Go beyond your

built-in protections

If you hold an account of significant value, you can supplement your built-in insurance with additional coverage in a plan personalized for you.

Get StartedIncremental protections

Add up to $100 million in supplemental coverage

As a Public member, you automatically qualify for up to $500,000 protection on your securities in your Public investment account (1). Additionally, you get up to $500,000 of protection on Treasuries in your Treasury Account (2). However, if your account balance exhausts either of these SIPC limits, you can now add supplemental insurance of up to $100,000,000 (3).

(1) Investment accounts on Public are offered by Open to the Public Investing, Inc., member FINRA and SIPC. View full disclosures here.

(2) Treasury accounts on Public are offered by Jiko Securities, Inc., member FINRA and SIPC. View full disclosures at US Treasuries disclosure.

(3) Coverage does not extend to cryptocurrency or alternative assets available through Public. More details will be provided upon inquiry.

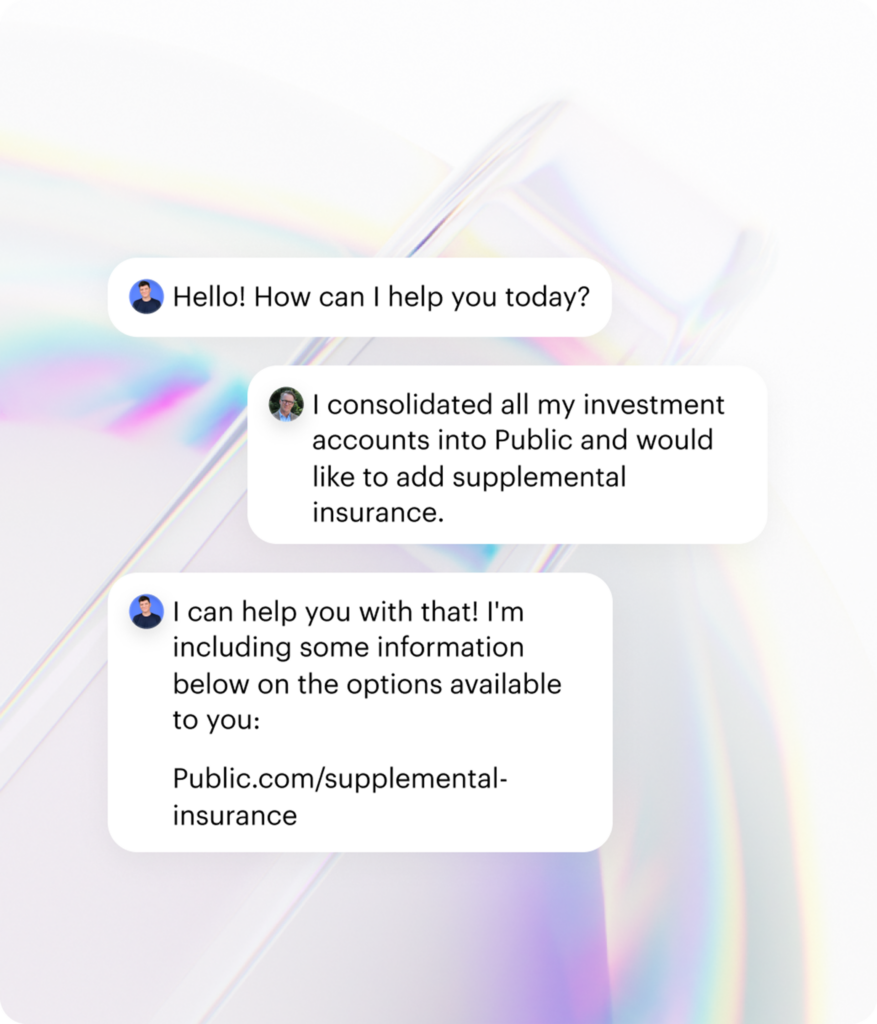

Enroll directly with a dedicated account manager

Ready to add supplemental insurance coverage to your Public account? Fill out the form below and your personal account representative will reach out to talk through your personalized plan.

Incremental protections

Know how you’re covered

While Public offers significant protections on your account value, it’s important to note that SIPC, Apex Clearing, and Public insurance does not protect you against losses in the market value of securities. Additionally, it does not apply to crypto assets held by Apex Crypto and some alternative assets on Public.

Have questions? Find answers.

Is the Public app actually free?

You can sign up for Public and open a brokerage account with Open to the Public Investing, Inc. with as little as $1. At Public, our mission is to open the markets to all. Equity trades are commission-free, meaning $0 commission trading on self-directed individual cash brokerage accounts that trade U.S. listed securities placed online. We never charge any hidden service or convenience fees but other fees, such as wire transfer fees and paper statement fees, may apply. See Public’s Disclosures to learn more. We believe everything you invest and earn should stay yours!

Do I earn a free slice of stock when I sign up for Public?

Let us help you get started! When you sign up for Public, open an approved brokerage account and deposit funds into your account, you qualify to receive a free slice of stock. The value of the slice of stock you receive varies from $3 to $300 and the amount designated for each redemption is random. This offer is available to new users only. Visit Public’s New User Free Stock Program to learn more about the terms and conditions.

Can I share Public with friends?

Absolutely! When your friend uses your unique referral link to sign up for Public, opens an approved brokerage account, and deposits funds into their account, then both you and your friend qualify for a free slice of stock. The value of the slice of stock varies from $3 to $300 and the amount designated for each redemption is random. Check out the Public Referral Program to learn how you can earn free stock slices when you invite your friends to Public and what terms and conditions apply.

Is Public Safe, Secure and Credible?

Securities trading services are provided by Open to the Public Investing, Inc., a wholly-owned subsidiary of Public and a FINRA- and SEC-registered broker-dealer. Open to the Public Investing, Inc. is also a Member of Securities Investor Protection Corporation (“SIPC”). SIPC protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). More details, including an explanatory brochure upon request, are available at www.sipc.org. Public is also fully backed by the investors behind Venmo and Facebook and we are located in New York City. If you ever have any questions or concerns, then please feel free to reach out to our friendly, knowledgeable, and fully Licensed & Registered Support Team at support@public.com. 🔒

Have additional questions about Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

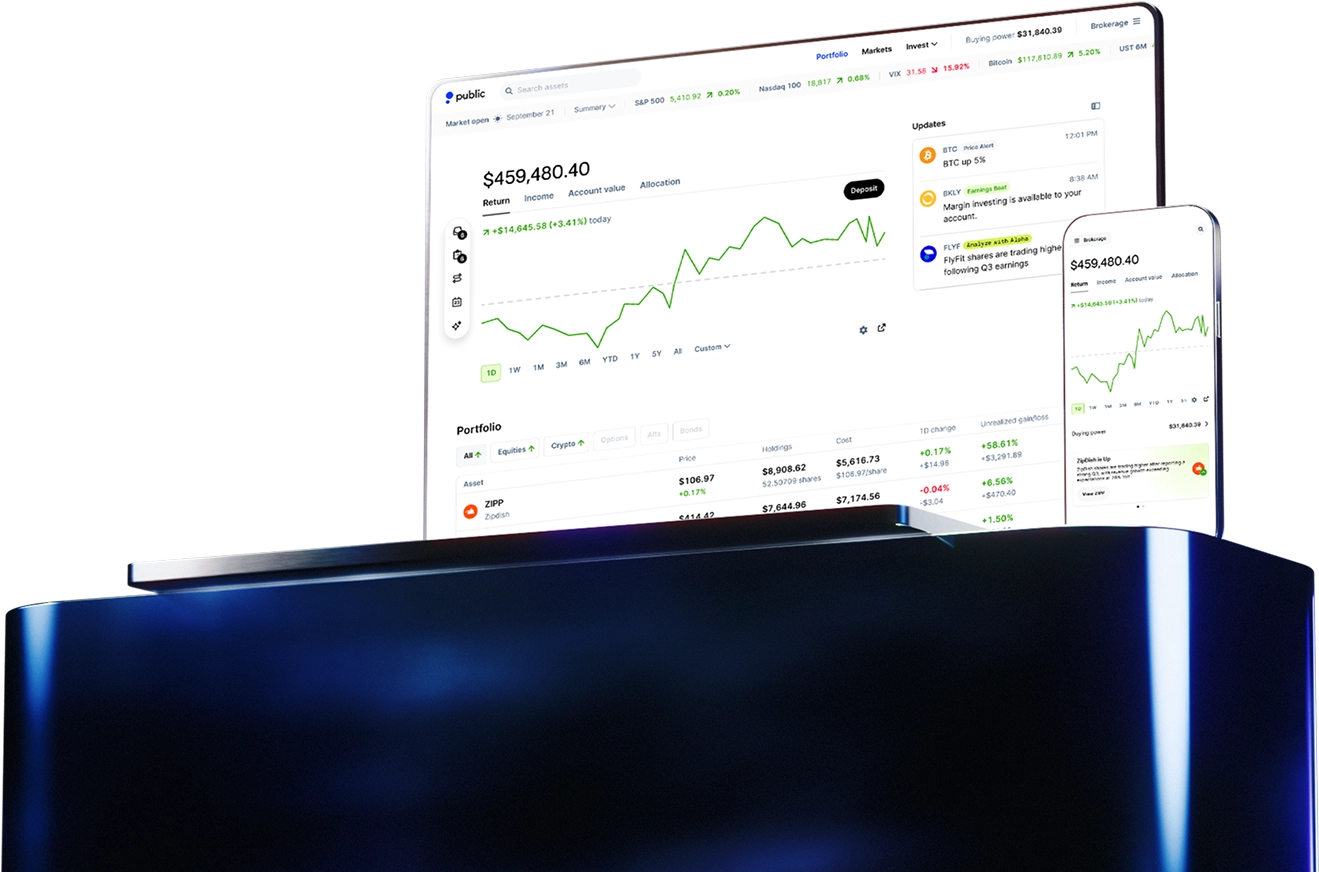

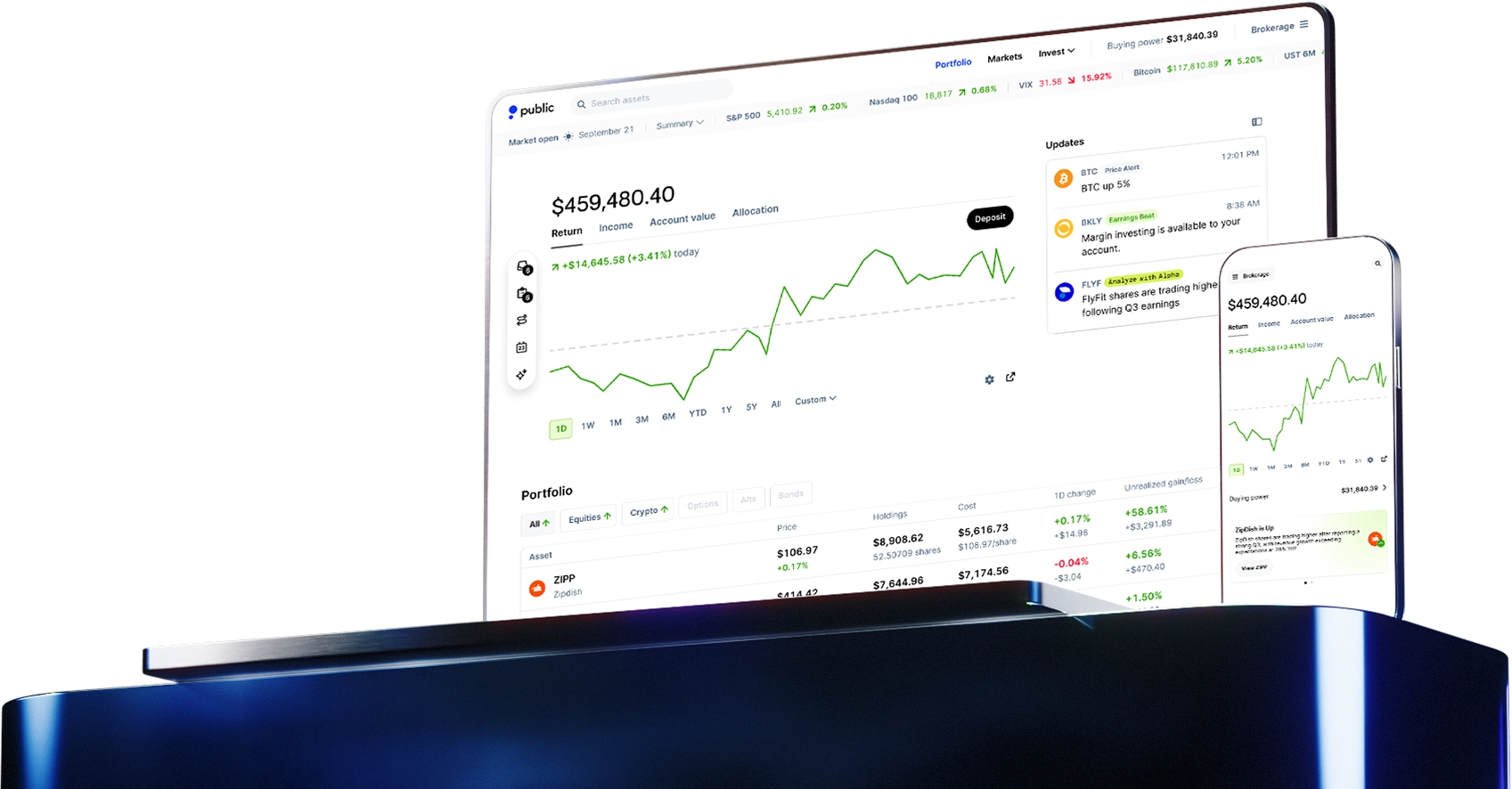

Build your portfolio with Public