Investing in stocks and understanding their potential can be complex, especially with terms like price targets frequently appearing in financial news and stock analysis. Price targets offer insights into what analysts believe a stock may be worth in the future. Let’s break down what price targets are, how they’re set, and how to interpret them for smarter investing decisions.

What are price targets? How to interpret and calculate them?

Table of Contents

Key takeaway

-

Price targets indicate the future estimated value of a stock

-

Analysts use popular valuation techniques such as the price-to-earnings (PE) ratio and discounted cash flow (DCF) analysis to determine a stock’s target price

-

There is no guarantee that a stock will reach or fall to an estimated target price

-

A stock’s price target can be a good indication of whether an investor should buy, sell or hold on to a stock

What are price targets?

A price target is a projection of a stock’s future price based on an analyst’s assessment of the company’s financial health, market conditions, and growth potential. These targets indicate what an analyst believes a stock should be worth over a certain period, often the next 6 to 12 months. A price target reflects the anticipated performance of a stock and can help investors gauge whether the stock is undervalued, overvalued, or fairly priced.

To determine a stocks price target, analysts use various valuation methodologies to predict the company’s future earning potential. Based on the calculated price target, analysts will issue a recommendation to buy, sell, or hold the stock in question. Since the market is generally unpredictable, many investors see price targets as only a piece of the puzzle when deciding when to invest or sell stock in a company. As an investor, it helps to know how to determine and interpret price targets so you can come to your own conclusions when deciding your position on a company.

How are price targets determined?

Price targets are not random figures but are derived from a combination of quantitative analysis, financial modeling, and qualitative factors. Here are some key factors analysts consider when setting price targets:

1. Company financials:

Analysts scrutinize financial statements, including revenue, profits, debt, and cash flow. They use these metrics to assess a company’s financial stability, growth trajectory, and profit potential, which in turn affects the price target.

2. Valuation metrics:

Common metrics include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA) ratio. Analysts compare these ratios to industry benchmarks to determine if the stock is undervalued or overvalued.

3. Industry trends:

Understanding industry trends is crucial. Analysts evaluate how macroeconomic trends, consumer preferences, and technological advancements impact the company and its competitors.

4. Company growth prospects:

This includes assessing future growth opportunities, such as expanding into new markets, launching innovative products, or acquiring other companies. Analysts consider these factors when estimating how much the stock price could rise.

5. External economic factors:

Factors like interest rates, inflation, and currency fluctuations influence stock price targets, as these factors can affect company profitability and the broader stock market.

6. Sentiment and market demand:

Analysts often account for market sentiment, investor behavior, and demand for the stock. High investor demand can push prices up, influencing the price target.

Read More: How to know when to take profits

How are price targets calculated?

Price targets are calculated based on financial metrics, valuation models, and market assumptions. Analysts use different approaches depending on the company’s business model and industry. Below is a simplified explanation of two common methods:

1. Price-to-earnings (P/E) ratio method

The P/E ratio method estimates the stock price target using the expected earnings per share (EPS) and a projected P/E multiple.

Formula: Price Target = Projected EPS × Expected P/E Ratio

Example:

If a company’s projected EPS for the next year is $5 and the expected P/E ratio is 20:

Price Target = 5×20=100

This suggests a price target of $100.

2. Discounted cash flow (DCF) method

The DCF method calculates the present value of a company’s projected future cash flows, discounted back to today’s value.

Formula: Price Target = Future Cash Flows ÷ (1 + r)^n

Where:

- rrr = Discount rate

- nnn = Number of periods

This method is more complex and accounts for long-term growth, making it suitable for valuing companies with stable cash flows.

Price target methodologies

There are a few different methodologies analysts use when estimating the target price of a stock, but most of them fall into one of two categories: Relative valuation and absolute valuation.

1. Relative valuation:

Relative valuation is a method used to estimate a company’s stock value by comparing it to similar companies in the same industry. Wherever possible, you can or may use this method to understand stock worth relative to peers.

Common methods of relative valuation

Relative valuation involves key financial ratios, such as:

- Price-to-Earnings (P/E)

- Price-to-Cash Flow (P/CF)

- Price-to-Sales (P/S)

- Price-to-Book (P/B)

The P/E ratio is widely used because it is straightforward and effective.

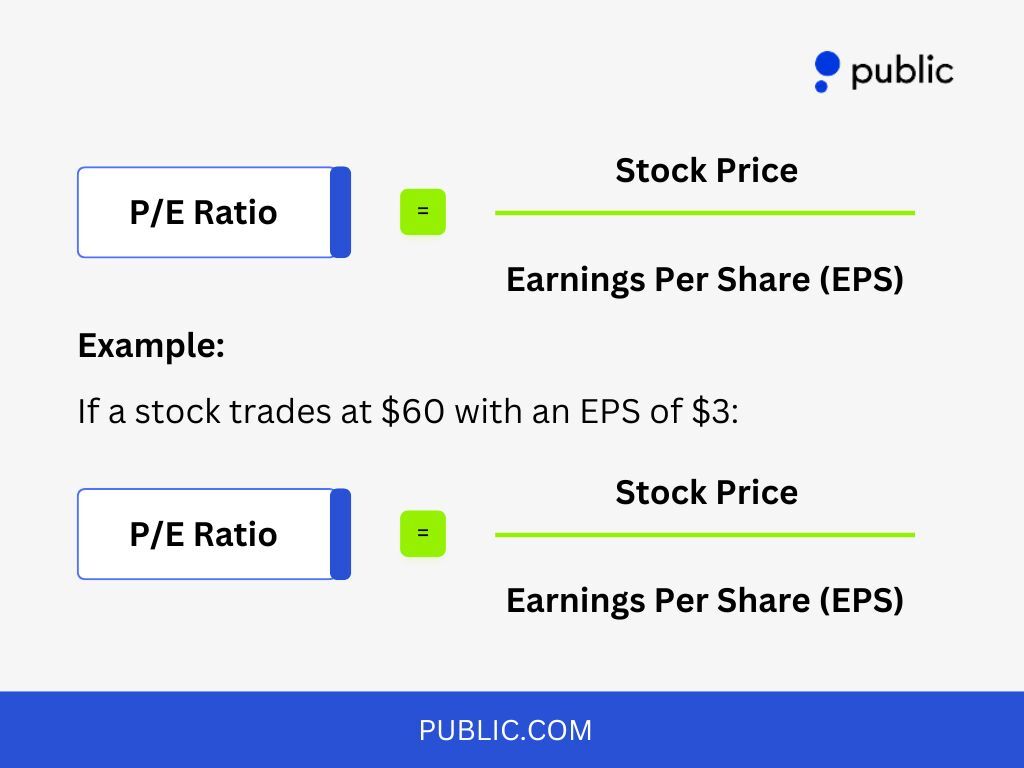

What is the P/E Ratio?

The P/E ratio measures how much investors are willing to pay for each dollar of a company’s earnings.

This indicates investors are paying 20 times the earnings for the stock.

Wherever possible, you can or may compare this ratio to industry averages for deeper insights.

Different industries typically have unique average P/E multiples. Analysts often lean on these benchmarks to select the most appropriate multiple for price target calculations.

Estimating projected EPS

To estimate a stock’s price target, analysts need projected EPS for the next 12 months. Wherever possible, you can or may:

- Examine the company’s historical earnings growth rate.

- Consider recent news or developments impacting the company.

Price target calculation: A simple example

Here’s a step-by-step example of price target estimation using the P/E method:

A. Data collection:

- Stock Price: $60

- EPS: $3

- Industry P/E Average: 19

B. Projecting EPS:

- Historical EPS growth: 5% annually.

- Projected EPS for next 12 months: 3 * (1+0.05) = 3.15

C. Price target calculation:

Price Target = P/E Multiple * Projected EPS

19 * 3.15 = 59.85

The resulting price target is $59.85. Wherever possible, you can or may refine this by accounting for additional variables or updated data.

This overview highlights how relative valuation—especially the P/E method—can help estimate a company’s stock price target with flexibility for adjustments as needed.

2. Absolute valuation:

Absolute valuation focuses on determining a company’s stock value independently, without comparing it to competitors. Wherever possible, you can or may use this method for a detailed stock assessment.

The discounted cash flow (DCF) method

The most common absolute valuation technique is the discounted cash flow (DCF) analysis, which calculates a stock’s current value based on its future cash flows.

How DCF works?

- Project future cash flows:

- Analysts predict the company’s cash flows for the next 10 years.

- Beyond 10 years, they project cash flows in perpetuity using an estimated growth rate.

- Discount to present value:

- Future cash flows are discounted back to their present value using a predetermined discount rate.

- Determine stock value:

- The total present value of all cash flows is divided by the number of outstanding shares to estimate the stock’s “true” value.

Wherever possible, you can or may use this approach to gauge whether a stock is undervalued or overvalued.

Analyzing the results

- If the calculated stock value is higher than its current market value, the stock may have potential for a price increase.

- Conversely, if it is lower, the stock could be overvalued.

Challenges with DCF analysis

The DCF method has limitations because it relies heavily on accurate predictions of:

- Future cash flows

- Growth rates

- Discount rate

Wherever possible, you can or may mitigate these challenges by conducting thorough research on the company’s:

- Historical cash flow and growth patterns.

- Business cycle and industry trends.

Example: Growth stage consideration

- High-growth companies:

- For a new, rapidly growing company, analysts may assume a high growth rate for the first 5 years of the analysis.

- Mature companies:

- For a mature company past its high-growth stage, analysts may assume a more stable, moderate growth rate.

Wherever possible, you can or may adjust growth rates based on the company’s lifecycle and market conditions.

Absolute valuation, particularly through DCF analysis, is a powerful method to determine a stock’s intrinsic value. However, it involves subjective assumptions about future cash flows and growth rates. Wherever possible, you can or may refine these estimates with comprehensive research and industry knowledge to achieve more reliable results.

How to interpret price targets?

Price targets can be useful for assessing a stock’s future potential, but interpreting them effectively requires understanding a few essential points:

1. Price target range:

Analysts may provide a range rather than a single target, reflecting the possible variability in the stock’s performance. For instance, if a stock’s price target is $50–$60, it means the analyst believes the stock could settle within that range in the projected time frame.

2. Target revision:

Price targets are not static; they are often revised based on new information, such as quarterly earnings, company announcements, or market shifts. Watching for target revisions (upward or downward) can signal changes in an analyst’s outlook on the stock.

3. Analyst ratings:

Most price targets come with an analyst rating, such as “buy,” “hold,” or “sell.” These ratings provide context to the price target:

- Buy: The stock is expected to outperform, with a price increase likely.

- Hold: The stock may perform similarly to the market, with limited price movement.

- Sell: The stock is expected to underperform or decrease in price.

4. Consensus price target:

The consensus price target is the average of multiple analysts’ price targets for a stock. This figure gives a broader market perspective, balancing the views of various analysts and reducing the impact of individual biases.

5. Comparing to current price:

Compare the price target with the current stock price:

- Higher than current price: Indicates potential upside, suggesting the stock might be undervalued.

- Lower than current price: Indicates potential downside, suggesting the stock might be overvalued.

Example:

If a stock is currently trading at $40 and has a consensus price target of $55, analysts expect a potential price increase of 37.5%. Investors might interpret this as a sign of growth potential. However, if the stock’s current price is $65 with a consensus target of $55, it may suggest the stock is overvalued, and investors might consider caution.

Conclusion

Price targets can provide valuable insights into an asset’s potential future performance, helping you make informed decisions about your investments. By analyzing price targets, you may better align your trading strategies with your financial goals.

Public.com offers the tools and data you can use to track price targets and market trends effortlessly. With Alpha, Public’s AI-powered assistant, you can dive deeper into price targets and other key performance metrics in real-time. If you already have a portfolio, transferring it to Public is simple and can be done directly from your phone.

Join our investing community, and start investing by downloading the Public app.