Investing for those who take it seriously

Stocks

Bonds

Treasuries

Options

Crypto

ETFs

Direct Indexing

High-Yield Cash Acct

Bond Account

IRAs

3.3% APY1

1% Match3

5.4%2

Transfer your portfolio. Earn a 1% match.3

You can earn a 1% uncapped match when you transfer your portfolio from another brokerage—whether it's a brokerage account, IRA, or 401(k) rollover.

1 Rate as of 02/19/2026. APY is variable and subject to change.

2 Yield represents average annualized rate of return across all bonds, before fees, as of 02/19/2026. Since yield is subject to change daily, yield will be locked in at the time of purchase and may be different from the yield shown

3 See full terms and conditions of Public’s IRA Contribution Match Program.

Generated Assets

Turn any idea into an investable index with AI

With Generated Assets, you can type in any prompt, and our AI will screen thousands of stocks to build a custom index that matches your intent.

This demonstration is for illustrative purposes only, does not reflect actual investment results, and is not an investment recommendation.

Options Trading

Trade options.Earn rebates.

Only on Public, you can earn rebates on your Stock & ETF options contracts, based on monthly trading volume. No commissions or per-contract fees.

*Options are risky and are not suitable for all investors. To learn more read the Options Disclosure Document. See terms & conditions for enrolling in Public’s options rebates at public.com/disclosures/rebate-terms.

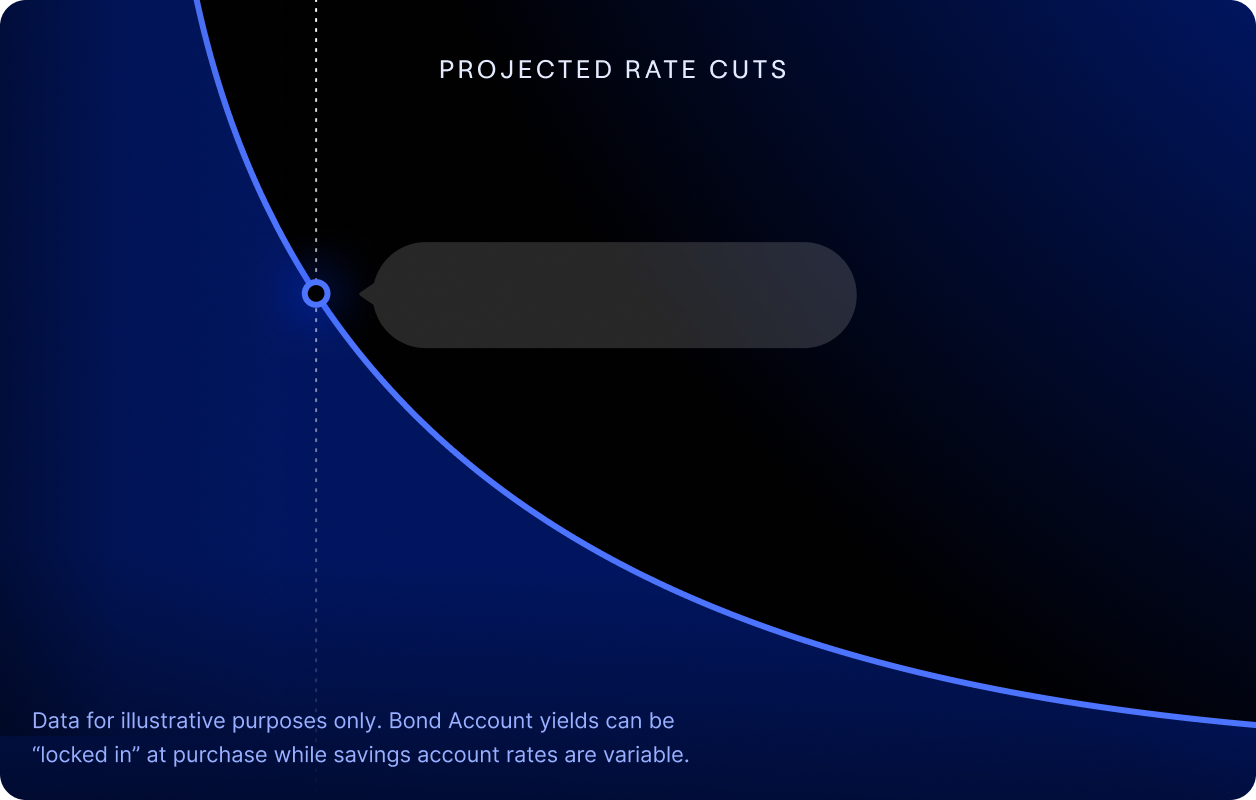

Bond Account

5.4% yield.***Locked in.

Locked-in Rate of 5.4%

Now, you can lock in a 5.4% yield that won't change if the Fed cuts rates with a diversified portfolio of investment-grade and high-yield bonds.

*** This yield is the current average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees. Because the YTW of each bond is a function of the bond’s market price, which can fluctuate, your yield at the time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults. Learn more.

Products that perform.

Features that deliver.

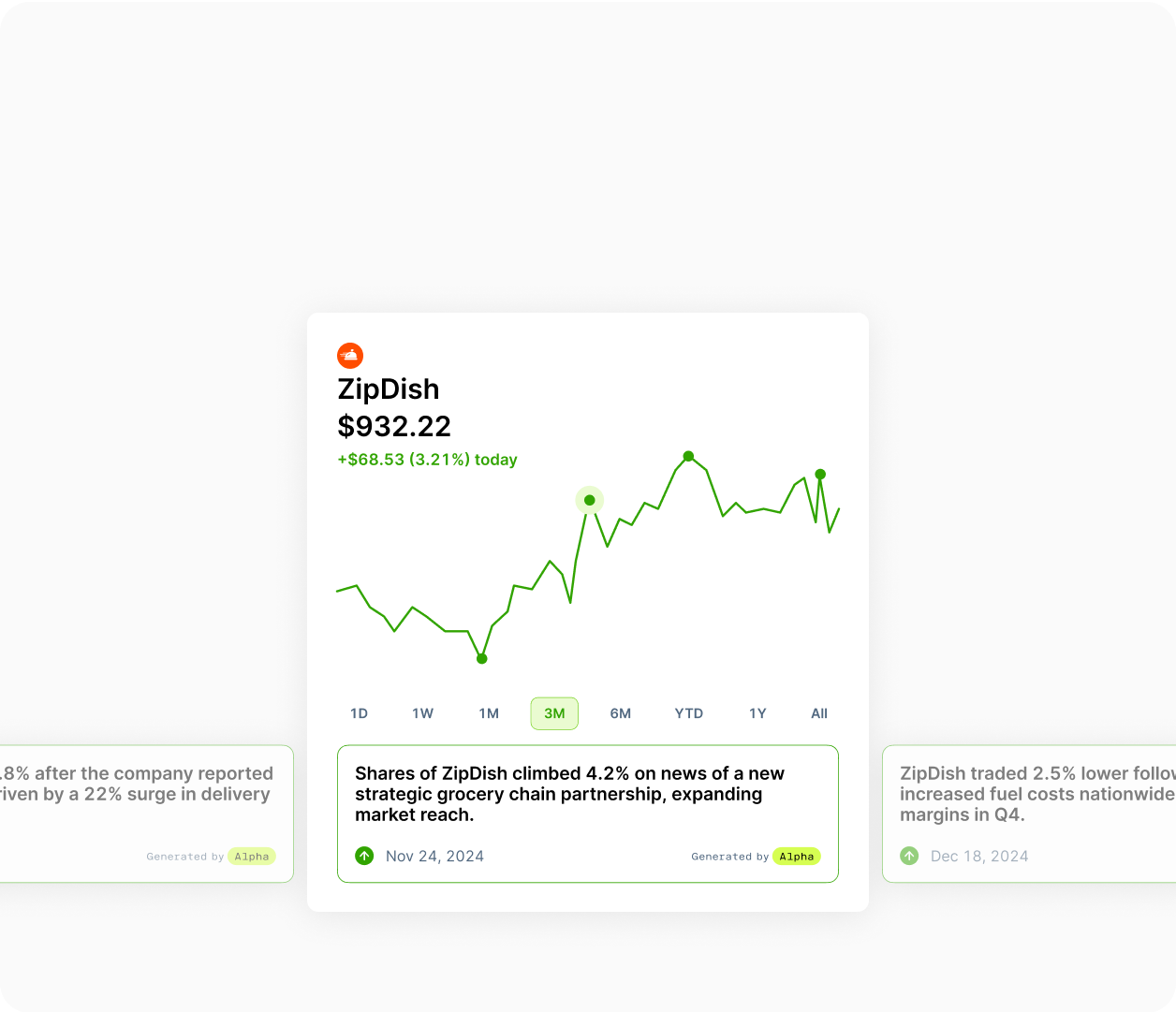

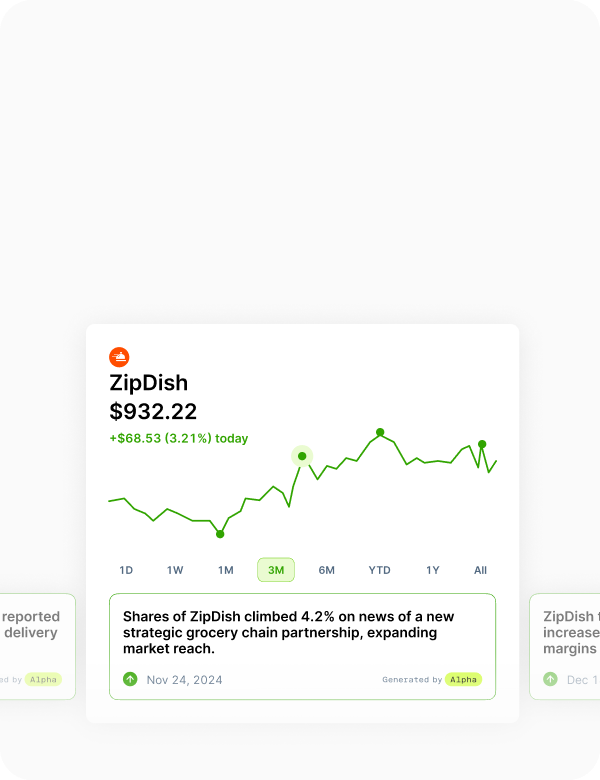

Key Moments

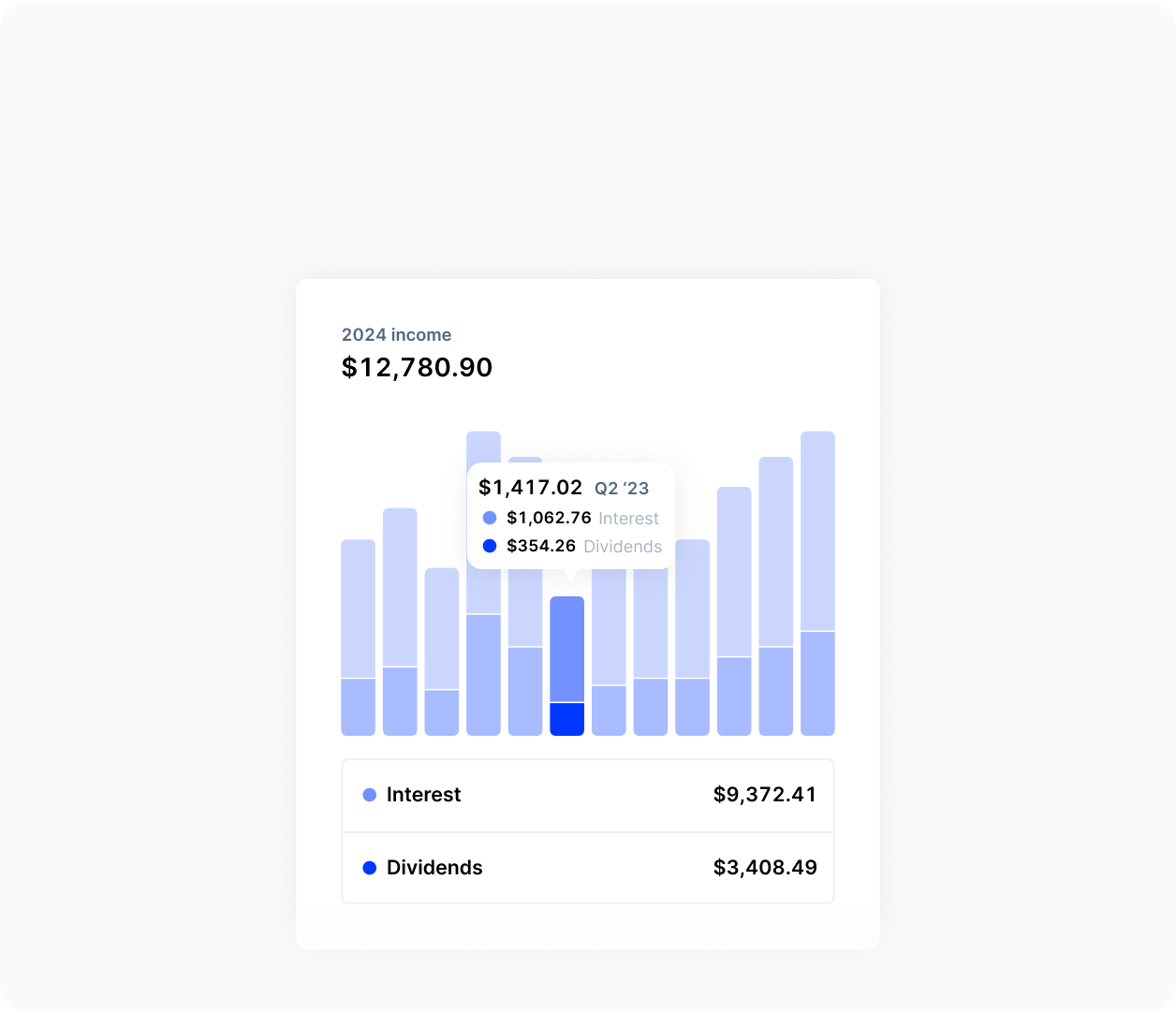

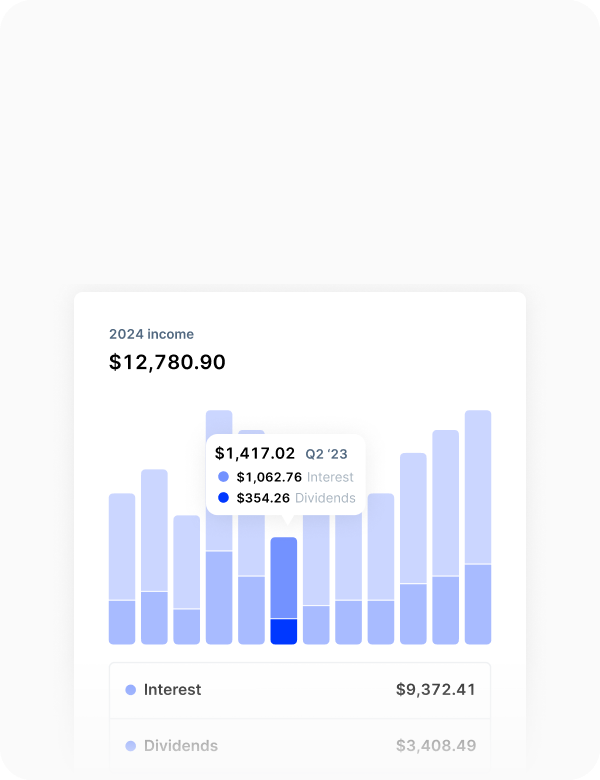

Income Hub

Discover the reasons behind every major stock price movement with detailed, AI-generated summaries embedded right on the asset’s performance chart.

View a monthly breakdown of your earnings from every income-generating asset you own. Plus, see a forecast of your earnings for the year ahead.

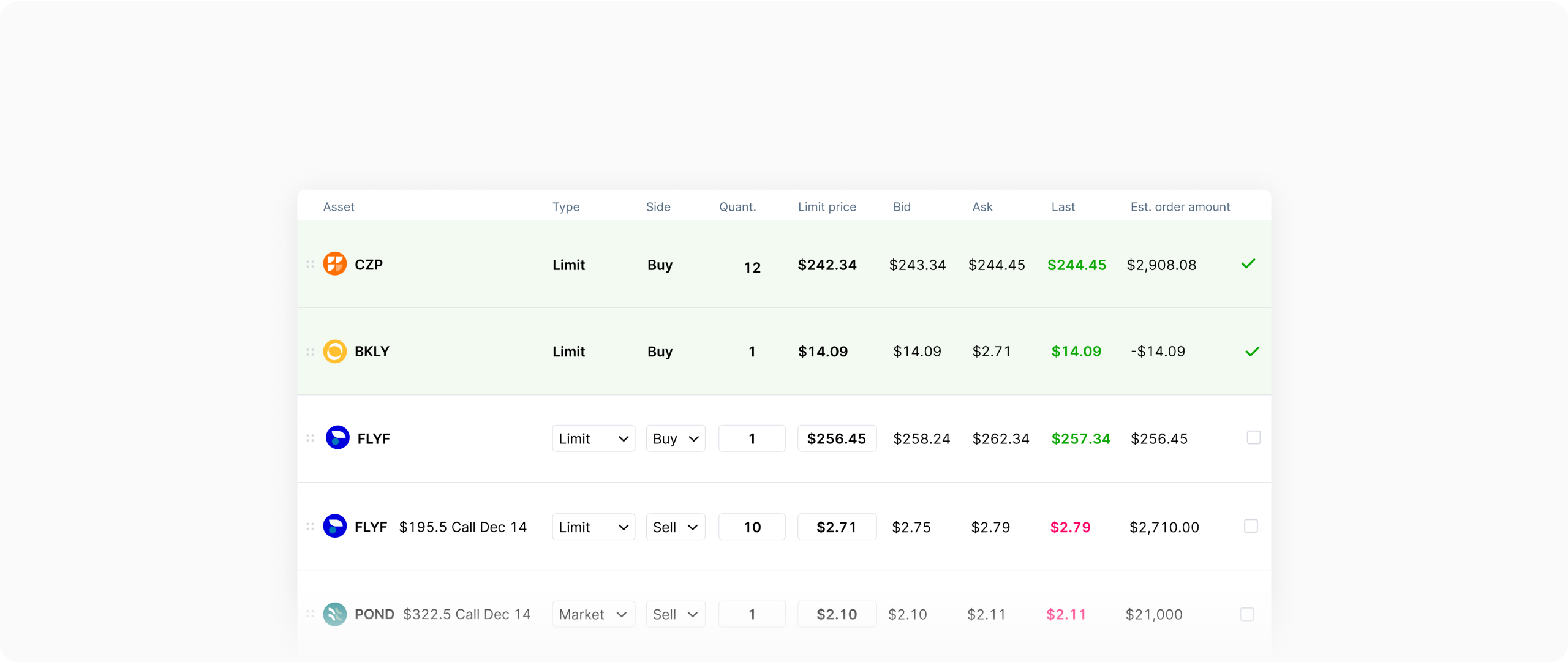

Queue

Gain more investing control with a tool that lets you plan, edit, and execute multiple trades simultaneously, all with real-time price updates.

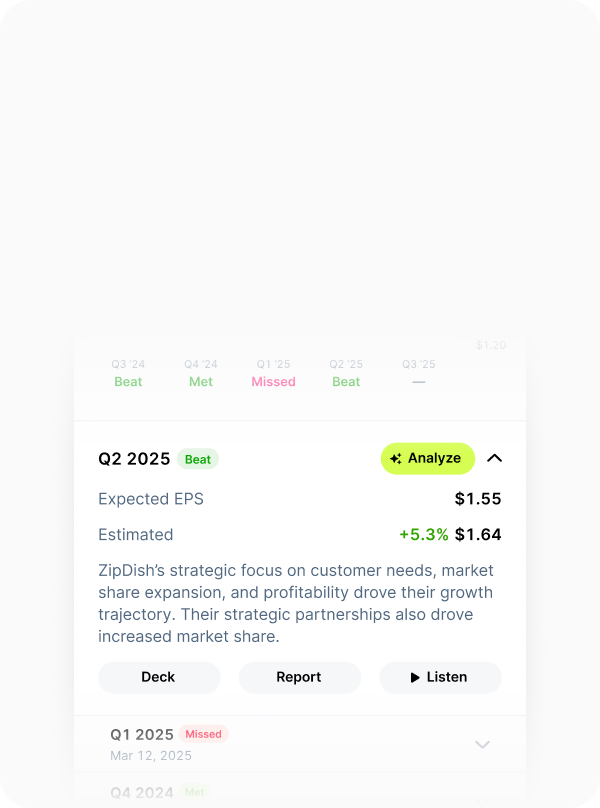

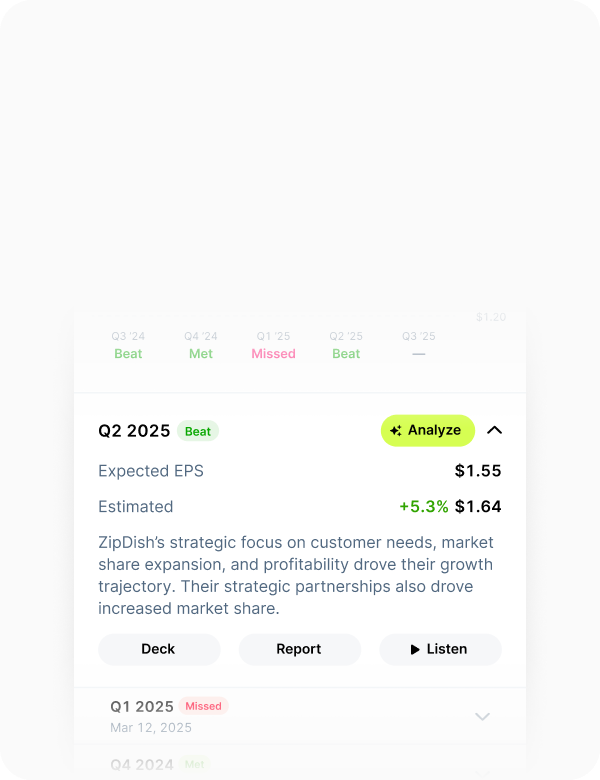

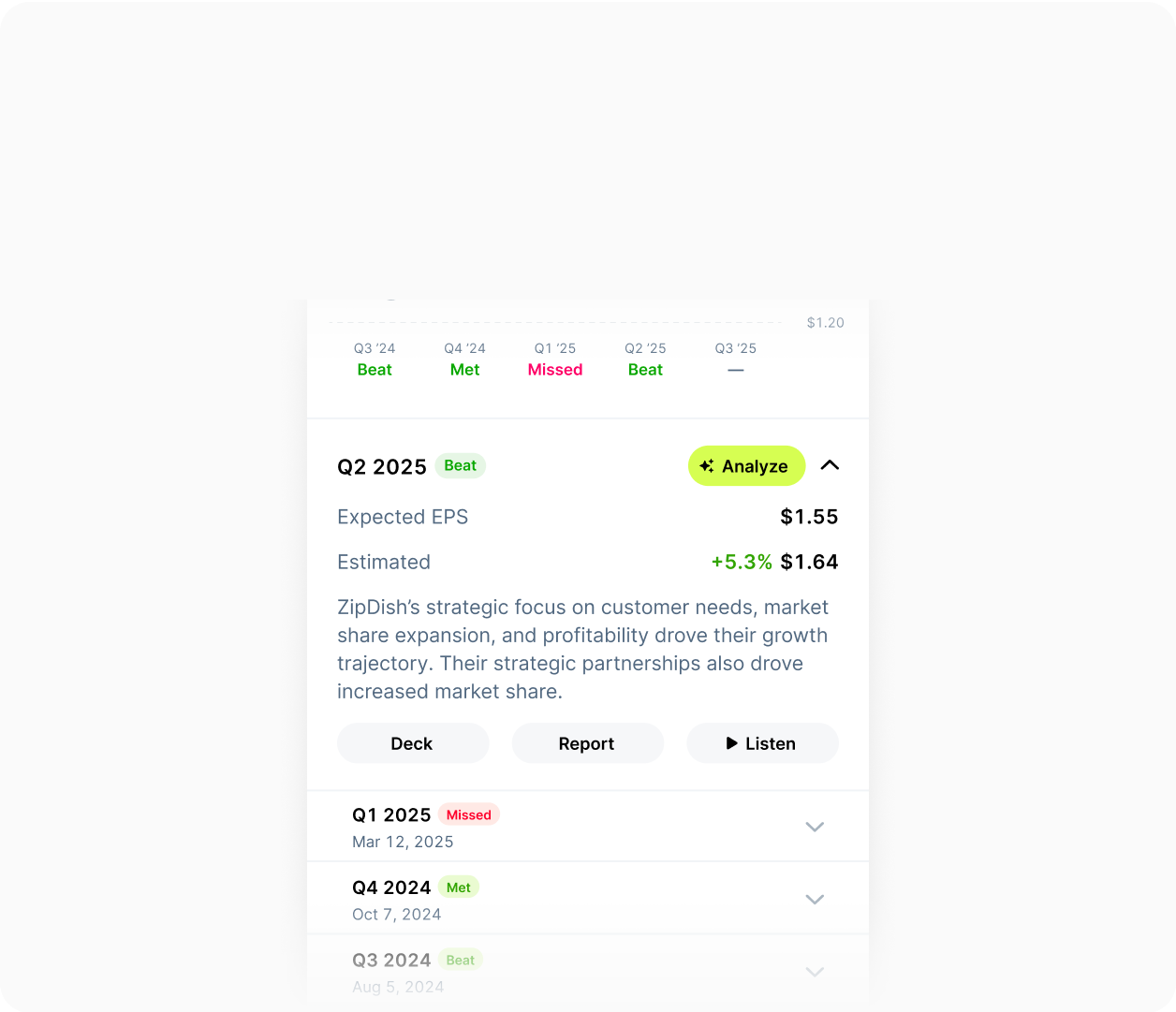

Earnings Hub

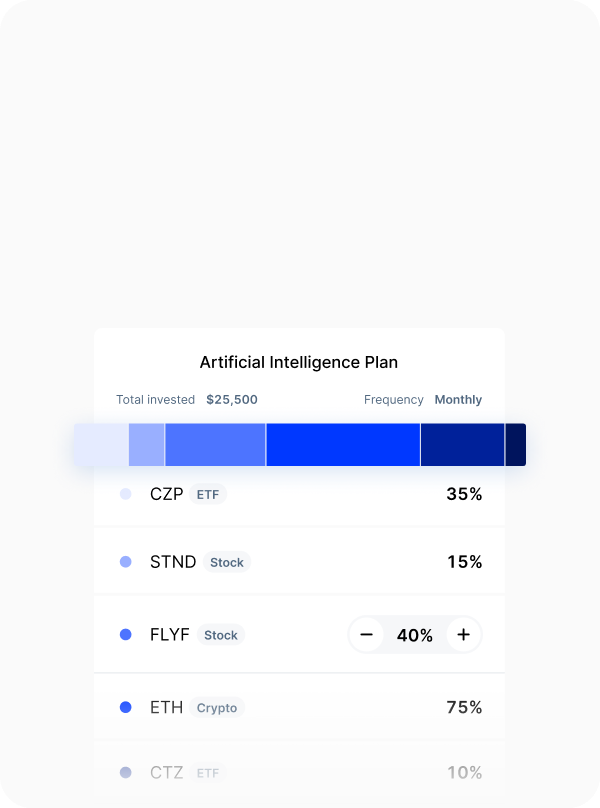

Investment Plans

Access AI-generated earnings recaps, company KPIs, investor presentations, and the actual audio of the earnings call—all without leaving Public.

Schedule recurring investments into personalized Investment Plans with up to 20 stocks, ETFs, and cryptos, and grow your portfolio automatically.

And up to $250,000

in instant buying power

Take advantage of every investment opportunity by making moves without waiting for funds to settle.

Varies by account.

Why join Public?

Invest in stocks, bonds, options, crypto, and more. Plus, turn any idea into an investable index with Generated Assets, exclusively on Public.

AI-powered analysis

Multi-asset investing

Industry-leading yields

Generated Assets

Direct indexing

Active trading API

Trusted by millions

US-based support

Financial-grade security

Get a 1% match when you transfer

¹ Options are risky and aren't suitable for all investors. To learn more, read the Options Disclosure Document.

*Cost comparisons accurate as of December 22, 2023. To qualify for revenue sharing, options trading must be activated by March 31, 2024.

² This feature provides hypothetical profit and loss based on the conditions in the market when you select a contract to be visualized, and does not guarantee future results. No contract has been bought or sold. The P&L charts are for informational purposes only and should not be considered a personalized recommendation or investment advice. Actual profits or losses may differ based on a number of factors not accounted for in these assumptions.

³ This feature provides a visualization of numerous datapoints related to a given options contract. The data is provided on an as-is basis and does not guarantee accuracy. The advanced charts are for informational purposes only and should not be considered a personalized recommendation or investment advice.

⁴ This feature provides lists of options contracts based on quantitative methodological screens. The data is provided on an as-is basis and does not guarantee accuracy. The Options Hub and all screens are for informational purposes only and should not be considered a personalized recommendation or investment advice.

⁵ PFOF rebates are only issued for options trades that are subject to PFOF. Public Investing shares 50% of the estimated order flow revenue as a rebate to help reduce trading costs on options. For more information, see our Fee Schedule and FAQs on PFOF Rebates.

⁶ Please note: Public doesn't charge per-contract fees. However, there are regulatory fees assessed for certain options transactions. See our fee schedule to learn more.Competitor trade cost data as of December 22, 2023 and subject to change. While the information is deemed reliable, Public makes no representations or warranties with respect to the accuracy or completeness of the information provided. All investments involve risk, including the possible loss of principal.Trading options involves significant risk and is not appropriate for all investors. To learn about risks, read the OCC’s Options Disclosure Document. Not included in this comparison are regulatory transaction fees and trading activity fees. These fees are set by our regulators, and are subject to change without notice. Most brokers, including ones in this comparison, pass on these fees to their customers on certain sell orders. For more information, please see Public's Fee Schedule.

⁷ This feature provides educational materials and videos related to options. The data is provided on an as-is basis and does not guarantee accuracy. The resource center is for informational purposes only and should not be considered a personalized recommendation or investment advice.

Options revenue sharing offered to customers who activate options trading on Public by 3/31/24. Full options revenue rebate terms can be found at public.com/disclosures/rebate-terms

© Copyright 2023 Public Holdings, Inc. All Rights Reserved.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

Product offerings and availability vary based on jurisdiction.

Stocks, ETFs, Options, Bonds.

Self-directed brokerage accounts and brokerage services for US-listed, registered securities, options, and Bonds, except for treasury securities offered through Jiko Securities, Inc., are offered to self-directed customers by Open to the Public Investing, Inc. (“Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Public Investing is not registered. Securities products offered by Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits. Additional information can be found here.

Investment Plans

Plans available to US members only. Diversification does not eliminate risk. Plans shown in our marketplace are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are not based on your needs or risk profile. Plans involve continuous investments, regardless of market conditions. Investment Plans shown in the marketplace are for informational purposes only. Investment Plans are meant to provide a helpful starting point as you discover, research, and create an Investment Plan that meets your specific investing needs. Investment Plans presented in the marketplace are created using defined, objective criteria based on generally accepted investment theory. They are made up of stocks and ETFs only. Refer to the Investment Plan Methodology to learn more. You should do your own research before purchasing a Plan. Plans will not be rebalanced and allocations will not be updated in any way, except for Corporate Actions. Learn more in our Investment Plans Terms and Conditions. You can find more information about any conflicts of interest associated with Sponsored Investment Plans in our Sponsored Content and Conflicts of Interest Disclosure.

Before investing in an ETF, you should read the prospectus, which provides detailed information on the ETF’s investment objective, principal investment strategies, risks, costs, and historical performance (if any), among other things. Prospectuses can be found on the ETF issuer's website. ETFs are bought and sold at market price, which can vary from the Net Asset Value of the fund. Rebalancing and other fund activities may result in tax consequences.

Brokerage services for stocks and ETFs on Public.com are offered by Open to the Public Investing, Inc., a registered broker-dealer and member FINRA & SIPC.

Commission-free trading of stocks refers to $0 commissions for Open to the Public Investing self-directed individual cash brokerage accounts that trade the U.S.-listed, registered securities electronically during the Regular Trading Hours. Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Open to the Public Investing’s Fee Schedule to learn more.

Fractional shares are illiquid outside of Public and not transferable. For a complete explanation of conditions, restrictions and limitations associated with fractional shares, see our Fractional Share Disclosure to learn more.

All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.