Investing comes with a certain amount of risk. Some investments, like the equity market, are riskier than other assets, like U.S. government bonds. Understanding that risk can help investors make the right choices for them when it comes to asset allocation.

But how do you know how risky something is? That is where risk premium comes in. Risk premium is the return expected by an investor in exchange for putting their money on the line. Knowing the risk premium can help you decide which stocks and ETFs to invest in.

In this blog, we’ll explore the concept of risk premium, how to calculate it, and its significance for investors.

What is a risk premium?

Risk premium refers to the additional return an investor expects to earn for taking on a riskier investment compared to a risk-free investment. In simpler terms, it’s the reward for assuming greater uncertainty.

Risk-free investments, such as U.S. Treasury bonds, are considered virtually risk-free because the likelihood of the government defaulting on its obligations is extremely low. Riskier investments, like stocks or corporate bonds, come with uncertainties like market fluctuations or credit risk. The risk premium bridges the gap between these two types of investments.

Key components of risk premium

- Risk-free rate: The return on a risk-free investment, often represented by the yield on U.S. Treasury bonds.

- Expected return: The return an investor anticipates from a risky investment.

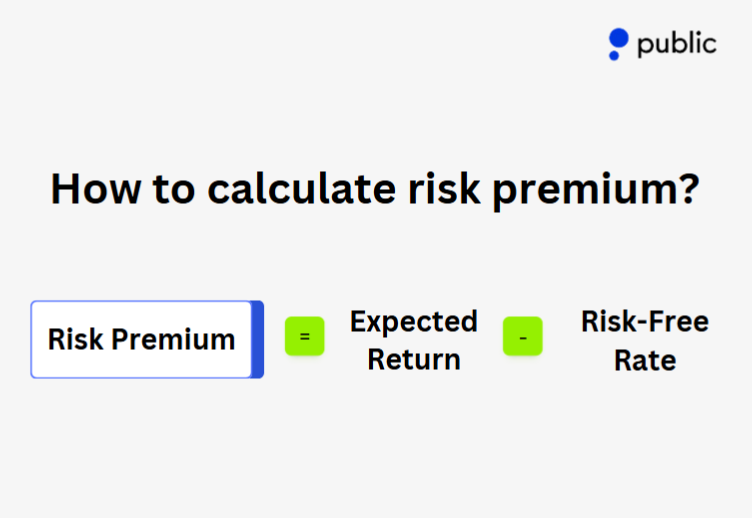

- Risk premium formula: Risk premium = Expected return – Risk-free rate

Types of risk premium every investor should know

There are about five risks associated with the risk premium that investors should keep in mind. All of these risks can hurt an investor’s bottom line, which means an investor should make sure their risk premium is adequate before they invest.

With the Public app, Safety Labels warn investors of potential risky stocks and exchange traded funds so you can stay safe and aware of any risk you are taking with your money.

1. Business risk

Business risk refers to uncertainties surrounding a company’s financial performance, such as variations in cash flow and operations. Companies with stable financials tend to require a lower risk premium, while those with unpredictable or seasonal cash flows demand a higher premium to compensate investors for the uncertainty.

Example: A utility company with consistent cash flows might have a business risk premium of 2%. In contrast, a seasonal retail business with variable earnings may require a 6% premium to attract investors.

2. Financial risk

Financial risk relates to a company’s ability to meet its financial obligations. Companies with high levels of debt face greater risks of default and require a higher financial risk premium. In contrast, companies with no debt and significant equity pose minimal financial risks.

Example: A tech company with zero debt and robust cash reserves might have a financial risk premium of 1%, while a debt-laden real estate firm might require a 5% premium to account for its higher leverage.

3. Liquidity risk

Liquidity risk is the risk of an investor not knowing when they will be able to exit an investment. Exiting an investment immediately depends on the type of security or asset held. A blue-chip stock is easier to sell because it’s in higher demand, while a stock from a company that is not well known might be harder to exit from.

Example: A widely traded blue-chip stock might have a liquidity risk premium of 0.5%, while a privately held company’s shares with limited buyers might demand a 3% premium.

4. Exchange-rate risk

Exchange-rate risk is the risk of investments in a currency other than the currency of the investor. An American investor who buys stock of a French company that is denominated in euros will have more volatility associated with the exchange rate, as the rate can change at any time. The more variation between the currencies, the more compensation or premium risk investors demand.

Example: A U.S. investor purchasing French stocks denominated in euros may require a 4% exchange-rate risk premium due to potential currency fluctuations.

5. Country-specific risk

An investment made in a country with political and economic uncertainty will face greater risk than in a country with a steady political environment. Risks can include regime change, policy changes, economic collapse, and war. The U.S. and Canada are low country-specific risk places because they tend to have a more stable nature, while places like Russia or Venezuela pose a greater risk due to their political and economic turmoil.

Example: A bond from Canada might carry a country-specific risk premium of 0.5%, while a bond from Venezuela could demand an 8% premium to account for higher political and economic risks.

How to calculate risk premium?

Risk premium is calculated by comparing the expected return of a risky investment with the return of a risk-free investment. The difference between these two returns represents the additional compensation investors demand for taking on the extra risk associated with the investment.

The formula for risk premium:

Risk premium = Expected return – Risk-free rate

- Expected return: The anticipated return from a risky asset, such as a stock or corporate bond.

- Risk-free rate: The return on a risk-free investment, often represented by the yield on a U.S. Treasury bond.

Steps to calculate risk premium

1. Identify the expected return:

Determine the expected return on the risky investment. This can be based on historical data, analyst projections, or valuation models like the Capital Asset Pricing Model (CAPM).

2. Determine the risk-free rate:

Use the yield on a government bond, such as the 10-year U.S. Treasury bond, as the risk-free rate. This rate is widely regarded as the baseline for “safe” returns.

3. Subtract the risk-free rate from the expected return:

The difference between these two values is the risk premium, which reflects the extra return required to compensate for the investment’s risk.

Examples of risk premium

Let’s break down how risk premium is calculated with two examples:

Scenario 1: Company ABC

- Expected return: 8%

- Risk-free rate (U.S. treasury): 2.75%

- Risk premium calculation: 8% – 2.75% = 5.25%

Scenario 2: Company XYZ

- Expected return: 25%

- Risk-free rate (U.S. treasury): 2.75%

- Risk premium calculation: 25% – 2.75% = 22.25%

Insights

- Company ABC: A stable, blue-chip stock with relatively consistent share prices. Lower risk implies a lower risk premium.

- Company XYZ: A more volatile stock with significant price swings. Higher risk necessitates a higher risk premium to attract investors as compensation for potential losses.

Market risk premium vs. Equity risk premium

A market risk premium is the expected return on an index or portfolio, while an equity risk premium is a return from just stocks. An equity risk premium is often higher than a market risk premium, as a market risk premium can include other assets like bonds, currencies, and commodities.

Both returns use the U.S. Treasury government bond as a benchmark since Treasuries are considered risk-free compared to other types of investments.

Why would an investor consider or avoid a risk premium?

You should always be aware of the risk you are taking when investing in a market portfolio. The risk premium helps you understand the potential risk of your stock allocation as well as the potential reward. If you are okay with taking the risk of losing your money in exchange for a potential higher stock returns, then investing in risky assets with a high risk premium might make sense for you.

But if you want to try to avoid losing your funds, then investing in more conservative assets or less risky investment might make more sense. In that case you might consider investing in stocks or ETFs with a lower risk premium. Of course it’s also important to understand that past performance doesn’t guarantee the same returns in the future. There is always a bit of risk with any type of investment.

Conclusion

The risk premium can help you know how much risk you are taking in an investment and can help you decide if the amount of potential return is worth it.

At Public, we have implemented Safety Labels on riskier stocks and ETFs to help you keep your money safe and understand when you are taking on a risky investment.

You can also get insight into potential investments with Public Premium, including insights on a company’s cash flow, operating expenses, growth, revenue segments, and more. You also get access to exclusive news and articles from research firm Morning Star.

This information can help you decide if the risk premium of an investment makes sense for your portfolio.