Cracking the Code: Revealing the Untapped Potential of High-Yield Cash Accounts.

Decoding High-Yield Cash Accounts – A Complete Guide

Table of Contents

What Are High-Yield Cash Accounts?

High-yield cash accounts (HYCA) are financial instruments that offer a significantly higher interest rate compared to traditional savings accounts. They function as dependable places for investors to hold cash but with the added benefit of earning more interest. These accounts are typically offered by banks, credit unions, and online financial institutions, and they stand out for their higher Annual Percentage Yield (APY).

For financial portfolios, high-yield cash accounts serve a dual purpose. Firstly, they act as a reliable repository for cash reserves, offering stability and easy access to funds. Secondly, they provide an opportunity to earn a higher return on cash holdings, which can be particularly beneficial in periods of low-interest rates. This makes them an attractive option for investors looking to maintain liquidity while still earning some income from their cash assets.

When compared with other cash options like traditional savings accounts, money market accounts, or certificates of deposit (CDs), high-yield cash accounts often offer a more favorable balance between accessibility and potential returns. Unlike CDs, which may have longer lock-in periods, or traditional savings accounts, which typically offer lower interest rates, HYCAs aim to provide higher interest rates while maintaining liquidity. This combination is especially valuable for investors who desire immediate access to their funds while still maximizing their earning potential.

Mechanics of High-Yield Cash Accounts

High-Yield Cash Accounts (HYCA) work by offering higher interest rates on deposited funds compared to standard savings accounts. Financial institutions may offer these elevated rates typically because they may have lower overhead costs, especially in the case of online banks, or they may invest deposited funds in a diversified portfolio of assets with a focus on capital preservation and income generation. The interest accrued on these accounts is usually compounded daily and paid out monthly, allowing the account balance to grow faster due to the compounding effect.

When it comes to safety, HYCAs are generally considered relatively secure, especially when provided by FDIC-insured banks or NCUA-insured credit unions, which typically offer insurance coverage of up to $250,000 per account. This insurance means that even if the bank or credit union fails, the deposited funds up to the specified limit are protected. However, it’s important to note that while the principal is protected, the interest rate risk remains, as rates can fluctuate based on market conditions.

The credit risk associated with HYCAs is typically low, particularly if they are offered by well-established and highly rated financial institutions. However, investors should conduct due diligence and consider the institution’s credit rating and financial stability before opening an account; these factors can impact the overall risk level.

The interest rates on high-yield cash accounts are usually variable, meaning they can change over time based on prevailing economic conditions and central bank policies. The Annual Percentage Yield (APY) is a key factor for investors to consider, as it reflects the actual rate of return that will be earned on the account. It accounts for the effect of compounding interest.

It’s crucial for investors to understand that the APY can fluctuate, which means the attractiveness of an HYCA may vary with changing interest rates. While the initial offered rate might be high, it’s important to monitor the rate regularly to ensure it remains competitive. Some financial institutions may offer a promotional rate for a limited period, after which the APY may decrease.

Exploring Variations in Cash Investment Options

For cash investment options, it’s crucial to understand the differences between various types, such as Treasury accounts and High-Yield Cash Accounts (HYCA). Each comes with its own set of features, risks, and benefits, catering to different investor needs and risk appetites.

Treasury Account

Treasury accounts represent investments in government securities, offering a blend of safety and steady returns.

-

Distinguishing Features: Treasury accounts involve investing in government securities, such as treasury bills (T-bills), bonds, and notes. These are debt instruments issued by the government to fund its operations and projects. The main attraction of treasury accounts is their reliability, as they are backed by the full faith and credit of the government.

-

Risks: The risks associated with treasury accounts are generally lower compared to other investment types. The primary risk is interest rate risk; if interest rates rise, the market value of existing treasury securities usually falls.

-

Benefits: Treasury accounts offer a reliable investment option with predictable returns. They are particularly appealing during times of economic uncertainty or market volatility. Additionally, certain types of treasury securities offer tax advantages, such as being exempt from state and local taxes. Please note that Public.com does not provide legal, tax, or accounting advice. It is recommended to consult your legal, tax, or financial advisors before making any financial decisions.

High-Yield Cash Accounts

HYCAs are popular for their higher interest rates than traditional savings accounts, suitable for investors seeking enhanced yield on their cash reserves.

-

Distinguishing Features: HYCAs offer higher interest rates than traditional savings accounts. They are offered by banks, credit unions, and online financial institutions, making them easily accessible.

-

Risks: The risks of HYCA include credit risk, although this is generally low for accounts provided by insured institutions. Interest rate risk is also a concern; the variable nature of the rates means that returns can fluctuate.

-

Benefits: The primary benefit of a HYCA is the higher interest rate, which allows for greater income potential on idle cash. These accounts are also typically highly liquid, providing easy access to funds.

Benefits of High-Yield Cash Accounts

HYCAs offer a range of benefits that make them a valuable addition to any investment portfolio.

-

Diversification for Portfolios: HYCAs provide an excellent way to diversify investment portfolios. While they are essentially cash holdings, their higher interest rates set them apart from traditional savings accounts, offering a blend of safety and increased earnings. This diversification is particularly beneficial in balancing portfolios that have higher-risk investments.

-

Stability in Returns: Unlike more volatile investment options like stocks or mutual funds, HYCAs offer stability in returns. The interest rates, although variable, are typically higher than those of traditional savings accounts, providing a steady, predictable income stream. This stability is appealing, especially in fluctuating market conditions.

-

Tax Advantages: While not tax-free, the interest earned on HYCAs may have certain tax advantages depending on the account type and the investor’s overall tax situation. For instance, some types of accounts may offer benefits like deferred taxation, making them a tax-efficient choice for income generation.

Wrapping Up: Key Insights on High-Yield Cash Accounts

High-Yield Cash Accounts stand out for their combination of higher potential returns and accessibility, making them an attractive component of a diversified portfolio. However, investors must exercise due diligence, especially in understanding the variable nature of interest rates and the creditworthiness of the financial institution.

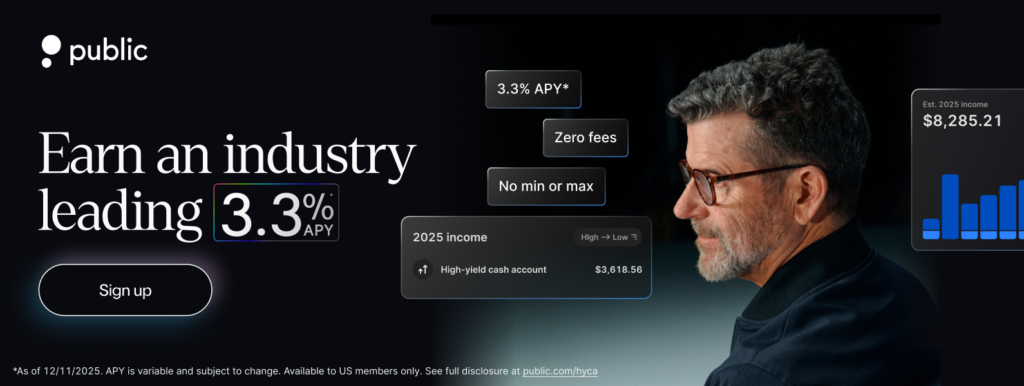

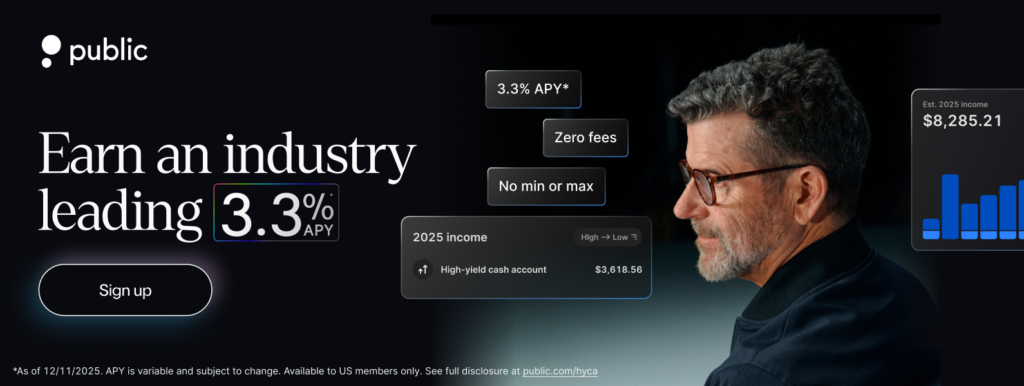

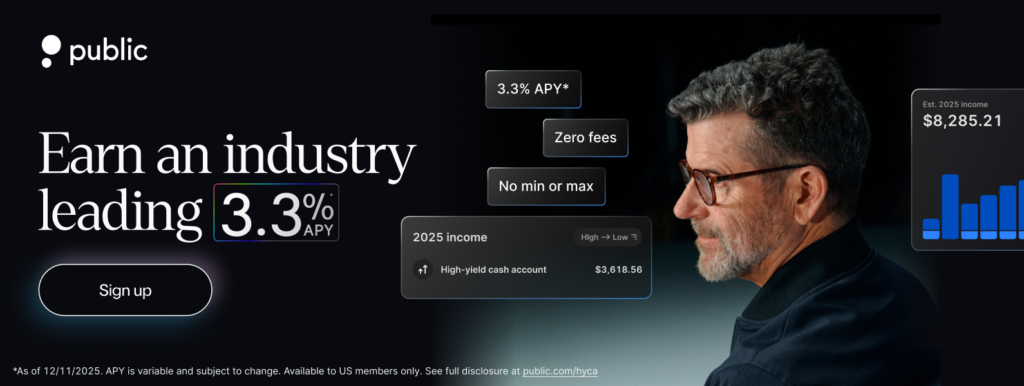

At Public, we have made it extremely simple for those exploring High-Yield Cash Accounts (HYCA). Our platform is designed for ease of use and informed decision-making, with no subscription requirements, no account fees, and no minimum or maximum balance requirements. We also provide the flexibility of unlimited transfers and withdrawals.

Additionally, while a standard bank offers up to $250,000 of FDIC insurance coverage, Public has partnered with 20 banks to offer you a combined coverage of up to $5M, ensuring your investments are secure and protected. To further empower your financial decisions, try our HYCA calculator and see the impact of a 3.3% yield on your cash. Easily compare our rates with competitors and find your perfect financial fit. Start exploring your high-yield cash investment options with us today and maximize the potential of your cash reserves with confidence!

FAQs

How to Invest in High-Yield Cash Accounts?

Investing in High-Yield Cash Accounts is straightforward, especially with platforms like Public. Simply sign up on Public, navigate to the HYCA page, and follow the easy steps to open an account.. As of 12/13/2025, our high yield cash account offers a 3.3% yield.

What is the Minimum Investment Required in a High-Yield Cash Account?

The minimum investment required for High-Yield Cash Accounts varies depending on the financial institution offering them. At Public, there are no minimums or maximums for our high-yield cash account.

Are HYCA similar tof HYSA?

High-Yield Cash Accounts (HYCA) are similar to High-Yield Savings Accounts (HYSA). They both offer higher interest rates compared to traditional savings accounts, but HYCA typically come with additional features or requirements depending on the provider.

Interest Payment Frequency?

The interest payment frequency for High-Yield Cash Accounts typically is monthly. However, this can vary with different financial institutions. It’s important to verify the specifics with your chosen provider.

Are Earnings from High-Yield Cash Accounts Truly Tax-Free?

Earnings from High-Yield Cash Accounts are not typically tax-free. Interest earned is usually subject to federal (and sometimes state) taxes. However, certain types of accounts might offer tax advantages. To understand the tax implications and explore tax-efficient investment options, consider consulting with a financial advisor. Our platform offers resources to help you make informed decisions about your investments.