If you’re an investor in the U.S., you’ve likely heard the term “cash alternatives” tossed around, especially when market volatility rises or interest rates shift. But what exactly are cash alternatives, and how might they fit into your financial toolkit?

This guide breaks down what you need to know, from definitions and types to the key facts you should know before making any decisions.

Let’s begin.

What are cash alternatives?

Cash alternatives are financial instruments that you can use instead of holding (idle) cash in your bank account. Cash alternatives include treasury bills, high-yield savings accounts, CDs, money market accounts, bonds and more options. The right choice depends on factors such as access, risk preference, and the interest rate offered

Earning higher interest on your cash balances is the primary reason for using cash alternatives. They are particularly useful when ordinary bank accounts provide near-zero interest rates. In September 2022, for example, the average interest rates of U.S. banks were 0.03% for checking accounts and 0.06% for savings accounts.

Besides generating higher yields, these instruments help you with diversification or the strategy of putting your money in multiple investments instead of one or two. This helps balance your portfolio when some investments don’t perform well, thus minimizing losses.

Common types of cash alternatives

Several types of cash alternatives are widely used in the U.S. Each has its own features, benefits, and trade-offs.

- U.S. Treasury bills (T-bills): Commonly known as T-Bills, these are securities issued by the U.S. Treasury, ranging between $100 to $5 million, maturities ranging from a few days to one year. You basically lend money to the U.S. government by purchasing T-Bills. They’re sold at a discount and pay the face value at maturity.

Summary table: Common cash alternatives

Here is a short comparison table of various assets, interests, liquidity, and risk levels.

How to choose a cash alternative

While most cash equivalents are considered low-risk investments, it’s still important to carefully evaluate your options before deciding. Here are the key factors you should consider when choosing a cash alternative for your portfolio:

1. Liquidity needs

Liquidity refers to how quickly you can access your funds without significant loss of value. Most cash alternatives offer high liquidity, but certain products, like CDs, may restrict access to your money until maturity or impose penalties for early withdrawal.

2. Yield:

The interest or return you earn can vary widely among cash alternatives. High-yield savings accounts and money market funds may offer higher rates than traditional savings accounts, but these rates can fluctuate over time. CDs typically provide fixed rates for a set term.

3. Insurance and regulatory safeguards

Not all cash alternatives are insured. Bank accounts and CDs are insured by the FDIC or NCUA, while money market mutual funds and other investment products are not.

Knowing whether your funds are insured or protected under specific regulations may help you make a more informed decision about risk.

4. Risk profile

While cash alternatives are generally low risk, they are not risk-free. For example, money market mutual funds are not insured by the FDIC, and their value can fluctuate in rare circumstances.

Conclusion

Cash alternatives can play a valuable role in your financial toolkit, offering liquidity, stability, and the potential for modest returns when you need a safe place for your funds. While options like high-yield savings accounts, money market funds, and T-bills are popular, each comes with its own features and risks. Understanding these differences may help you make informed decisions that fit your needs and goals.

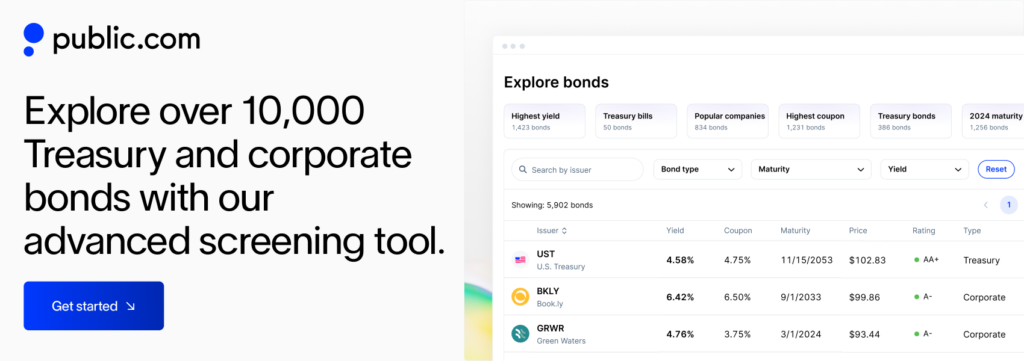

If you’re exploring ways to keep your cash working for you, Public.com offers a wide range of fixed income offerings, including high-yield cash accounts, Treasury bills, bonds, and more, all in one place.

Sign up on Public app today and start building your multi-asset portfolio with the tools, data, and insights.