Investing for those who take it seriously

Stocks

Bonds

Treasuries

Options

Crypto

ETFs

Direct Indexing

High-Yield Cash Acct

Bond Account

IRAs

3.3% APY1

1% Match3

5.7%2

Transfer your portfolio. Earn a 1% match.3

You can earn a 1% uncapped match when you transfer your portfolio from another brokerage—whether it's a brokerage account, IRA, or 401(k) rollover.

1 Rate as of 03/07/2026. APY is variable and subject to change.

2 Yield represents average annualized rate of return across all bonds, before fees, as of 03/07/2026. Since yield is subject to change daily, yield will be locked in at the time of purchase and may be different from the yield shown

3 See full terms and conditions of Public’s IRA Contribution Match Program.

Generated Assets

Turn any idea into an investable index with AI

With Generated Assets, you can type in any prompt, and our AI will screen thousands of stocks to build a custom index that matches your intent.

This demonstration is for illustrative purposes only, does not reflect actual investment results, and is not an investment recommendation.

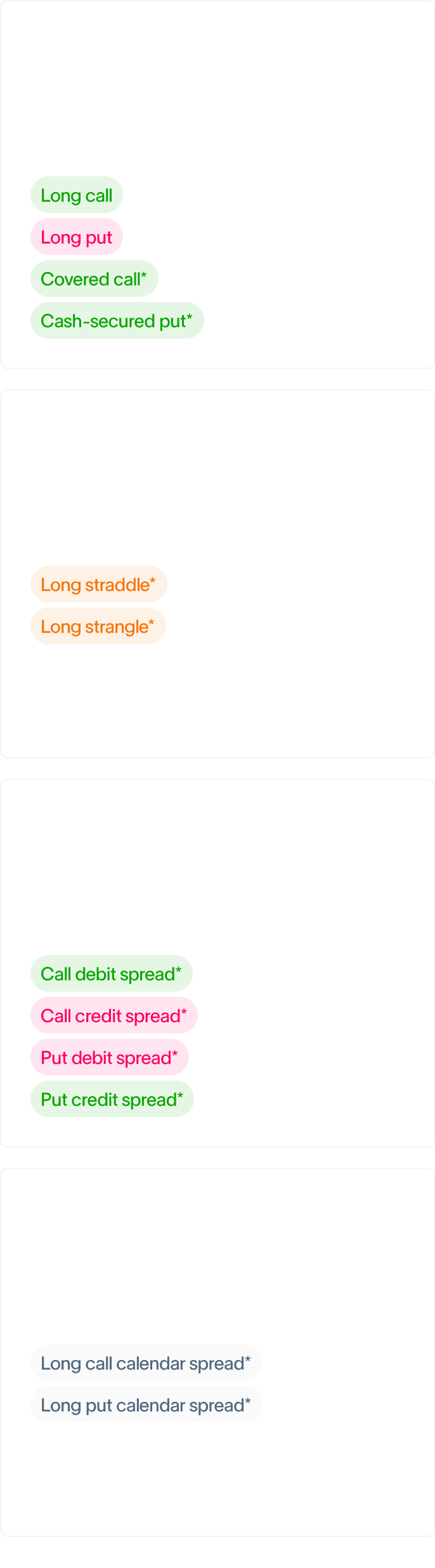

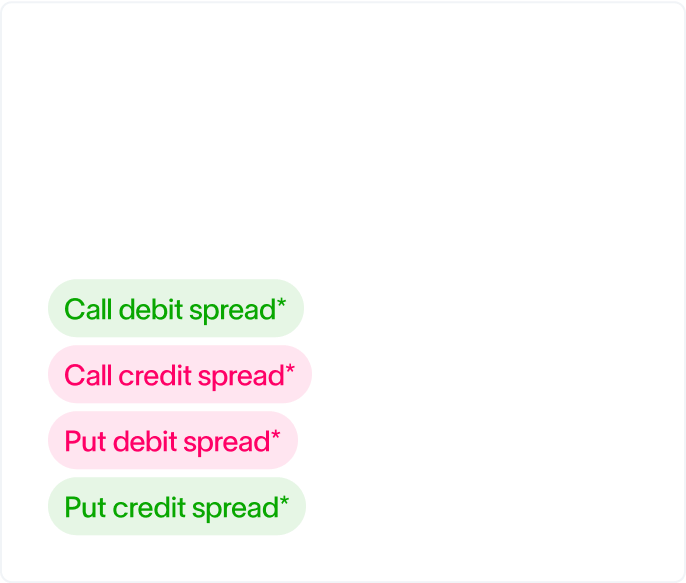

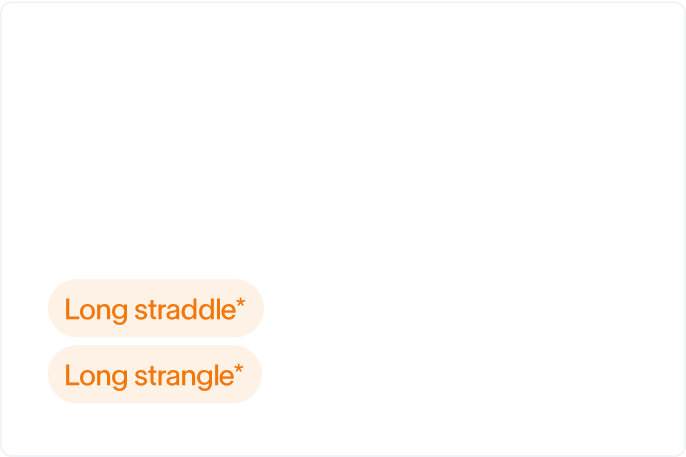

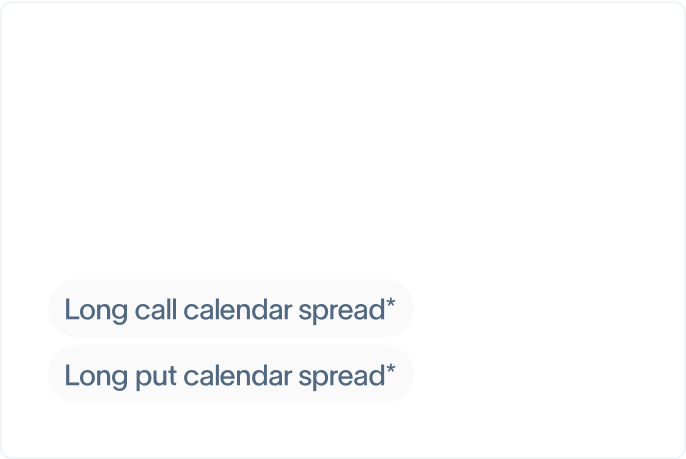

Options Trading

Trade options.Earn rebates.

Only on Public, you can earn rebates on your Stock & ETF options contracts, based on monthly trading volume. No commissions or per-contract fees.

*Options are risky and are not suitable for all investors. To learn more read the Options Disclosure Document. See terms & conditions for enrolling in Public’s options rebates at public.com/disclosures/rebate-terms.

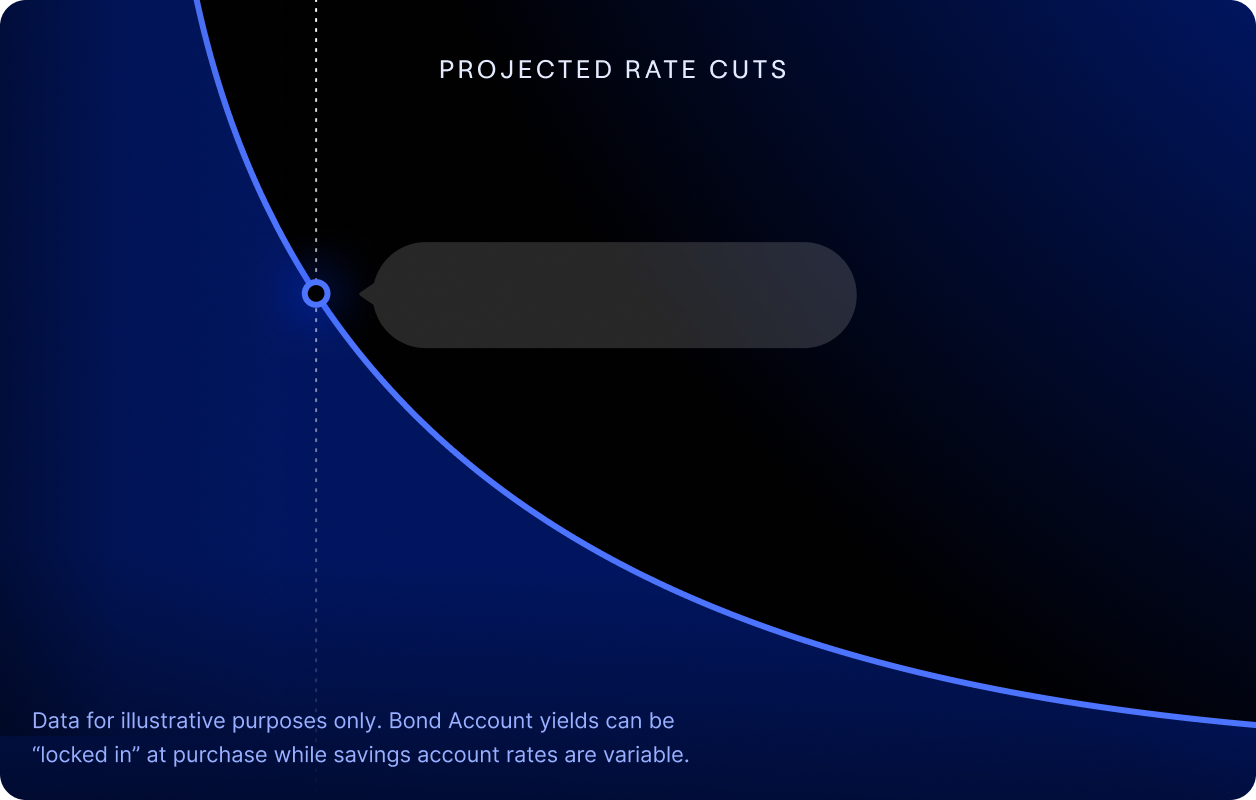

Bond Account

5.7% yield.***Locked in.

Locked-in Rate of 5.7%

Now, you can lock in a 5.7% yield that won't change if the Fed cuts rates with a diversified portfolio of investment-grade and high-yield bonds.

*** This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. Because the YTW of each bond is a function of the bond’s market price, which can fluctuate, your yield at the time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.

Products that perform.

Features that deliver.

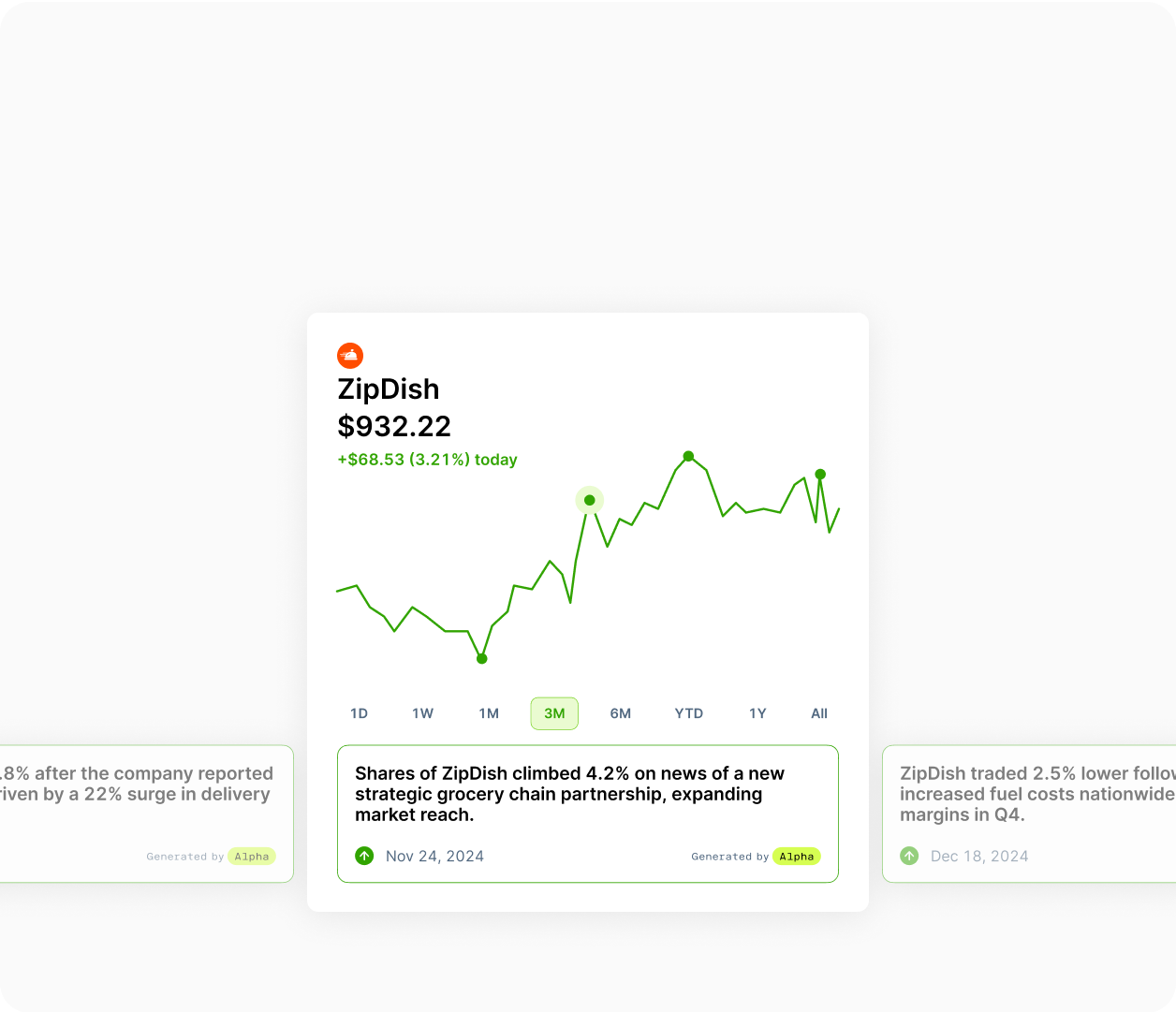

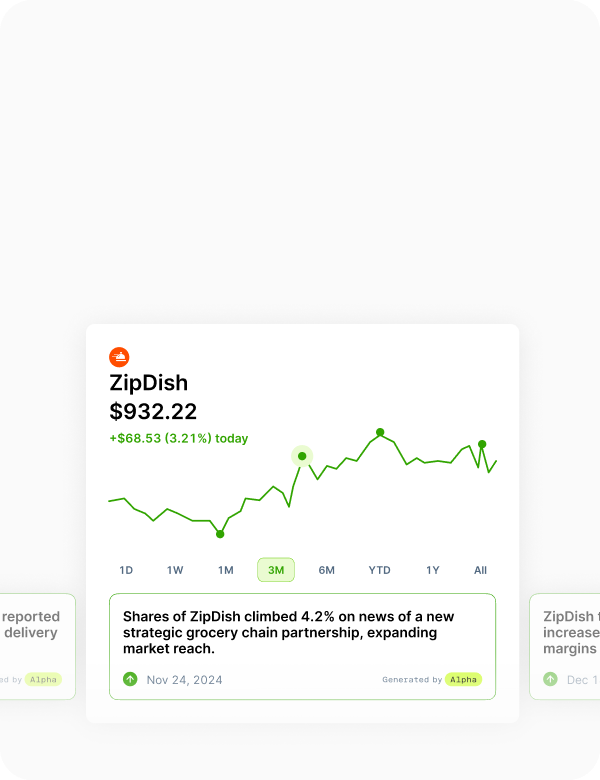

Key Moments

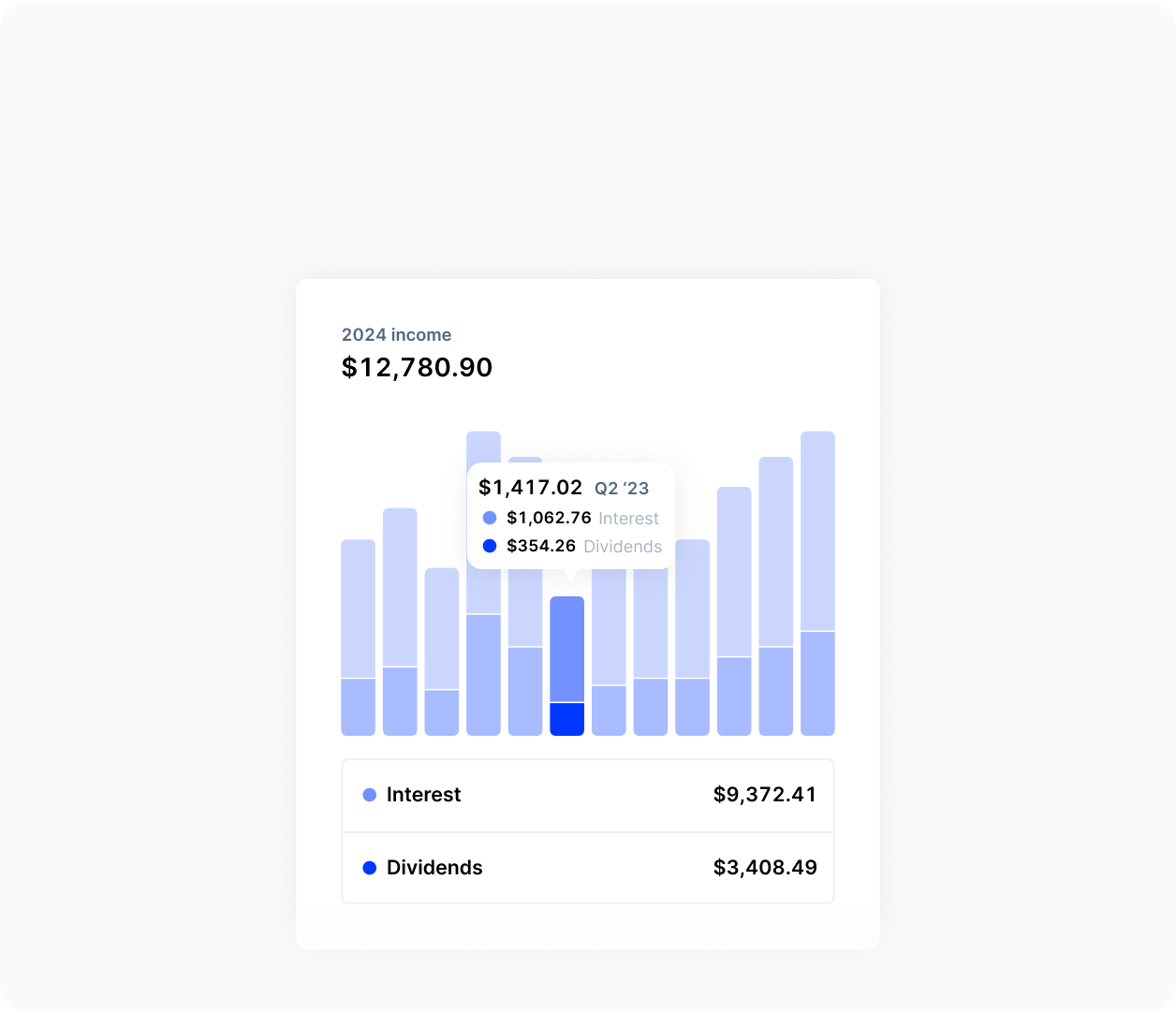

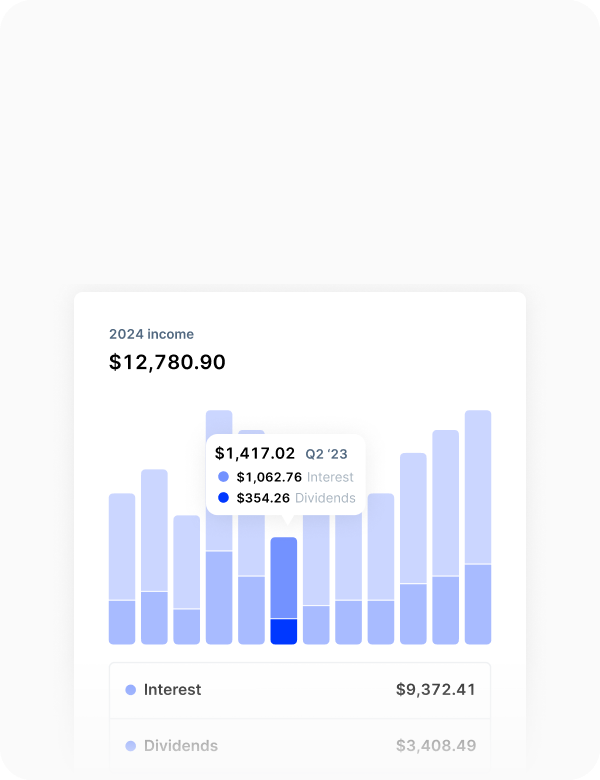

Income Hub

Discover the reasons behind every major stock price movement with detailed, AI-generated summaries embedded right on the asset’s performance chart.

View a monthly breakdown of your earnings from every income-generating asset you own. Plus, see a forecast of your earnings for the year ahead.

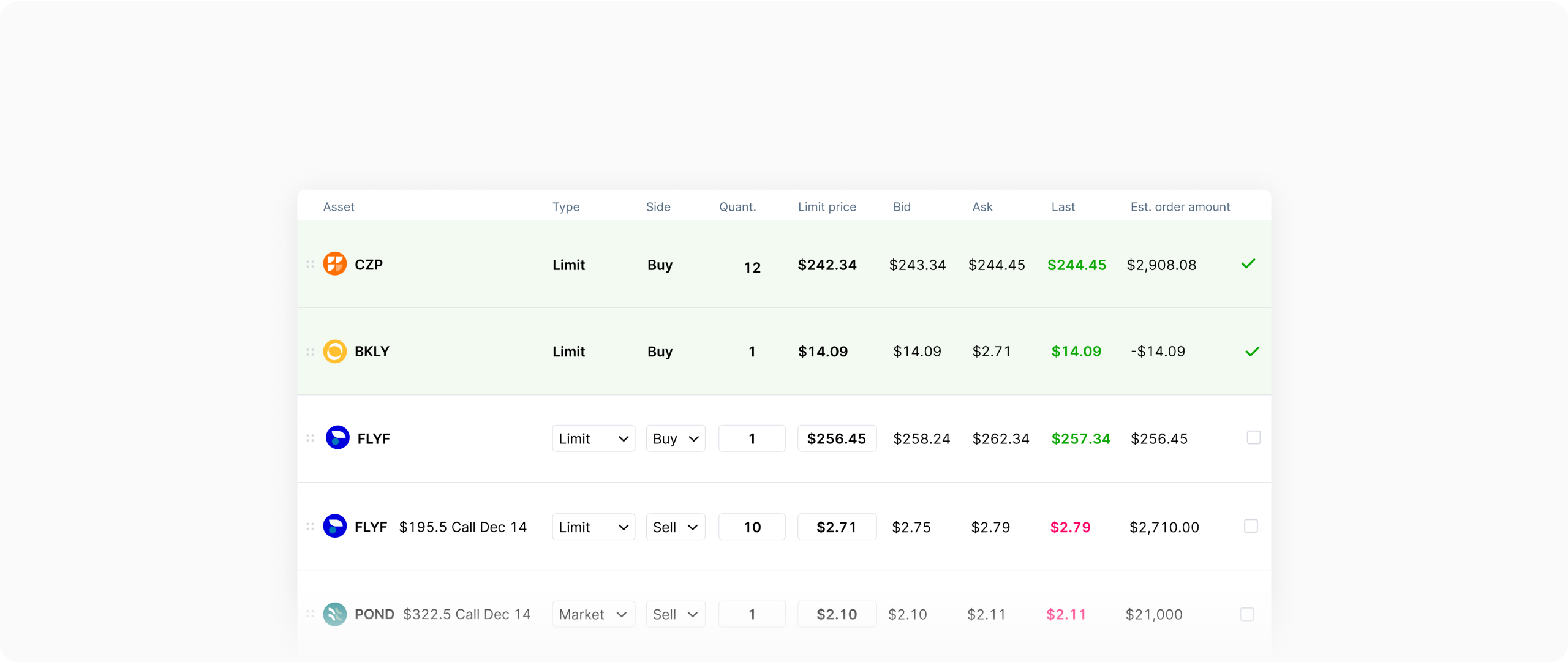

Queue

Gain more investing control with a tool that lets you plan, edit, and execute multiple trades simultaneously, all with real-time price updates.

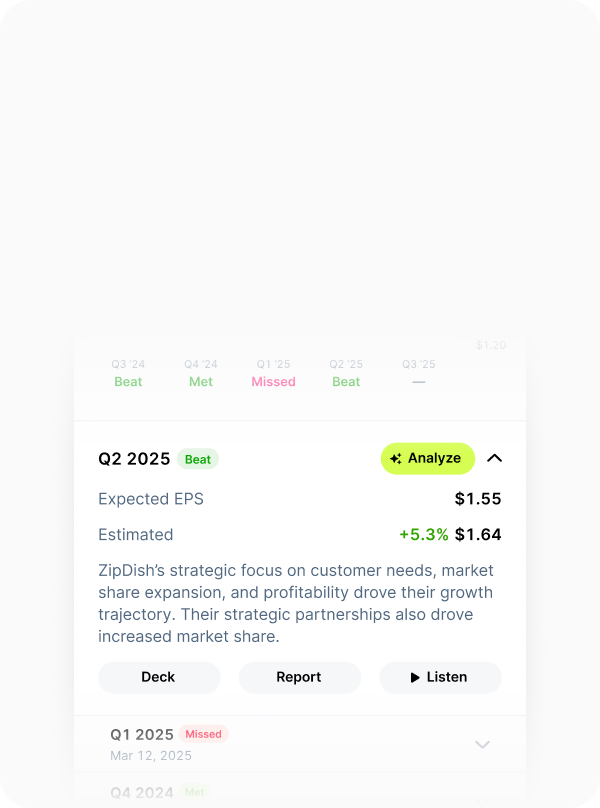

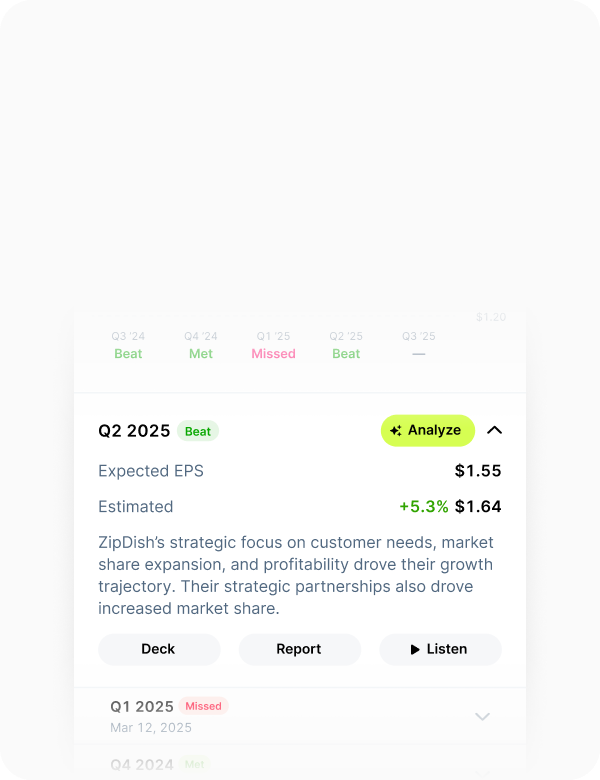

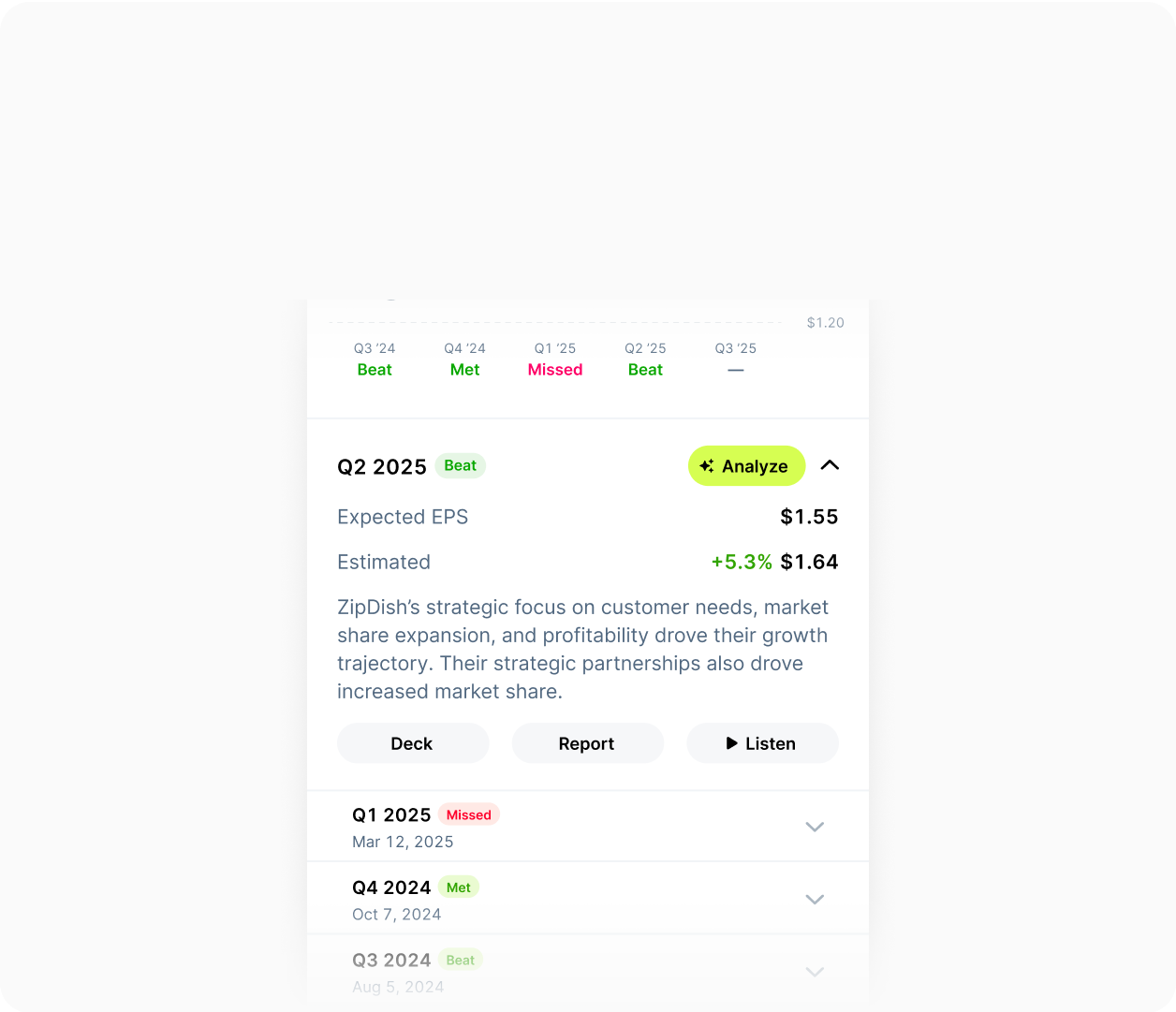

Earnings Hub

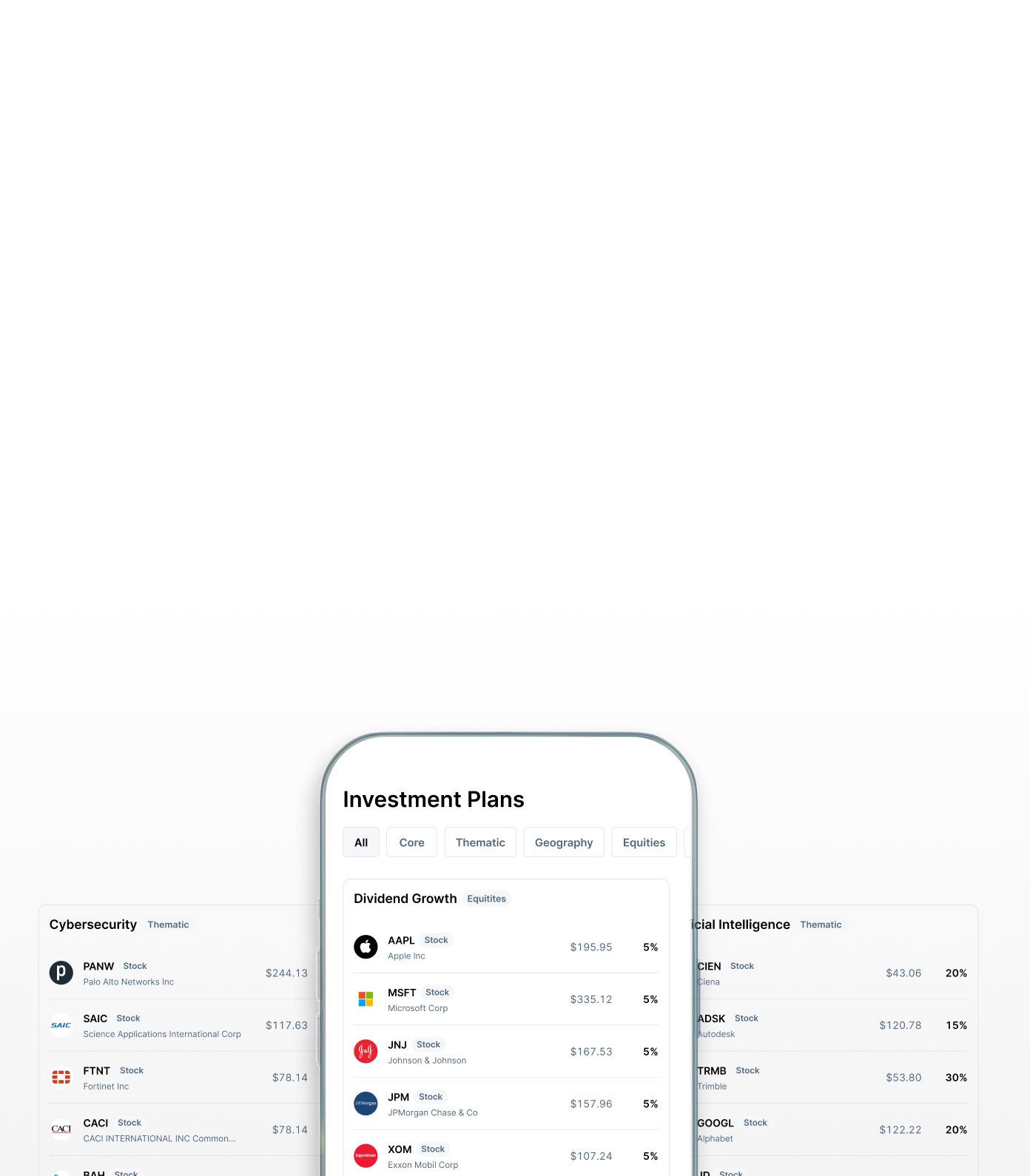

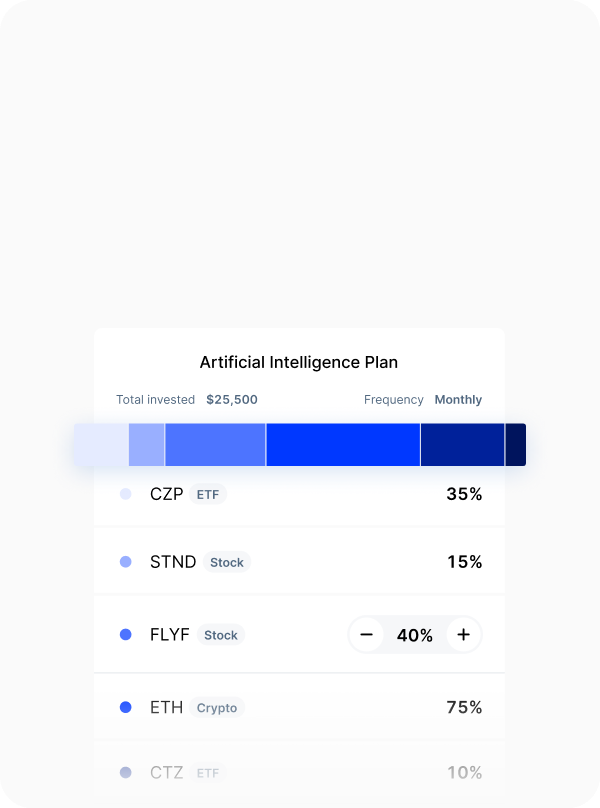

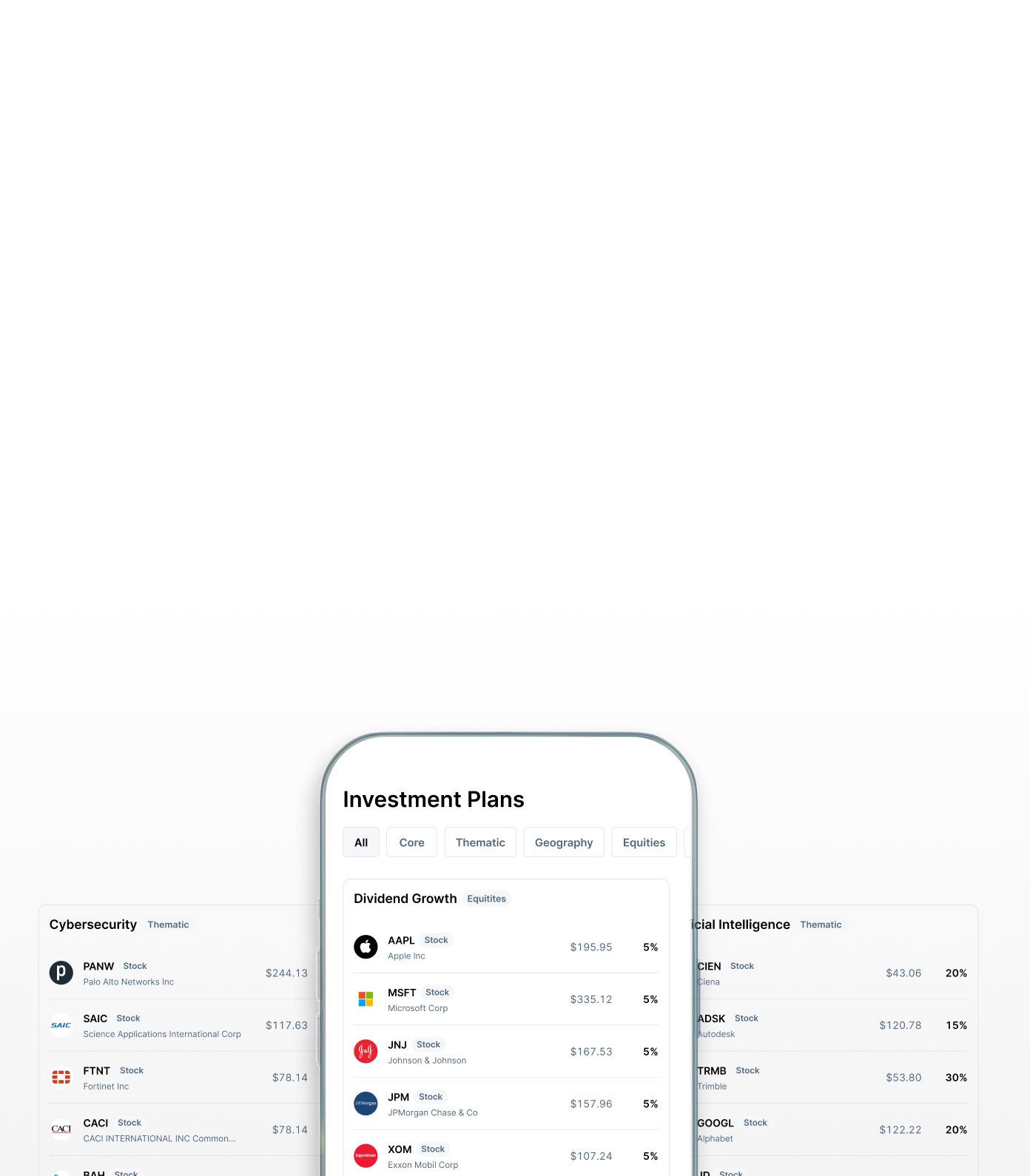

Investment Plans

Access AI-generated earnings recaps, company KPIs, investor presentations, and the actual audio of the earnings call—all without leaving Public.

Schedule recurring investments into personalized Investment Plans with up to 20 stocks, ETFs, and cryptos, and grow your portfolio automatically.

And up to $250,000

in instant buying power

Take advantage of every investment opportunity by making moves without waiting for funds to settle.

Varies by account.

Why join Public?

Invest in stocks, bonds, options, crypto, and more. Plus, turn any idea into an investable index with Generated Assets, exclusively on Public.

AI-powered analysis

Multi-asset investing

Industry-leading yields

Generated Assets

Direct indexing

Active trading API

Trusted by millions

US-based support

Financial-grade security

Get a 1% match when you transfer

© Copyright 2025 Public Holdings, Inc. All Rights Reserved.

Market data powered by Xignite.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

PUBLIC ADVISORS LLC

Direct Index Accounts. Investment advisory services for Direct Index Accounts (“DI Accounts”) are provided by Public Advisors LLC (“Public Advisors”), an SEC-registered investment adviser, and brokerage services are provided by Open to the Public Investing, Inc. (“Public Investing”), member FINRA / SIPC. Public Advisors and Public Investing are affiliates, and both charge fees for their respective services. Before investing, consider your investment objectives, all fees and expenses, and any potential conflicts of interest. For more details, see Public Advisors’ Firm Brochure, Form CRS, and Fee Schedule. Your DI Account’s composition and performance may deviate from the benchmark index due to tracking error, market conditions, the frequency of rebalancing and tax loss harvesting, and any portfolio customizations. A $1,000 initial investment may only enable your DI Account to track some, but not all, of a benchmark index’s stocks. Indexes are not available for direct investment; therefore, their performance does not reflect the expenses associated with management of a DI Account. See additional disclosures.

Tax-Loss Harvesting. Tax-loss harvesting (“TLH”) will automatically occur whenever your DI Account rebalances or experiences a cash inflow or outflow. In order to opt out of TLH altogether, you must set your rebalancing schedule to “None.” The ability of TLH to reduce tax liability is not guaranteed and will depend on your entire tax and investment profile. The performance of replacement stocks purchased through TLH may be worse than the securities sold, and TLH may cause the composition and performance of your portfolio to deviate from the benchmark index. Learn more about additional TLH risks. Public Advisors does not provide tax advice or assume liability for tax consequences of client transactions.

Treasury Accounts.

Investment advisory services for Treasury Accounts are provided by Public Advisors LLC (“Public Advisors”), an SEC-registered investment adviser. Brokerage services are provided by Public Investing (see below). Public Advisors and Public Investing are wholly-owned subsidiaries of Public Holdings, Inc. (“Public Holdings”), and both subsidiaries charge a fee for their respective Treasury Account services. Before investing, consider your investment objectives, all fees and expenses, and any potential conflicts of interest. For more details, see Public Advisors’ Form CRS, Form ADV Part 2A, Fee Schedule, and other disclosures. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance.

Investing in U.S. Treasuries securities (“Treasuries”) involves risks, including but not limited to, interest rate risk, credit risk, and market risk. Although Treasuries are considered safer than many other financial instruments, you can still lose all or part of your investment. Early withdrawal or sale prior to maturity of Treasuries may result in a loss of principal or impact returns. Reinvestment into new Treasuries is subject to market conditions and may result in different yields. As a general rule, the price of Treasuries moves inversely to changes in interest rates. Before investing, you should consider your tolerance for these risks and your overall investment objectives. For more details, see Public Advisors’ Form ADV Part 2A.

OPEN TO THE PUBLIC INVESTING, INC.

Securities, Options, Bonds.

Self-directed brokerage accounts and brokerage services for US-listed, registered securities, options, and bonds, except for treasury securities offered through Jiko Securities, Inc., are offered to self-directed customers by Open to the Public Investing, Inc. (“Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Public Investing is not registered. Securities products offered by Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Additional information can be found here.

Options.

Options trading entails significant risk and is not suitable for all investors. Options investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk and costs. Investors must read and understand the Characteristics and Risks of Standardized Options before considering any options transaction. Index options have special features and fees that should be carefully considered, including settlement, exercise, expiration, tax, and cost characteristics. See Fee Schedule for all options trading fees. Supporting documentation for any claims will be furnished upon request. To learn more about options rebates, see terms of the Options Rebate Program. Rebate rates vary monthly from $0.06-$0.18 and depend on your current and prior month’s options trading volume. Rates are subject to change at any time.

Margin Investing. Margin Accounts are offered by Public Investing. Margin investing involves significant risk, including losses greater than your initial investment. You must repay margin debt regardless of the value of securities purchased. Public Investing may change its maintenance margin requirements at any time without prior notice, and if your account falls below the minimum requirements, Public may sell your securities without notice. Review Public’s

Margin Disclosure Statement, Margin Agreement, and Fee Schedule.

Bonds.

“Bonds” shall refer to corporate debt securities and U.S. government securities offered on the Public platform through a self-directed brokerage account held at Public Investing and custodied at Apex Clearing. For purposes of this section, Bonds exclude treasury securities held in your Jiko Account, as explained under the “Jiko Account” section.

Investments in Bonds are subject to various risks including risks related to interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications and other factors. The value of Bonds fluctuate and any investments sold prior to maturity may result in gain or loss of principal. In general, when interest rates go up, Bond prices typically drop, and vice versa. Bonds with higher yields or offered by issuers with lower credit ratings generally carry a higher degree of risk. All fixed income securities are subject to price change and availability, and yield is subject to change. Bond ratings, if provided, are third party opinions on the overall bond's credit worthiness at the time the rating is assigned. Ratings are not recommendations to purchase, hold, or sell securities, and they do not address the market value of securities or their suitability for investment purposes.

Bond Accounts

A Bond Account is a self-directed brokerage account with Public Investing. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The Bond Account’s yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more.

ETFs & ETPs.

Before investing in an ETF, you should read the prospectus carefully, which provides detailed information on the fund’s investment objectives, risks, charges, and expenses and unique risk profile. Prospectuses can be found on the ETF issuer's website. All investments involve risks, including the loss of principal. Performance data represents past performance and is no guarantee of future results. Investment returns and principal value will fluctuate such that an investment, when redeemed, may be worth more or less than the original cost.

A spot bitcoin exchange-traded product (“ETP”) is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and is not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA. The performance of a spot bitcoin ETP will not reflect the specific return an investor would realize if the investor actually purchased bitcoin. Investors will not have any rights that bitcoin holders have and will not have the right to receive any redemption proceeds in bitcoin. Digital assets like Bitcoin are highly speculative and may be subject to increased risk of price volatility, illiquidity, market manipulation, and loss, including loss of your entire investment.

Margin Accounts:

Margin investing increases your level of risk and has the potential to magnify your losses, including loss of more than your initial investment. Please assess your investment objectives, risk tolerance, and financial circumstances to determine whether margin is appropriate for you. You must repay your margin debt regardless of the underlying value of the securities you purchased. Public Investing can change its maintenance margin requirements at any time without prior notice. If the equity in your margin account falls below the minimum maintenance requirements, you may be required to deposit additional cash or securities. If you are unable to do so, Public Investing may sell some or all of your securities, without prior approval or notice. You are not entitled to an extension of time on a margin call. For more information please see Public Investing’s Margin Disclosure Statement, Margin Agreement, and Fee Schedule.

Individual Retirement Accounts

Self-directed individual retirement accounts are offered by Public Investing, a registered broker-dealer and member of FINRA & SIPC. Information about retirement accounts on Public is for educational purposes only and is not tax or investment advice. Consult your tax advisor for individual considerations. Visit the IRS website for more information on the limitations and tax benefits of Traditional and Roth IRAs. All investing involves risk.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all IRA transfers and 401(k) rollovers made to your Public IRA; and (b) all contributions made to your Public IRA up to the annual contribution limit. The matched funds must be kept in the IRA account for at least 5 years to avoid an early removal fee. See full terms of the Program here. Rate and terms are subject to change at any time.

High-Yield Cash Account.

A High-Yield Cash Account is a secondary brokerage account with Public Investing. Funds in your High-Yield Cash Account are automatically deposited into partner banks (“Partner Banks”), where that cash earns interest and is eligible for FDIC insurance. See here for a list of current Partner Banks. Your Annual Percentage Yield is variable and may change at the discretion of the Partner Banks or Public Investing. Apex Clearing and Public Investing receive administrative fees for operating this program, which reduce the amount of interest paid on swept cash. Neither Public Investing nor any of its affiliates is a bank. Learn more.

Cryptocurrency.

Cryptocurrency trading, execution, and custody services are provided by Bakkt Crypto Solutions, LLC (NMLS ID 1828849) (“Bakkt”). Cryptocurrency is highly speculative, involves a high degree of risk, and has the potential for loss of the entire amount of an investment. Cryptocurrencies offered by Bakkt are not securities and are not FDIC insured or protected by SIPC. Your cryptocurrency assets are held in your Bakkt account. Bakkt is a licensed virtual currency business by the New York State Department of Financial Services and a licensed money transmitter, but is not a registered broker-dealer or a FINRA member. Your Bakkt Crypto account is separate from your brokerage account with Public Investing, which holds US-listed stocks and ETFs. Please review the Risk Disclosures before trading.

Treasury Accounts.

Investing services in treasury accounts offering 6 month US Treasury Bills on the Public platform are through Jiko Securities, Inc. (“JSI”), a registered broker-dealer and member of FINRA & SIPC. See JSI’s FINRA BrokerCheck and Form CRS for further information.

JSI uses funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s value at maturity). T-bills are purchased at a discount to the par value and the T-bill’s yield represents the difference in price between the “par value” and the “discount price.” Aggregate funds in your Treasury Account in excess of the T-bill purchases will remain in your Treasury Account as cash. The value of T-bills fluctuate and investors may receive more or less than their original investments if sold prior to maturity. T-bills are subject to price change and availability - yield is subject to change. Past performance is not indicative of future performance. Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. Although T-bills are considered safer than many other financial instruments, you could lose all or a part of your investment. See Jiko U.S. Treasuries Risk Disclosures for further details.

Investments in T-bills: Not FDIC Insured; No Bank Guarantee; May Lose Value.

Banking services and bank accounts are offered by Jiko Bank, a division of Mid-Central National Bank.

JSI and Jiko Bank are not affiliated with Public Holdings, Inc. (“Public”) or any of its subsidiaries. None of these entities provide legal, tax, or accounting advice. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

Trading Commissions

Commission-free trading refers to $0 commissions charged on trades of US listed registered securities placed during the U.S. Markets Regular Trading Hours in self-directed brokerage accounts offered by Public Investing. Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Fee Schedule to learn more.

Fractional shares are illiquid outside of Public and not transferable. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see our Fractional Share Disclosure to learn more.

Investment Plans. Investment Plans (“Plans”) shown in our marketplace are for informational purposes only and are meant as helpful starting points as you discover, research and create a Plan that meets your specific investing needs. Plans are self-directed purchases of individually-selected assets, which may include stocks, ETFs and cryptocurrency. Plans are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are created using defined, objective criteria based on generally accepted investment theory; they are not based on your needs or risk profile. You are responsible for establishing and maintaining allocations among assets within your Plan. Plans involve continuous investments, regardless of market conditions. Diversification does not eliminate risk. See our Investment Plans Terms and Conditions and Sponsored Content and Conflicts of Interest Disclosure.

PUBLIC HOLDINGS, INC.

Alpha

Alpha is an experiment brought to you by Public Holdings, Inc. (“Public”). Alpha is an AI research tool powered by GPT-4, a generative large language model. Alpha is experimental technology and may give inaccurate or inappropriate responses. Output from Alpha should not be construed as investment research or recommendations, and should not serve as the basis for any investment decision. All Alpha output is provided “as is.” Public makes no representations or warranties with respect to the accuracy, completeness, quality, timeliness, or any other characteristic of such output. Your use of Alpha output is at your sole risk. Please independently evaluate and verify the accuracy of any such output for your own use case.

Market Data.

Quotes and other market data for Public’s product offerings are obtained from third party sources believed to be reliable, but Public makes no representation or warranty regarding the quality, accuracy, timeliness, and/or completeness of this information. Such information is time sensitive and subject to change based on market conditions and other factors. You assume full responsibility for any trading decisions you make based upon the market data provided, and Public is not liable for any loss caused directly or indirectly by your use of such information. Market data is provided solely for informational and/or educational purposes only. It is not intended as a recommendation and does not represent a solicitation or an offer to buy or sell any particular security.

Individual Retirement Accounts

Self-directed individual retirement accounts are offered by Public Investing, a registered broker-dealer and member of FINRA & SIPC. Information about retirement accounts on Public is for educational purposes only and is not tax or investment advice. Consult your tax advisor for individual considerations. Visit the IRS website for more information on the limitations and tax benefits of Traditional and Roth IRAs. All investing involves risk.

As part of the IRA Contribution Match Program, Public Investing will fund a 1% match of all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.