Bonds resource center

Bond overview

Evaluating bonds

Bond strategies

Bond overview

Bonds are loans that governments, municipalities, or companies are contractually obligated to repay at a specific date. Bonds may generate income and contribute to a balanced risk-return portfolio.

Types of bonds

- U.S. Treasuries

Issued by the U.S. Government and considered lower risk with lower yields. State tax-exempt. - Corporate bonds

Issued by corporations to fund operations, expansion, or debt refinancing. - Municipal bonds

Issued by local or state governments to fund public projects. May offer federal and state tax benefits.

Other types of bonds include Treasury Inflation-Protected Securities(TIPS); agency securities, such as those issued by Freddie Mac or Fannie Mae; international or emerging market bonds; green bonds, which fund environmentally-friendly projects; and asset-backed bonds, secured by pools of assets like mortgages, credit card debt, or car loans.

Benefits of investing in bonds

- Steady income streams: Bonds often pay interest at regular intervals via coupon payments.

- Diversification: Combining bonds with equities may reduce portfolio risk.

- Capital preservation: If held to maturity with no defaults, you receive the full principal plus the interest payments.

- Risk management: Fixed income may carry lower risk than equities due to less sensitivity to macroeconomic factors and seniority relative to equity holders.

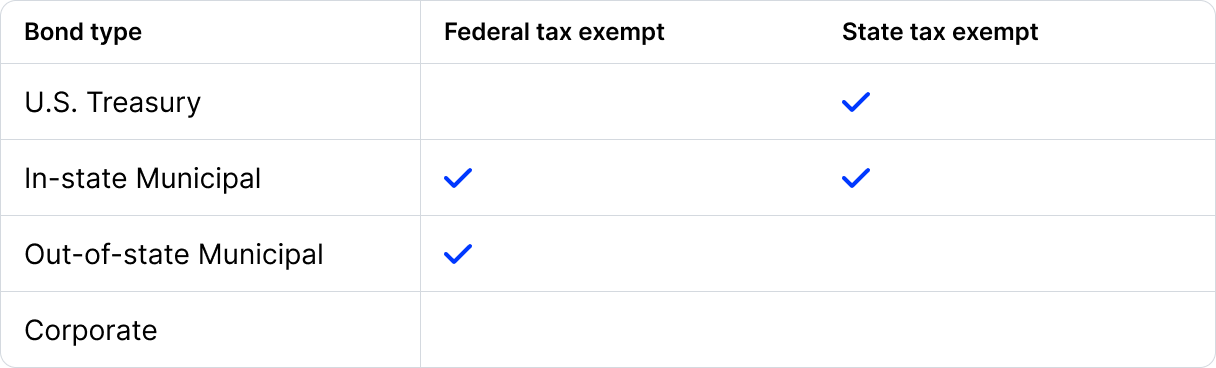

- Tax benefits: Treasury and municipal bonds may be tax exempt on the federal, state, or local level.

Tax implications

Bonds are taxed based on the income investors receive from their investment as well as any gains if the bond is sold at a profit. Different types of bonds have different tax treatments:

Risks of investing in bonds

- Interest rate risk: When market interest rates rise, the prices of existing bonds tend to fall. New bonds are issued with higher yields, making older, lower-yielding bonds less attractive.

- Inflation risk: If the rate of inflation outpaces the fixed income from a bond, this may reduce the real return on investment.

- Credit risk: There is a risk that an issuer may not be able to make interest payments or repay principal.

- Liquidity risk: The bond market is not as active as the stock market; there is less trading volume and fewer liquidity providers. A less liquid market may make it more difficult to sell bonds quickly or at a favorable price. There is currently only one counterparty for fractional bond transactions.