Options Trading

Trade options.Earn rebates.

*1

No commission fees

No per-contract fees

Options are risky and aren't suitable for all investors. Other fees, like index options contract fees, may apply. To learn more, read the Options Disclosure Document.

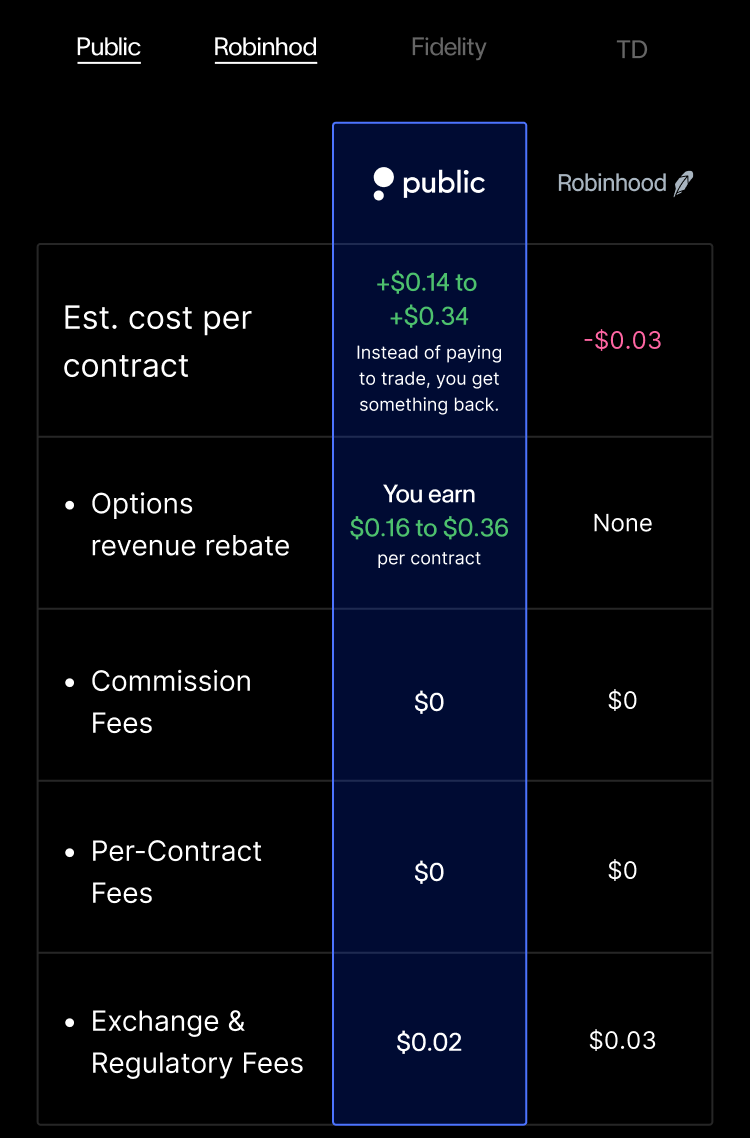

One of the most cost-effective ways to trade options

2

We share our options revenue with you on stock and ETF trades, reducing your trading costs. Other fees may apply.

Rebate

Fees

Earn $0.06-$0.18

$0.05

per stocks and most ETF contracts3

per stocks and most ETF contracts

Robinhood

None

$0.05

Fidelity

None

$0.67

Charles Schwab

None

$0.66

2 Trading fees for competitors were taken from their website on 3/2/2025, and are exclusive of promo rates. The trading fees above are an approximation, are subject to change, and may vary based on factors such as the total number of contracts and price per contract. See terms & conditions for enrolling in Public's options rebates at public.com/disclosures/rebate-terms

3 We provide an adjusted rebate on QQQ, SPY, and IWM contracts. Members in Tiers 1-3 earn $0.06 per contract, while Tier 4 earns $0.10 per contract. See public.com/disclosures/rebate-terms for details.

Boost your options trading rebate*

Each month, you can boost your rebate based on your trading volume and keep that tier for the following month.

*We provide an adjusted rebate on QQQ, SPY, and IWM contracts. Members in Tiers 1-3 earn $0.06 per contract, while Tier 4 earns $0.10 per contract.

Uncover trading opportunities

Explore the markets with a sophisticated suite of research and technical analysis tools.

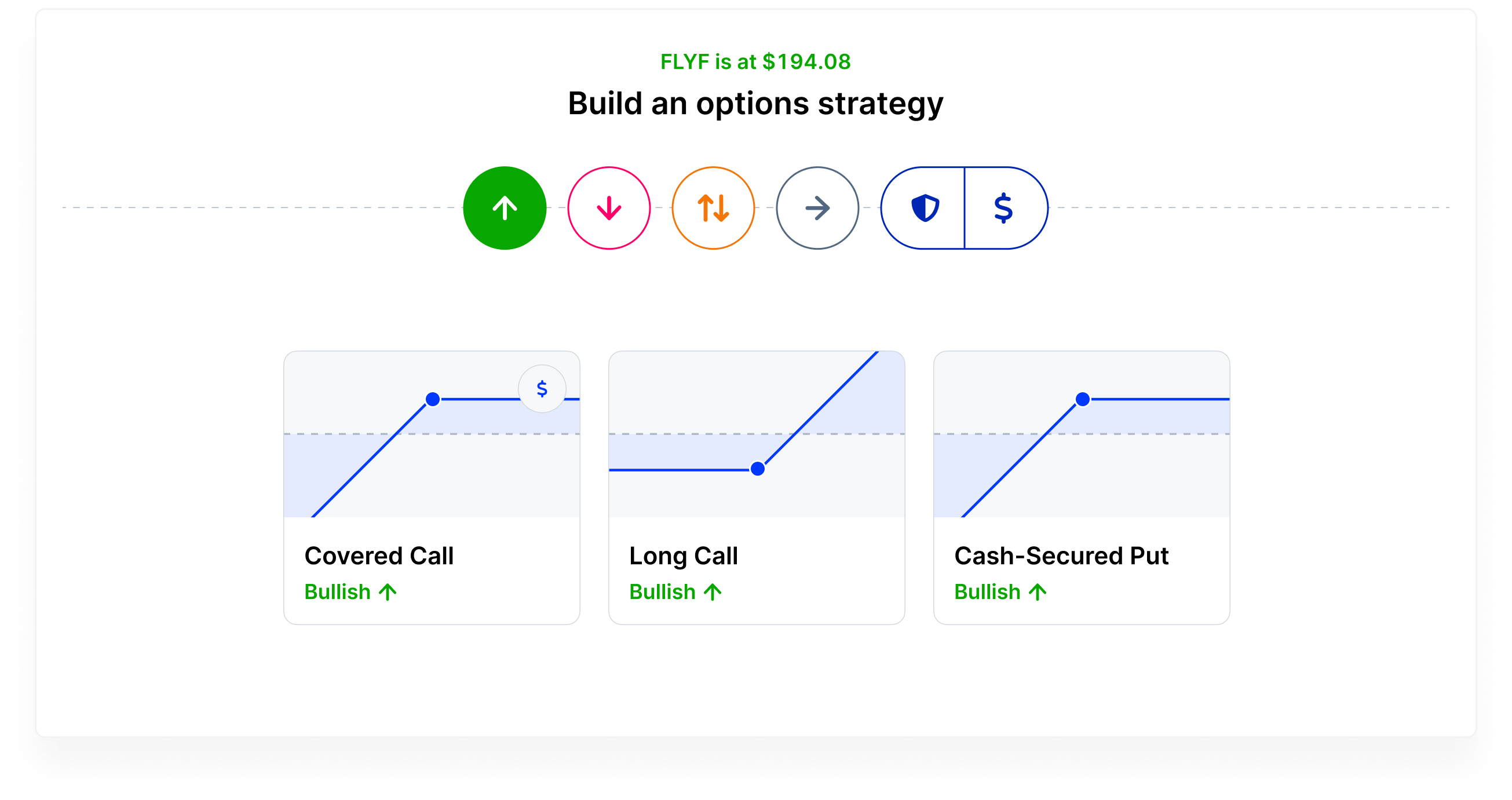

Build your options strategies

Plan single and multi-leg options strategies with our comprehensive strategy builder.

Stay on top of every trade

Closely monitor all of your options positions from our intuitive trading experience.

For additional information visit: https://public.com/trade-options/resources/options-101

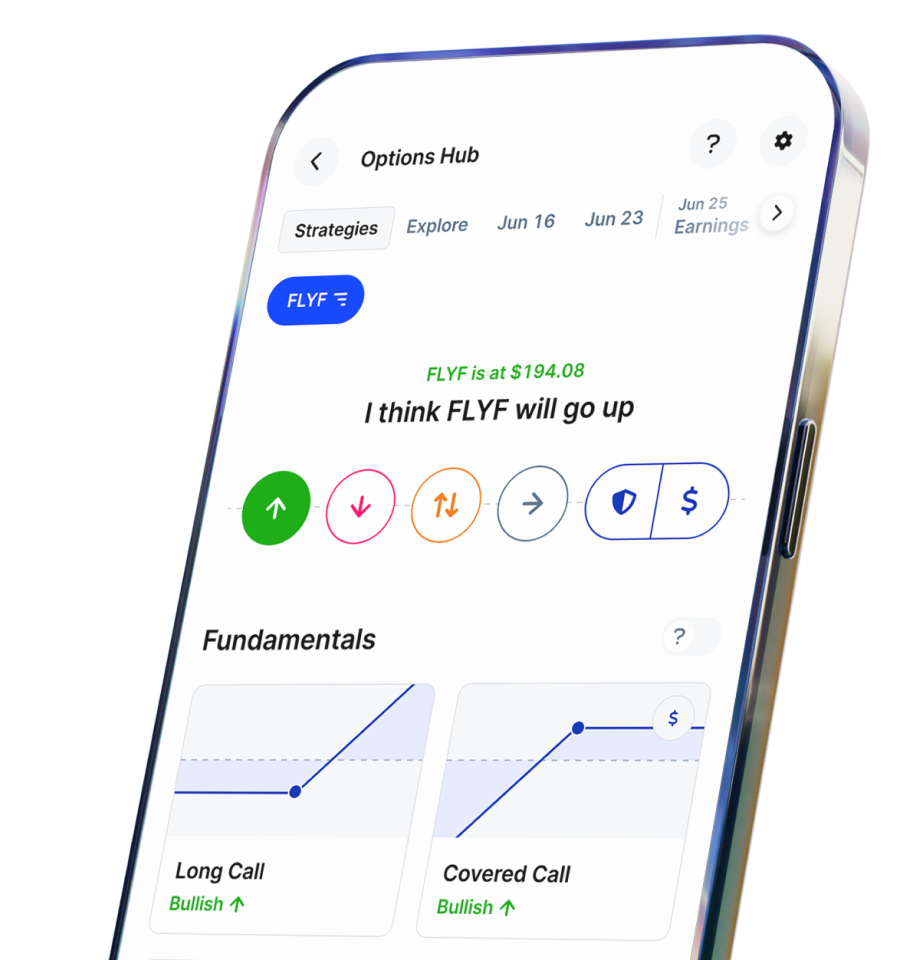

Plan your trades with our strategy builder

3

With our options strategy builder, you can plan your trades based on your outlook on a stock and visualize your potential profit and loss outcomes.

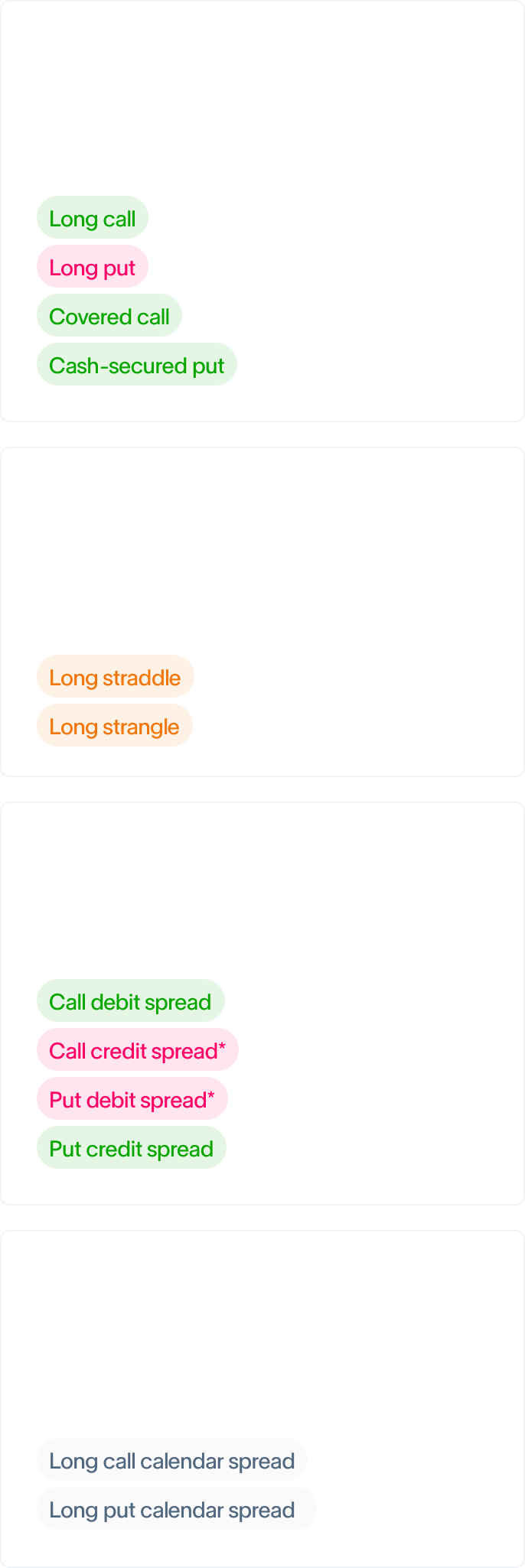

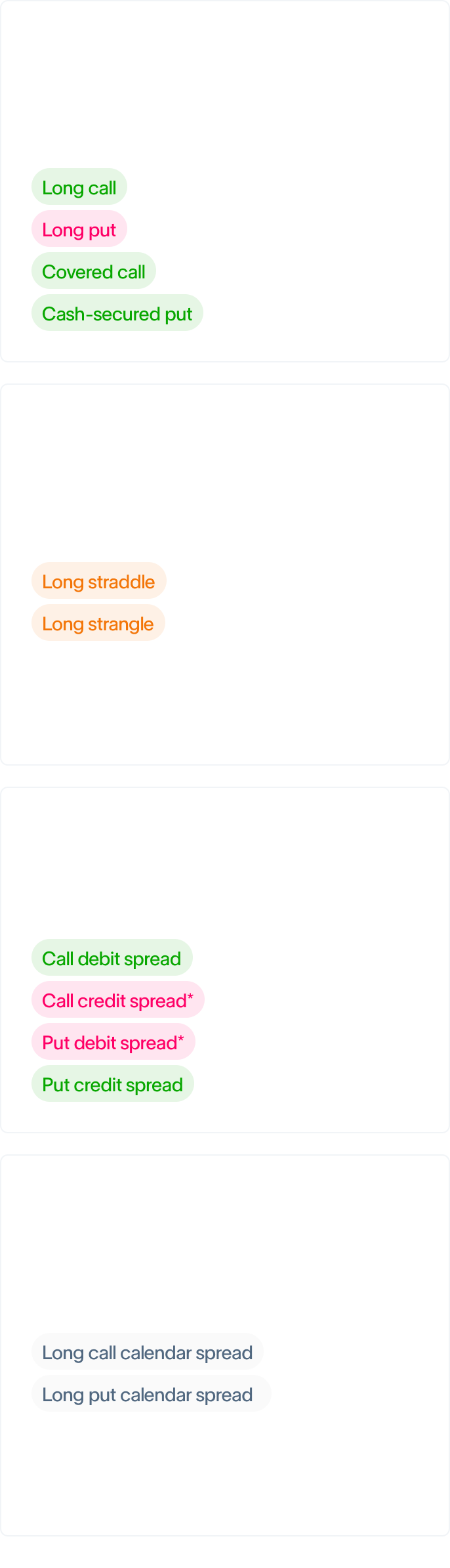

Fundamentals

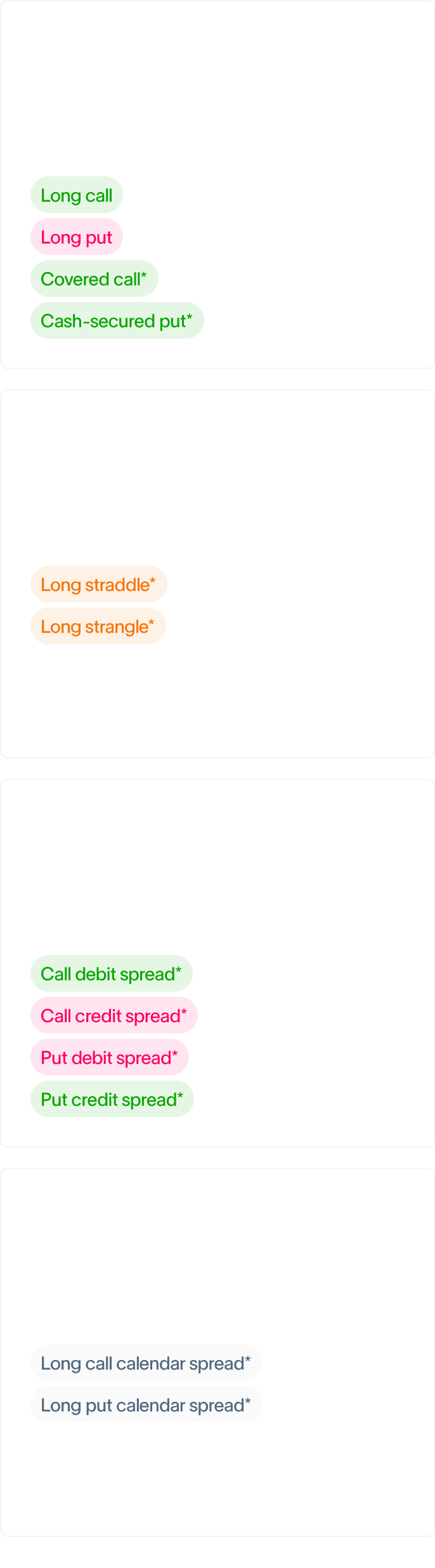

Straddles and strangles

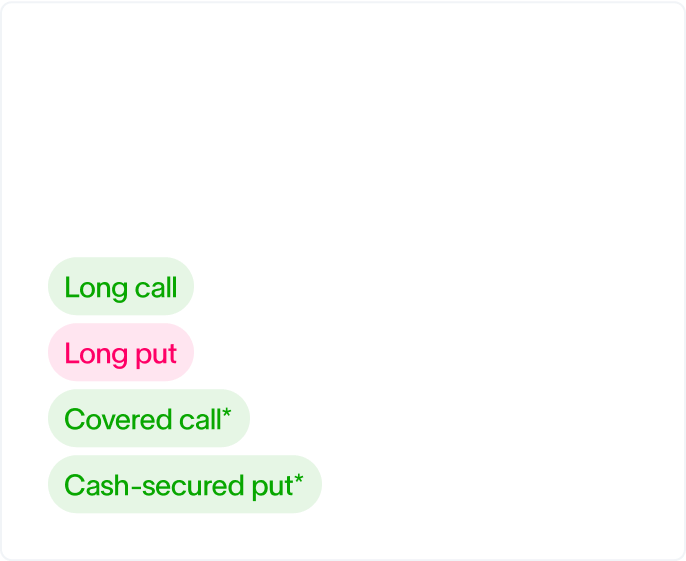

Vertical spreads

Calendar spreads

Buy or sell single-leg options strategies.

Buy a call and a put with the same (straddle) or different (strangle) strike prices.

Buy and sell two options of the same type (calls or puts) with different strike prices.

Buy and sell two options of the same type (calls or puts) with the same strike price but different expirations.

For additional information visit: https://public.com/trade-options/resources/options-101

Simple. Sophisticated.Significantly cheaper.

¹ Options are risky and aren't suitable for all investors. To learn more, read the Options Disclosure Document.

² Trading fees for competitors were taken from their website on 11/3/2025, and are exclusive of promo rates. The trading fees above are an approximation, are subject to change, and may vary based on factors such as the total number of contracts and price per contract. See terms & conditions for enrolling in Public's options rebates at public.com/disclosures/rebate-terms

³ Options are not suitable for all investors and carry significant risk.

Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade. Prior to buying or selling an option, investors must read the “Characteristics and Risks of Standardized Options”, also known as the options disclosure document (ODD) which can be found here.

¹ Options are risky and aren't suitable for all investors. To learn more, read the Options Disclosure Document.

*Cost comparisons accurate as of December 22, 2023. To qualify for revenue sharing, options trading must be activated by March 31, 2024.

² This feature provides hypothetical profit and loss based on the conditions in the market when you select a contract to be visualized, and does not guarantee future results. No contract has been bought or sold. The P&L charts are for informational purposes only and should not be considered a personalized recommendation or investment advice. Actual profits or losses may differ based on a number of factors not accounted for in these assumptions.

³ This feature provides a visualization of numerous datapoints related to a given options contract. The data is provided on an as-is basis and does not guarantee accuracy. The advanced charts are for informational purposes only and should not be considered a personalized recommendation or investment advice.

⁴ This feature provides lists of options contracts based on quantitative methodological screens. The data is provided on an as-is basis and does not guarantee accuracy. The Options Hub and all screens are for informational purposes only and should not be considered a personalized recommendation or investment advice.

⁵ PFOF rebates are only issued for options trades that are subject to PFOF. Public Investing shares 50% of the estimated order flow revenue as a rebate to help reduce trading costs on options. For more information, see our Fee Schedule and FAQs on PFOF Rebates.

⁶ Please note: Public doesn't charge per-contract fees. However, there are regulatory fees assessed for certain options transactions. See our fee schedule to learn more.Competitor trade cost data as of December 22, 2023 and subject to change. While the information is deemed reliable, Public makes no representations or warranties with respect to the accuracy or completeness of the information provided. All investments involve risk, including the possible loss of principal.Trading options involves significant risk and is not appropriate for all investors. To learn about risks, read the OCC’s Options Disclosure Document. Not included in this comparison are regulatory transaction fees and trading activity fees. These fees are set by our regulators, and are subject to change without notice. Most brokers, including ones in this comparison, pass on these fees to their customers on certain sell orders. For more information, please see Public's Fee Schedule.

⁷ This feature provides educational materials and videos related to options. The data is provided on an as-is basis and does not guarantee accuracy. The resource center is for informational purposes only and should not be considered a personalized recommendation or investment advice.

Options revenue sharing offered to customers who activate options trading on Public by 3/31/24. Full options revenue rebate terms can be found at public.com/disclosures/rebate-terms

© Copyright 2023 Public Holdings, Inc. All Rights Reserved.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

Product offerings and availability vary based on jurisdiction.

Stocks, ETFs, Options, Bonds.

Self-directed brokerage accounts and brokerage services for US-listed, registered securities, options, and Bonds, except for treasury securities offered through Jiko Securities, Inc., are offered to self-directed customers by Open to the Public Investing, Inc. (“Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Public Investing is not registered. Securities products offered by Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Additional information can be found here.

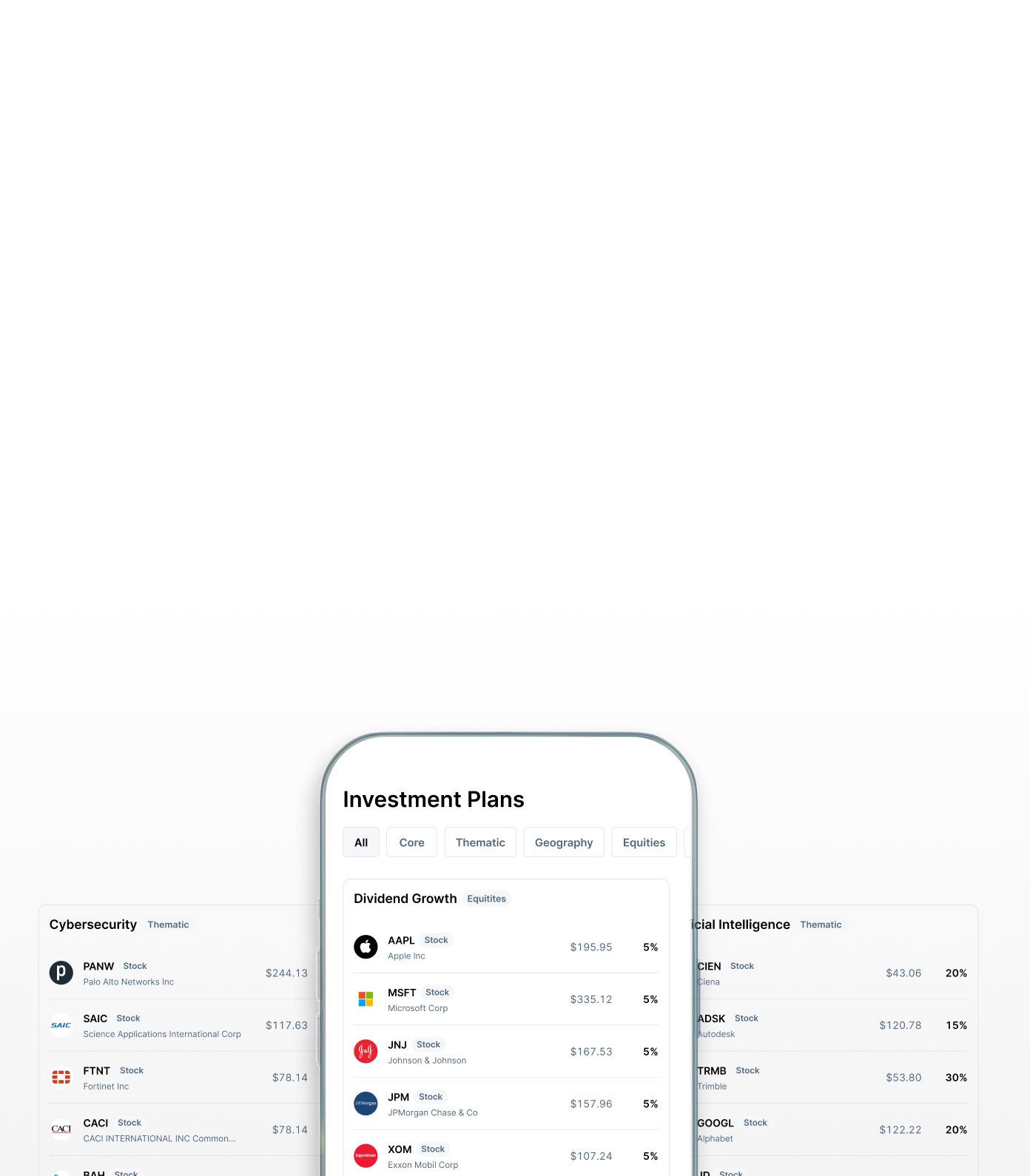

Investment Plans

Plans available to US members only. Diversification does not eliminate risk. Plans shown in our marketplace are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are not based on your needs or risk profile. Plans involve continuous investments, regardless of market conditions. Investment Plans shown in the marketplace are for informational purposes only. Investment Plans are meant to provide a helpful starting point as you discover, research, and create an Investment Plan that meets your specific investing needs. Investment Plans presented in the marketplace are created using defined, objective criteria based on generally accepted investment theory. They are made up of stocks and ETFs only. Refer to the Investment Plan Methodology to learn more. You should do your own research before purchasing a Plan. Plans will not be rebalanced and allocations will not be updated in any way, except for Corporate Actions. Learn more in our Investment Plans Terms and Conditions. You can find more information about any conflicts of interest associated with Sponsored Investment Plans in our Sponsored Content and Conflicts of Interest Disclosure.

Before investing in an ETF, you should read the prospectus, which provides detailed information on the ETF’s investment objective, principal investment strategies, risks, costs, and historical performance (if any), among other things. Prospectuses can be found on the ETF issuer's website. ETFs are bought and sold at market price, which can vary from the Net Asset Value of the fund. Rebalancing and other fund activities may result in tax consequences.

Brokerage services for stocks and ETFs on Public.com are offered by Open to the Public Investing, Inc., a registered broker-dealer and member FINRA & SIPC.

Commission-free trading of stocks refers to $0 commissions for Open to the Public Investing self-directed individual cash brokerage accounts that trade the U.S.-listed, registered securities electronically during the Regular Trading Hours. Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Open to the Public Investing’s Fee Schedule to learn more.

Fractional shares are illiquid outside of Public and not transferable. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see our Fractional Share Disclosure to learn more.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.

days

Activate by March 31st

Options trading on Public

hours

mins

Trade options. Earn rebates.

secs