Buy bonds for any dollar amount. Exclusively on Public.

Bonds typically have high minimum purchase prices, up to $50,000. Only Public lets you corporate and Treasury bonds for as little as $100 and in any increment.

Thousands of

unique bonds.

More ways to invest.

Bonds typically have high minimum purchase prices, up to $50,000. Only Public lets you corporate and Treasury bonds for as little as $100 and in any increment.

Our sophisticated screener lets you narrow down 40,000+ bonds to match your investment goals with the right yield, risk level, time horizon, and more.

We've built Alpha, our proprietary layer of artificial intelligence, right into the bond-screening experience. Go ahead: Ask any question about any bond.

It's never been easier to evaluate corporate bonds with a live snapshot of any company's financials, including debt-to-equity ratio and balance sheet data.

Companies issue corporate bonds to raise capital for various purposes, such as funding expansion, investing in new projects, or refinancing debt. Unlike selling company shares, issuing bonds allows them to secure funds without diluting ownership or ceding control. Bondholders receive periodic interest payments and the promise of repayment at maturity. Corporate bonds also offer tax advantages for companies compared to other forms of financing. Investors, in turn, seek to receive a steady income stream and a relatively secure investment, as bonds are backed by the company’s assets and repayment promise.

Companies issue new corporate bonds as needed to raise capital for specific projects, debt refinancing, or other financial requirements. It can range from several times a year to less often, depending on the company’s financial strategies and market conditions. Factors such as interest rates, economic conditions, and the company’s financial health influence when and how often they issue bonds.

When you buy a corporate bond, you’re lending money to the company and become a creditor. In return, you receive regular interest payments and the promise of repayment at maturity, making it a relatively low-risk investment, though all investments involve risk. On the other hand, buying company stock means you own a portion of the company, which comes with the potential for capital gains but also greater risk as stock prices can fluctuate significantly. Investors turn to corporate bonds when seeking out predictable income, and stocks for ownership and potential for higher returns, which comes with greater volatility.

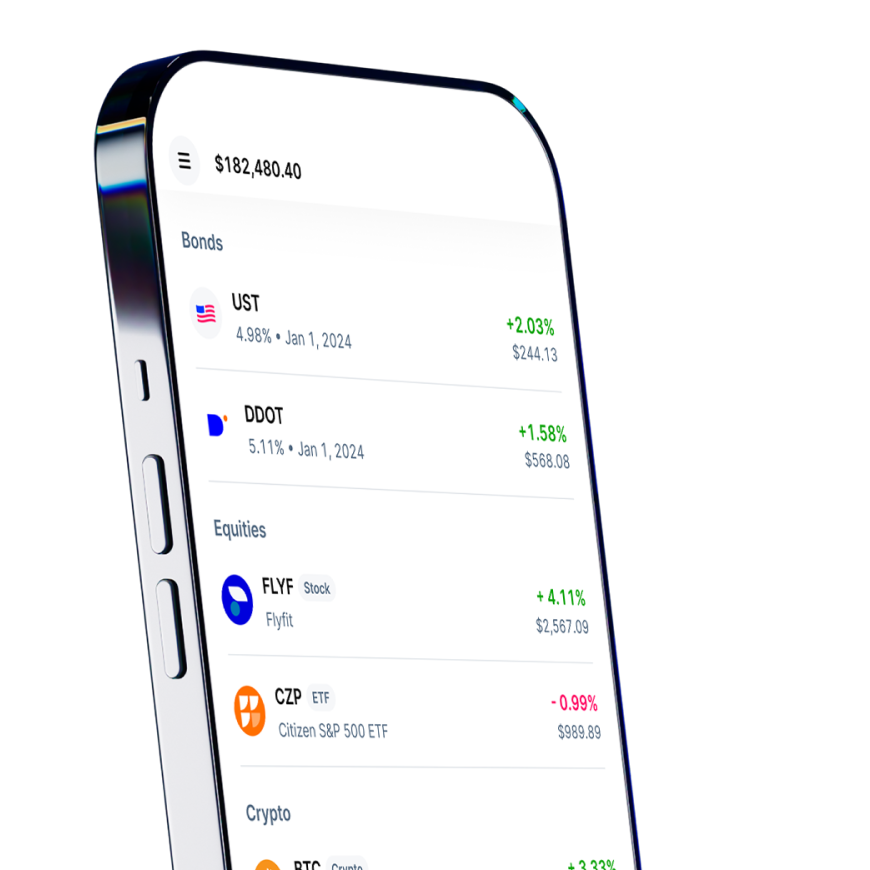

Investors use bonds in their portfolio strategies for diversification, income, and risk management. Bonds provide a stable source of income through periodic interest payments. They can also act as a counterbalance to the volatility of stocks, enhancing portfolio stability. Diversifying with bonds can reduce overall risk as they often move differently than stocks in response to economic conditions. Additionally, bonds are crucial for preserving capital and meeting financial goals, making them a valuable component of a well-rounded investment portfolio. Retail investors use bonds as a way to balance the potential for higher returns from stocks while maintaining a safety net of steady income and reduced risk.

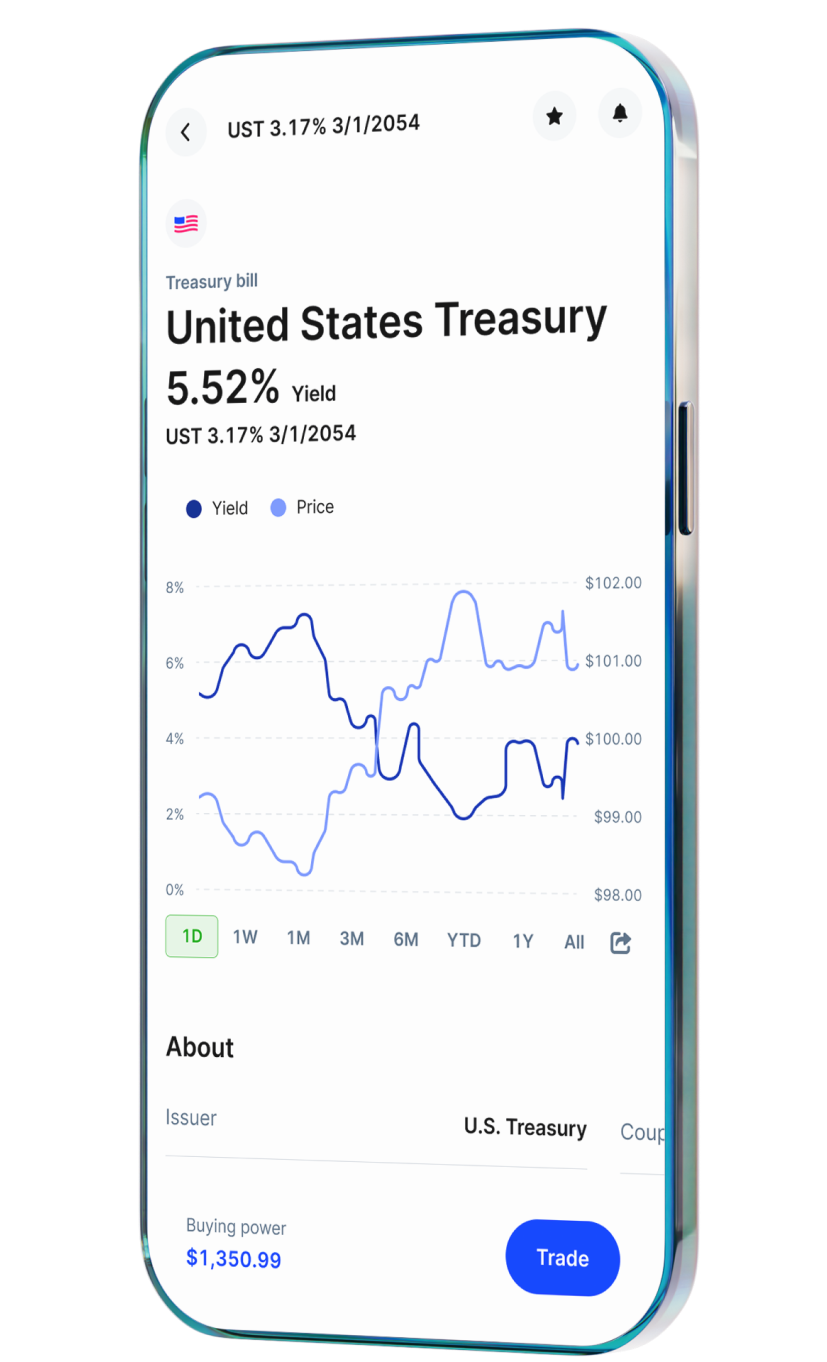

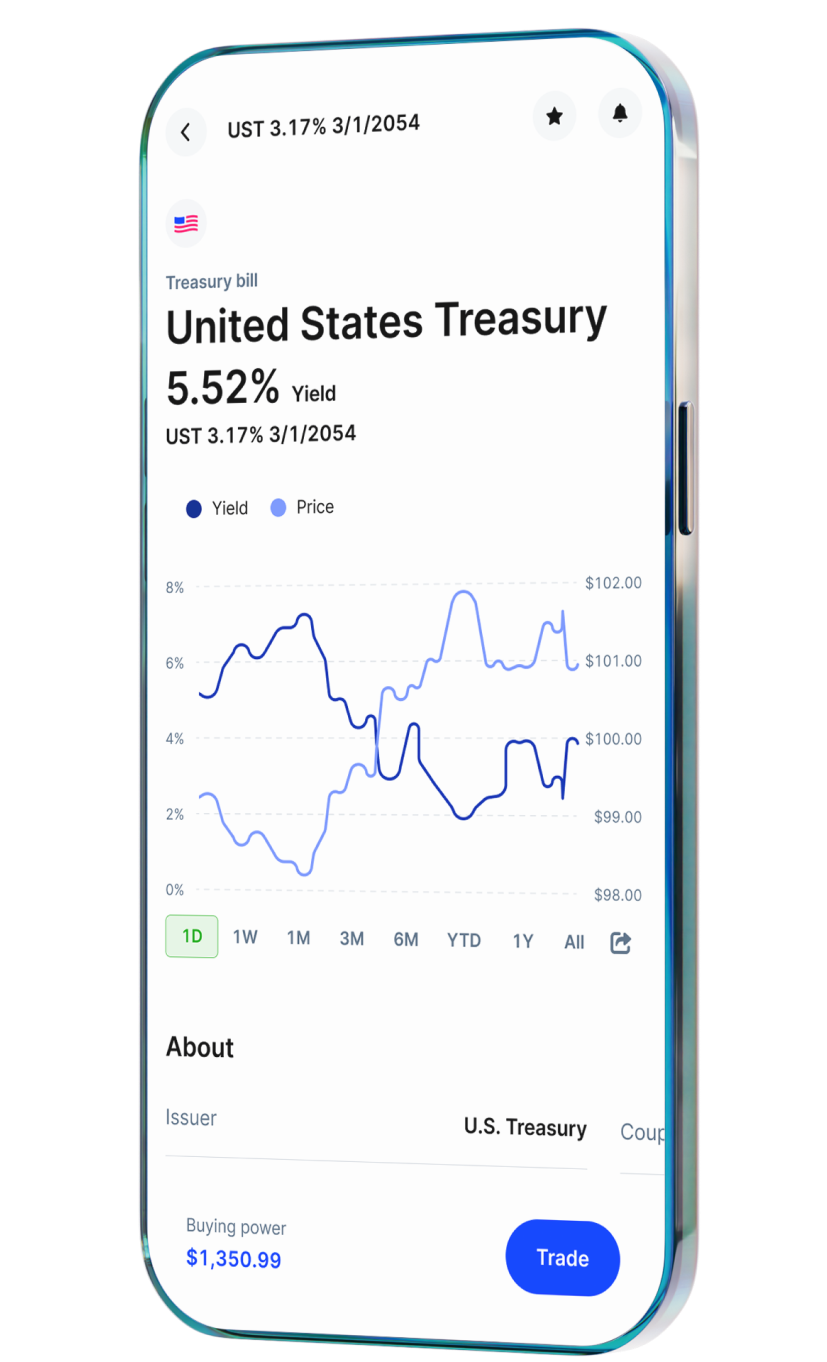

Bond prices and bond yields have an inverse relationship. When bond prices rise, bond yields fall, and vice versa. This inverse relationship is due to the fixed-interest payments bonds provide. If you buy a bond with a fixed coupon rate, and market interest rates drop, your bond becomes more attractive to investors, causing its price to rise. On the other hand, if market rates rise, your fixed-rate bond’s interest payments become less competitive, resulting in a lower price. This dynamic is crucial for investors, as it impacts the value of their bond holdings and the attractiveness of new bond purchases in changing interest rate environments.

The yield curve is a graphical representation of interest rates for bonds with different maturities. It typically slopes upward, with short-term rates lower than long-term rates. The shape of the yield curve conveys vital information about the bond market and the economy. A normal yield curve, with the long end showing higher yields, suggests a healthy economy. An inverted curve, with short-term rates higher than long-term rates, can indicate economic uncertainty or potential recession. A flat curve may signal an economic transition.

Bond ratings are assessments of a bond’s creditworthiness and risk issued by rating agencies like Moody’s and S&P, and they can help investors gauge the safety and reliability of a bond investment. Ratings range from high (e.g., AAA) for the lowest risk to lower ratings (e.g., BB or below) indicating higher risk. Investors use these ratings to make informed decisions, balancing risk and return. Lower-rated bonds offer higher potential returns but come with increased risk, including the possibility of default. Bond ratings provide a valuable reference point for investors to align their risk tolerance and investment goals with the appropriate bonds in their portfolios.

Fixed-rate bonds offer a set interest rate throughout the bond’s term, providing predictability but potentially lower returns if market rates rise. In contrast, variable-rate bonds have interest rates that adjust periodically. This adjustment makes them more responsive to changing market rates, offering the potential for higher returns if rates increase. Investors choosing between them should consider their risk tolerance and the prevailing interest rate environment, as fixed-rate bonds provide stability, while variable-rate bonds offer flexibility and the chance for greater income in rising-rate environments.

The key difference between Treasury bonds and Treasury bills is their maturity. Treasury bonds have longer maturities, typically ranging from 10 to 30 years, making them ideal for long-term investors seeking a steady income stream and a safe haven for capital. In contrast, Treasury bills, often referred to as T-bills, have short-term maturities, typically less than one year, making them a preferred choice for investors looking for a secure, short-term parking place for their money. Both are considered extremely low-risk as they are backed by the full faith and credit of U.S. government.

If you sell a bond before its maturity date, you’ll encounter the bond’s market price, which may be higher or lower than its face value. The price fluctuates due to changes in interest rates, credit risk, and market demand. Selling a bond before maturity can result in capital gains if you sell it at a price higher than you paid, or capital losses if you sell it for less. It provides flexibility but also exposes you to potential gains or losses, influenced by the prevailing interest rate environment and the bond’s creditworthiness. Consider these factors when deciding to sell a bond before its maturity.

The tax implications of bond yields vary across different types of bonds:

Understanding these tax implications is essential for making informed investment decisions aligned with your tax situation and financial goals.

Our US-based customer experience team has FINRA-licensed specialists standing by to help.