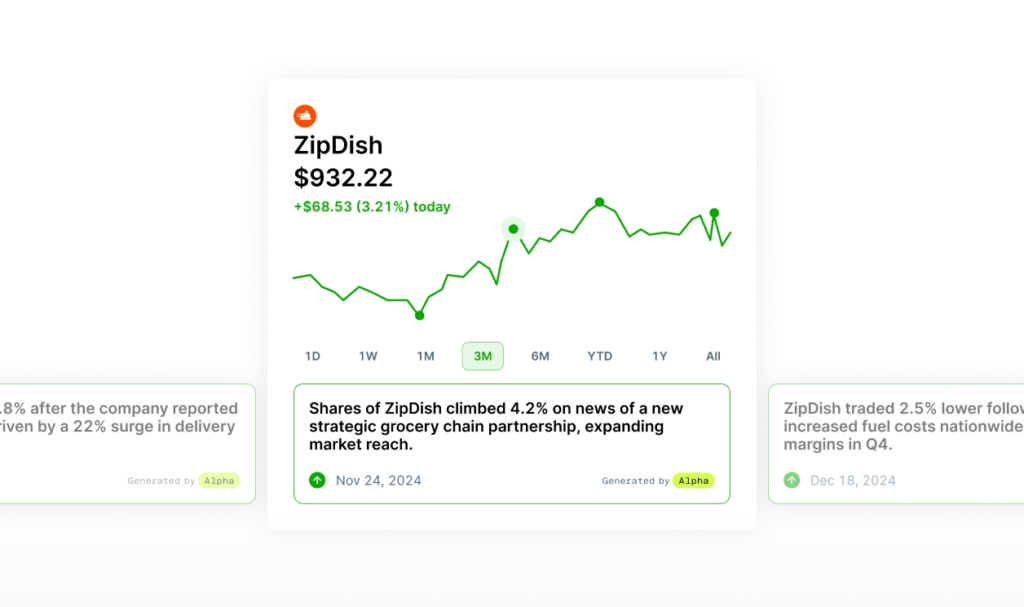

Make AI-powered

investment decisions

AI is more than a feature on Public—it's woven throughout your entire experience. Access real-time alerts and investing insights you can actually use.

-

Learn exactly why a stock is trading up or down.

-

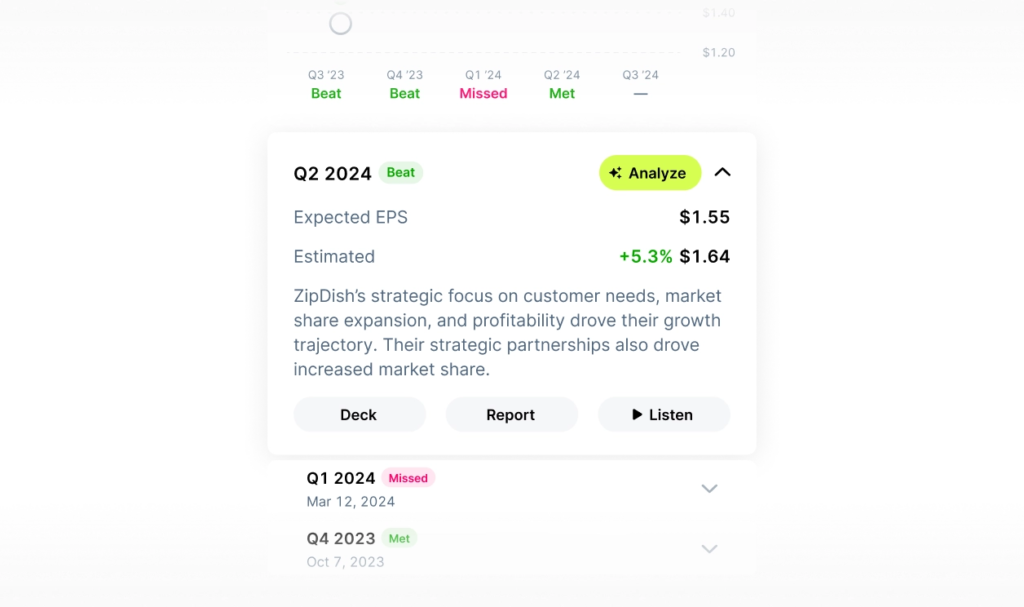

Get an AI-generated recap of any earnings call.

-

Ask any question about any stock you care about.