If you’ve been exploring investment strategies, you’ve likely come across the term “60/40 portfolio.” This strategy has been around for decades and is often discussed in the context of long-term investment planning. But what does it actually mean for you as an investor? And more importantly, does it still hold relevance in today’s economic environment?

Let’s break down the essentials of the 60/40 portfolio—how it works, why some investors may consider it, what the risks are, and what recent performance tells you about its potential role in your overall investing approach.

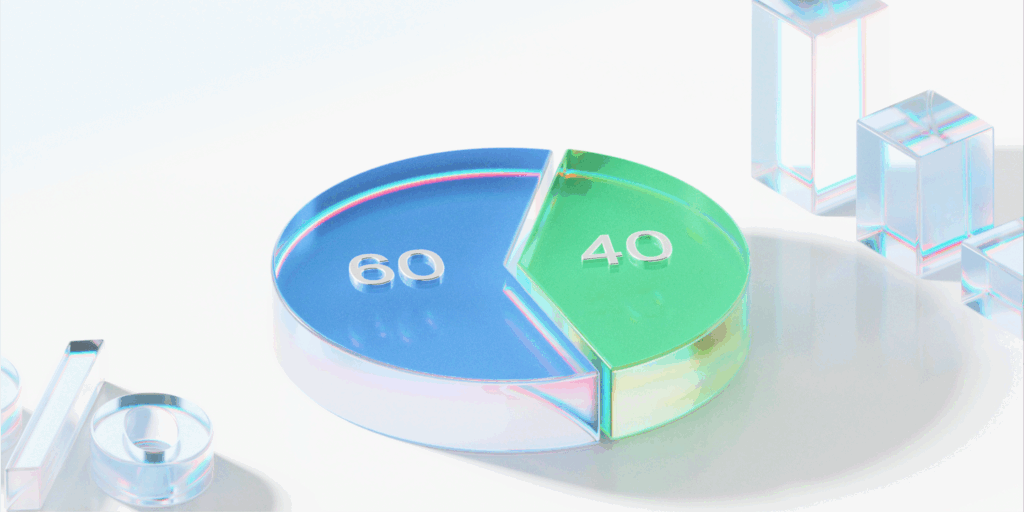

What is a 60/40 portfolio?

A 60/40 portfolio refers to an investment mix where 60% of the portfolio is allocated to stocks (equities) and 40% to bonds (fixed income). The idea is to balance growth potential with stability. Stocks, known for their higher risk and higher return potential, may drive long-term growth. Bonds, on the other hand, may provide income and act as a buffer against market volatility.

The stock portion typically includes a diversified mix of U.S. large-cap equities, but you may also find international stocks, small-cap, and sector-specific funds in some implementations. The bond portion often consists of investment-grade U.S. government and corporate bonds, but may also include municipal or inflation-protected securities, depending on your tax situation and risk preferences.

How does a 60/40 portfolio work in practice?

If you were to apply this approach, your portfolio might include:

- 60% in a total stock market ETF or mutual fund (e.g., U.S. stocks, international developed markets, emerging markets)

- 40% in bond funds or ETFs (e.g., a mix of government and corporate bonds with varying durations)

You may also choose to rebalance your portfolio periodically, which involves adjusting your allocations back to the 60/40 ratio if market performance causes them to drift over time.

Example:

Let’s say you invest $100,000. In a 60/40 allocation:

- $60,000 goes into a diversified group of stock funds.

- $40,000 goes into bond funds or fixed-income securities.

If stocks have a strong year and grow to 70% of your portfolio, you might decide to rebalance, selling some stocks and buying more bonds to return to the original 60/40 ratio.

Rationale behind the 60/40 split

So why this specific mix?

- Simplicity: You only need to manage two main asset classes, which may make it easy to implement and maintain.

- Diversification: A 60/40 portfolio may offer diversification across asset classes, which might help mitigate risk.

- Risk mitigation: Bonds might act as a counterweight to stock market fluctuations, especially in bear markets.

- Income generation: Fixed-income investments may offer regular interest payments, which might be appealing during market turbulence.

- Historical use: Many institutional investors and pension funds have followed a 60/40 approach because it has traditionally delivered a reasonable risk-adjusted return.

Of course, historical performance doesn’t guarantee future outcomes, and the suitability of any mix may depend on your goals, timeline, and comfort with risk.

Asset types commonly used in a 60/40 portfolio

Your 60/40 allocation can be customized depending on your comfort with different types of securities, your time horizon, and your tax preferences. Here’s a general breakdown:

Equity portion (60%):

- U.S. large-cap stocks (e.g., S&P 500)

- U.S. mid-cap and small-cap stocks

- International developed and emerging market equities

- Exchange-traded funds (ETFs) and mutual funds tracking broad indexes

Bond portion (40%):

You might choose to further diversify within each category, such as mixing long-term and short-term bonds or including both growth and value equities.

If you’re looking to access these asset types, whether it’s U.S. stocks, international equities, or a range of bond funds, Public offers a single platform where you can explore them all. From broad-market ETFs to U.S. Treasuries and corporate bond options, you can build and manage a diversified portfolio in one place, with transparency into the companies and funds you’re investing in.

For decades, the 60/40 strategy was widely viewed as a core framework for moderate investors. According to research from Morningstar, a classic 60/40 portfolio delivered average annual returns of around 8%–9% over the past several decades (especially from the 1980s through the 2010s), depending on market cycles and rebalancing frequency.

But this performance hasn’t always been consistent year to year.

- In 2022, both stocks and bonds posted negative returns—a rare occurrence.

- In 2023 and early 2024, as interest rates began to stabilize, some recovery in balanced portfolios was observed.

While past performance doesn’t predict future results, historical data can offer context for how different allocation strategies have performed under various economic conditions.

Is the 60/40 portfolio still relevant?

The 60/40 portfolio remains a foundational strategy for many investors, but its effectiveness is sometimes questioned, especially in light of changing market conditions. For example, when both stocks and bonds fall at the same time (as in 2022), the diversification benefits are reduced. Some experts argue that the traditional 60/40 mix may not provide enough diversification in today’s environment, where correlations between stocks and bonds can shift.

Recent discussions have focused on the potential benefits of adding alternative assets such as commodities, real estate, or private equity to the mix. These assets can offer additional diversification, but they also come with their own risks and complexities.

If you’re considering trying out a 60/40 approach, there are various tools and platforms that can support you:

Brokerage platforms like Public.com offer access to both stocks and bonds, which can simplify your allocation choices. You can explore low-cost funds and monitor your asset mix in one place.

Potential limitations to consider

No strategy is without trade-offs. The 60/40 portfolio may come with some challenges you’ll want to keep in mind:

- Interest rate sensitivity: When rates rise, bond prices typically fall, which may drag down the 40% portion of the portfolio.

- Equity volatility: The 60% equity allocation can still experience significant swings during bear markets.

- Inflation risk: Both stocks and bonds may underperform when inflation remains high or unpredictable.

Conclusion

The 60/40 portfolio has stood the test of time as a widely referenced asset allocation strategy. Whether you’re just starting your investing journey or revisiting your long-term plan, understanding how this balanced approach works might offer clarity.

You might not need to follow this model strictly, but using it as a foundation may help you think about how to structure your own mix of assets. With today’s digital tools and access to diversified investment products on platforms like Public.com, building a portfolio tailored to your risk preferences and financial timeline is more accessible than ever.

Sign up on Public app today and start building your multi-asset portfolio with the tools, data, and insights you need to make informed investment decisions.