Options Trading

Trade options.Earn rebates.

*1

No commission fees

No per-contract fees

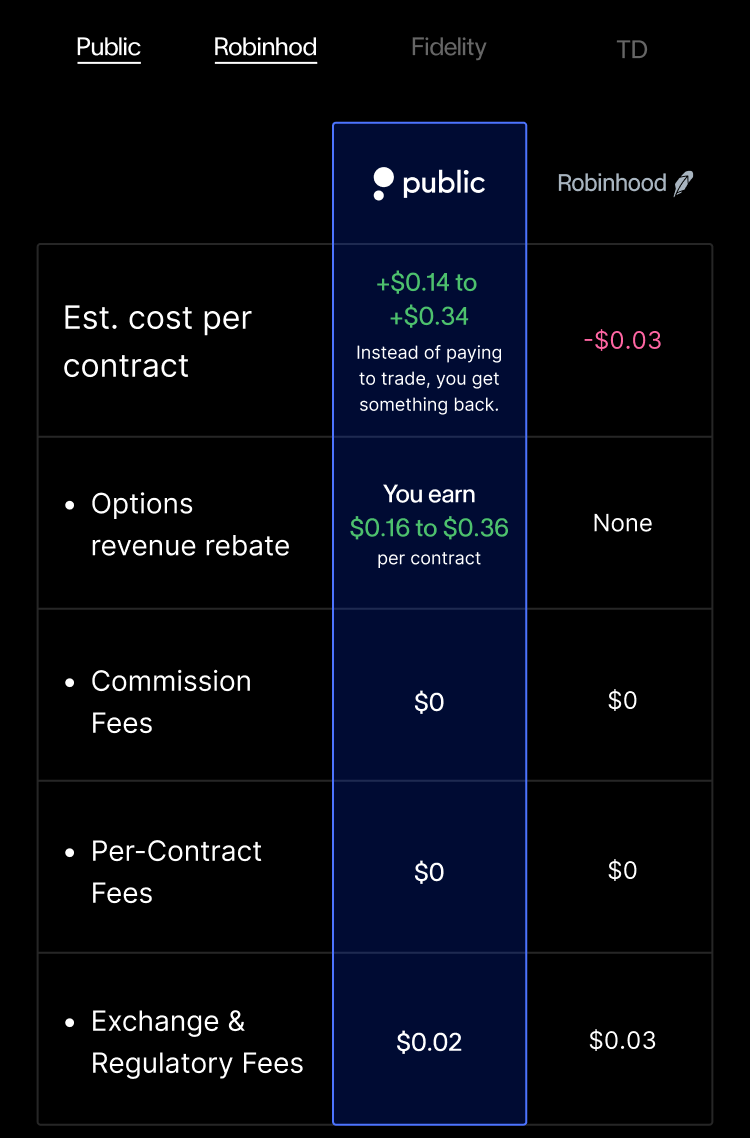

The most cost-effective way to trade options

The cheapest way to trade options

5

We share our options revenue with you on every trade, reducing your trading costs.

+$0.15

Est. cost per contract

-$0.03

-$0.67 to -$0.69

~ -$0.66

Instead of paying to trade, you get something back.

- Options revenue rebate

Earn up to +$0.18

None

None

None

per contract

- Commission Fees

$0

$0

$0

$0

- Contract Fees

$0

$0

$0.65

$0.65

- Exchange & Regulatory Fees

$0.03

$0.03

$0.02 to $0.04

$0.01

Costs accurate as of March 18, 2024. All costs are rounded to the nearest cent. Support for claims, comparisons, statistics, or data will be supplied upon request.

Uncover trading opportunities

Build your options strategies

Stay on top of every trade

Explore the markets with a sophisticated suite of research and technical analysis tools.

Plan single and multi-leg options strategies with our comprehensive strategy builder.

Closely monitor all of your options positions from our intuitive trading experience.

Plan your trades with our strategy builder

3

With our options strategy builder, you can plan your trades based on your outlook on a stock and visualize your potential profit and loss outcomes.

Option Strategies

Fundamentals

Straddles and strangles

Vertical spreads

Calendar spreads

Buy or sell single-leg options strategies.

Buy a call and a put with the same (straddle) or different (strangle) strike prices.

Buy and sell two options of the same type (calls or puts) with different strike prices.

Buy and sell two options of the same type (calls or puts) with the same strike price but different expirations.

*Coming soon

Significantly reduce your transaction costs

5

At Public, we've always worked to get you the best possible price execution. That's why, in an industry first, we’re sharing our options revenue directly with you, the customer. Every time you place an options trade on Public, you can get 50% of our options revenue, minimizing your transaction costs.

¹ Options are risky and aren't suitable for all investors. To learn more, read the Options Disclosure Document.

*Cost comparisons accurate as of December 22, 2023. To qualify for revenue sharing, options trading must be activated by March 31, 2024.

² This feature provides hypothetical profit and loss based on the conditions in the market when you select a contract to be visualized, and does not guarantee future results. No contract has been bought or sold. The P&L charts are for informational purposes only and should not be considered a personalized recommendation or investment advice. Actual profits or losses may differ based on a number of factors not accounted for in these assumptions.

³ This feature provides a visualization of numerous datapoints related to a given options contract. The data is provided on an as-is basis and does not guarantee accuracy. The advanced charts are for informational purposes only and should not be considered a personalized recommendation or investment advice.

⁴ This feature provides lists of options contracts based on quantitative methodological screens. The data is provided on an as-is basis and does not guarantee accuracy. The Options Hub and all screens are for informational purposes only and should not be considered a personalized recommendation or investment advice.

⁵ PFOF rebates are only issued for options trades that are subject to PFOF. Public Investing shares 50% of the estimated order flow revenue as a rebate to help reduce trading costs on options. For more information, see our Fee Schedule and FAQs on PFOF Rebates.

⁶ Please note: Public doesn't charge per-contract fees. However, there are regulatory fees assessed for certain options transactions. See our fee schedule to learn more.Competitor trade cost data as of December 22, 2023 and subject to change. While the information is deemed reliable, Public makes no representations or warranties with respect to the accuracy or completeness of the information provided. All investments involve risk, including the possible loss of principal.Trading options involves significant risk and is not appropriate for all investors. To learn about risks, read the OCC’s Options Disclosure Document. Not included in this comparison are regulatory transaction fees and trading activity fees. These fees are set by our regulators, and are subject to change without notice. Most brokers, including ones in this comparison, pass on these fees to their customers on certain sell orders. For more information, please see Public's Fee Schedule.

⁷ This feature provides educational materials and videos related to options. The data is provided on an as-is basis and does not guarantee accuracy. The resource center is for informational purposes only and should not be considered a personalized recommendation or investment advice.

© Copyright 2024 Public Holdings, Inc. All Rights Reserved.

Market data powered by Xignite.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

Stocks, ETFs, Options, Bonds.

Self-directed brokerage accounts and brokerage services for US-listed, registered securities, options, and Bonds, except for treasury securities offered through Jiko Securities, Inc., are offered to self-directed customers by Open to the Public Investing, Inc. (“Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Public Investing is not registered. Securities products offered by Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Additional information can be found here.

Options.

Certain requirements must be met in order to trade options. Options can be risky and are not suitable for all investors. Options transactions are often complex, and investors can rapidly lose the entire amount of their investment or more in a short period of time. Investors should consider their investment objectives and risks carefully before investing in options. Refer to the Characteristics and Risks of Standardized Options before considering any options transaction. Supporting documentation for any claims, if applicable, will be furnished upon request. Tax considerations with options transactions are unique and investors considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Options Order Flow Rebate.

If you are enrolled in our Options Order Flow Rebate Program, Public Investing will share a percentage of our estimated order flow revenue for each completed options trade as a rebate to help reduce your trading costs. Rebate rates vary monthly from $0.06-$0.18 and depend on your current and prior month’s options trading volume. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation. To learn more, see our Options Rebate Program Terms & Conditions, Options Rebate FAQ, and Fee Schedule.

Bonds.

“Bonds” shall refer to corporate debt securities and U.S. government securities offered on the Public platform through a self-directed brokerage account held at Public Investing and custodied at Apex Clearing. For purposes of this section, Bonds exclude treasury securities held in treasury accounts with Jiko Securities, Inc. as explained under the “ Treasury Accounts” section.

Investments in Bonds are subject to various risks including risks related to interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. The value of Bonds fluctuate and any investments sold prior to maturity may result in gain or loss of principal. In general, when interest rates go up, Bond prices typically drop, and vice versa. Bonds with higher yields or offered by issuers with lower credit ratings generally carry a higher degree of risk. All fixed income securities are subject to price change and availability, and yield is subject to change. Bond ratings, if provided, are third party opinions on the overall bond's credit worthiness at the time the rating is assigned. Ratings are not recommendations to purchase, hold, or sell securities, and they do not address the market value of securities or their suitability for investment purposes.

A Bond Account is a self-directed brokerage account with Public Investing. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The Bond Account’s yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more.

High-Yield Cash Account.

A High-Yield Cash Account is a secondary brokerage account with Public Investing. Funds in your High-Yield Cash Account are automatically deposited into partner banks (“Partner Banks”), where that cash earns interest and is eligible for FDIC insurance. See here for a list of current Partner Banks. Your Annual Percentage Yield is variable and may change at the discretion of the Partner Banks or Public Investing. Apex Clearing and Public Investing receive administrative fees for operating this program, which reduce the amount of interest paid on swept cash. Neither Public Investing nor any of its affiliates is a bank. Learn more.

Cryptocurrency.

Cryptocurrency trading, execution, and custody services are provided by Bakkt Crypto Solutions, LLC (NMLS ID 1828849) (“Bakkt”). Cryptocurrency is highly speculative, involves a high degree of risk, and has the potential for loss of the entire amount of an investment. Cryptocurrencies offered by Bakkt are not securities and are not FDIC insured or protected by SIPC. Your cryptocurrency assets are held in your Bakkt account. Bakkt is a licensed virtual currency business by the New York State Department of Financial Services and a licensed money transmitter, but is not a registered broker-dealer or a FINRA member. Your Bakkt Crypto account is separate from your brokerage account with Public Investing, which holds US-listed stocks and ETFs. Please review the Risk Disclosures before trading.

Treasury Accounts.

Investing services in treasury accounts offering 6 month US Treasury Bills on the Public platform are through Jiko Securities, Inc. (“JSI”), a registered broker-dealer and member of FINRA & SIPC. See JSI’s FINRA BrokerCheck and Form CRS for further information.

JSI uses funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s value at maturity). T-bills are purchased at a discount to the par value and the T-bill’s yield represents the difference in price between the “par value” and the “discount price.” Aggregate funds in your Treasury Account in excess of the T-bill purchases will remain in your Treasury Account as cash. The value of T-bills fluctuate and investors may receive more or less than their original investments if sold prior to maturity. T-bills are subject to price change and availability - yield is subject to change. Past performance is not indicative of future performance. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. Although T-bills are considered safer than many other financial instruments, you could lose all or a part of your investment. See Jiko U.S. Treasuries Risk Disclosures for further details.

Investments in T-bills: Not FDIC Insured; No Bank Guarantee; May Lose Value.

Banking services and bank accounts are offered by Jiko Bank, a division of Mid-Central National Bank.

JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. None of these entities provide legal, tax, or accounting advice. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

Commission-free trading refers to $0 commissions charged on trades of US listed registered securities placed during the US Markets Regular Trading Hours in self-directed brokerage accounts offered by Public Investing. Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Public’s Investing’s Fee Schedule to learn more.

Fractional shares are illiquid outside of Public and not transferable. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see our Fractional Share Disclosure to learn more.

Investment Plans. Investment Plans (“Plans”) shown in our marketplace are for informational purposes only and are meant as helpful starting points as you discover, research and create a Plan that meets your specific investing needs. Plans are self-directed purchases of individually-selected assets, which may include stocks, ETFs and cryptocurrency. Plans are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are created using defined, objective criteria based on generally accepted investment theory; they are not based on your needs or risk profile. You are responsible for establishing and maintaining allocations among assets within your Plan. Plans involve continuous investments, regardless of market conditions. Diversification does not eliminate risk. See our Investment Plans Terms and Conditions and Sponsored Content and Conflicts of Interest Disclosure.

Alpha

Alpha is an experiment brought to you by Public Holdings, Inc. (“Public”). Alpha is an AI research tool powered by GPT-4, a generative large language model. Alpha is experimental technology and may give inaccurate or inappropriate responses. Output from Alpha should not be construed as investment research or recommendations, and should not serve as the basis for any investment decision. All Alpha output is provided “as is.” Public makes no representations or warranties with respect to the accuracy, completeness, quality, timeliness, or any other characteristic of such output. Your use of Alpha output is at your sole risk. Please independently evaluate and verify the accuracy of any such output for your own use case.

Market Data.

Quotes and other market data for Public’s product offerings are obtained from third party sources believed to be reliable, but Public makes no representation or warranty regarding the quality, accuracy, timeliness, and/or completeness of this information. Such information is time sensitive and subject to change based on market conditions and other factors. You assume full responsibility for any trading decisions you make based upon the market data provided, and Public is not liable for any loss caused directly or indirectly by your use of such information. Market data is provided solely for informational and/or educational purposes only. It is not intended as a recommendation and does not represent a solicitation or an offer to buy or sell any particular security.