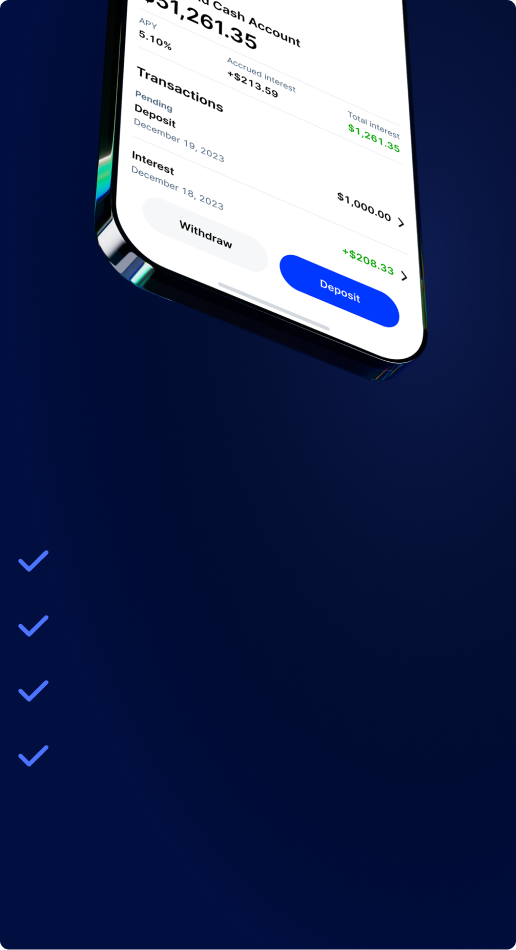

Earn an industry-leading

5.1%

APY*

No subscription required

No account fees

No minimums or maximums

Unlimited withdrawals anytime

* Rate subject to change.

See how a high-yield cash account on Public stacks up:

Rate

Annual Subscription

FDIC Insurance

5.1% APY*

$0

$5M

Robinhood

5.0% APY

$60

$2.25M

Robinhood Gold

M1

5.0% APY

$0

$3.75M

M1 Plus

Betterment

5.0% APY

$0

$2M

Betterment Cash Reserve

SoFi

4.6% APY

$0

$2M

SoFi Plus

Marcus

4.4% APY

$0

$250K

Marcus Online Saving Account

Rates for competitors taken from their websites on June 25, 2024, not incl promo rates.

Compare how much interest a $20,000 balance generates in 12 months

8.8x

more interest than the national savings average

¹ As of Jan 23, 2024 based on data from Bankrate. Rate subject to change.

² APYs as of Jan 25, 2024. This calculation assumes that the balance and rate do not change for 12 months. APY is variable and may change without notice.

Access your cash. Whenever.

Get up to 20x the standard FDIC coverage**

Withdrawing from your high-yield cash account is as easy as making a deposit. There are no fees or limits to how often you can access your cash.

A standard bank offers up to $250,000 of FDIC insurance coverage. We partner with 20 of them so you can get a combined coverage of up to $5M.

Build your multi-asset portfolio

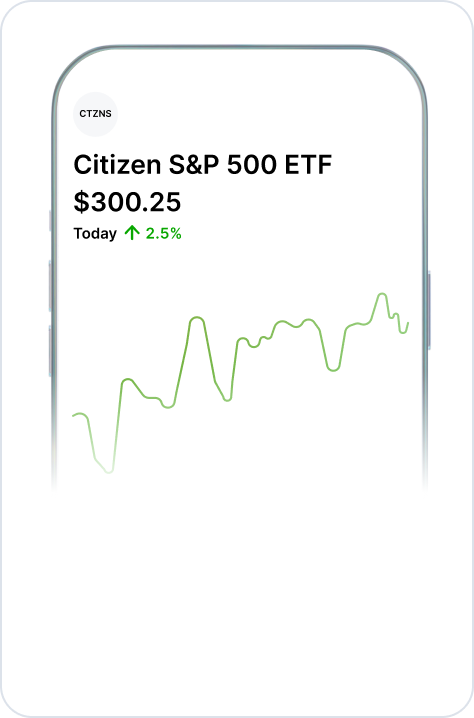

Stocks

ETFs

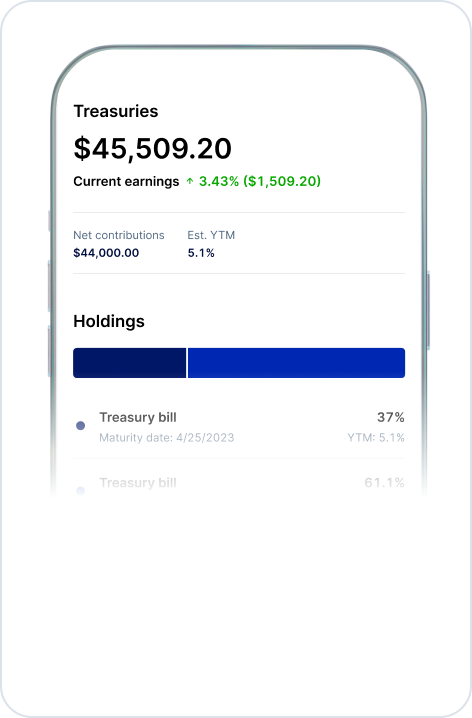

Treasuries

Crypto

Access to over 9,000 equities and get the market insights you need.

Gain exposure to entire sectors and industries with ETFs.

Put your cash to work with government-backed Treasuries.

Buy, hold, and sell a growing collection of 10+ crypto.

What is better than a high-yield savings account?

A High-Yield Cash Account on Public can outpace most high-yield savings accounts with its industry-leading 5.1% APY.* Plus you get 20x the standard FDIC insurance.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.Is it worth putting money into a high-yield savings account?

When you move your money into a High-Yield Cash Account on Public, you can secure an industry-leading 5.1% APY* with no subscription required.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.Do you pay taxes on a high-yield savings account?

The income you generate from a High-Yield Cash Account is taxed at a federal and state level—just like a traditional savings account.

Neither Public Investing nor any of its affiliates is a bank. Learn more.Is there a downside to a high-yield savings account?

Beyond its industry-leading 5.1% APY*, a High-Yield Cash Account on Public also has zero fees and 20x the standard FDIC insurance.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more.How much will $10,000 make in a high-yield savings account?

A high-yield cash account on Public generates an industry-leading 5.1% APY*. With a $10,000 investment, you could earn $522** over 12 months.

*Rate subject to change. Neither Public Investing nor any of its affiliates is a bank. Learn more. **This calculation assumes that balance and rate do not change for 12 months. APY is variable and subject to change.

Financial-grade security

Member of FINRA

All of the interest. None of the fees.

Automatic SIPC insurance

Headquartered in New York

US-based customer support

* As of 1/25/24. Rate variable and subject to change. A High-Yield Cash Account is a brokerage account with Public Investing, member FINRA/SIPC. Funds from this account are automatically deposited into partner banks where they earn interest and are eligible for FDIC insurance. Neither Public Investing nor any of its affiliates is a bank. US members only. Learn more on public.com/hyca.

** Source: FDIC.gov

© Copyright 2023 Public Holdings, Inc. All Rights Reserved.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

Product offerings and availability vary based on jurisdiction.

Stocks and ETFs.

Brokerage services for US-listed, registered securities are offered to self-directed customers by Open to the Public Investing, Inc. (“Open to the Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Additional information can be found here.

Brokerage services for US-listed, registered securities are offered to self-directed customers by Open to the Public Investing, Inc. (“Open to the Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”) and is affiliated with Public Investing UK Limited through common ownership. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Additional information can be found here.

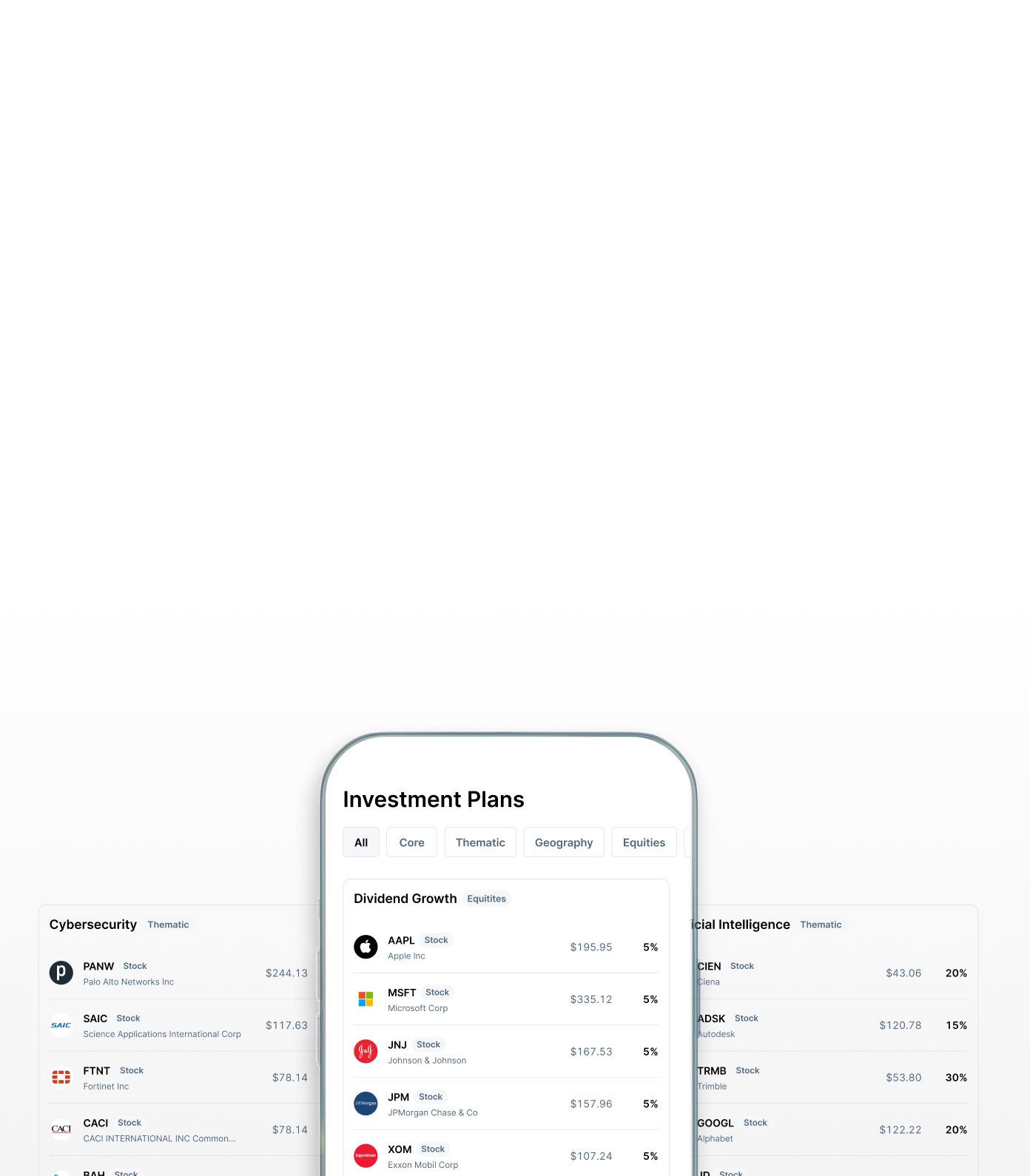

Investment Plans

Plans available to US members only. Diversification does not eliminate risk. Plans shown in our marketplace are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are not based on your needs or risk profile. Plans involve continuous investments, regardless of market conditions. Investment Plans shown in the marketplace are for informational purposes only. Investment Plans are meant to provide a helpful starting point as you discover, research, and create an Investment Plan that meets your specific investing needs. Investment Plans presented in the marketplace are created using defined, objective criteria based on generally accepted investment theory. They are made up of stocks and ETFs only. Refer to the Investment Plan Methodology to learn more. You should do your own research before purchasing a Plan. Plans will not be rebalanced and allocations will not be updated in any way, except for Corporate Actions. Learn more in our Investment Plans Terms and Conditions. You can find more information about any conflicts of interest associated with Sponsored Investment Plans in our Sponsored Content and Conflicts of Interest Disclosure.

Before investing in an ETF, you should read the prospectus, which provides detailed information on the ETF’s investment objective, principal investment strategies, risks, costs, and historical performance (if any), among other things. Prospectuses can be found on the ETF issuer's website. ETFs are bought and sold at market price, which can vary from the Net Asset Value of the fund. Rebalancing and other fund activities may result in tax consequences.

Brokerage services for stocks and ETFs on Public.com are offered by Open to the Public Investing, Inc., a registered broker-dealer and member FINRA & SIPC.

Commission-free trading of stocks refers to $0 commissions for Open to the Public Investing self-directed individual cash brokerage accounts that trade the U.S.-listed, registered securities electronically during the Regular Trading Hours. Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Open to the Public Investing’s Fee Schedule to learn more.

Fractional shares are illiquid outside of Public and not transferable. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see our Fractional Share Disclosure to learn more.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.