The cryptocurrency and blockchain space move fast, with constant evolutions to crypto asset prices and their underlying technologies. One of the hottest topics in the space is the Ethereum Merge event.

This article will help you understand what the Ethereum Merge is and why it’s a significant update to the second largest cryptocurrency by market cap.

While this article is not investment advice, it will explain the Ethereum Merge and its potential impact on Ethereum’s associated crypto asset, Ether (ETH).

Read on to be a better investor.

Table of Contents:

- Understanding the Ethereum infrastructure

- Difference between Proof-of-Work (PoW) and Proof-of-Stake (PoS)

- What is the Merge?

- Timeline of Ethereum Merge updates

- When is the Merge happening?

- Common misconceptions about the Merge?

- What happens after the Merge?

- What will ETH holders do for the Merge?

- Will the Merge affect ETH price?

- Should you invest in ETH?

- How to invest in Ether (ETH) and other crypto assets

- Frequently Asked Questions

Key Takeaways

- The Ethereum Merge refers to the transition of the Ethereum blockchain from a Proof-of-Work to a Proof-of-Stake consensus protocol.

- The Merge will be completed when the Ethereum Mainnet merges with the Proof-of-Stake Beacon chain.

- Ethereum developers are conducting multiple trials before the final Merge.

- The Merge is scheduled for somewhere between September 10-20, 2022.

- The Merge itself won’t solve Ethereum’s scalability issues and high gas fees. But it will lay the foundation for these future Ethereum developments, namely Surge, Verge, Purge, and Splurge.

- The Ethereum Merge reflects a change to Ether’s (ETH) underlying blockchain technology, but is not expected to impact ETH as a crypto asset.

- Some crypto analysts believe the Merge has already been “priced in” to the asset; however, crypto investors will be following the event closely.

Understanding the Ethereum infrastructure

Before we dive deeper, let’s dig into the Ethereum blockchain. Ethereum is the blockchain technology that underpins the native crypto asset Ether (ETH).

The Ethereum blockchain is a distributed ledger that functions without the intervention of centralized intermediaries like banks. The obvious question is: Who maintains and updates the ledger? The Ethereum network uses a security system called a consensus mechanism to add new blocks of transactions to the blockchain.

Since it was created in July 2015, Ethereum has been using the Proof-of-Work mechanism to validate on-chain transactions. However, Ethereum developers have been working for a long time to transition to a Proof-of-Stake consensus. But, why? To answer the question, let us first explain how the two mechanisms work.

Difference between Proof-of-Work (PoW) and Proof-of-Stake (PoS)

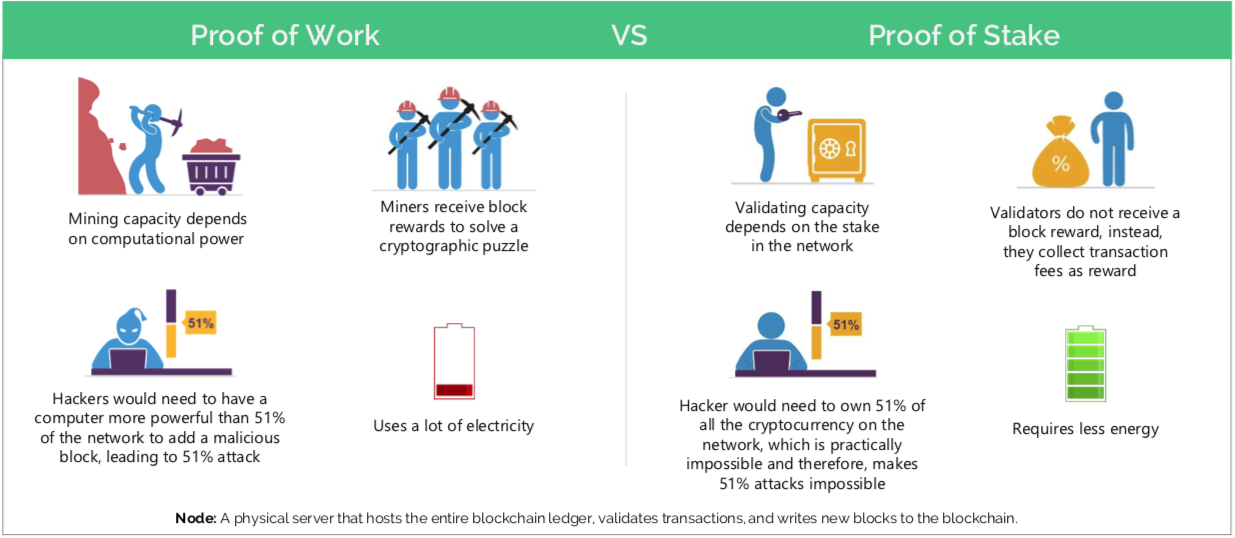

In Proof-of-Work, miners compete against each other by using energy-intensive mining rigs to solve complex computations.The winner validates transactions and earns rewards in the blockchain’s native cryptocurrency. For example, Bitcoin miners earn Bitcoin for successfully validating transactions.

PoW miners with more computational energy have a greater chance of validating transactions. However, complex computations lead to high energy consumption for PoW blockchains. For instance, 1 Ethereum transaction consumes 238 kWh of energy. In comparison, 100K VISA transactions consume just 149 kWh of energy.

On the contrary, in Proof-of-Stake, stakers lock their crypto to become validators. The protocol randomly chooses validators to verify transactions and add them to the blockchain. Validators receive the native cryptocurrency as incentives for validating legitimate transactions. However, slashing forfeits the staked crypto as a penalty if someone approves illegitimate transactions.

Since staking does not require competition among energy-guzzling computing machines, PoS blockchains are highly energy-efficient. It is one of the primary reasons why Ethereum wants to migrate from PoW to PoS. The Ethereum Foundation states that the transition to Proof-of-Stake will reduce Ethereum’s energy usage by 99.5%.

Source: Coindesk

Source: Coindesk

Now that you know the basics, it’s time to get to the real issue: The Merge.

What is the Merge?

The Merge is a significant Ethereum upgrade that will mark the complete transition of the Ethereum ecosystem to the Proof-of-Stake mechanism. In technical terms, the Merge means the joining of the Ethereum Mainnet with the Beacon chain. Let’s break this down into simpler terms.

Just like Rome wasn’t built in a day, the Ethereum Merge isn’t an overnight event. Vitalik Buterin, the co-founder of Ethereum, published two articles on Proof-of-Stake in 2014 and 2020. As the timeline demonstrates, the transition from PoW to PoS is a long-drawn event. One of the first steps of the Merge was the launch of the Beacon chain.

The Beacon chain, the side chain that introduced staking to Ethereum, went live on December 1, 2020. The Beacon chain existed as a separate chain and did not handle any smart contract data or process transactions. However, Beacon coordinated a network of stakers, reaching a consensus on its own state through its active validators. At the time of writing, Beacon has 417,598 active validators.

The Beacon consensus layer has been running parallel to the Mainnet chain leading up to the Merge. After the Merge, the Beacon chain will become the consensus engine for Ethereum and can process execution layer transactions. In other words, the Merge will officially make the Beacon chain the engine of block production with Proof-of-Stake as consensus.

The Merge is a sophisticated and complex procedure. Thus, it requires rigorous testing and trial runs before the official merging of the two chains. The following section provides a broad overview of some major Ethereum updates.

Timeline of Ethereum Merge updates

- London hard fork (August 5, 2021): The EIP-1559 and EIP-3554 introduced new fee structures to eventually make mining unprofitable for miners.

- Altair upgrade (October 27, 2021): Node operators had to upgrade their client servers, otherwise they wouldn’t be able to participate in the network after the Merge.

- Arrow Glacier upgrade (December 9, 2021): It pushed back the date of the “difficulty bomb” to June 2022. The difficulty bomb forces PoW networks to stop producing blocks and disincentivize miners.

- Kiln testnet merge (March 16, 2022): This event involved a test run of the PoW execution layer merging with PoS Beacon. Tim Beiko, a core Ethereum member, tweeted that validators can produce transaction-filled blocks after merging.

- Ropsten testnet merge (June 8, 2022): It was the first of three public testnet to undergo successful merging and had a 99% participation rate

- Gray Glacier upgrade (June 30, 2022): This pushed the difficulty bomb by 700,000 blocks to sometime in September.

- Sepolia testnet merge (July 6, 2022): Thiswas the second public testnet, which was also successful.

- Goerli testnet merge (August 10, 2022): This was the final public testnet which demonstrated a successful migration to Proof-of-Stake.

- Mainnet shadow forks 1-10 (from April 10, 2022): Developers conducted a test run of the Merge on the primary network with a small number of network nodes. This would give a realistic idea of how PoS would function in realistic conditions.

When is the Merge happening?

Following years of gradual updates and testing, the Ethereum Foundation is readying the Ethereum Merge for mid-September 2022.

There are certain factors that will decide the exact date of the Merge. The Bellatrix upgrade will activate on the Beacon chain on September 6, 2022, which will eventually make PoW mining impossible on Ethereum. Once that happens, the Execution layer will merge with the Consensus layer, and Ethereum will become a PoS blockchain.

Common misconceptions about the Merge

The hype around the Merge has led to some misconceptions and myths. We want to dispel these misunderstandings for Ethereum investors.

Myth 1: The Merge will reduce transaction fees (gas fees).

No, it will not. The Merge is a transition from a Proof-of-Work to a Proof-of-Stake algorithm. It is not an expansion of network capacity. Therefore, high network demand can still result in high gas.

Myth 2: Transactions will be faster after the Merge.

No, there won’t be any significant difference in transaction speed. While PoW takes 13.3 seconds to add a new block, the Beacon chain slots occur every 12 seconds. PoS block production is 10% faster than PoW blocks, which is practically unnoticeable.

Myth 3: You need to stake 32 ETH to run a node.

Validators require a significant stake in Ether (ETH) in order to run a node. These nodes hold block proposers accountable, verify their validity, and propagate it through the network. However, block proposal node providers have to commit economic resources (GPU hash power or staked ETH).

Myth 4: You can withdraw the ETH staked after the Merge.

No, withdrawals will be disabled on the Beacon chain till the Shanghai upgrade, which may take 6-12 months.

Myth 5: Validators will not receive any liquid ETH rewards.

No, validators will instantly receive their fees and rewards earned while proposing new blocks.

Myth 6: After the Shanghai upgrade, there will be a mass exodus of ETH stakers.

No, the protocol limits validator exit rates which adjust itself according to the ETH staked. Currently, only 1,350 validators can exit every day (only 43,200 ETH out of 10 million ETH).

The Merge is the stepping stone towards a radically transformed Ethereum. Although the Merge itself won’t make Ethereum faster and more scalable, it will lay the foundation for future developments. Vitalik Buterin has laid out a 4-stage roadmap for Post-Merge Ethereum development.

- The Surge: It will introduce scalability to Ethereum via sharding and rollups. Sharding will split Ethereum into 64 smaller chains to distribute the network data. Optimistic rollups and Zero-knowledge rollups will execute transactions on layer-2 networks.

- The Verge: It will also make Ethereum more scalable through the introduction of Verkle trees. Verkle is an upgrade from Merkle trees that optimizes storage by reducing the node size.

- The Purge: It will reduce historical data storage, thereby minimizing network congestion. Buterin believes this will increase Ethereum’s efficiency, as the network will be able to process 100K transactions per second.

- The Splurge: It is the ultimate stage to ensure that Ethereum runs smoothly and the updates do not cause any hindrance to users.

There are several material upgrades ahead in Ethereum’s evolution, with many stages ahead in the blockchain’s overhaul.

What will ETH holders do for the Merge?

Investors in the Ether crypto asset, ETH, should not expect major changes following the Merge given that the updates are to the crypto asset’s “rails” and not the ETH asset itself. ETH investors are expected to have the same ability to trade and store ETH with no anticipated disruptions. Importantly, the Merge is NOT a hard fork, so the transaction history will remain unaltered. The funds in your wallet or in the associated wallet of your crypto exchange, will still be yours after the Merge. You do not need to upgrade anything.

Some crypto watchers warn that the Merge event could cause an uptick in attempted scams to dupe investors during this high-visibility moment. One example is a dubious project offering “ETH2 tokens” with the aim of executing what’s called a crypto rug pull.

Will the Merge affect ETH price?

Historical data shows that news about the Merge launch date and successful test runs have resulted in upward ETH price movements, but it’s important to remember that in investing, past performance does not guarantee future events.The news of the expected Merge date caused ETH to rise above $1,500 in July 2022. Similarly, ETH surpassed the $1,900 mark on August 11, 2022, reaching a two-month high after the Goerli test. However, in early September, it has fallen back to a level of around $1,500.

Some analysts believe that in the near term, the Merge is already priced into the current price of ETH. Longer-term, some bullish analysts believe that future potential of the Merge and subsequent upgrades will strengthen the value of ETH over time, although these are predictions and not guarantees. In addition, bear market conditions and market volatility make it more difficult to hypothesize how the Merge will impact prices in the near-and long-term.

Should you invest in ETH?

Ethereum 2.0 is expected to reduce the carbon footprint of Ethereum, and push for more decentralization and security. Moreover, staking will bring down ETH token issuance by almost 90%, making it a potential hedge against inflation. Some bullish crypto investors believe that ETH has potential to appreciate in value over time – though others are skeptical of cryptocurrency as a whole. However, your decision to invest should depend on your research, financial goals, and risk appetite.

Editor’s tip: Crypto investing on Public.com: Sign up today to build a portfolio of crypto assets, stocks, NFTs, and alternative assets. Automate your strategy by setting up recurring investments. Get started now.

The Merge could also set the stage for diversifying Ethereum’s use cases. It’s possible that the number of NFTs, DeFi, Dapp, and stablecoin projects on the network will increase in the near future, and so crypto investors will be watching the Merge closely.

Editor’s tip: Level up your crypto knowledge on Public.com: Tune in to live audio shows unpacking the latest crypto news and market events everyday, all in the same platform you invest in cryptos, stocks, ETFs, and alts. On Public.com, you can get the context around your portfolio and become a better investor. Get started now.

How to invest in Ether (ETH) and other crypto assets

If you decide to invest in Ether (ETH) or other crypto assets, how should you get started?

Public.com offers the ability to build a modern portfolio in a single platform, with your crypto assets, stocks, ETFs, and soon alternative investments all managed within a single platform. This makes it possible to view your investment strategy holistically and track your diversification.

Sign up for Public.com today to start exploring Ether (ETH) and dozens of other crypto assets, in addition to stocks, ETFs, and, soon alternative assets all available via fractional buys. Fractional investing allows you to invest in a portion of a single share, with you determining the exact dollar amount you want to invest. Public.com also offers the following features:

- Invest in crypto assets and manage your portfolio in a single platform available within a mobile app and web (desktop) experience.

- Understand market volatility and breaking news and events with context right alongside your portfolio. Public.com offers free daily audio shows with experts and analysts, and other information built directly into the experience. Become a better investor as you build your portfolio.

- Invest with more flexibility, with the ability to use a debit card to invest.

- Connect with other ETH and crypto investors to share ideas. Public.com offers community features that make it easy to collaborate with other investors and discuss the latest news and trends.

Frequently Asked Questions

What is Ethereum Merge? What does it mean for ETH investors?

The Ethereum Merge is the official transition of the Ethereum blockchain from Proof-of-Work to Proof of Stake consensus mechanism.

The Ethereum Merge is not expected to directly impact ETH investors on Public, though other platforms may limit transfers or other activity for a short period of time. Ether (ETH) is the crypto asset associated with the Blockchain Ethereum, and the Merge is an upgrade to the blockchain technology and not the crypto asset. .

When is the Ethereum Merge date?

According to the Ethereum Foundation, the Ethereum Merge will happen sometime between September 10 and 20, 2022. Since it’s a highly complex technical operation, it is difficult to fix a date and may face delays.

Will the Ethereum Merge lower gas fees?

No, the ETH Merge is a change in consensus mechanism and not an expansion of network capacity. However, the Merge will lay the foundation for the expansion of network capacity, which will eventually lead to lower gas fees.

How will the Ethereum merge affect the price of ETH?

Historical data shows that ETH prices have responded positively to news about the Merge, but past performance cannot predict future events. Some analysts believe that in the near-term, the Merge may already be priced into the price of ETH. Crypto market volatility also makes it more difficult to predict impact on ETH price. Crypto watchers bullish on the Merge and future upgrades believe in the increasing value of ETH over time; however investors should do their own research before deciding if an investment in ETH or oher crypto assets is right for them.

Is ETH a good long term crypto investment?

Ethereum is one of the more widely used blockchain networks, and it is trusted by many developers. Its native currency, ETH, is the second largest crypto asset by market cap, behind Bitcoin (BTC). However, as we’ve seen in 2022, the crypto markets are prone to high volatility.

Can I buy ETH with a credit/debit card?

You can buy Ether (ETH) as well as other digital currencies with your debit card on Public.com. Public also facilitates instant deposits with zero wait time for making an investment. Funding via credit card is not yet available.

Where can I invest in ETH?

Today, there are several crypto exchanges and platforms that offer the ability to invest in ETH and other crypto assets. If you’re looking for a place to invest in cryptos like ETH alongside your stock market investments, Public.com offers a single platform for building a diversified portfolio across multiple asset types.

Cryptocurrency execution and custody services are provided by Apex Crypto LLC (NMLS ID 1828849) through a software licensing agreement between Apex Crypto LLC and Public Crypto LLC. Apex Crypto is not a registered broker-dealer or a member of SIPC or FINRA. Cryptocurrencies are not securities and are not FDIC or SIPC insured. Apex Crypto is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Please ensure that you fully understand the risks involved before trading: Legal Disclosures, Apex Crypto.