AI for investors

Analyze assets in incredible detail through our intuitive, natural-language interface, and get real-time investing context before you know you need it.

"*" indicates required fields

Alpha is an experiment brought to you by Public Holdings, Inc. (“Public”). Alpha is an artificial intelligence investment exploration tool powered by GPT-4, a generative large language model offered by OpenAI. Given ... Read Morethat Alpha is an experimental technology, it may sometimes give inaccurate or inappropriate information. Any output generated by Alpha is not and should not be construed as investment research, investment advice, or a recommendation to buy or sell a security, nor should any output serve as the basis for any investment decisions. Alpha output is provided “as is” and Public makes no representations or warranties with respect to the accuracy, completeness, quality, timeliness, or any other characteristic of Alpha output. We strongly recommend that you independently evaluate and verify the accuracy of any Alpha output for your use case.

AI-powered context. Straight to your inbox.

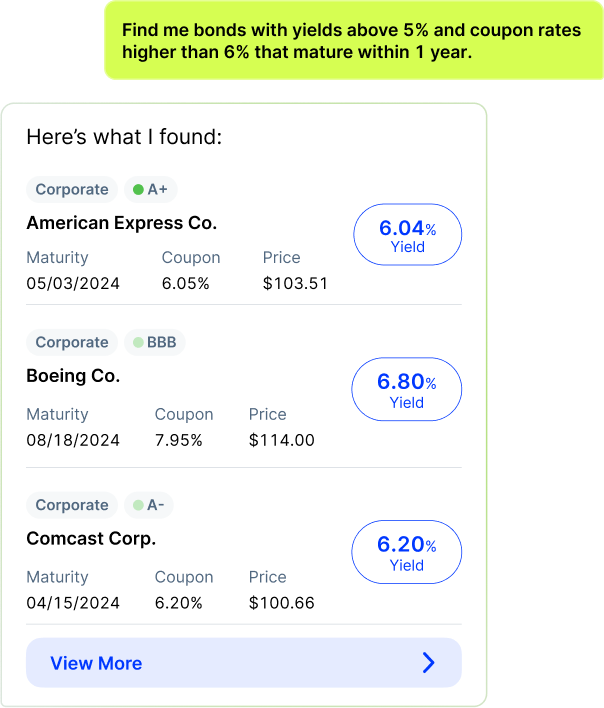

Have a question about a stock? Swipe down and ask.

See how Alpha can enhance your investment research

Combining the power of AI with real-time data

Alpha synthesizes financial data, enriches it with contextual understanding, and presents it to you through an intuitive, natural language interface.

THE CONTEXT LAYER

Have questions? Find answers.

Is Alpha powered by ChatGPT?

Alpha is not powered by ChatGPT, but it does leverage GPT-4, the underlying model that powers applications like ChatGPT. GPT-4 is a generative large language model trained by OpenAI to understand and generate natural language based on the inputs you provide it.

How does Alpha AI help improve my investment decisions?

Alpha can access real-time and historical information about thousands of stocks, bonds, ETFs, crypto, and more. The natural language interface instantly delivers the insights you need to make informed investment decisions.

How much does Alpha cost?

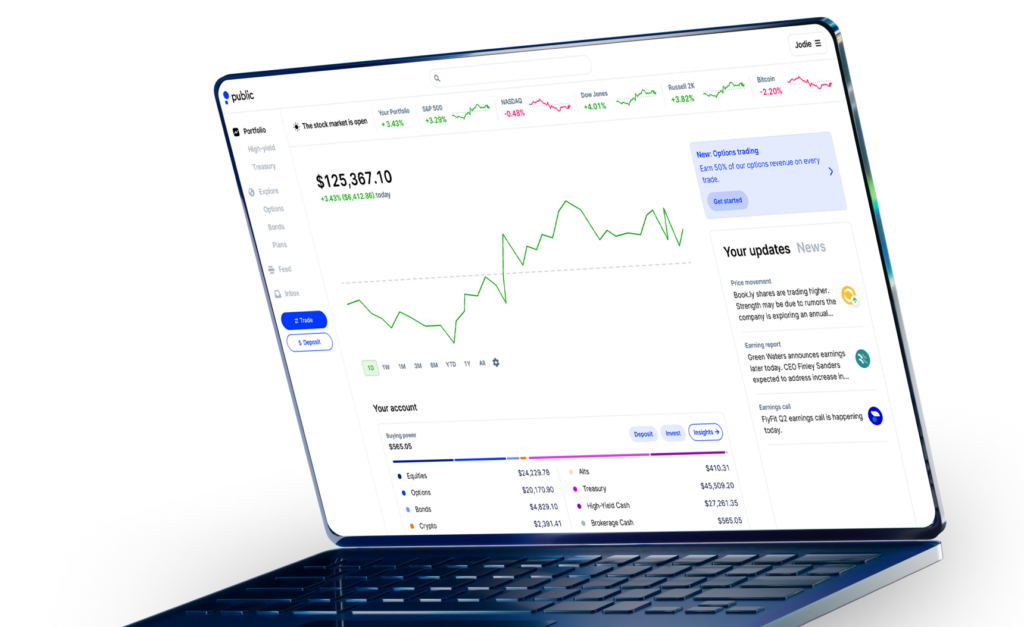

Alpha is free to use for all Public members. You can access the reactive chat feature from your portfolio page or on any asset page. Alpha is also responsible for providing the timely market insights you receive throughout your investing experience on Public.

Can I use Alpha AI without a brokerage account?

While you do need to create a Public account to use Alpha, Public does not have to be your primary brokerage account. On Public, you can invest in stocks, options, bonds, crypto, ETFs, and alternative assets—all in one place.

What investing aspects can Alpha cover?

Alpha, AI for investors, is designed to simplify your investment journey with SEC filings, earnings calls and transcripts, quotes and historicals, analyst ratings and reports, news and reports, and social sentiment.

Does Alpha give financial advice?

While Alpha is a powerful investment research assistant, it is important to note that it does not provide financial advice. Instead, Alpha offers in-depth market data, insights, and analysis to help you reach your own conclusions about your investments.

Build your portfolio with Public

"*" indicates required fields

Free trading refers to $0 commissions for Open to the Public Investing, Inc Financial self-directed individual cash brokerage accounts that trade U.S. listed securities via mobile devices. Relevant SEC & FINRA fees may apply. Please see our Commission and Fee Schedule.

This is not an offer, solicitation of an offer or advice to buy or sell securities, or open a brokerage account in any jurisdiction where Open to the Public Investing, Inc is not registered.

Open to the Public Investing, Inc does not recommend any securities. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing.

The above content is provided for general informational purposes only. It is not intended to constitute investment advice or any other kind of professional advice and should not be relied upon as such. Before taking action based on any such information, we encourage you to consult with the appropriate professionals. We do not endorse any third parties referenced within the article. Market and economic views are subject to change without notice and may be untimely when presented here. Do not infer or assume that any securities, sectors or markets described in this article were or will be profitable. Past performance is no guarantee of future results. There is a possibility of loss. Historical or hypothetical performance results are presented for illustrative purposes only.