Bonds resource center

Bond overview

Evaluating bonds

Bond strategies

Evaluating bonds

Evaluating bonds relies on individual investment goals and risk tolerance. Key factors for many investors include bond price, interest, and credit rating.

Key terms

- Coupon is the annual interest rate paid by the bond and does not change after the bond is issued.

- Yield measures the annual return from holding the bond at its current price.

- Face value(Par value) is the amount of money the bondholder will receive when the bond matures.

- Price reflects the bond's current value in the secondary market, influenced by demand, time to maturity, credit quality, and macroeconomic factors.

- Callable bonds give issuers the option to redeem them before its maturity.

Interest payment example

- Bond price$1,000

- Coupon6.00%

- Semi-annual interest paymentsThis does not change if the bond price moves up or down$30 twice a year

If the bond’s price fluctuates, the yield will change as it’s tied to the market value. The coupon rate will not change, as it’s tied to the face value.

Let’s say in the example above, the bond price moves to $960, you will still receive $30 semiannual interest payments, but the yield will rise to 6.25%(60/960 = 6.25%).

Let’s say in the example above, the bond price moves to $960, you will still receive $30 semiannual interest payments, but the yield will rise to 6.25%(60/960 = 6.25%).

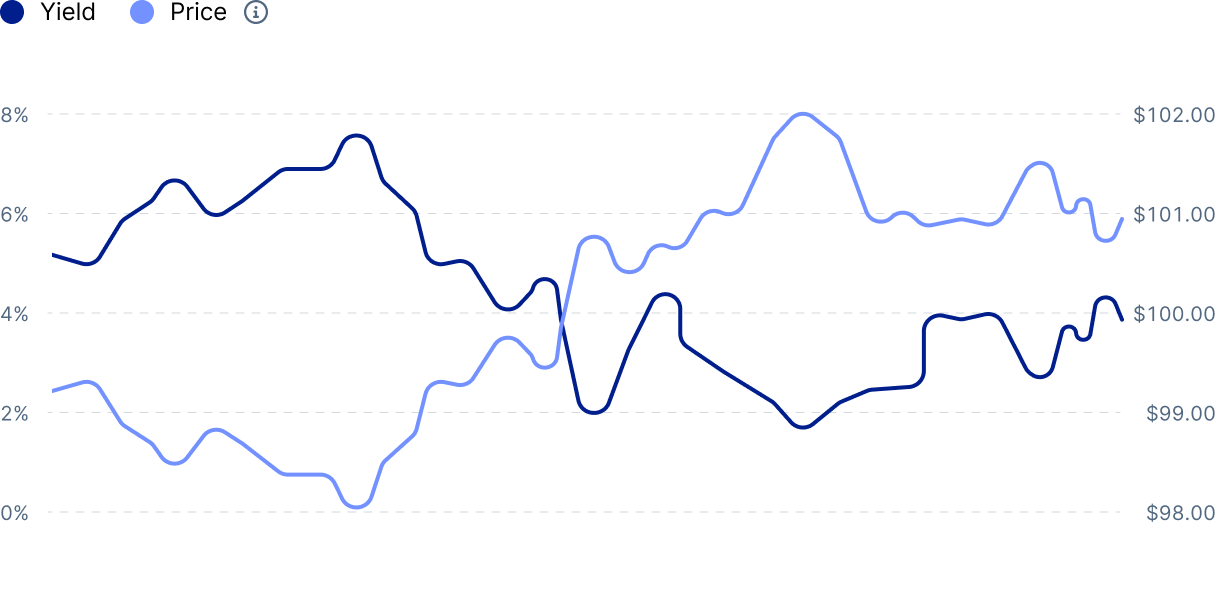

Price vs. Yield

Bond prices and yields are inversely related. As bond prices rise, yields fall, and vice versa. Both price and yield over time are shown on each bond’s asset page.

Bid-ask spread

You will see two numbers on each bond – the bid and the ask, similar to stocks and other assets. Here’s what you need to know:

- Bid is the price a buyer is willing to pay for the bond.

- Ask is the price a seller would accept.

- Bid-ask spread is the difference between the two numbers. A smaller spread suggests higher liquidity. Corporate bonds generally have a wider spread than Treasury.

- Price of a bond is often the mid-point between the bid-ask. There are other methods for calculating prices for bonds that may not have an active market.

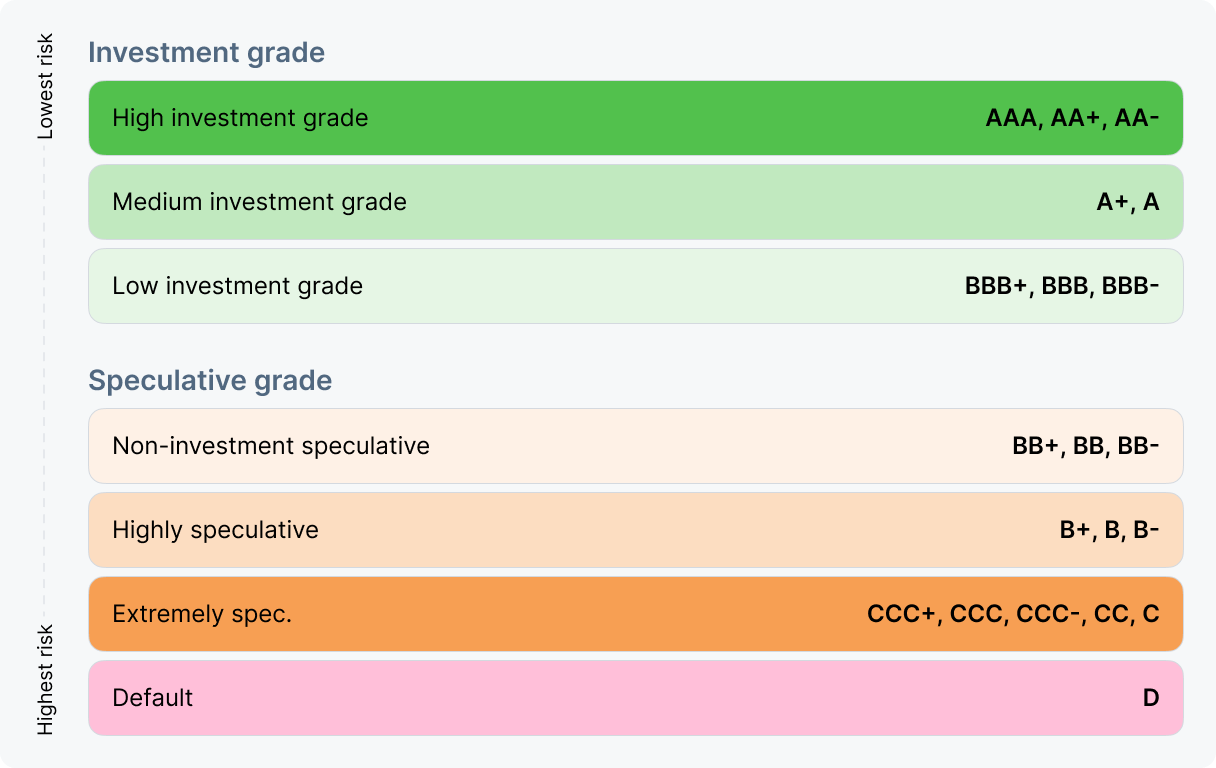

Bond rating

Bond ratings are used to categorize the creditworthiness of a bond to understand and compare risk.

Public uses the S&P rating, which ranges from AAA(highest rated) to D (highly speculative).

Public uses the S&P rating, which ranges from AAA(highest rated) to D (highly speculative).

- Investment grade: Rated BBB- or higher. May offer lower yields but have lower risk of default.

- Speculative “junk” grade: Rated BB+ or lower. May offer higher yields, but with higher risk of default.

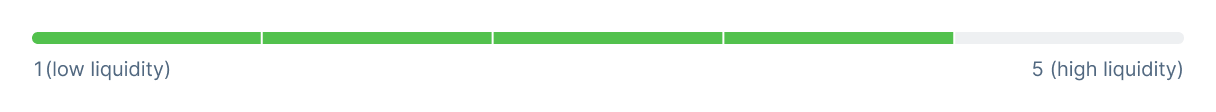

Bond liquidity

Bonds receive a liquidity score ranging from 1(low) to 5(high). A score of 5 suggests a very active market, while 1 indicates limited market activity. Bonds with scores of 1-3 are considered illiquid, potentially lacking an active market and carrying additional risks.

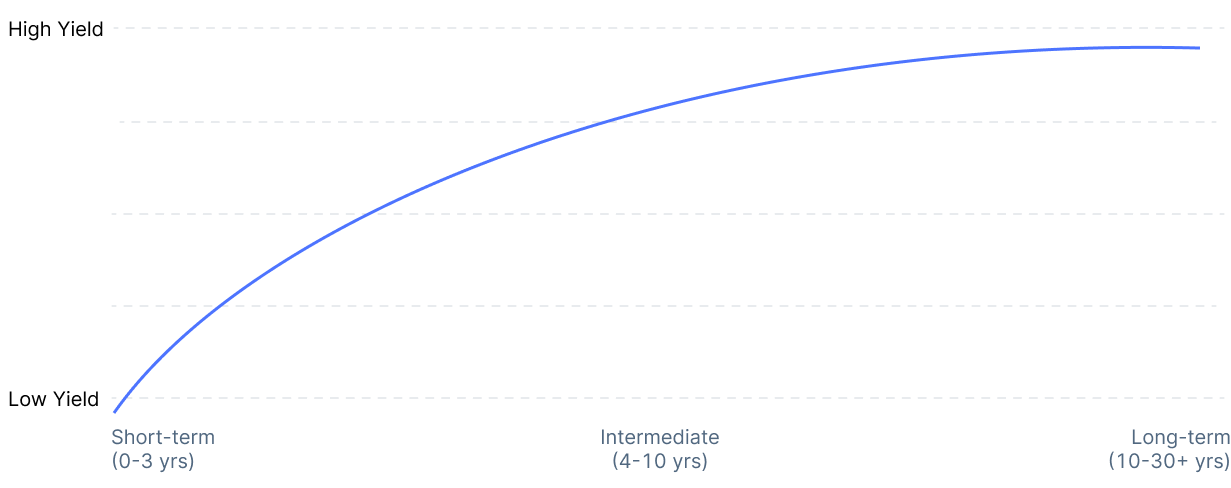

Bond maturity

Bond maturity indicates the duration of coupon payments. At maturity, the principal is repaid, concluding the bond.

In general, shorter term bonds(0-3 yrs) offer lower yields but quicker principal repayment and increased flexibility. Longer-term bonds(10-30+ yrs) often yield more but are more sensitive to rate changes.

Bonds can be sold before maturity if there’s sufficient liquidity. Selling may result in foregoing interest payments, with potential profit from price increase or loss if sold below the purchase price.

In general, shorter term bonds(0-3 yrs) offer lower yields but quicker principal repayment and increased flexibility. Longer-term bonds(10-30+ yrs) often yield more but are more sensitive to rate changes.

Bonds can be sold before maturity if there’s sufficient liquidity. Selling may result in foregoing interest payments, with potential profit from price increase or loss if sold below the purchase price.

Callable vs non-callable bonds

Callable bonds give issuers the option to redeem them before its maturity, often done when interest rates decline. This benefits issuers, allowing them to re-borrow at more favorable rates. Investors in callable bonds receive a more attractive interest rate compared to non-callable ones.

When called, the issuer pays a pre-set call price and accrued interest. For example, a bond with a call price of 102 would give an investor $1,020 for every $1,000 invested. The issuer will then stop making interest payments.

Most municipal bonds are callable, while corporate bonds may be callable or non-callable. Treasury bonds are always non-callable.

When called, the issuer pays a pre-set call price and accrued interest. For example, a bond with a call price of 102 would give an investor $1,020 for every $1,000 invested. The issuer will then stop making interest payments.

Most municipal bonds are callable, while corporate bonds may be callable or non-callable. Treasury bonds are always non-callable.