Curious to learn about bond valuation and pricing? Our comprehensive guide introduces you to the basics of bonds, emphasizing the importance of valuation and offering practical steps to price a bond. It provides valuable insights for incorporating bonds into your investment portfolio.

How to Price a Bond: An Introduction to Bond Valuation

Table of Contents

Introduction to Bonds

A bond is a type of investment that represents a loan made by an investor to a borrower, typically a corporation or governmental entity. When you purchase a bond, you essentially lend money to the bond issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are commonly used by companies, municipalities, states, and sovereign governments to finance projects and operations.

As a debt instrument, bonds play a crucial role in the financial world. Unlike issuing stocks, they offer a way for entities to raise funds without diluting ownership. For investors, bonds are a potential way to earn a more predictable income stream, usually through regular interest payments known as coupons. Bonds are often considered lower-risk investments than stocks, making them an attractive option for conservative investors or those seeking to balance their investment portfolios. Please note that while bonds are often considered lower-risk investments than stocks, all investments carry some level of risk. It’s important for investors to carefully assess their individual financial situation and seek professional advice before making investment decisions.

Basics of Bond Valuation

Bond valuation is the process of determining the fair value of a bond. Unlike stocks, whose values are largely based on future expectations of company performance, bond values hinge on factors like interest rates, the bond’s credit rating, and its duration. The bond value is calculated as the sum of the present values of future cash flows, which include periodic coupon payments and the principal amount at maturity, all discounted to their present values using a relevant discount rate.

Valuing a bond is crucial for both issuers and investors. For issuers, it helps set a competitive interest rate that reflects their credit risk. For investors, bond valuation is essential to ensure they are paying a fair purchase value. Overpaying for a bond can lead to a lower yield, while underpaying might suggest a bargain. Understanding a bond’s fair market value also aids investors in assessing their investment performance relative to the market.

Here are some key terms that can help understand bond valuation:

-

Maturity Date The date on which the bond will expire and the principal, or face value, will be paid to the bondholder.

-

Coupon Rate The interest rate that the bond issuer will pay on the face value of the bond to the bondholder, expressed as a percentage.

-

Current Price: The price at which a bond is trading in the market currently, which can differ from its face value.

-

Face Value (Par Value) The amount of money the bondholder will receive when the bond matures. It is also the amount on which the coupon payments are based.

-

Tenure The total time until the bond’s maturity.

-

Yield to Maturity (YTM) The total return anticipated on a bond if it is held until it matures, accounting for its current market price, face value, coupon rate, and time to maturity.

-

Current Yield A calculation that involves dividing the bond’s annual rate of return (coupon payment) by its current price to indicate the income return that an investor can expect to receive.

How to Price a Bond?

Pricing a bond is an essential skill in the financial world, helping investors and financial institutions determine whether a bond is a worthwhile investment. The process involves several key steps:

-

Identifying Key Numbers: The first step in pricing a bond is to identify its face value (or par value), coupon rate, and maturity date.

-

Calculating Expected Cash Flow: This step involves calculating the cash flows that the bond will generate over its lifetime. These cash flows are typically the annual coupon payments. For example, if a bond has a face value of $1,000 and an annual coupon rate of 5%, the annual cash flow would be $50.

-

Discounting the Expected Cash Flow to the Present: The next step is to discount these cash flows to their present value. This is done using a discount rate, which reflects the bond’s risk and the time value of money. The formula used is:

Periodic CashFlow ÷ (1+r)t

Here, ‘r’ is the discount rate, and ‘t’ is the time in years until the cash flow will be received.

-

Valuing Individual Cash Flows and the Final Face Value Payment: Finally, calculate the present value of each of the cash flows and add them up. This includes the present value of the regular coupon payments and the final face value payment at maturity. The sum of these present values gives you the bond’s value.

For example, if a bond has a series of annual $30 cash flows for 30 years, plus a final face value payment of $1,000, you would discount each of these cash flows back to their present value and sum them to find the total current value of the bond.

The bond pricing process is vital for understanding how changes in the market interest rate affect the value of a bond. When interest rates rise, bond prices generally fall, and vice versa. This inverse relationship is crucial for investors to understand, especially if they plan to sell the bond before maturity.

A Practical Example to Illustrate Bond Valuation

To bring the concept of bond valuation to life, let’s consider a practical example. Suppose there is a bond with the following characteristics:

-

Face Value (Par Value): $1,000

-

Annual Coupon Rate: 5%

-

Maturity: 10 years

-

Market Interest Rate (Discount Rate): 6%

In this scenario, the bond pays an annual coupon of 5% of its face value, which amounts to $50 per year ($1,000 x 5%). The bond will continue to pay this amount each year for 10 years, at which point it will repay the $1,000 face value. Our task is to find the present value of these future cash flows, given that the current market interest rate is 6%.

-

Calculating the Annual Cash Flows: The bond will pay $50 every year for 10 years. These are our annual cash flows.

-

Discounting Each Cash Flow: Each of these annual payments of $50 must be discounted to their present value. The formula for discounting is:

Present Value = Cash Flow / (1 + r)t

Here, ‘r’ is the discount rate (6%), and ‘t’ is the number of years until the payment is received. -

Calculating the Present Value of Each Payment:

Year 1 Cash Flow PV: $50 / (1 + 0.06)^1 = $47.17Year 2 Cash Flow PV: $50 / (1 + 0.06)^2 = $44.50

Same as above for Year 3 to Year 9.

Year 10 Cash Flow PV: $50 / (1 + 0.06)^10 = $28.07

-

Calculating the Present Value of the Face Value: The face value of $1,000 paid in 10 years is also discounted back to the present:

$1,000 / (1 + 0.06){10} = $558.39 -

Summing the Present Values: The bond’s price is the sum of the present values of all the cash flows, including the annual coupon payments and the face value payment:

Bond Price = ∑ (Present Values of Cash Flows) + Present Value of Face Value

This would be the sum of the present values of each of the $50 payments plus the present value of the $1,000 face value.

In this example, the bond’s price would be the total of all these present values, which is $926.39. This calculated price helps investors decide whether the bond is a good investment compared to the current market rate. If the calculated value is lower than the bond’s current market price, the bond may be overvalued in the market. Conversely, if it’s higher, the bond could be undervalued.

Main Characteristics of Bond Pricing

Several characteristics inherently affect a bond’s price, and it’s essential to recognize how these factors interplay in the market.

-

Coupon Rate: The coupon rate of a bond directly impacts its price. A higher coupon rate typically means the bond will pay higher interest, making it more attractive to investors. As a result, bonds with higher coupon rates generally influence higher prices in the market.

-

Principal/Par Value: The par value of a bond is the amount that will be repaid to the investor at maturity. Higher par values can lead to higher-priced bonds since they represent a larger repayment at maturity. In the case of zero-coupon bonds, which pay no coupons, the interest is earned through the bond being sold at a discount to its par value, resulting in the principal at maturity.

-

Yield to Maturity: The yield to maturity (YTM) is a critical determinant of a bond’s price. It represents the total return expected on a bond if it is held until maturity. A bond selling at a premium (price above par value) usually has a YTM lower than the coupon rate. Conversely, if the market interest rate (yield) is higher than the coupon rate, the bond will likely be priced lower as it offers lower returns compared to the prevailing market rates.

-

Periods to Maturity: The number of periods to maturity, which could be annual, semi-annual, or quarterly, impacts bond pricing. Generally speaking, the longer the time to maturity, the higher the risk as there is more time for potential changes in interest rates and the issuer’s creditworthiness. This can lead to a lower price due to the increased risk.

-

Time Value of Money: The concept of time value of money is foundational in bond pricing. It shows that future cash flows are discounted back to their present value using the YTM. This calculation takes into account the fact that money available in the present is worth more than the same amount in the future due to its earning potential.

-

Other Influencing Factors: Beyond these empirical characteristics, other factors can also impact bond pricing, particularly in secondary markets. These include the creditworthiness of the issuing firm, the liquidity of the bond trade, and time to the next payment. Bonds with higher credit ratings are deemed relatively safer and thus can influence higher prices. Bonds that are more liquid (easily tradable) are generally more valuable. The time to the next coupon payment can also have an impact on a bond’s price, with prices often rising as the payment date approaches.

Bond Investment Simplified with Public

In this article, we’ve delved into bond valuation and pricing, emphasizing key elements like coupon rates and yield to maturity. Understanding these factors, along with market dynamics, is essential for informed investment decisions.

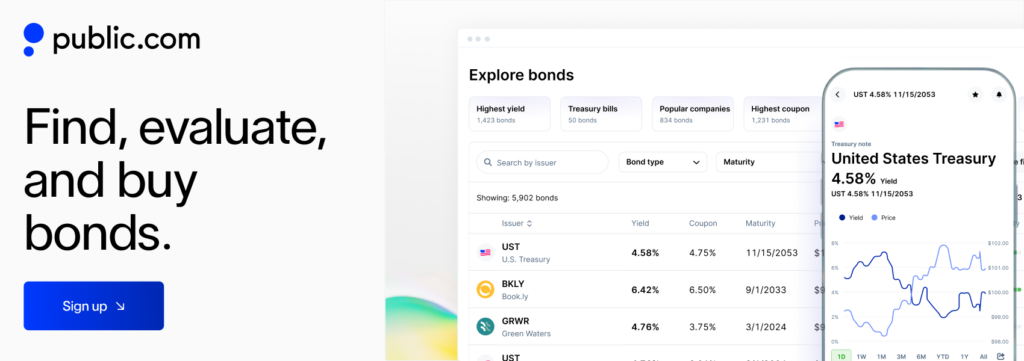

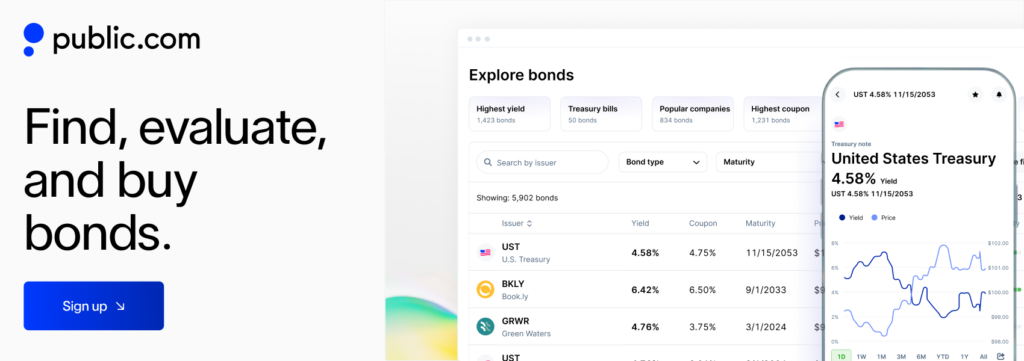

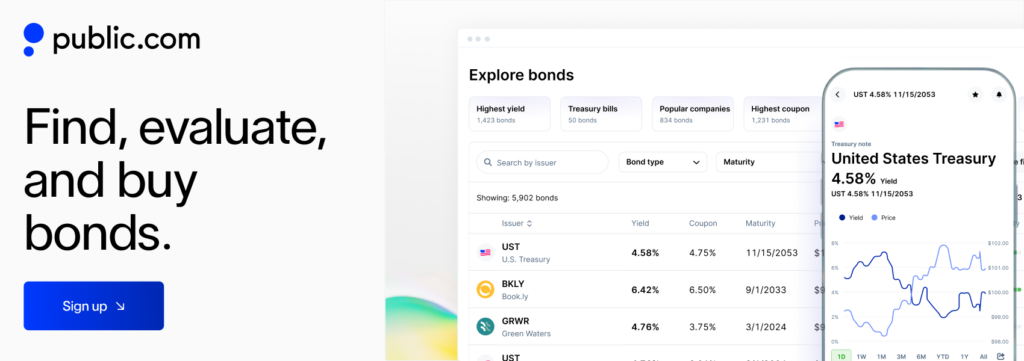

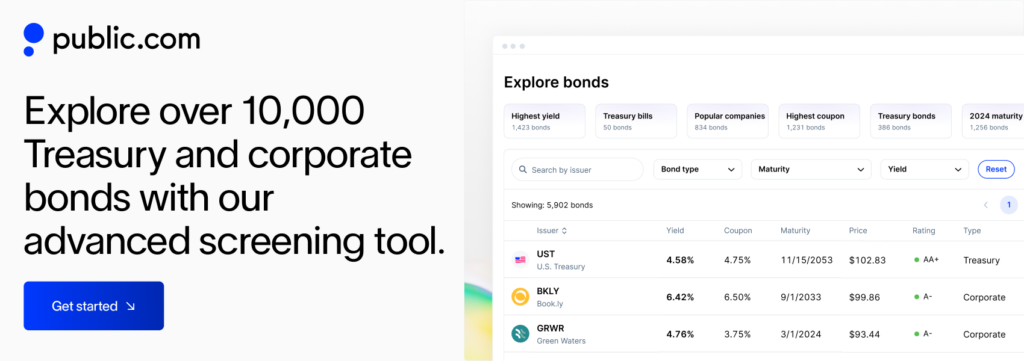

Public.com now offers a bonds screener where you can explore 10,000+ US Treasury, Corporate and Municipal bonds and filter them based on yield, maturity, rating and other criteria.

Whether you’re a seasoned investor or just starting out, our platform provides a wealth of information and tools for a more tailored and strategic approach to bond investing. Try it out today!

FAQs

What is the formula for pricing a bond?

The bond valuation formula can be represented as: Bond Price = C* ((1-(1+r)^-n)/r )) + F/(1+r)^n; where,

F = Face / Par value of bond,

r = Yield to maturity (YTM) and.

n = No. of periods till maturity

C= Periodic coupon payments

ELI5 bond yields for beginners

A bond yield is like getting a reward for lending your money. Put simply, a bond yield is the return on the capital invested by an investor. Bond yields and Bond price share an inverse relationship- they usually move in opposite directions.

How Does Bond Maturity Impact its Pricing?

Bond maturity directly affects its pricing. Longer maturities usually mean higher yields due to increased risk, while shorter maturities often yield less, being less sensitive to interest rate changes.

What Role Does a Bond's Coupon Rate Play in its Pricing?

A higher coupon rate typically indicates a more valuable bond, leading to a higher selling price in the market, as it offers more interest income to the bondholder. Conversely, a bond with a lower coupon rate usually sells at a lower price due to its lower interest payouts.