The most coveted card in American sports history is the T206 Honus Wagner. Aesthetically, it’s beautiful; Wagner’s square jaw sprouts out of a turn-of-the-century Pittsburgh Pirates baseball button-down, neatly parted brown hair cropped across his scalp. Honus was one of the greatest shortstops of all time, and, as the story goes, he protested the use of his likeness in cigarette packs, limiting its circulation. That historical accident ensured that he’d be the face of the rarest card printed in the 1910s. The golden rule in the collecting industry is that the older the artifact is, the more value it draws on the open market. That’s certainly true for the T206; in pristine condition it’s sold for over $3 million. But recently, that adage hasn’t proven to be as true as it was in the past. Just this August, a Mike Trout rookie card sold for nearly $4 million. Trout has a lot in common with Wagner; they’re both all-time great hitters in the sport they love. The only difference is that Trout’s rookie card was inked in 2009, while the T206 hit newsstands 100 years earlier, in 1909.

All of a sudden, it feels like time has no meaning in the card market. Decades after a boom period and a subsequent contraction in the ’90s, as those who invested in sports cards watched the bubble burst, we’re living through an industry-wide renaissance. And surprisingly, the athletes powering this resurgence are several generations in front of Honus Wagner. In July, a LeBron James rookie card auctioned for $1.8 million. The owner of a signed, 2013-14 Giannis Antetokounmpo card took home a similar fee in September. It’s a brave new world, and veterans in the card collecting industry are still trying to make sense of it.

“I’ve never priced more Michael Jordan rookie cards in my life than I have in the past five months or so,” says Dave Hobson, who runs the appraisal service BaseballCardBuyer.com, and tells me he’s seen the size of the market grow upwards of 300 percent in the last year. “Once the word gets out there, people start digging.”

Hobson has a career arc common among enthusiast collectors. The 54-year old got into the card business after graduating college in the ’80s, at a time where it seemed that trading cards were going to retain their value indefinitely. But as that market tapered off, and it became increasingly clear that there wasn’t as much money in paperboard as previously hoped, he pivoted into a more secure line of work; selling mutual funds as a security broker without worrying about the going-ons at the ballpark. He was tempted back into the industry long before it went into overdrive this year, and traditionally, he focused on vintage stock: Baseball cards from before 1970. Now though, he frequently finds himself selling Tim Duncans and Ken Griffeys, athletes who hung up their jerseys in recent living memory. The idea of buying a card and watching it accrue value in 10 short years was the fantasy that seduced so many amateur millennial collectors at the height of the ’90s card obsession. Now, inexplicably, that pipe dream is coming true for the luckiest among them.

”A lot of people bought cards when the whole hobby was looked at as a sure thing for investment. They looked at the track record and thought, ‘If I put this away for a few decades it will pay off.’ It didn’t really pan out for most of those cards,” says Hobson. “But now it’s being reborn.”

Like most ebbs and flows in the market, it’s hard to pin down the sports card comeback to any one particular wrinkle. But Hobson highlights one trend he’s noticed. There’s been an uptick in nostalgia for athletes who peaked in the ’90s and 2000s—as their statistical resumes recede into history, perhaps it’s a little easier to regard them as bona fide timeless legends. In particular, adds Hodson, ESPN documentary series The Last Dance sparked a huge run on Michael Jordan cards, as a nation under quarantine rediscovered their dormant Bulls fandom. That fervor reminded countless people of the cards they bought as teens or young adults and stowed away in their personal archive, and as the asking cost ticked up, those citizens brought their decades-old investment to market.

“People are finally seeing the return that they hoped for, back then,” explains Hobson.

That same attitude has taken hold in the buying market for sports cards. As the hobby becomes cool again, it’s attracted a lot of the people who initially fell out of the community in adolescence. Chris McGill, a 34-year old in Illinois, hosts the House of Jordans podcast, which focuses primarily on the buying, hunting, and selling of basketball cards. He found his way back into the scene in 2016, long after he first started collecting as a kid, and therefore he has a ton of nostalgia for the ’90s boom period that first drew him in.

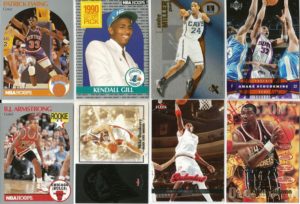

”Sports cards—as works at the intersection of graphic design, technology, and photography—evolved significantly during that era,” says McGill. “They became works of visual art. Intentional rarity, such as producing limited, serial-numbered cards, became a mainstay. In short, cards became much more collectible during this period as the industry refined its product.”

Naturally, when McGill started ripping open boosters again as an adult, it came from a place of childhood fulfillment. He now had the financial solvency and the purchasing power to spend as much as he wanted on the hobby, which is a different dynamic from the way we begged our parents for a few Upper Deck packs while waiting in line at Target.

“Personally, one of the first things I did when I returned to sports cards was buy the card that I could never afford as a kid,” continues McGill. “This is a common story among other returning collectors that I talk with.”

Within that context, he adds, the expansion of the sports card market becomes a simple math problem. The scarcest items in the Panini, Upper Deck, and Topps catalogues are frequently limited to 100 or less. The supply is so slim, that once there’s a small increase in the number of interested buyers—just a few more wistful 40-year olds remembering the good old days—the demand can skyrocket. “Especially given that auctions—which pit bidders against each other—are one of the dominant modes of buying and selling sports cards online,” says McGill.

So does that mean that casual observers should immediately start searching their garages for any stray Jose Cansecos that they could immediately flip for a month’s worth of rent? No, not really. Everyone I spoke to for this story says that they’ve been frequently accosted by friends and family members about the value of long-neglected personal collections, and almost every time, they’re forced to be the bearers of bad news. It’s also difficult to know exactly where the hobby will go from here. The history of commercial collecting is full of booms and busts, and there are some fears that a downturn might be accelerated now that the feeding frenzy is on. But McGill isn’t too worried about that. As long as the community keeps its heart pure, there’s no reason to think the second sports card boom will slow down anytime soon.

“I relish the opportunity to talk about sports cards with others who share my passion. I have a network of friends that is built upon our common interest in sports cards. In short, I don’t see myself moving away from sports cards. My life would become less fun if that were to happen,” he finishes. “If this is the case for most people in sports cards, and if it proves to be the case for people who are new or returning to sports cards, then I think sports cards have a bright future.”

Expand your investment portfolio beyond cards

For many, collecting and trading cards is more than just a hobby. And when you’re ready to explore opportunities beyond the world of cards, Public is here to help. On Public, you can build a multi-asset portfolio of stocks, options, bonds, crypto, ETFs and more. Plus, you can access AI-powered fundamental data and custom analysis to guide your investment decisions.

Sign up today and explore how you can expand your investment portfolio beyond card collecting. With options like high-yield cash accounts (HYCA) and expert guidance on stocks, crypto, and ETFs, Public is your platform for smarter investing.