Build your retirement savings with tax-deferred growth with a Traditional IRA, while giving you flexibility in how you contribute each year.

Traditional IRAs

This in-depth guide addresses the essentials you need to know about traditional IRAs in 2025.

Table of contents

What is a traditional IRA?

A Traditional IRA (Individual Retirement Account) is a type of investment account designed to help you save for retirement while deferring taxes. Contributions to a Traditional IRA are often tax-deductible, meaning they can reduce your taxable income for the year.

The funds in the account grow tax-deferred, and you won’t owe taxes on your investments until you withdraw them during retirement.

Why should you consider a traditional IRA?

A Traditional IRA can provide a flexible way to save for retirement while potentially offering tax advantages, depending on your circumstances. Here are some reasons why you might want to learn more about this type of account:

1. Potential tax benefits:

If you meet certain requirements, your contributions to a Traditional IRA may be tax-deductible, which could reduce your taxable income for the year you contribute.

2. Tax-deferred growth:

Earnings such as interest, dividends, and capital gains within a Traditional IRA are not taxed until you withdraw the funds, allowing your investments to grow without immediate tax impact.

3. Broad investment choices:

Traditional IRAs typically allow you to invest in a wide variety of assets, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

4. Accessibility:

You can contribute to a Traditional IRA even if you do not have access to a 401(k) or another employer-sponsored retirement plan, as long as you have earned income.

5. Rollover flexibility:

If you leave a job or retire, you may be able to roll over assets from certain workplace retirement plans into a Traditional IRA, which can help you keep your retirement savings consolidated.

As with any financial decision, it’s essential to consider your situation and review the latest IRS rules or consult with a qualified professional before making contributions.

Traditional IRA rules and considerations

Understanding how a Traditional IRA works means being aware of key rules that affect contributions, withdrawals, and distributions.

1. Contribution limits

For 2025, you can contribute up to $7,000 if you’re under 50, or $8,000 if you’re 50 or older. These limits are combined across all your IRAs, including both Traditional and Roth IRAs.

2. Withdrawals

Withdrawals from a Traditional IRA are allowed at any time. However, if you take money out before age 59½, you will typically pay a 10% early withdrawal penalty plus income tax. Penalty exceptions include qualified education expenses, first-time home purchases (up to $10,000 lifetime), certain unreimbursed medical expenses, disability, death, health insurance costs while unemployed, and others.

3. Required minimum distributions (RMDs)

Once you turn 73, the IRS requires you to begin taking annual distributions from your Traditional IRA. These RMDs are taxable and must be calculated based on your account balance and life expectancy tables provided by the IRS.

4. Tax considerations

Your contributions may be fully or partially deductible, depending on your income and whether you’re covered by a workplace retirement plan. Earnings grow tax-deferred, and withdrawals are taxed as ordinary income.

These rules may influence how you contribute to and draw from your IRA over time, so it’s important to stay updated each year. Always refer to official IRS guidelines or speak with a qualified tax professional if you’re unsure how the rules apply to your situation.

Estimate how your traditional IRA may grow over time

You can explore how your Traditional IRA savings may grow using a compound interest calculator. Just enter your current savings, annual contribution (up to $7,000 for 2025), expected return, and years to retirement. You’ll see how compounding over time may impact your future balance.

Try out the IRA calculator on Public.

Where can you open a traditional IRA?

Traditional IRAs can be opened through banks, brokerages, or other financial institutions. If you’re using a platform like Public.com, you have the option to open and manage a Traditional IRA within your existing brokerage setup.

This allows you to invest in a broad range of assets like stocks, bonds, ETFs, options, crypto, and treasuries. You can automate contributions and access tax documents all within one portfolio.

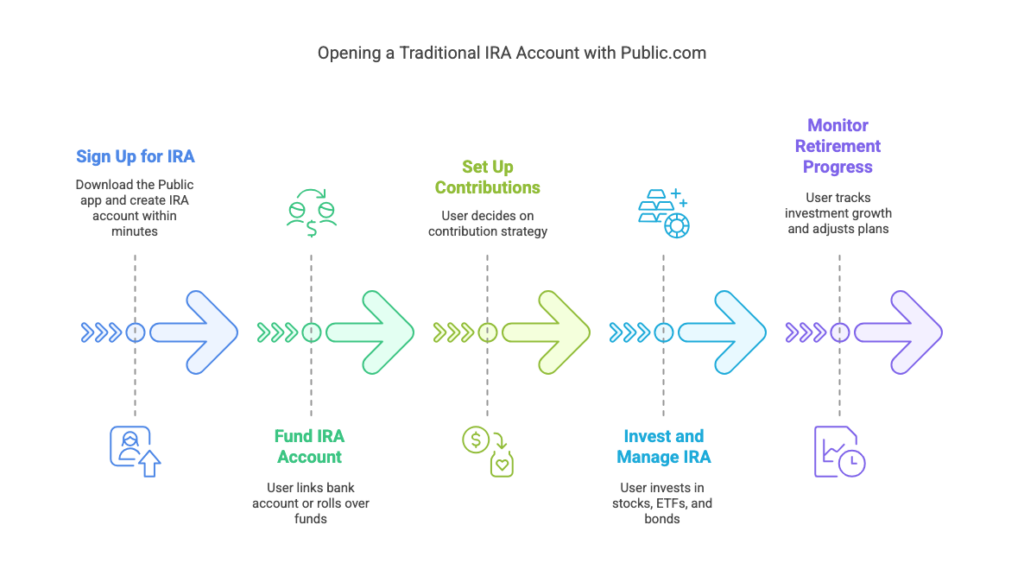

How to open a traditional IRA account on Public.com

Public.com offers a way to open and manage a traditional IRA alongside your existing investments. Here’s how the process works:

- Open IRA: To open an IRA, visit Public.com or download the Public app on iOS or Android

- Sign up: Create an account in the app. Navigate to the “Build Your Portfolio” section or Account Settings, and select “Open IRA” to start the process.

- Fund your account: Link your bank for secure transfers, or roll over an existing IRA or 401(k). Public.com supports both direct contributions and rollovers.

- Set up contributions: Choose one-time or automatic recurring deposits to help stay on track with your retirement goals.

- Invest and manage: Access thousands of stocks, ETFs, and bonds, and use Public’s tools to build and monitor your portfolio.

- Track progress: Use the dashboard to monitor your investments and adjust as needed.

Conclusion

Traditional IRAs may play an essential role in retirement planning, offering tax-deferred growth and broad investment options. As contribution limits and RMD rules change, it’s important to stay updated to manage your IRA within current guidelines.

If you prefer to manage your Traditional IRA within the same platform as your taxable accounts, Public offers an option where you can:

- Automate contributions with a built-in auto-stop feature that enables you to stay within IRS limits

- Earn a 1% match on qualified rollovers and transfers, plus 1% on annual contributions

- Trade options within your IRA

- Program trades to align with your investing approach

- Get SIPC protection for eligible assets in your account

- Manage your IRA alongside your other investment assets

Whether you’re contributing up to $7,000—or $8,000 if you’re 50 or older—you can open a Traditional IRA through Public.com and manage it alongside your other investments.

Frequently asked questions

Do traditional IRA investments grow tax-free?

No, Investments in a Traditional IRA don’t grow entirely tax-free, but they do grow tax-deferred. This means you won’t pay taxes on your earnings—like interest, dividends, or capital gains—until you withdraw the money in retirement.

Is a traditional IRA the same as a 401K?

No, a traditional IRA is different from a 401(k). IRAs are individual retirement accounts that are not connected to your employer, and you can have one in addition to a 401(k).

Can you roll over a traditional IRA?

Yes, you can roll over a traditional IRA into a 401(k) if you’re looking to consolidate your retirement accounts. You can also roll over 401(k) accounts into a traditional IRA for more flexibility. Additionally, you can perform a Roth conversion to convert a traditional IRA into a Roth IRA.

Can I take an early withdrawal from my traditional IRA without a penalty?

Any early withdrawals from a traditional IRA will be subject to a 10% penalty. The only exception to this is if you roll over your traditional IRA into a 401(k) or convert it to a Roth IRA.

Is a Traditional IRA the same as a 401(k)?

No, a Traditional IRA is not the same as a 401(k). A Traditional IRA is opened individually, while a 401(k) is offered through an employer. Both offer tax-deferred growth but have different contribution limits and rules.