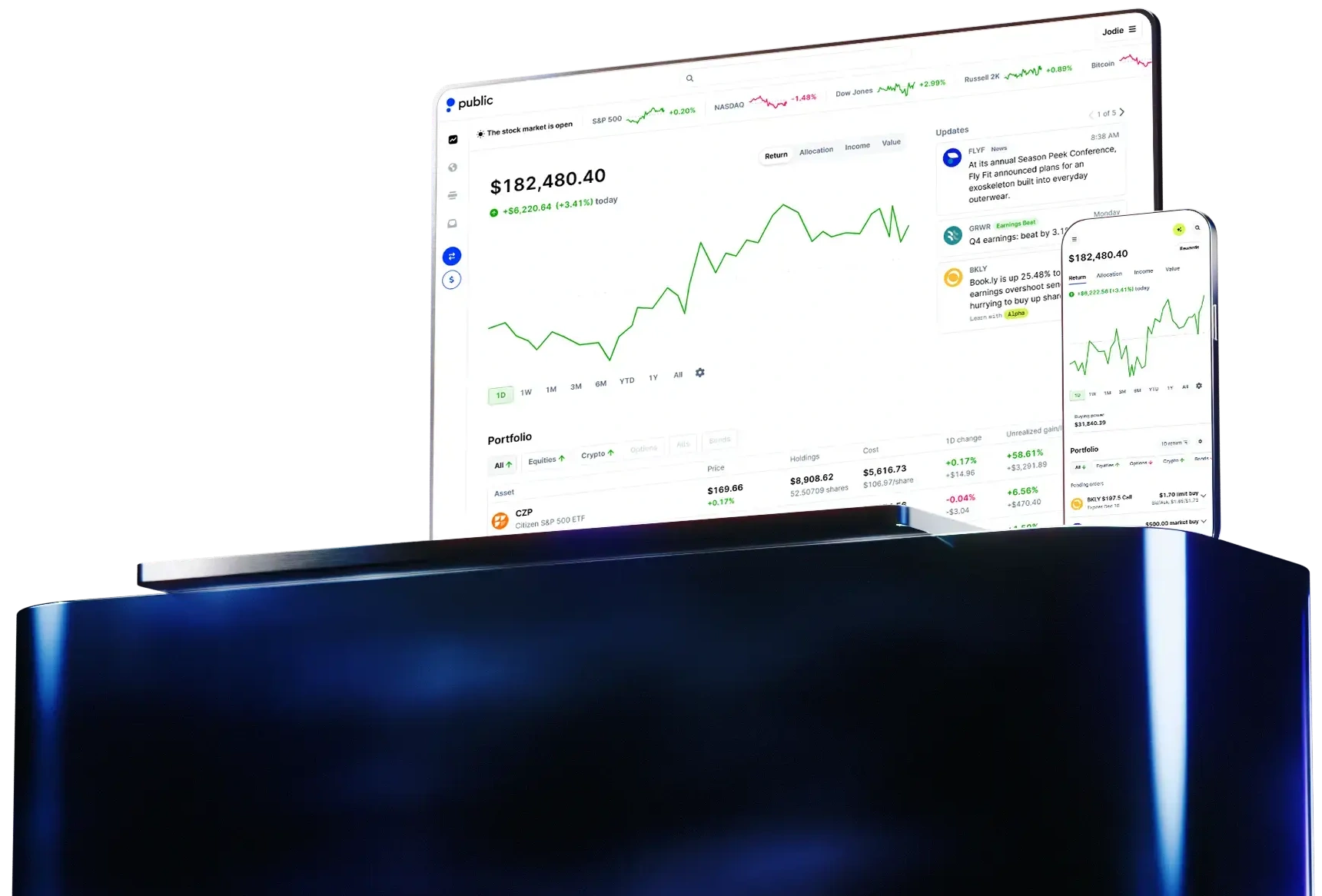

AI for investors.

Research and proactive insights.

-

Ask any question about any stock.

-

Receive earnings call breakdowns the minute they hang up.

-

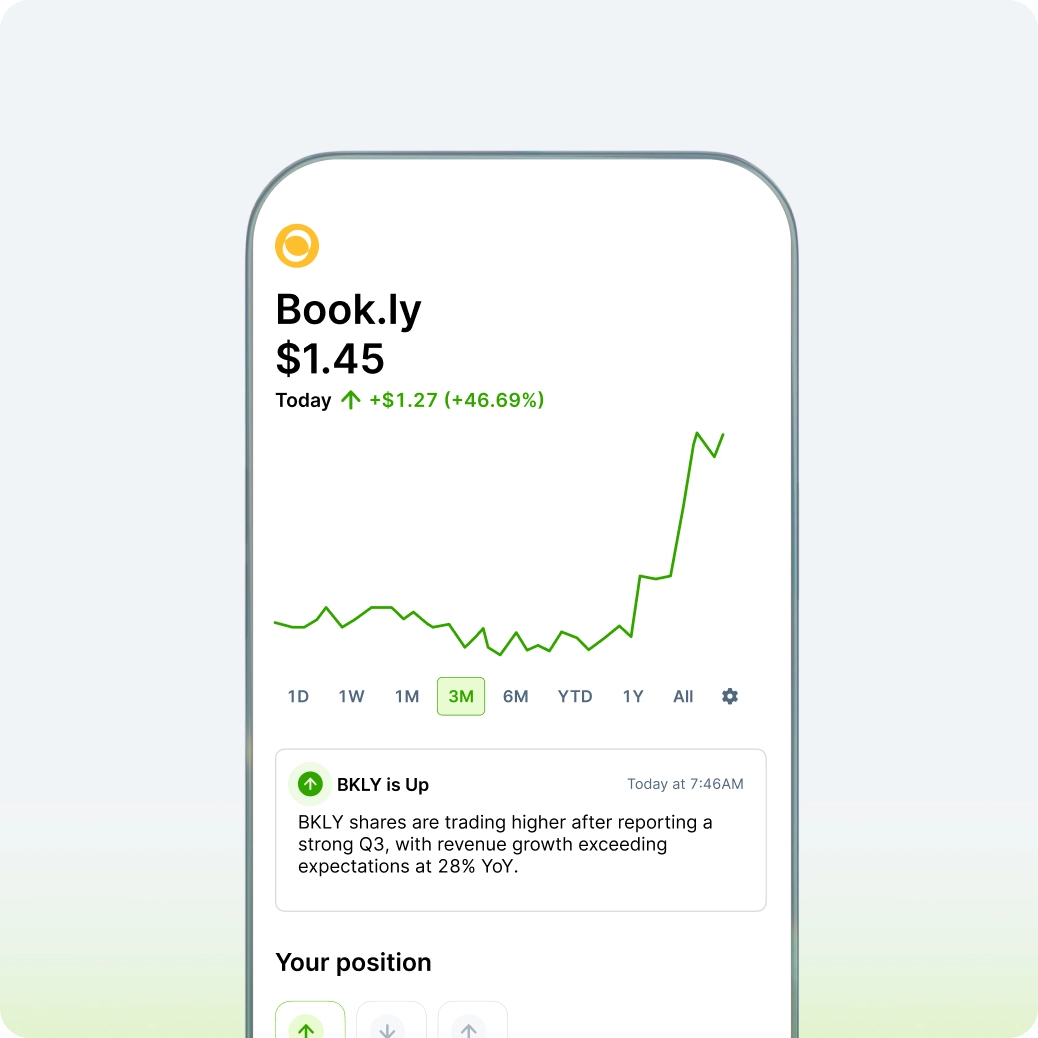

Know why a stock is moving—not just that it is.

*Alpha is an experiment brought to you by Public Holdings, Inc. (“Public”). Alpha is an artificial intelligence investment exploration tool powered by GPT-4, a generative large language model offered by OpenAI. Given that Alpha is an experimental technology, it may sometimes give inaccurate or inappropriate information. Any output generated by Alpha is not and should not be construed as investment research, investment advice, or a recommendation to buy or sell a security, nor should any output serve as the basis for any investment decisions. Alpha output is provided “as is” and Public makes no representations or warranties with respect to the accuracy, completeness, quality, timeliness, or any other characteristic of Alpha output. We strongly recommend that you independently evaluate and verify the accuracy of any Alpha output for your use case. Learn more at public.com/disclosures.