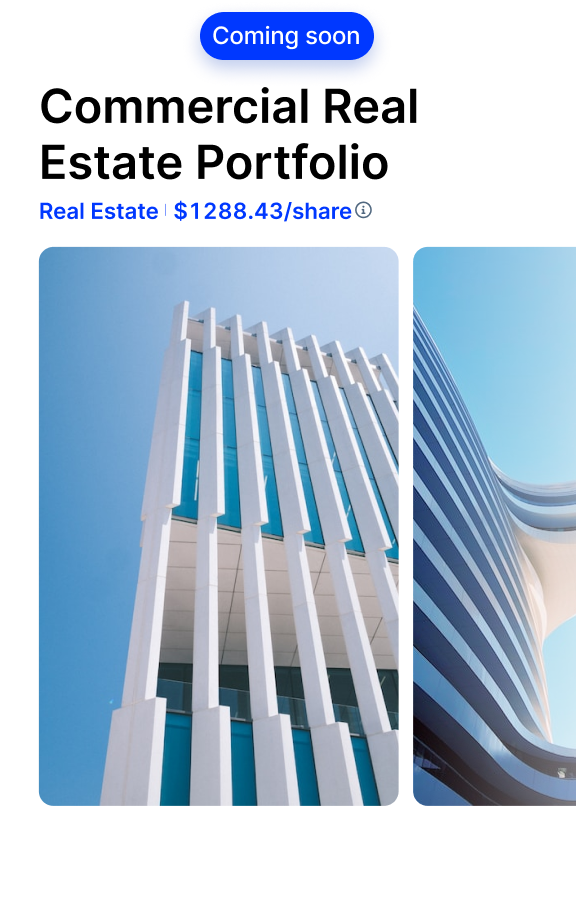

Invest in alternative assets

Diversify your portfolio with shares of alternative assets, like fine art and collectibles. Coming soon: even more assets.

Sign UpExplore AlternativesCurated Investments

Make empowered investing decisions

Explore an expertly curated collection

Our in-house team sources rare finds from private collectors and top auction houses and rigorously vets each alternative asset.

Gain broad market exposure

On Public, you can invest in alternative asset Portfolios that include multiple items curated around a category or theme. Think of it like an ETF but for alternative assets.

Invest with greater access to liquidity

The Public platform is one of the world's largest alternative asset investing platforms*, with a growing secondary market to buy and sell shares.

*Trading of alternative assets occurs through Dalmore on the Public platform.

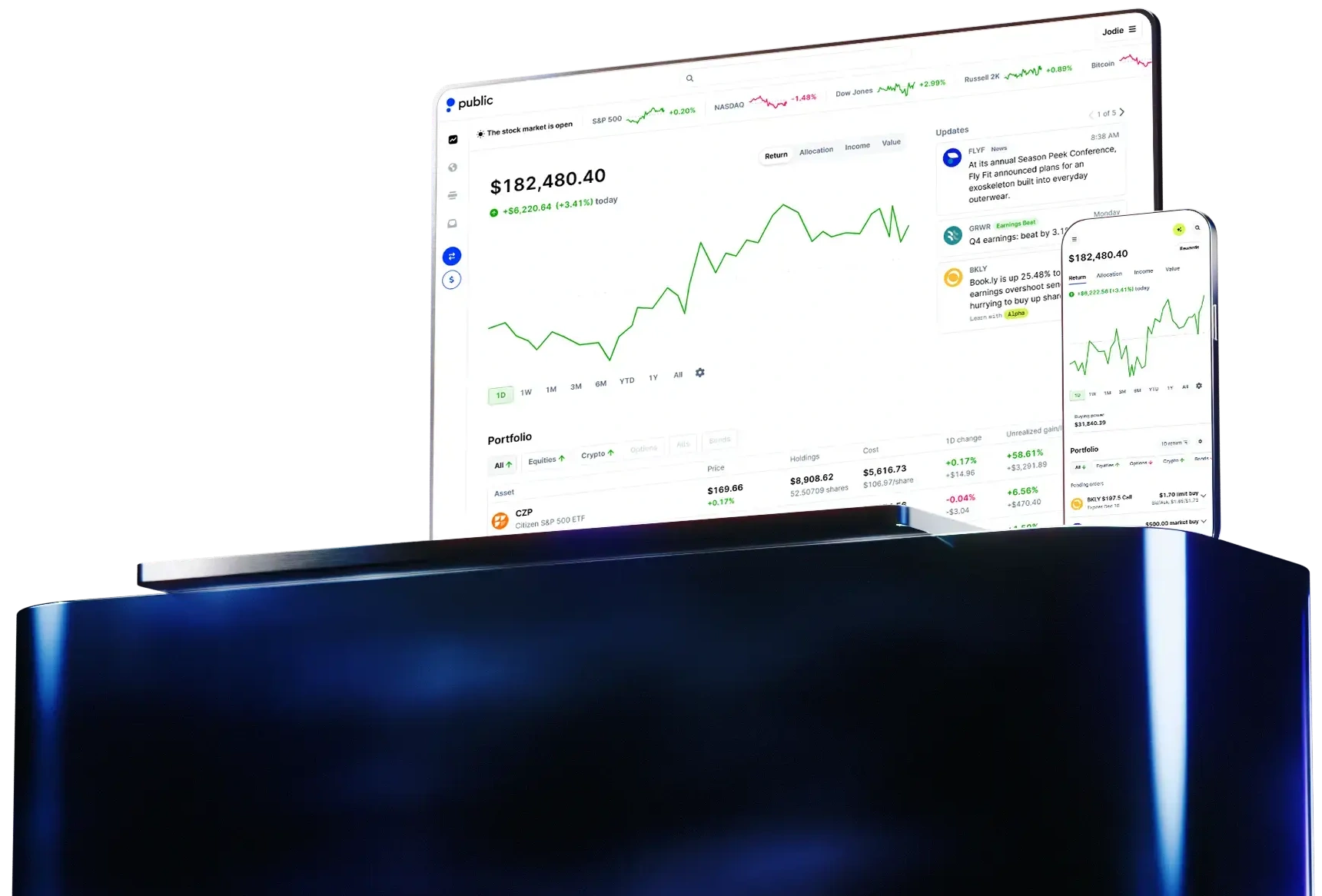

Buy, hold, and sell in one place

Purchase shares

Buy shares of new IPOs or shares of existing alternative assets from Public members.

Manage your portfolio

View your alternative assets right alongside your stocks, ETFs, and crypto.

Earn a return

Sell your shares within the Public app. You can also potentially earn a return if we sell the underlying asset.

Have questions? Find answers.

What are alternative assets?

“Alternative assets” usually refers to investments that fall outside traditional asset classes like stocks, bonds and cash.

How does fractional investing in alts work on Public?

Public makes investing in Alts accessible for our investors. Members can buy membership interests, or shares, in a range of alts including art, collectibles and more. You can then manage your holdings directly through the app. For more information on how Alts investing on Public works, learn more here.

Why do investors consider alts for their portfolio?

Given that some alternative assets have reduced correlation with the stock market as opposed to other forms of investments, some investors find that they are useful vehicles to diversify their investment portfolio. Additionally, alternative assets have historically been viewed as a partial hedge against inflation. You should speak with your legal, financial and tax advisors to learn more and determine if alternative assets make sense for you.

What are the risks associated with alts?

Alternatives have a unique set of risks. You should review the applicable offering documents to determine if an investment is right for you. For more information, see this article.

Alternatives are not guaranteed, are generally less liquid than other types of securities, and are not protected by SIPC. Accordingly, you may not be able to sell interests in securities you have purchased. Please contact your attorney and tax advisors for details specific to you on investing in Securities. Past performance is no guarantee of future results.

Have additional questions about investing in Alts with Public?

Our US-based customer experience team is standing by to help.

Build your portfolio with Public

Get started