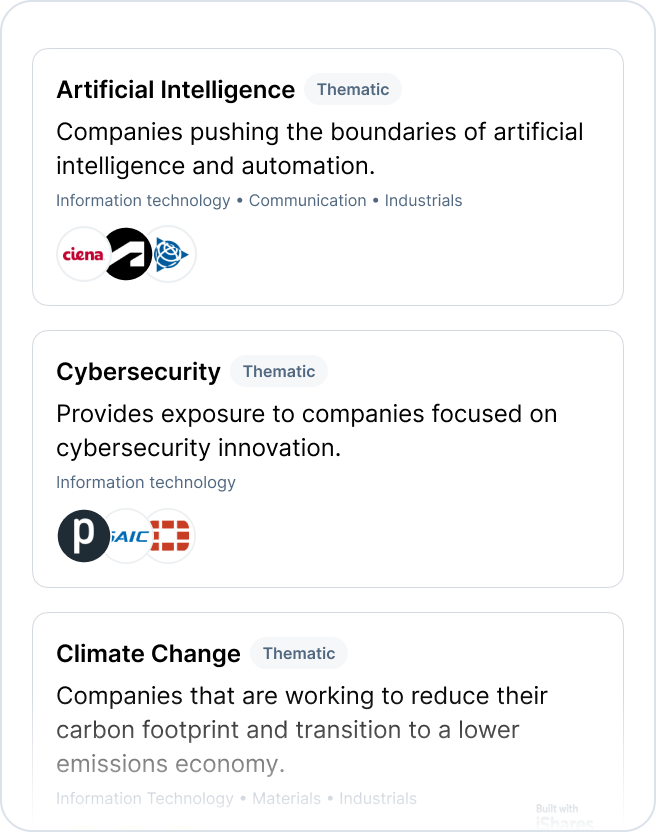

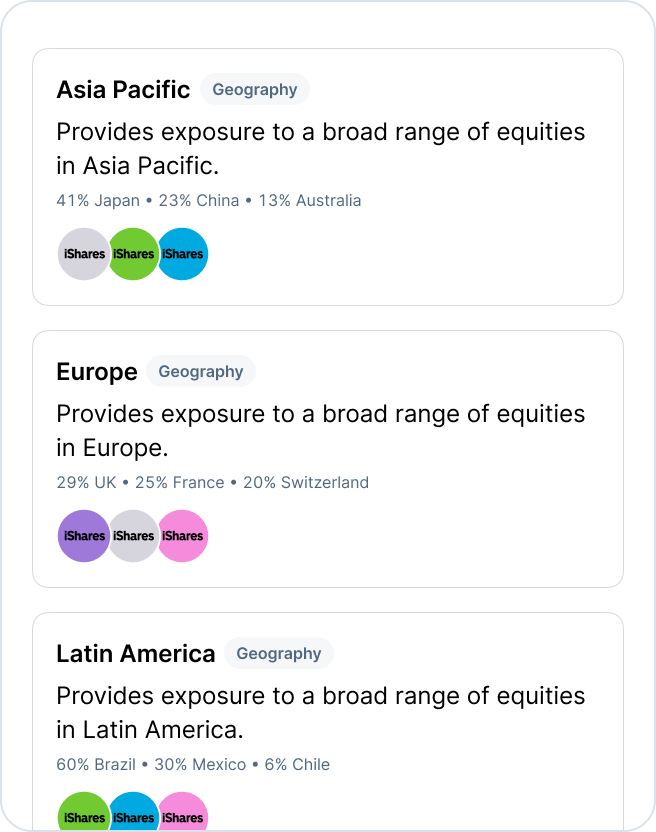

Explore our catalog of Plans

Our catalog presents a diverse range of Investment Plans organized by theme, geographic region, industry, and more. Choose the Plan that’s right for you or design your own with up to 20 assets.

Decide how much you want to invest

Once you've chosen your assets, you then decide how much and how frequently you want to contribute to your Investment Plan. Select from daily, weekly, biweekly, or monthly frequencies, aligning with your unique investing objectives.

Fine-tune your asset allocation

The final step involves distributing your funds across the assets in your Investment Plan. Every Plan in our catalog comes with a data-backed asset allocation that you're free to adjust to your preferences.

Have questions? Find answers.

What is dollar-cost averaging?

Instead of trying to time the markets, dollar-cost averaging is when you invest money at regular intervals, regardless of the investment’s price. This approach does not eliminate risk altogether, but it can mitigate the impact of market volatility on your overall investment.

Can I choose my own asset allocation?

Every Investment Plan in our catalog features a predefined asset allocation, informed by robust model portfolios. Upon selecting a Plan, you’re free to customize your asset allocation in 1% increments or opt for an even split of funds across assets. You can even remove assets altogether if you want. If you’re building your own Investment Plan from the ground up, the asset allocation is entirely in your hands.

Are there fees for adding stocks or ETFs to an Investment Plan?

Public routes orders directly to exchanges and does not receive any payment for order flow revenue. However, placing trades in the stock market is not without cost. To cover the expenses associated with each transaction, we charge a nominal fee based on the number of assets in your Investment Plan. If you’re a Public Premium member, you’re exempt from paying these fees. See our fee schedule.

Are there fees for adding crypto to an Investment Plan?

For Investment Plans containing crypto, Bakkt Crypto charges a fee to execute the recurring cryptocurrency purchases in your Plan. That fee is 1.25% of the total cryptocurrency order amount, which covers the costs associated with facilitating crypto transactions and storage. Public Crypto, LLC (“Public Crypto”) receives a portion of the revenue generated by Bakkt Crypto in exchange for licensing our software to Bakkt Crypto.

Have additional questions about Investment Plans on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Build your portfolio with Public