What are

Treasury bills?

Learn how T-bills can help you preserve your capital and earn 3.18%1 yield on your cash.

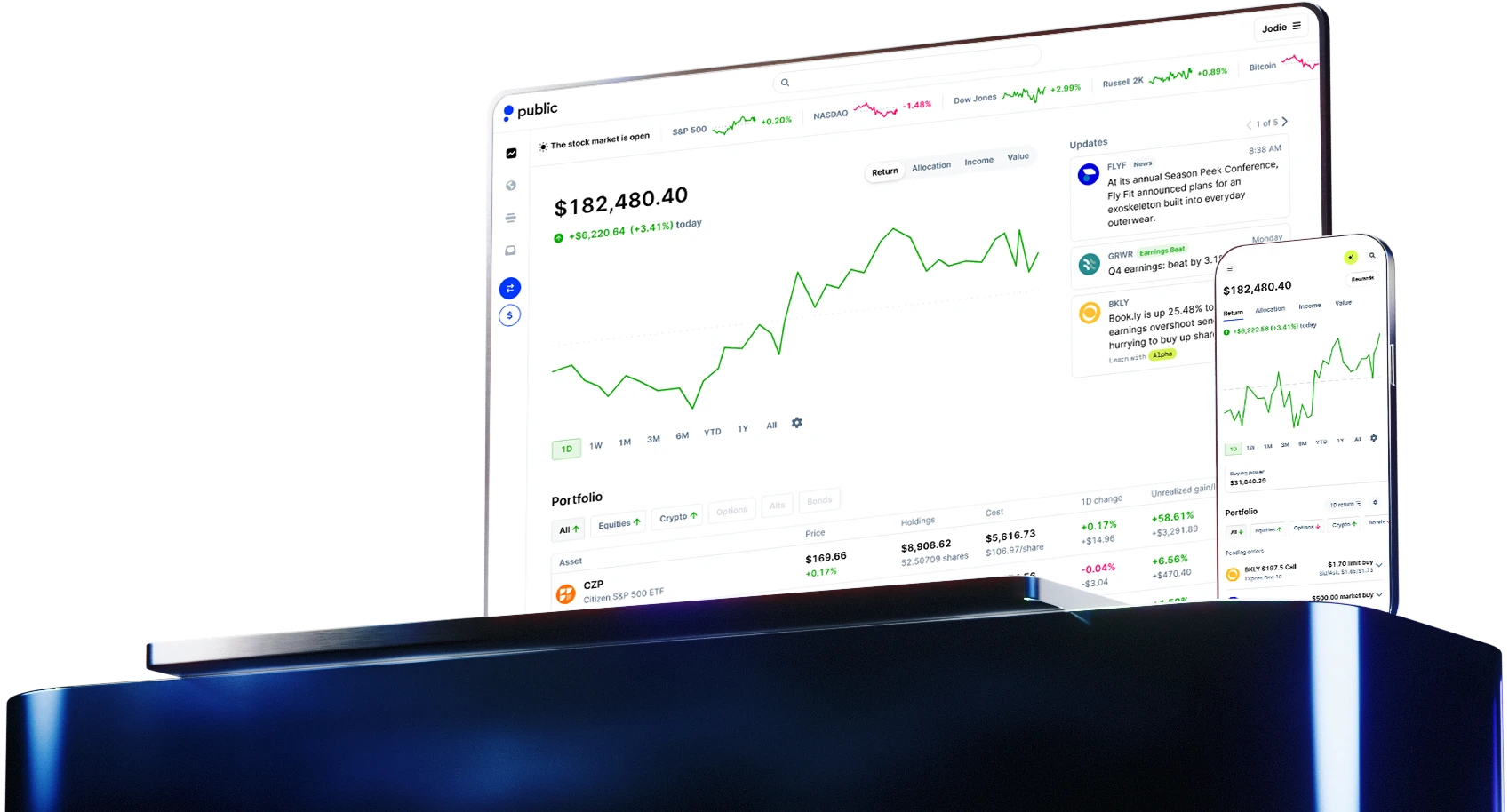

Get StartedMake your money work harder with Treasury Accounts

US Treasuries

High-yield savings account

3.18%1

3.6% APY2

Investment product

Banking product

Fixed

Variable

Backed by the full faith of the US Government. SIPC-insured up to $500,000.

FDIC-insured up to $250,000

$1003

$1+4

See how much you can earn with Treasury bills

When you move your cash into a Treasury Account on Public, you can earn a higher yield than a high-yield savings account.2 Plus, the income you generate is exempt from state and local taxes, allowing you to keep more of your earnings.

Lock in your 3.18% rate1 today.

1 26-week T-bill rate (as of 9/11/24) when held to maturity. Rate shown is gross of fees.

2 3.18% APY is the average of the best high-yield savings accounts, compiled by NerdWallet.com as of 7/25/23.

3 Deposits below $100 may be permitted, but not invested.

4 Different banks may have different deposit requirements.

Sruthi Lanka, Public CFO, is not associated with the broker dealer, Open to the Public Investing, Inc. and does not provide investment advice. Video is for informational purposes only.

Investments in T-bills: Not FDIC Insured; No Bank Guarantee; May Lose Value.

All U.S. Treasury investments and investment advisory services provided by Jiko Securities, Inc., a registered broker-dealer, member FINRA and SIPC. Securities in your account are protected up to $500,000. For details, please see www.sipc.org.

Banking services provided by Jiko Bank, a division of Mid-Central National Bank.

Jiko Group, Inc. and its affiliates do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. See FINRA BrokerCheck, Jiko U.S. Treasuries Risk Disclosures and Jiko Securities Inc. Form CRS.

Brokerage accounts on Public.com are through Open to the Public Investing, Inc, member FINRA and SIPC. Brokerage services for alternative assets are offered by Dalmore Group, LLC, member FINRA & SIPC. Cryptocurrency trading services are offered by Apex Crypto LLC (NMLS ID 1828849), which is licensed to engage in virtual currency business activity by the NYSDFS. Securities investments: Not FDIC Insured; No Bank Guarantee; May Lose Value.

See public.com/disclosures for more information.