Your guide to Fed Week

Fed Week is here, and if you're like most investors, you want to understand the impact of rate changes (or lack thereof) on your portfolio. At Public, we closely monitor the economic calendar and track pivotal reports—employment, inflation, and, of course, interest rate decisions—to help you stay informed about what could move the market.

Fed Week: July 2024

Each Fed Week, we bring you insider takes, rapid reactions, and context for your portfolio.

How do Fed decisions impact the markets?

When the Fed changes the interest rate, it impacts both the economy and the stock markets because borrowing becomes either more expensive or less expensive for individuals and businesses. Watch as Public contributor Austin Hankwitz breaks it down in less than 3 minutes.

Fixed income and the Fed

FOMC decisions have a clear impact on the fixed-income markets.

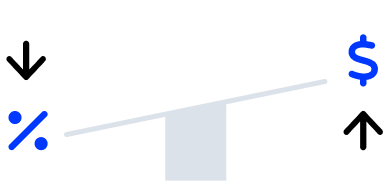

If the Fed cut rates…

Bond prices will rise and yields will fall. Investors may opt to lock in higher yields by buying bonds before an anticipated rate cut.

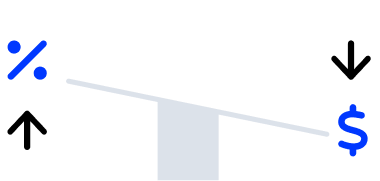

If the Fed raises rates…

Bond prices will fall and yields will rise. Investors may choose to wait until rates increase before purchasing bonds.

Will the Fed cut rates?

It’s impossible to predict the Fed's decisions with certainty. However, according to the CME Watch Tool, there is a 95% chance that rates will remain unchanged (as of 12 PM ET on 7/9/2024). Experts often rely on past statements from Jerome Powell to form their projections. Here are a few of their opinions:

Keep in mind the cuts will be soft due to the strong economy, so changes will most likely be slow to materialize. Once they are in full motion, I expect the yield curve to normalize, and bonds to become less attractive because of the opportunity cost of other investments. Typically, the areas within technology, real-estate, and utilities show consistent benefits in value.

Business with Brian

Business with Brian Given the recent inflation data, we may be entering a new normal rate level for the foreseeable future. Remember, the companies you purchased when the market was going up are the same companies today. Earnings are still beating expectations. Those who have the ability to separate their emotions and stick to their original decisions will win in the end.

Cori Arnold

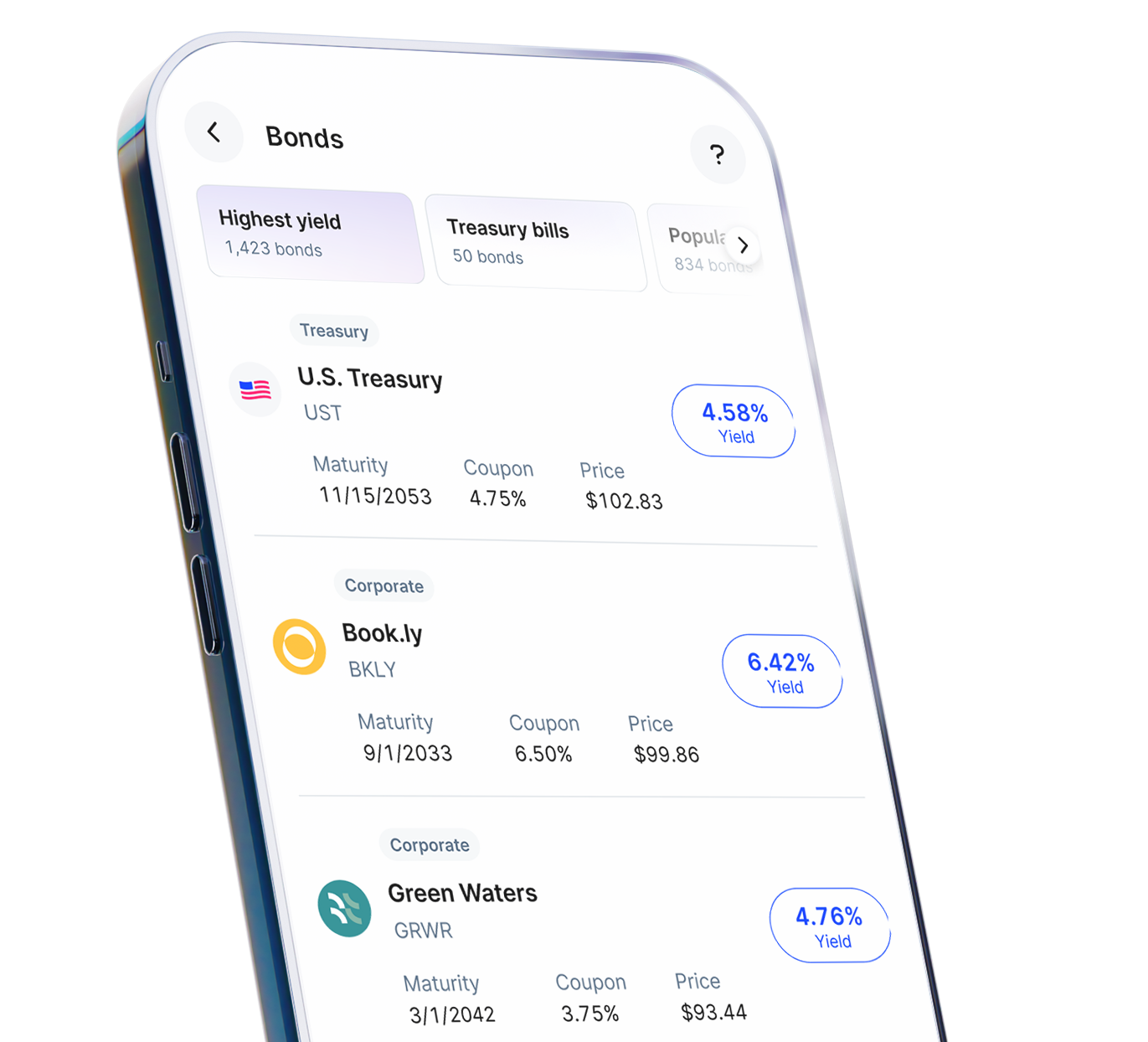

Cori ArnoldWant to stay ahead of potential interest rate cuts?

There are thousands of corporate and Treasury bonds available to purchase on Public, with over 2,000 bonds yielding 6% or more. It may be a good time to invest in bonds if you believe that the Fed will cut rates in the near future.

Explore bonds on Public