The 10-year Treasury yield plays a significant role in the U.S. economy and financial markets. It represents the return you can expect when you invest in a U.S. government treasury notes with a 10-year maturity. As an investor, understanding how it works and why it matters can help you better interpret market trends and economic conditions. This guide covers key aspects of the 10-year Treasury yield, its importance, and how it can influence various financial decisions.

What is the 10-year treasury yield?

Table of Contents

What are treasuries?

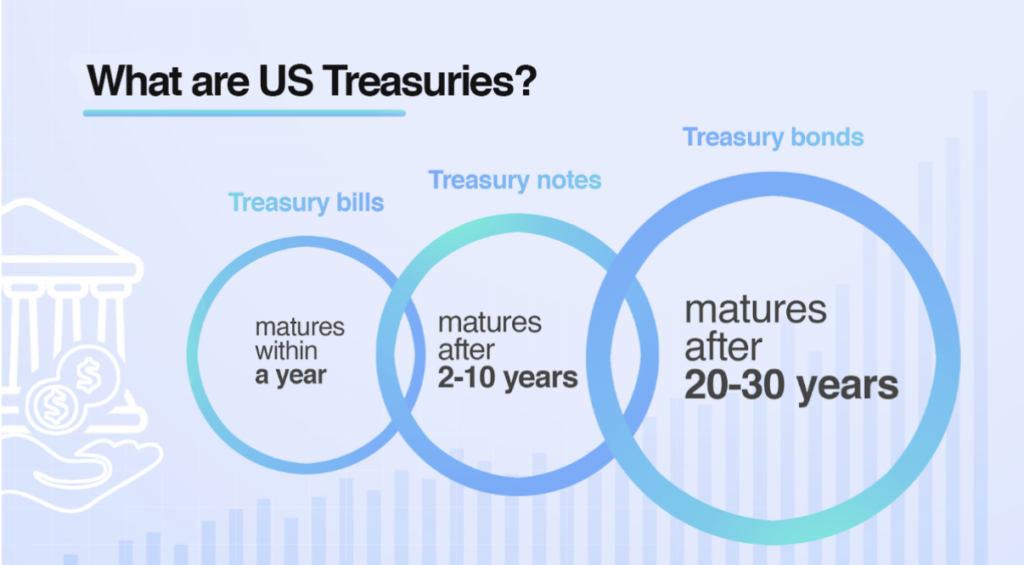

U.S. Treasuries are fixed-income investment bonds issued by the U.S. Department of the Treasury (DoT). They are widely regarded as some of the safest investments because they are backed by the full faith and credit of the U.S. government. Treasuries pay a fixed interest rate until they mature, making them popular for conservative investors.

Types of U.S. treasuries:

- Treasury Bills (T-Bills): Mature within one year.

- Treasury Notes (T-Notes): Mature between two and ten years.

- Treasury Bonds (T-Bonds): Mature between twenty and thirty years.

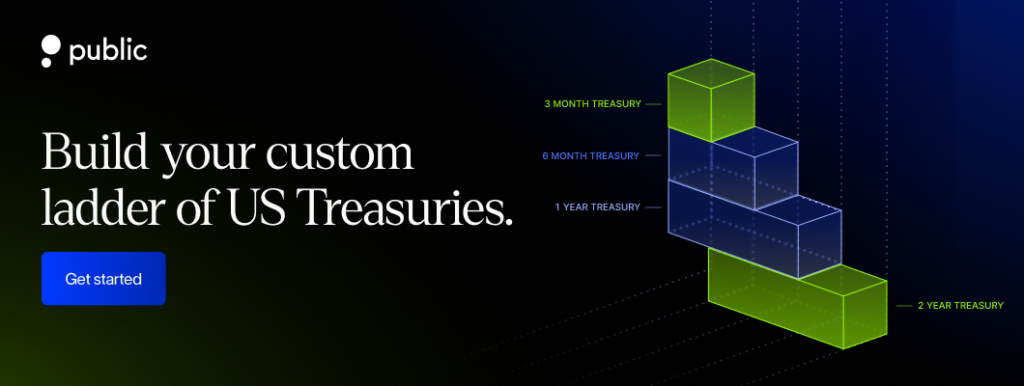

Investors—both individual and institutional—can purchase U.S. Treasuries directly from the U.S. Treasury through auctions or on the secondary market. Public.com simplifies this process, offering an easy-to-use platform where you can invest in Treasury bills, notes, and bonds alongside stocks, ETFs, crypto, and more—all in one place. With transparent pricing & a user-friendly experience, Public makes it easier to build a diversified portfolio that includes U.S. Treasuries. Get started today!

What is the 10-year treasury yield?

The 10-year Treasury yield refers to the return on investment for the U.S. government’s 10-year Treasury note. The U.S. Department of the Treasury issues these notes to raise funds. When you hear about the yield, it reflects the interest rate investors earn when they purchase these securities.

Key points:

- Issued by: U.S. Department of the Treasury

- Term: 10 years

- Interest Payments: Semi-annual

- Risk Level: Very low (potentially considered as risk-free)

For example, if you buy a 10-year Treasury note with a yield of 4%, you will receive interest payments (known as coupon payments) twice a year until the note matures in 10 years.

Why is the 10-year treasury yield important?

The 10-year Treasury yield is often considered a benchmark for other interest rates. Here’s why it matters:

1. Indicator of economic sentiment

The yield can provide insight into how investors feel about the economy.

- Rising yields may indicate optimism, suggesting investors expect stronger economic growth and potentially higher inflation.

- Falling yields can signal caution, as investors might seek the safety of Treasury notes during uncertain times.

For instance, during economic downturns, investors often purchase Treasury notes, causing yields to drop.

2. Benchmark for loan rates

Many loan products, including mortgages and corporate debt, are influenced by the 10-year Treasury yield.

- Mortgage lenders often use the yield as a reference point when setting long-term mortgage rates.

- A higher yield may lead to higher borrowing costs for consumers and businesses.

3. Influence on stock market valuations

The yield can also impact stock market performance.

- Higher yields may make Treasury notes more attractive compared to stocks, potentially putting pressure on stock prices.

- Conversely, lower yields might encourage investors to seek higher returns in the stock market.

How is the 10-year treasury yield calculated?

The yield is calculated based on the note’s price and coupon payments. Let us understand this in detail below.

- Note price falls: Yield rises (because new investors pay less for the same interest payment).

- Note price rises: Yield falls (investors pay more for the same interest payment).

For example, imagine a 10-year Treasury note with a face value of $1,000 and a 3% coupon rate. This means the note pays $30 annually in interest, split into two payments of $15 every six months.

-

If you purchase this note at its face value ($1,000), your yield equals the coupon rate: 3%.

-

Suppose the market price of the note drops to $950. You still receive $30 annually, but since you paid less for the same interest, your yield increases to approximately 3.16%.

-

Conversely, if the note’s price rises to $1,050, the yield decreases to about 2.86% because you paid more for the same $30 annual interest.

This relationship between price and yield helps explain why yields move inversely to prices and is a crucial concept in understanding bond and note markets.

Factors affecting the 10-year treasury yield

Several factors can influence changes in the yield of the 10-year Treasury note. Here are some of the key drivers explained in a concise way:

1. Federal reserve policies

The Federal Reserve’s interest rate decisions can indirectly affect the 10-year Treasury yield. When the Fed raises short-term rates to manage inflation, long-term yields may rise in response. Conversely, rate cuts can put downward pressure on yields.

2. Inflation expectations

If investors expect higher inflation, yields tend to increase to compensate for the decreased purchasing power. Lower inflation expectations often lead to lower yields.

3. Economic data

Reports on employment, GDP growth, and consumer spending can sway yields. Strong economic data usually pushes yields higher, while weaker data can lead to lower yields.

4. Global events

Geopolitical tensions, global economic slowdowns, or financial market uncertainty can boost demand for safe-haven assets like Treasuries, lowering yields.

5. Supply and demand

When the U.S. government issues more debt, yields may rise to attract buyers. High demand for Treasuries, however, tends to push yields down.

6. Market sentiment

Investor risk appetite plays a role. During optimistic market conditions, yields may rise as investors shift to riskier assets. In times of uncertainty, yields often decline as investors seek the safety of Treasuries.

Understanding these factors helps you make sense of yield movements without getting lost in complexity.

Conclusion

The 10-year Treasury yield may seem like just another economic metric, but its influence on financial markets and borrowing costs is significant. By watching it, you can better understand broader economic trends. While it’s not a tool for direct investment decisions, understanding how the yield moves can help you stay informed about market conditions.

If you’re considering investing in 10 year Treasury, signing up for a Treasury Account on Public.com makes it easy to get started. You can seamlessly invest in U.S. Treasuries with maturities ranging from 3 months to 30 years, lock in your yield at purchase, and benefit from state and local tax exemptions, helping you keep more of your earnings. Plus, Treasury notes are highly liquid, so you can access your cash if needed—though selling before maturity may impact your final yield.

FAQ's

What does the 10 year treasury yield indicate?

The 10 year treasury yield indicates the interest rate that the US government pays to borrow money for a 10-year period. It is also used as a benchmark for mortgage rates & corporate bond rates. A higher 10 year treasury yield usually indicates that investors are expecting higher inflation and economic growth, while a lower yield may suggest the opposite.

Why does 10 year treasury yield decrease?

The 10 year treasury yield may decrease due to a variety of factors such as a decrease in inflation economic growth expectations, or an increase in demand for safe-haven assets such as bonds. Additionally, actions taken by the Federal Reserve such as lowering interest rates or implementing quantitative easing can also impact the 10 year treasury yield.

Do Treasury yields affect interest rates?

Yes, Treasury yields do affect interest rates. When Treasury yields rise, interest rates also tend to rise, and vice-versa. This is because investors are more likely to invest in Treasury bonds when yields are high, which reduces the amount of money available for other types of borrowing and lending, leading to higher interest rates.

What is the difference between interest rates and treasury yields?

Interest rates are the rates at which borrowers pay to lenders for borrowing money, while Treasury yields are the returns that investors receive for investing in US government bonds. Interest rates are affected by various factors such as inflation, economic growth, and central bank policies, while Treasury yields are influenced by the demand and supply of government bonds in the market.

Why do treasury yields fall when stocks rise?

Treasury yields fall when stocks rise because investors tend to move their money from bonds to stocks in a strong economy, which increases demand for stocks and decreases demand for bonds. This decrease in demand for bonds leads to a decrease in their prices, which in turn increases their yields.