Learn all about optimizing financial plans and discover the strategic value of incorporating HYCA for a well-rounded approach.

Explore the nuances of financial optimization in personal finance, as we dissect the role of High-yield Cash Accounts (HYCA). This article delves into the strategic incorporation of HYCA, shedding light on its significance for a well-balanced financial plan.

The Importance of HYCAs in Financial Optimization

Financial optimization is a meticulous process involving the judicious allocation of resources to attain efficient outcomes, typically centered around goals like maximizing net profit and reducing expenses.

Various financial tools play vital roles in achieving optimization objectives. These tools could contribute to effective resource management, from budgeting applications to investment strategies. In this context, HYCAs emerge as a noteworthy tool. They are financial instruments designed to offer competitive interest rates on cash deposits while maintaining liquidity and balancing potential returns and accessibility. Historically, individuals held savings accounts at the same bank as their checking account for seamless transfers.

However, with the prevalence of online banking and online accounts in traditional banks, there is intense competition in saving rates. This has paved the way for HYCAs.

Role of HYCAs: Financial Security and Stability

Let us examine how HYCAs may potentially contribute to financial security and stability:

How to Incorporate HYCAs into Your Financial Plans

Incorporating HYCA into your financial plans requires a thoughtful approach aligned with your broader investment strategy. For an emergency fund, consider depositing at least three to six months’ worth of living expenses, leveraging the accessibility of HYCA compared to less flexible options like certificates of deposit (CDs). If saving for a specific goal, such as a home or vacation, a high-yield cash account can offer principal protection and interest earnings dedicated to your objective.

HYCAs, distinct from everyday usage accounts, may not facilitate check-writing or direct debit card linkage. Their strength lies in storing funds for infrequent use, making them perfect tools for achieving financial goals. Additionally, the flexibility to start small and incrementally contribute over time enhances their suitability for building or reinforcing an emergency fund. HYCA allows immediate access to funds without extended waiting periods, providing a financial safety net for unforeseen expenses like car repairs or home maintenance.

Investors can incorporate HYCAs into their financial planning for versatility—whether for planned expenses, or emergency funds. Before opening an account, it is advisable to exercise due diligence, considering individual circumstances.

Tailoring Investment Portfolios with HYCA

Integrating HYCA into a diversified portfolio aligns with the principle of balancing risk. While riskier assets may offer growth potential, the general stability of HYCA may become helpful in mitigating overall portfolio volatility. When tailoring investment portfolios with HYCA, no strict rule dictates the amount to allocate. The decision hinges on multiple factors, including the need for diversification. A general guideline suggests maintaining liquid access to funds equivalent to three to six months of living expenses, offering a safety net within a diversified investment strategy.. Balancing risk with HYCA may add stability to your investments, facilitating a safer approach while still aiming for potentially competitive returns. In long-term financial planning, the flexibility of HYCA aligns with the notion of preserving capital over time.

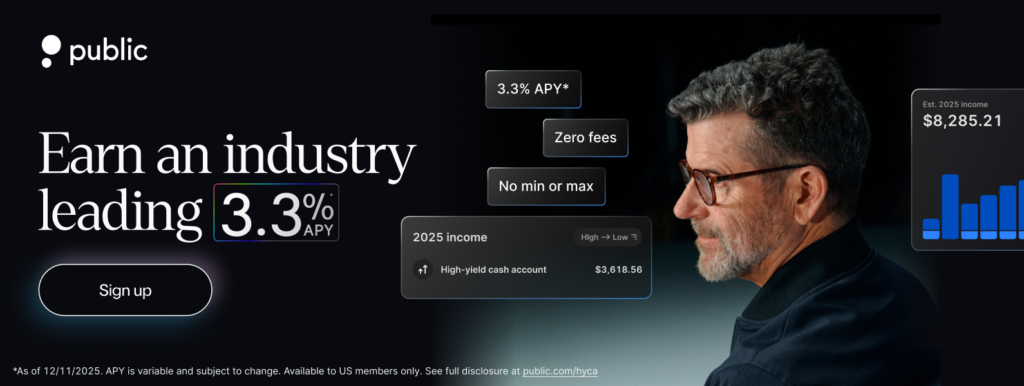

At Public, we support this approach by offering a seamless and user-friendly platform for HYCA. With no subscription or account fees and no minimum or maximum balance requirements, our platform enhances your financial flexibility. We also offer unlimited transfers and withdrawals, ensuring that your funds are always accessible when you need them. Furthermore, in contrast to the standard $250,000 FDIC insurance offered by most banks, Public has partnered with 20 banks to provide you with combined coverage of up to $5M. This unique feature ensures that your investments are secure and well-protected. To further empower your financial choices, try our HYCA calculator to see the impact of a 3.3% yield on your cash and compare our rates with competitors for an optimal financial fit.

Explore your HYCA options with Public.com and take the first step towards enhancing your savings potential. Join us now to start crafting a more secure and prosperous financial future, with all the tools and support you need for a smarter financial journey!

FAQs

How Does HYCA Fit into a Typical Financial Plan?

HYCA can generally integrate into a typical financial plan as a stable and accessible component. They can usually serve emergency funds, planned expenses, and portfolio diversification.

What Strategies Maximize HYCA's Benefits?

To optimize HYCA, consider maintaining a balance between accessibility and competitive returns. Regularly reassess interest rates, explore fee structures, and ensure the account aligns with your financial goals. Check out Public.com for a rewarding HYCA that aligns with your financial aspirations, offering a platform with no fees, no subscription requirements, and no limits on minimum or maximum investments, plus the added flexibility of unlimited withdrawals and transfers.

Can HYCA Be Used for Short-Term and Long-Term Goals?

Yes, HYCAs are versatile and suitable for short-term and long-term financial objectives. Their potential stability, liquidity, and competitive returns make them adaptable tools for various savings goals and financial planning strategies. Explore HYCA on Public.com and make your savings work harder for you!

How Does Taxation Work with HYCA?

The interest accrued in a high-yield cash account is subject to state and federal income taxes. The amount you pay on your earnings varies based on your location and the tax bracket you belong to, making it contingent on individual circumstances.